Enlarge image

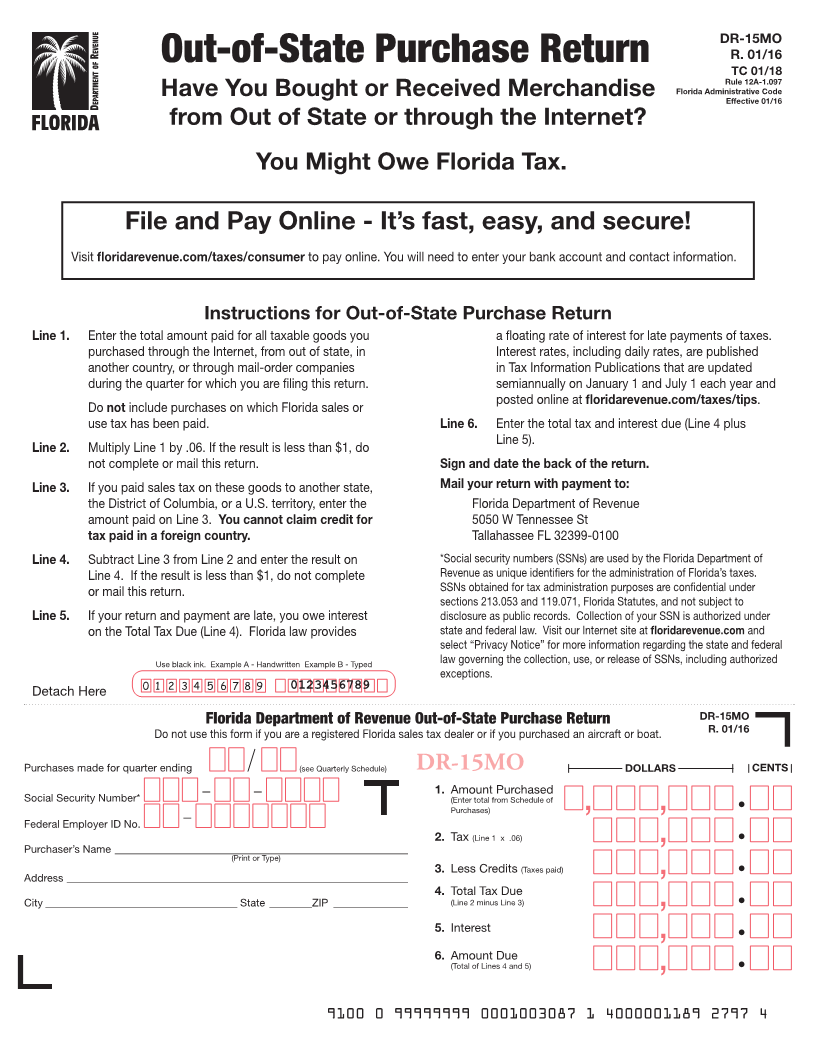

DR-15MO

R. 01/16

Out-of-State Purchase Return TC 01/18

Rule 12A-1.097

Have You Bought or Received Merchandise Florida Administrative Code

Effective 01/16

from Out of State or through the Internet?

You Might Owe Florida Tax.

File and Pay Online - It’s fast, easy, and secure!

Visit floridarevenue.com/taxes/consumer to pay online. You will need to enter your bank account and contact information.

