Enlarge image

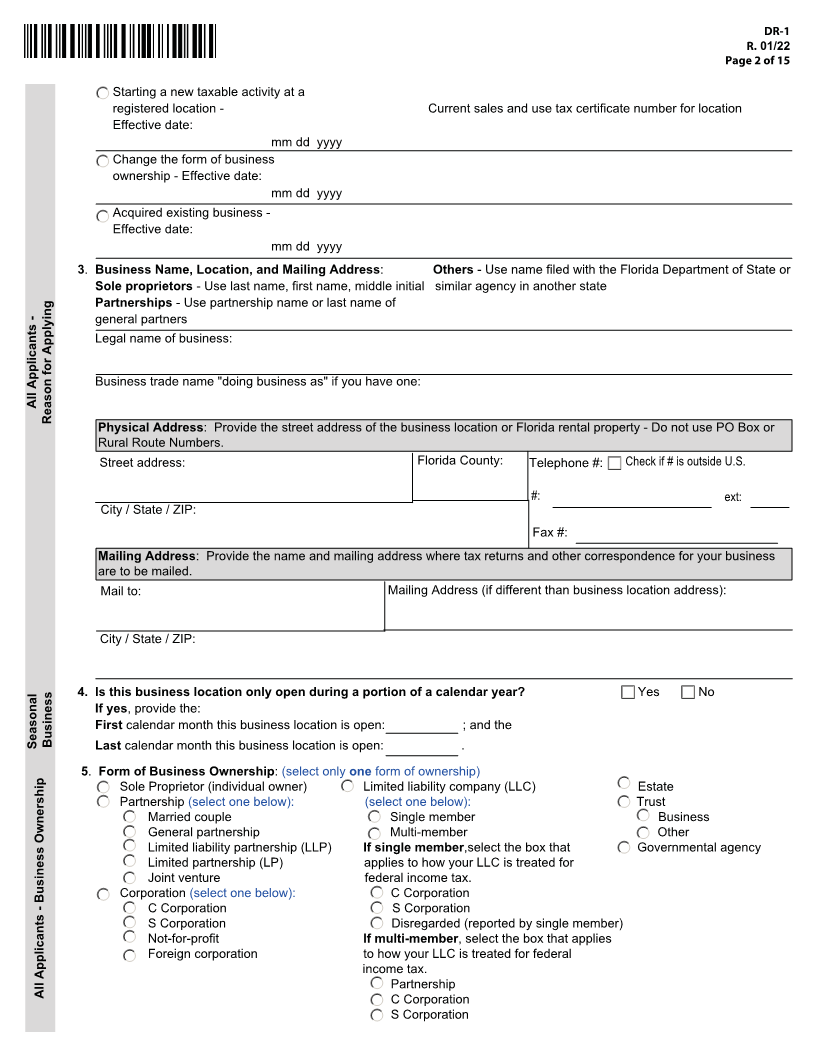

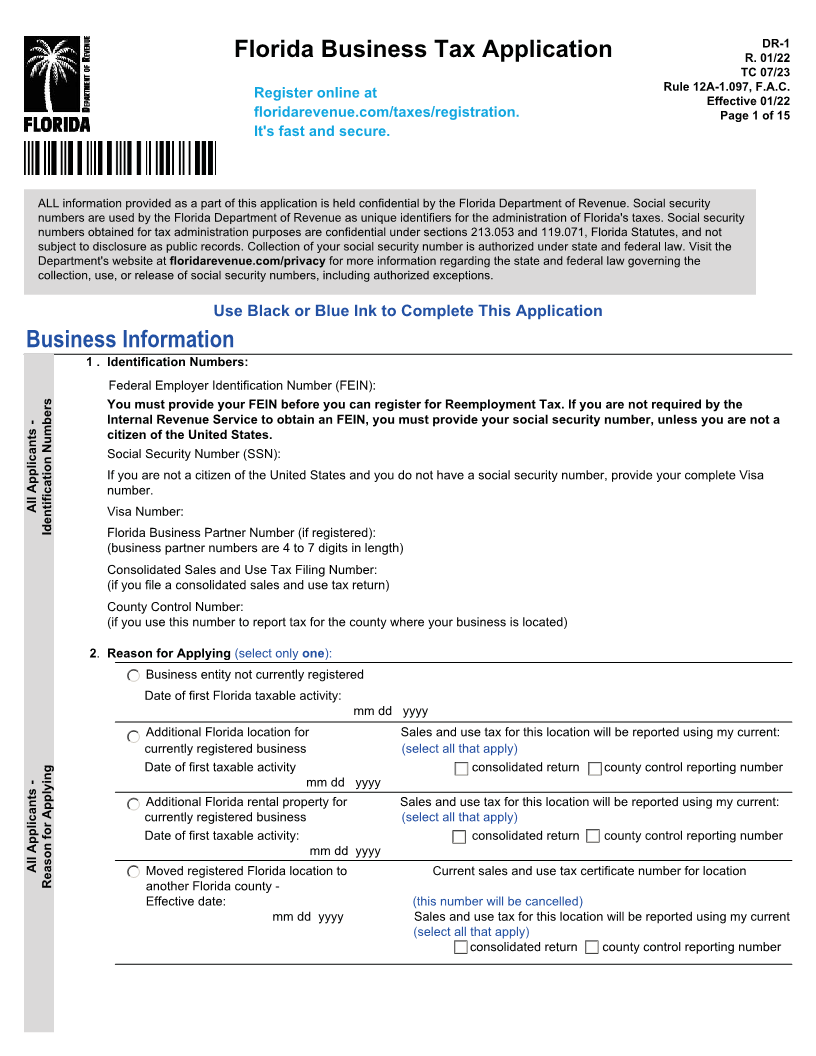

DR-1

Florida Business Tax Application R. 01/22

TC 07/23

Rule 12A-1.097, F.A.C.

Register online at

Effective 01/22

floridarevenue.com/taxes/registration. Page 1 of 15

It's fast and secure.

ALL information provided as a part of this application is held confidential by the Florida Department of Revenue. Social security

numbers are used by the Florida Department of Revenue as unique identifiers for the administration of Florida's taxes. Social security

numbers obtained for tax administration purposes are confidential under sections 213.053 and 119.071, Florida Statutes, and not

subject to disclosure as public records. Collection of your social security number is authorized under state and federal law. Visit the

Department's website at floridarevenue.com/privacy for more information regarding the state and federal law governing the

collection, use, or release of social security numbers, including authorized exceptions.

Use Black or Blue Ink to Complete This Application

Business Information

1 . Identification Numbers:

Federal Employer Identification Number (FEIN):

You must provide your FEIN before you can register for Reemployment Tax. If you are not required by the

Internal Revenue Service to obtain an FEIN, you must provide your social security number, unless you are not a

citizen of the United States.

Social Security Number (SSN):

If you are not a citizen of the United States and you do not have a social security number, provide your complete Visa

number.

All Applicants - Visa Number:

Identification Florida Business Partner Number (if registered): Numbers

(business partner numbers are 4 to 7 digits in length)

Consolidated Sales and Use Tax Filing Number:

(if you file a consolidated sales and use tax return)

County Control Number:

(if you use this number to report tax for the county where your business is located)

. 2 Reason for Applying (select only one):

Business entity not currently registered

Date of first Florida taxable activity:

mm dd yyyy

Additional Florida location for Sales and use tax for this location will be reported using my current:

currently registered business (select all that apply)

Date of first taxable activity consolidated return county control reporting number

mm dd yyyy

Additional Florida rental property for Sales and use tax for this location will be reported using my current:

currently registered business (select all that apply)

Date of first taxable activity: consolidated return county control reporting number

mm dd yyyy

All Applicants - Moved registered Florida location to Current sales and use tax certificate number for location

Reason another Florida county - for Applying

Effective date: (this number will be cancelled)

mm dd yyyy Sales and use tax for this location will be reported using my current

(select all that apply)

consolidated return county control reporting number