Enlarge image

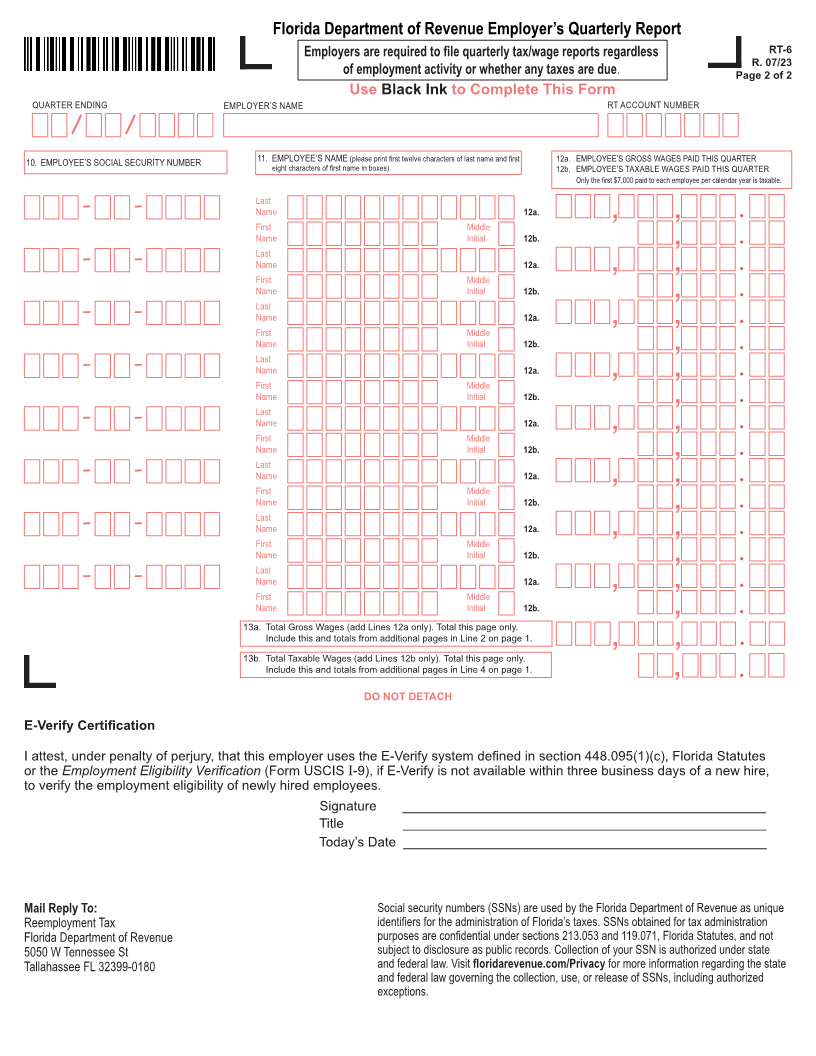

FloridaFlorida DepartmentDepartment ofof RevenueRevenue EmployerEmployer’s Quarterly Report’s Quarterly Report RT-6

R. 07/23

Employers are required to file quarterly tax/wage reports regardless Rule 73B-10.037, F.A.C.

Effective XX/XX

of employment activity or whether any taxes are due. Page 1 of 2

Use Black Ink to Complete This Form Provisional

QUARTER ENDING DUE DATE PENALTY AFTER DATE TAX RATE RT ACCOUNT NUMBER

/ /

Use black ink. Example A - Handwritten Example B - Typed Do not make changes If you do not have an account number, you

Example A Example B to the pre-printed are required to register (see instructions).

0 1 2 3 4 5 6 7 8 9 0123456789 information on this form. If F.E.I. NUMBER

changes are needed, visit

floridarevenue.com/taxes/

updateaccount to update

your information. FOR OFFICIAL USE ONLY POSTMARK DATE

Reverse Side Must be Completed

Name / /

Mailing 2. Gross wages paid this quarter

Address (Must total all pages)

City/St/ZIP 3. Excess wages paid this quarter

(See instructions)

4. Taxable wages paid this quarter

Location (See instructions)

Address 5. Tax due

City/St/ZIP (Multiply Line 4 by Tax Rate)

6. Penalty due

1. Enter the total number (See instructions)

of full-time and part-time 1st Month 7. Interest due

covered workers who , (See instructions)

performed services during or 2nd Month 8. Installment fee

period including the 12th of

received pay for the payroll , (See instructions)

the month. 3rd Month

, 9a. Total amount due

(See instructions)

Check if final return:

Date operations ceased. 9b. Amount Enclosed

(See instructions)

Check if you had out-of-state wages. Attach Employer’s If you are filing as a sole proprietor, is this for

Quarterly Report for Out-of-State Taxable Wages (RT-6NF). domestic (household) employment only?

RT-6 Yes No

Under penalties of perjury, I declare that I have read this return and the facts stated in it are true (section 443.171(5), Florida Statutes).

Signature Date Title

Preparer’s

signature Date Phone ( ) Fax ( )

Firm’s name Preparer check Preparer’s

(or yours if Name if self-employed SSN or PTIN

Paid self-employed)

preparers Address FEIN

only

Address Preparer’s

City/St/ZIP phone number ( )

DO NOT

Employer’s Quarterly Report Payment Coupon DETACH RT-6

R. 07/23

Florida Department of Revenue COMPLETE and MAIL with your REPORT/PAYMENT. DOR USE ONLY

Please write your RT ACCOUNT NUMBER on check.

Make check payable to: Florida U.C. Fund

POSTMARK OR HAND-DELIVERY DATE

RT ACCOUNT NO.

RT-6 U.S. Dollars Cents

F.E.I. NUMBER GROSS WAGES

(From Line 2 above.)

AMOUNT ENCLOSED

(From Line 9b above.)

Name PAYMENT FOR QUARTER

ENDING MM/YY -

Mailing

Address Check here if you are electing to Check here if you transmitted

City/St/ZIP pay tax due in installments. funds electronically.

9100 0 99999999 0068054031 7 5009999999 0000 49100 0 99999999 0068054031 7 5009999999 0000 4