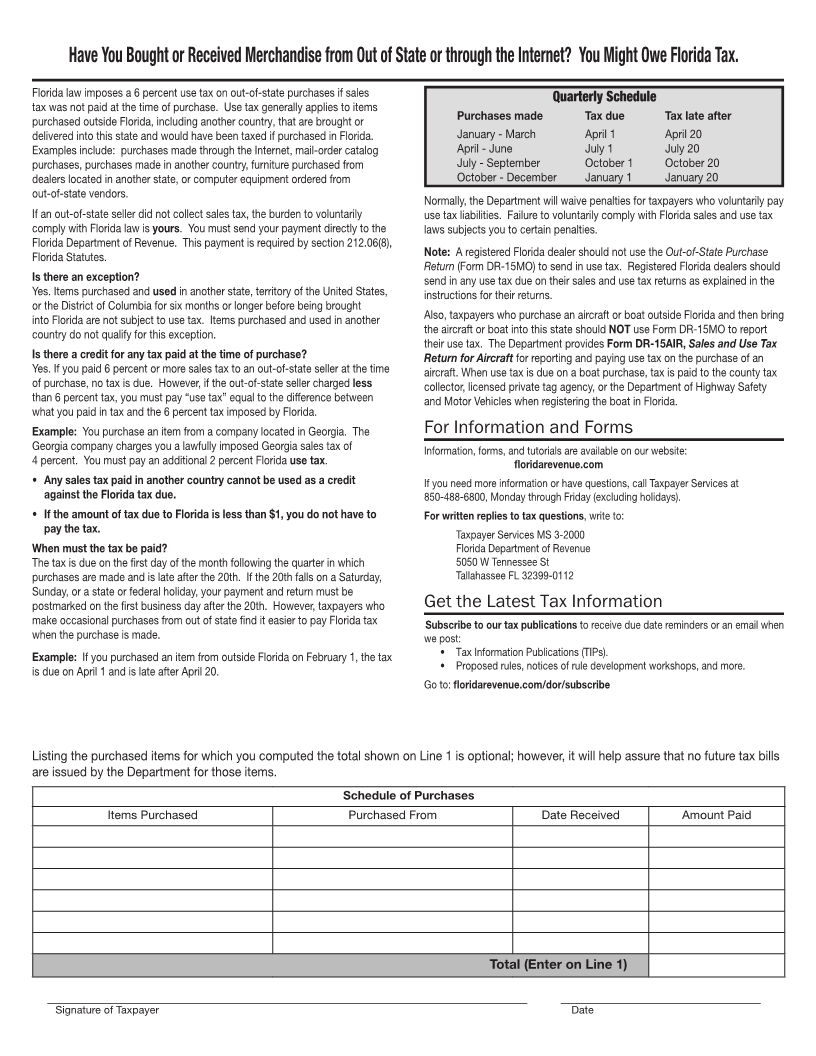

Instructions for Out-of-State Purchase Return

Line 1. Enter the total amount paid for all taxable goods you a floating rate of interest for late payments of taxes.

purchased through the Internet, from out of state, in Interest rates, including daily rates, are published

another country, or through mail-order companies in Tax Information Publications that are updated

during the quarter for which you are filing this return. semiannually on January 1 and July 1 each year and

posted online at floridarevenue.com/taxes/tips.

Do not include purchases on which Florida sales or

use tax has been paid. Line 6. Enter the total tax and interest due (Line 4 plus

Line 5).

Line 2. Multiply Line 1 by .06. If the result is less than $1, do

not complete or mail this return. Sign and date the back of the return.

Line 3. If you paid sales tax on these goods to another state, Mail your return with payment to:

the District of Columbia, or a U.S. territory, enter the Florida Department of Revenue

amount paid on Line 3. You cannot claim credit for 5050 W Tennessee St

tax paid in a foreign country. Tallahassee FL 32399-0100

Line 4. Subtract Line 3 from Line 2 and enter the result on *Social security numbers (SSNs) are used by the Florida Department of

Line 4. If the result is less than $1, do not complete Revenue as unique identifiers for the administration of Florida’s taxes.

or mail this return. SSNs obtained for tax administration purposes are confidential under

sections 213.053 and 119.071, Florida Statutes, and not subject to

Line 5. If your return and payment are late, you owe interest disclosure as public records. Collection of your SSN is authorized under

on the Total Tax Due (Line 4). Florida law provides state and federal law. Visit our Internet site at floridarevenue.com and

select “Privacy Notice” for more information regarding the state and federal

Use black ink. Example A - Handwritten Example B - Typed law governing the collection, use, or release of SSNs, including authorized

exceptions.

Detach Here 0 1 2 3 4 5 6 7 8 9 0123456789

Florida Department of Revenue Out-of-State Purchase Return DR-15MO

Do not use this form if you are a registered Florida sales tax dealer or if you purchased an aircraft or boat. R. 01/16

Purchases made for quarter ending (see Quarterly Schedule) DR-15MO DOLLARS CENTS

— — 1. Amount Purchased

Social Security Number* (Enter total from Schedule of

— , , •

Purchases)

Federal Employer ID No.

2. Tax (Line 1 x .06)

Purchaser’s Name _______________________________________________________ , •

(Print or Type)

3. Less Credits (Taxes paid)

Address ________________________________________________________________ , •

4. Total Tax Due

City ____________________________________ State ________ZIP ______________ (Line 2 minus Line 3) , •

5. Interest

, •

6. Amount Due

(Total of Lines 4 and 5) , •

9100 0 99999999 0001003087 1 4000001189 2797 4