Enlarge image

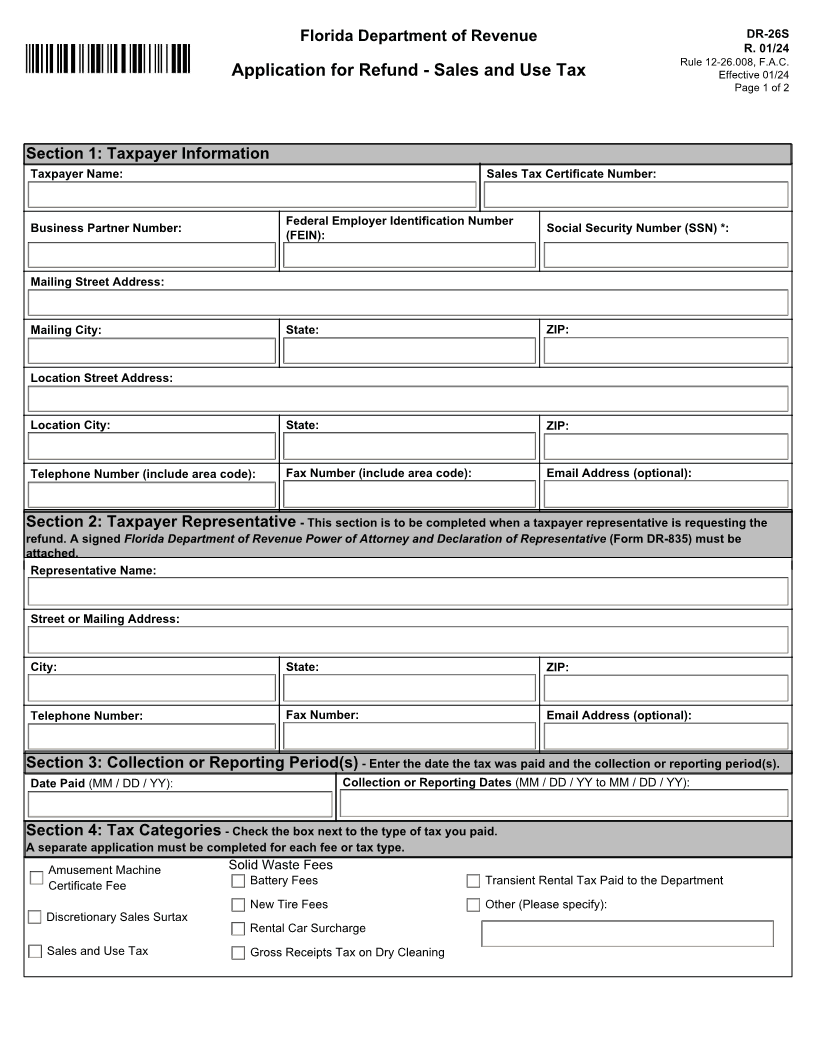

Florida Department of Revenue DR-26S

R. 01/24

Rule 12-26.008, F.A.C.

Application for Refund - Sales and Use Tax Effective 01/24

Page 1 of 2

Section 1: Taxpayer Information

Taxpayer Name: Sales Tax Certificate Number:

Federal Employer Identification Number

Business Partner Number: Social Security Number (SSN) *:

(FEIN):

Mailing Street Address:

Mailing City: State: ZIP:

Location Street Address:

Location City: State: ZIP:

Telephone Number (include area code): Fax Number (include area code): Email Address (optional):

Section 2: Taxpayer Representative - This section is to be completed when a taxpayer representative is requesting the

refund. A signed Florida Department of Revenue Power of Attorney and Declaration of Representative (Form DR-835) must be

attached.

Representative Name:

Street or Mailing Address:

City: State: ZIP:

Telephone Number: Fax Number: Email Address (optional):

Section 3: Collection or Reporting Period(s) - Enter the date the tax was paid and the collection or reporting period(s).

Date Paid (MM / DD / YY): Collection or Reporting Dates (MM / DD / YY to MM / DD / YY):

Section 4: Tax Categories - Check the box next to the type of tax you paid.

A separate application must be completed for each fee or tax type.

Amusement Machine Solid Waste Fees

Certificate Fee Battery Fees Transient Rental Tax Paid to the Department

New Tire Fees Other (Please specify):

Discretionary Sales Surtax

Rental Car Surcharge

Sales and Use Tax Gross Receipts Tax on Dry Cleaning