Enlarge image

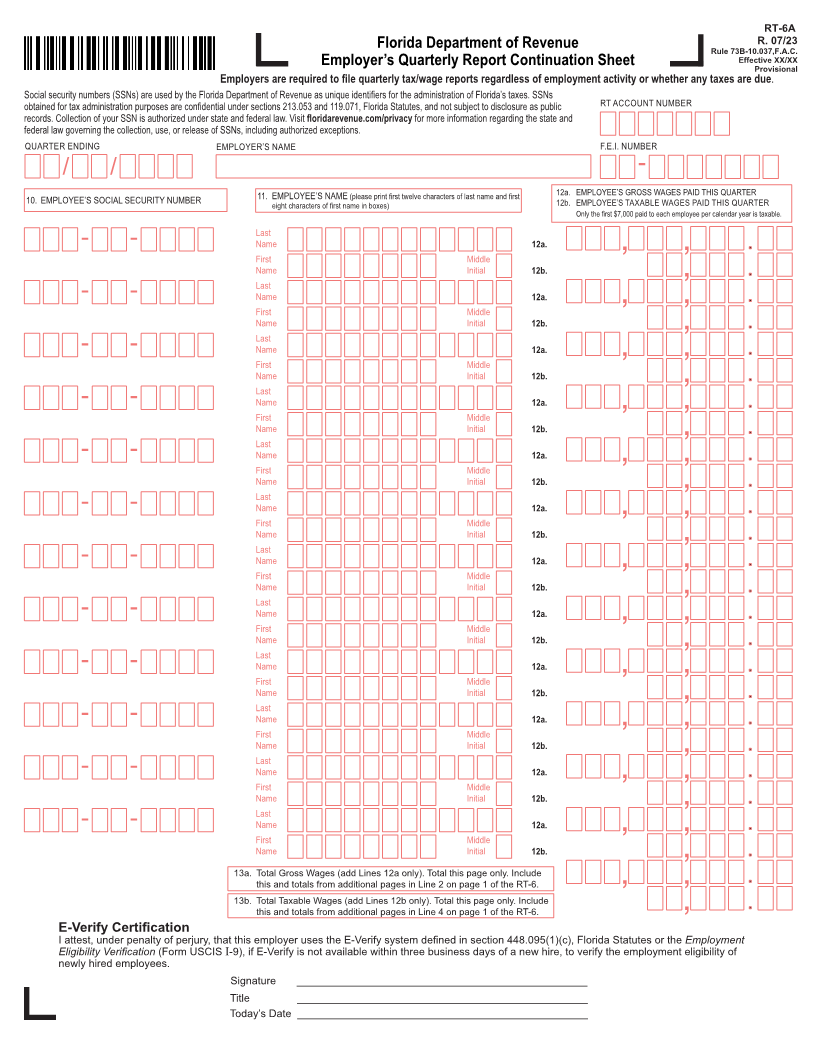

RT-6A

Florida Department of Revenue R. 07/23

Rule 73B-10.037,F.A.C.

Employer’s Quarterly Report Continuation Sheet Effective XX/XX

Provisional

Employers are required to file quarterly tax/wage reports regardless of employment activity or whether any taxes are due.

Social security numbers (SSNs) are used by the Florida Department of Revenue as unique identifiers for the administration of Florida’s taxes. SSNs

obtained for tax administration purposes are confidential under sections 213.053 and 119.071, Florida Statutes, and not subject to disclosure as public RT ACCOUNT NUMBER

records. Collection of your SSN is authorized under state and federal law. Visit floridarevenue.com/privacy for more information regarding the state and

federal law governing the collection, use, or release of SSNs, including authorized exceptions.

QUARTER ENDING EMPLOYER’S NAME F.E.I. NUMBER

/ // -

10. EMPLOYEE’S SOCIAL SECURITY NUMBER 11. EMPLOYEE’S NAME (please print first twelve characters of last name and first 12a. EMPLOYEE’S GROSS WAGES PAID THIS QUARTER

eight characters of first name in boxes) 12b. EMPLOYEE’S TAXABLE WAGES PAID THIS QUARTER

Only the first $7,000 paid to each employee per calendar year is taxable.

Last

- - Name 12a.

First Middle

Name Initial 12b.

Last

- - Name 12a.

First Middle

Name Initial 12b.

Last

- - Name 12a.

First Middle

Name Initial 12b.

Last

- - Name 12a.

First Middle

Name Initial 12b.

Last

- - Name 12a.

First Middle

Name Initial 12b.

Last

- - Name 12a.

First Middle

Name Initial 12b.

Last

- - Name 12a.

First Middle

Name Initial 12b.

Last

- - Name 12a.

First Middle

Name Initial 12b.

Last

- - Name 12a.

First Middle

Name Initial 12b.

Last

- - Name 12a.

First Middle

Name Initial 12b.

Last

- - Name 12a.

First Middle

Name Initial 12b.

Last

- - Name 12a.

First Middle

Name Initial 12b.

13a. Total Gross Wages (add Lines 12a only). Total this page only. Include

this and totals from additional pages in Line 2 on page 1 of the RT-6.

13b. Total Taxable Wages (add Lines 12b only). Total this page only. Include

this and totals from additional pages in Line 4 on page 1 of the RT-6.

E-Verify Certification

I attest, under penalty of perjury, that this employer uses the E-Verify system defined in section 448.095(1)(c), Florida Statutes or the Employment

Eligibility Verification (Form USCIS I-9), if E-Verify is not available within three business days of a new hire, to verify the employment eligibility of

newly hired employees.

Signature _________________________________________________

Title _________________________________________________

Today’s Date _________________________________________________