Enlarge image

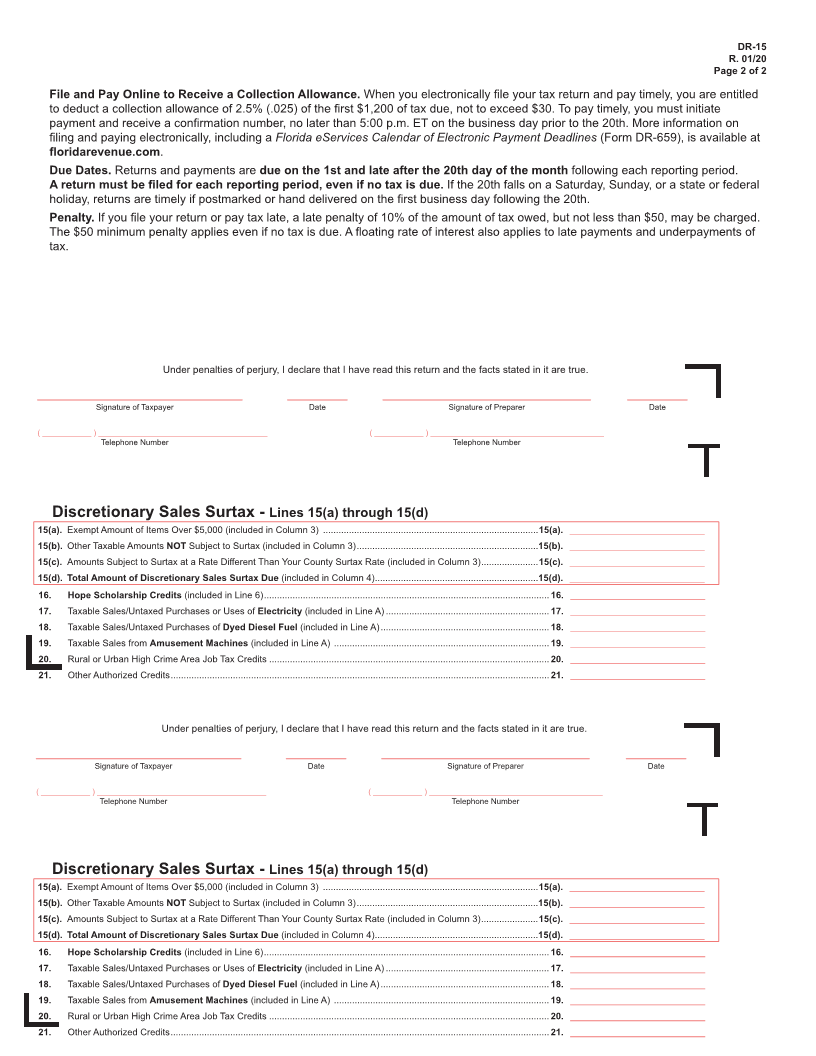

DR-15

Sales and Use Tax Return R. 01/20

Rule 12A-1.097, F.A.C.

Effective 01/20

Page 1 of 2

You may file and pay tax online or you may

complete this return and pay tax by check

or money order and mail to:

Florida Department of Revenue

5050 W Tennessee Street

Tallahassee, FL 32399-0120

Please read the Instructions for DR-15 Sales and

Use Tax Returns (Form DR-15N), incorporated

by reference in Rule 12A-1.097, F.A.C., before

you complete this return. Instructions are posted

at floridarevenue.com/forms.

Certificate Number: Sales and Use Tax Return HD/PM Date: / / DR-15 R. 01/20

Florida 1. Gross Sales 2. Exempt Sales 3. Taxable Amount 4. Tax Due

A. Sales/Services/Electricity . . . .

B. Taxable Purchases Include use tax on Internet / out-of-state untaxed purchases . .

C. Commercial Rentals . . . .

D. Transient Rentals . . . .

E. Food & Beverage Vending . . . .

5. Total Amount of Tax Due

Surtax Rate: Reporting Period .

6. Less Lawful Deductions .

7. Net Tax Due .

Name

Address 8. Less Est Tax Pd / DOR Cr Memo .

City/St 9. Plus Est Tax Due Current Month .

ZIP

Your Copy10. Amount Due .

FLORIDA DEPARTMENT OF REVENUE 11. Less Collection Allowance E-file/E-pay Only

5050 W TENNESSEE ST 12. Plus Penalty .

TALLAHASSEE FL 32399-0120 13. Plus Interest .

14. Amount Due with Return .

Due:

Late After: 9100 0 20249999 0001003031 8 4999999999 0000 5

Certificate Number: Sales and Use Tax Return HD/PM Date: / / DR-15 R. 01/20

Florida 1. Gross Sales 2. Exempt Sales 3. Taxable Amount 4. Tax Due

A. Sales/Services/Electricity . . . .

B. Taxable Purchases Include use tax on Internet / out-of-state untaxed purchases . .

C. Commercial Rentals . . . .

D. Transient Rentals . . . .

E. Food & Beverage Vending . . . .

5. Total Amount of Tax Due

Surtax Rate: Reporting Period .

6. Less Lawful Deductions .

Name 7. Net Tax Due .

Address 8. Less Est Tax Pd / DOR Cr Memo .

City/St 9. Plus Est Tax Due Current Month .

ZIP

10. Amount Due .

FLORIDA DEPARTMENT OF REVENUE 11. Less Collection Allowance E-file/E-pay Only

5050 W TENNESSEE ST 12. Plus Penalty .

TALLAHASSEE FL 32399-0120 13. Plus Interest .

14. Amount Due with Return .

Due:

Late After: 9100 0 20249999 0001003031 8 4999999999 0000 5