Enlarge image

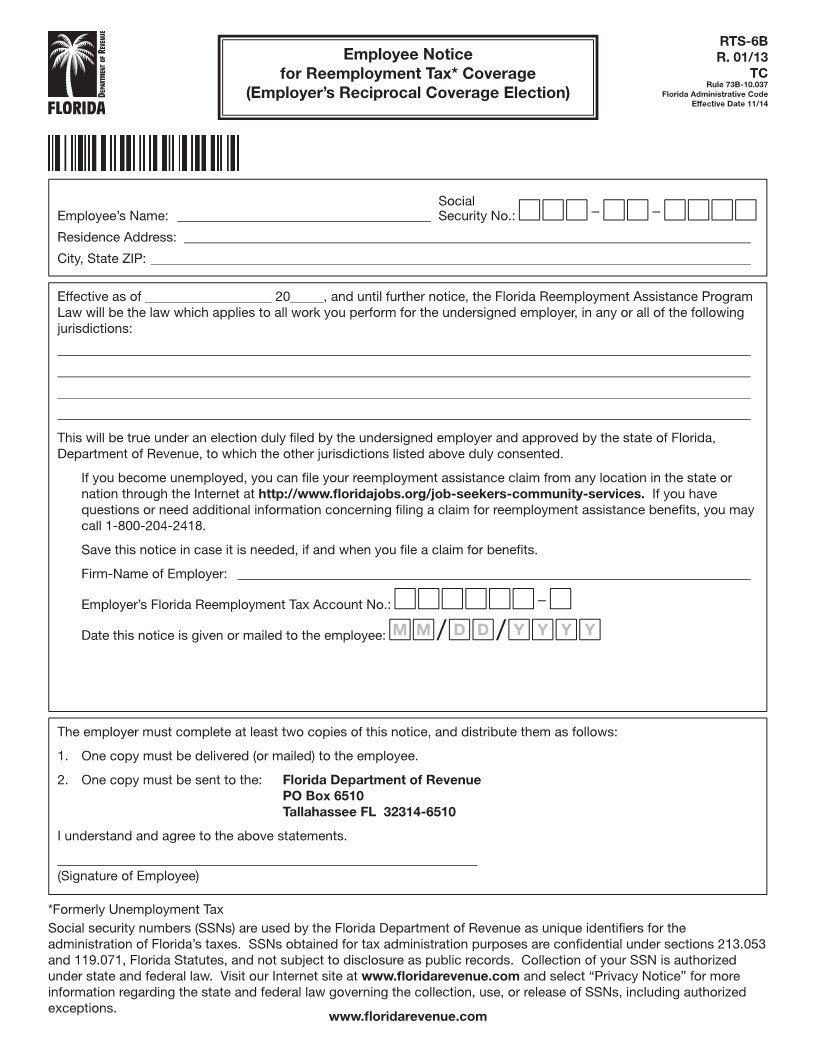

RTS-6B

Employee Notice R. 01/13

for Reemployment Tax* Coverage TC

Rule 73B-10.037

(Employer’s Reciprocal Coverage Election) Florida Administrative Code

Effective Date 11/14

Social

Employee’s Name: ______________________________________ Security No.: — —

Residence Address: _____________________________________________________________________________________

City, State ZIP: __________________________________________________________________________________________

Effective as of ___________________ 20_____, and until further notice, the Florida Reemployment Assistance Program

Law will be the law which applies to all work you perform for the undersigned employer, in any or all of the following

jurisdictions:

________________________________________________________________________________________________________

________________________________________________________________________________________________________

________________________________________________________________________________________________________

________________________________________________________________________________________________________

This will be true under an election duly filed by the undersigned employer and approved by the state of Florida,

Department of Revenue, to which the other jurisdictions listed above duly consented.

If you become unemployed, you can file your reemployment assistance claim from any location in the state or

nation through the Internet at http://www.floridajobs.org/job-seekers-community-services. If you have

questions or need additional information concerning filing a claim for reemployment assistance benefits, you may

call 1-800-204-2418.

Save this notice in case it is needed, if and when you file a claim for benefits.

Firm-Name of Employer: _____________________________________________________________________________

Employer’s Florida Reemployment Tax Account No.: —

D D Y Y Y Y

Date this notice is given or mailed to the employee: M M / /

The employer must complete at least two copies of this notice, and distribute them as follows:

1. One copy must be delivered (or mailed) to the employee.

2. One copy must be sent to the: Florida Department of Revenue

PO Box 6510

Tallahassee FL 32314-6510

I understand and agree to the above statements.

_______________________________________________________________

(Signature of Employee)

*Formerly Unemployment Tax

Social security numbers (SSNs) are used by the Florida Department of Revenue as unique identifiers for the

administration of Florida’s taxes. SSNs obtained for tax administration purposes are confidential under sections 213.053

and 119.071, Florida Statutes, and not subject to disclosure as public records. Collection of your SSN is authorized

under state and federal law. Visit our Internet site at www.floridarevenue.com and select “Privacy Notice” for more

information regarding the state and federal law governing the collection, use, or release of SSNs, including authorized

exceptions.

www.floridarevenue.com