Enlarge image

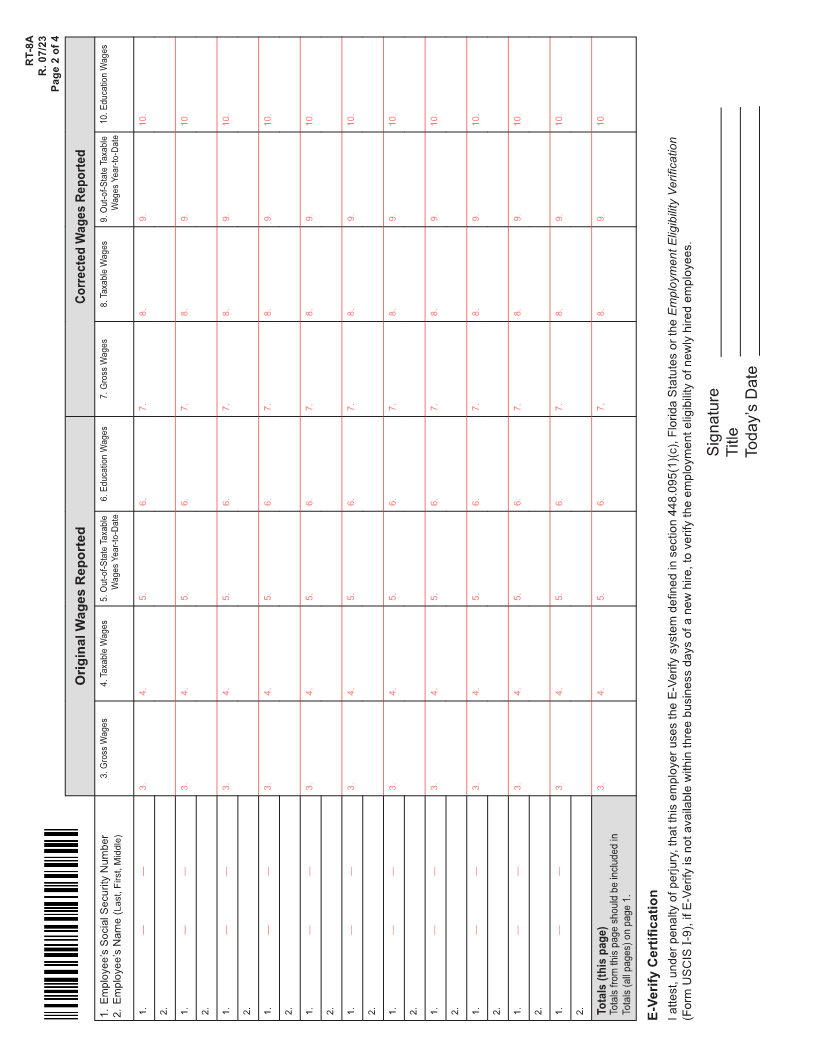

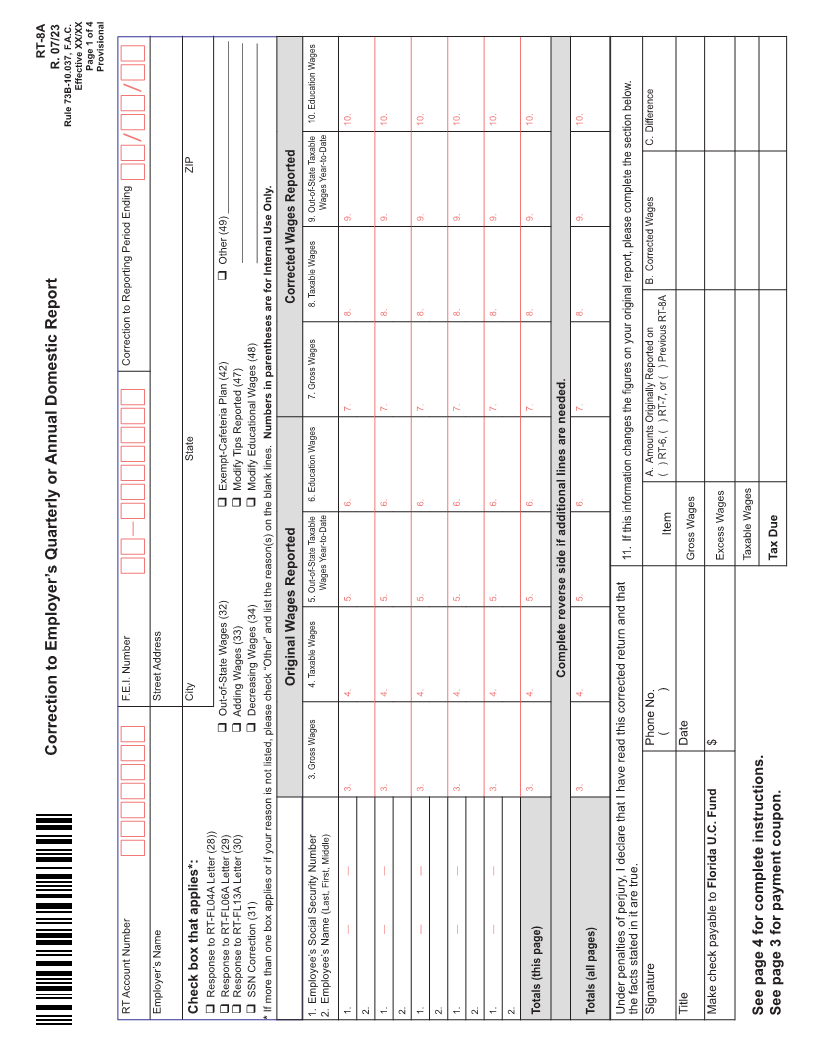

RT-8A

R. 07/23 Page 1 of 4 Provisional

Effective XX/XX

Rule 73B-10.037, F.A.C. 10. Education Wages 10. 10. 10. 10. 10. 10. 10.

C. Difference

ZIP

Wages Year-to-Date

9. Out-of-State Taxable 9. 9. 9. 9. 9. 9. 9.

Other (49) _____________________________ _____________________________________

q _____________________________________ B. Corrected Wages

Corrected Wages Reported 8. Taxable Wages

8. 8. 8. 8. 8. 8. 8.

Correction to Reporting Period Ending

7. Gross Wages

7. 7. 7. 7. 7. 7. 7.

Numbers in parentheses are for Internal Use Only.

State

A. Amounts Originally Reported on ( ) RT-6, ( ) RT-7, or ( ) Previous RT-8A

Exempt-Cafeteria Plan (42) Modify Tips Reported (47) Modify Educational Wages (48)

q q q 6. Education Wages 6. 6. 6. 6. 6. 6. 6.

If this information changes the figures on your original report, please complete the section below. Item

11. Gross Wages Excess Wages Taxable Wages Tax Due

Wages Year-to-Date

5. Out-of-State Taxable 5. 5. 5. 5. 5. 5. 5.

Complete reverse side if additional lines are needed.

Original Wages Reported 4. Taxable Wages

F.E.I. Number Street Address City 4. 4. 4. 4. 4. 4. 4.

Out-of-State Wages (32) Adding Wages (33) Decreasing Wages (34)

q q q

Phone No. ( ) Date $

Correction to Employer’s Quarterly or Annual Domestic Report

3. Gross Wages

3. 3. 3. 3. 3. 3. 3.

— — — — —

Florida U.C. Fund

Last, First, Middle)

— — — — —

Response to RT-FL04A Letter (28)) Response to RT-FL06A Letter (29) Response to RT-FL13A Letter (30) SSN Correction (31) Employee’s Social Security Number Employee’s Name (

If more than one box applies or if your reason is not listed, please check “Other” and list the reason(s) on the blank lines.

RT Account Number Employer’s Name Check box that applies*: q q q q * 1. 2. 1. 2. 1. 2. 1. 2. 1. 2. 1. 2. Totals (this page) Totals (all pages) Under penalties of perjury, I declare that I have read this corrected return and that the facts stated in it are true. Signature Title Make check payable to See page 4 for complete instructions. See page 3 for payment coupon.