Enlarge image

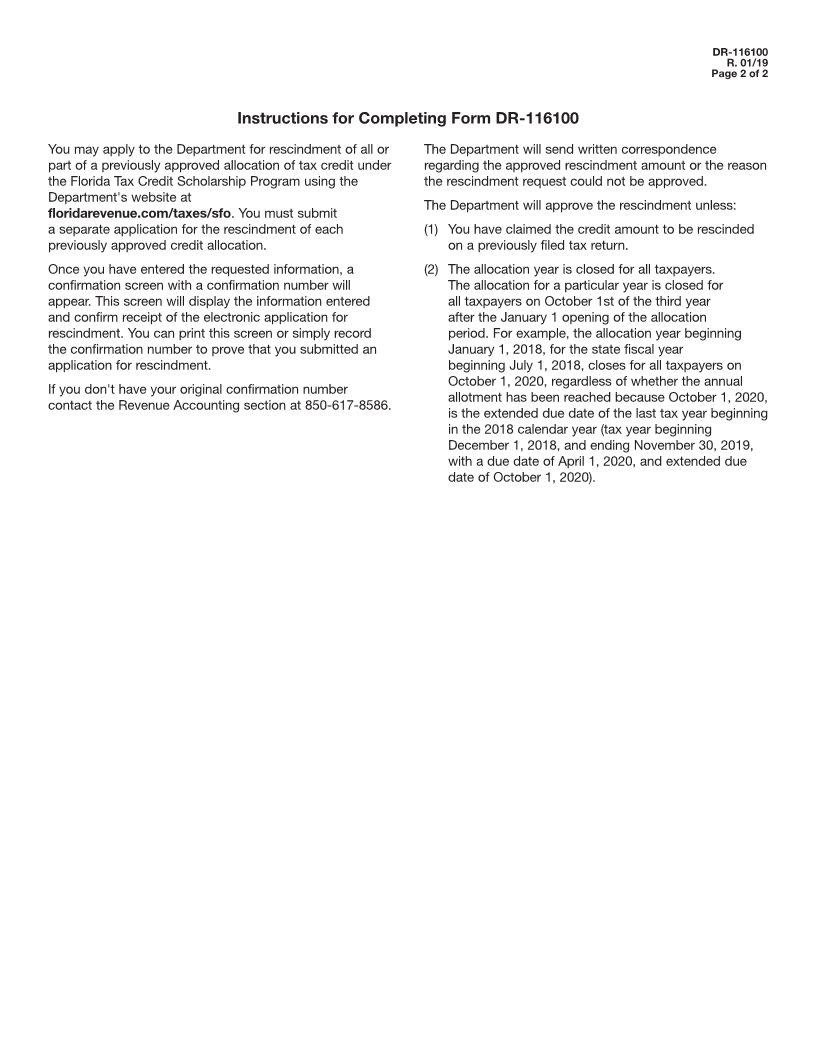

Florida Tax Credit Scholarship Program DR-116100

R. 01/19

Application for Rescindment of Previous Allocation of Tax Credit Rule 12-29.003, F.A.C.

Effective 01/19

(Under sections [ss.] 211.0251, 212.1831, 220.1875, 561.1211, 624.51055, Page 1 of 2

and 1002.395, Florida Statutes, [F.S.])

Business name ___________________________________________________________________________________________

Federal Employer Identification Number (FEIN) –

Mailing address __________________________________________________________________________________________

City ___________________________________________ State _____________ ZIP __________________________________

Contact person ___________________________ Contact’s telephone number ____________________________________

Contact person's email address ____________________________________________________________________________

If included in a consolidated Florida corporate income tax return, provide:

Parent Corporation’s FEIN –

Original amount of planned contribution $ , , .

Confirmation number of original credit allocation application __________________________________________________

Enter the name of the SFO the credit was originally approved for:

_________________________________________________________________________________________________________

Enter the amount you wish to rescind $ , , .

Enter the amount(s) below to rescind based on the tax type. (The sum of the amounts by tax cannot exceed the total

amount you wish to rescind above. The amount to be rescinded for each tax cannot exceed the amount allocated to

that tax on the original application.):

______________ Corporate Income Tax (Chapter 220, F.S.)

______________ Insurance Premium Tax (s. 624.509, F.S.)

______________ Excise Tax on Malt Beverages (s. 563.05, F.S.)

______________ Excise Tax on Wine Beverages (s. 564.06, F.S.)

______________ Excise Tax on Liquor Beverages (s. 565.12, F.S.)

______________ Sales Tax Paid by a Direct Pay Permit Holder (s. 212.183, F.S.)

______________ Tax on Oil Production (s. 211.02, F.S.)

______________ Tax on Gas Production (s. 211.025, F.S.)

I understand that section (s.) 1002.395(5)(f), Florida Statutes (F.S.), requires the Florida Department of Revenue to

provide a copy of any approval or denial it issues with respect to this application for rescindment to the nonprofit

scholarship-funding organization indicated on the associated application for an allocation of credit.

Under penalty of perjury, I declare that I have read this application form and that the facts stated in it are true.

________________________________________________ ______________________

Signature of officer, owner, or partner Date