Enlarge image

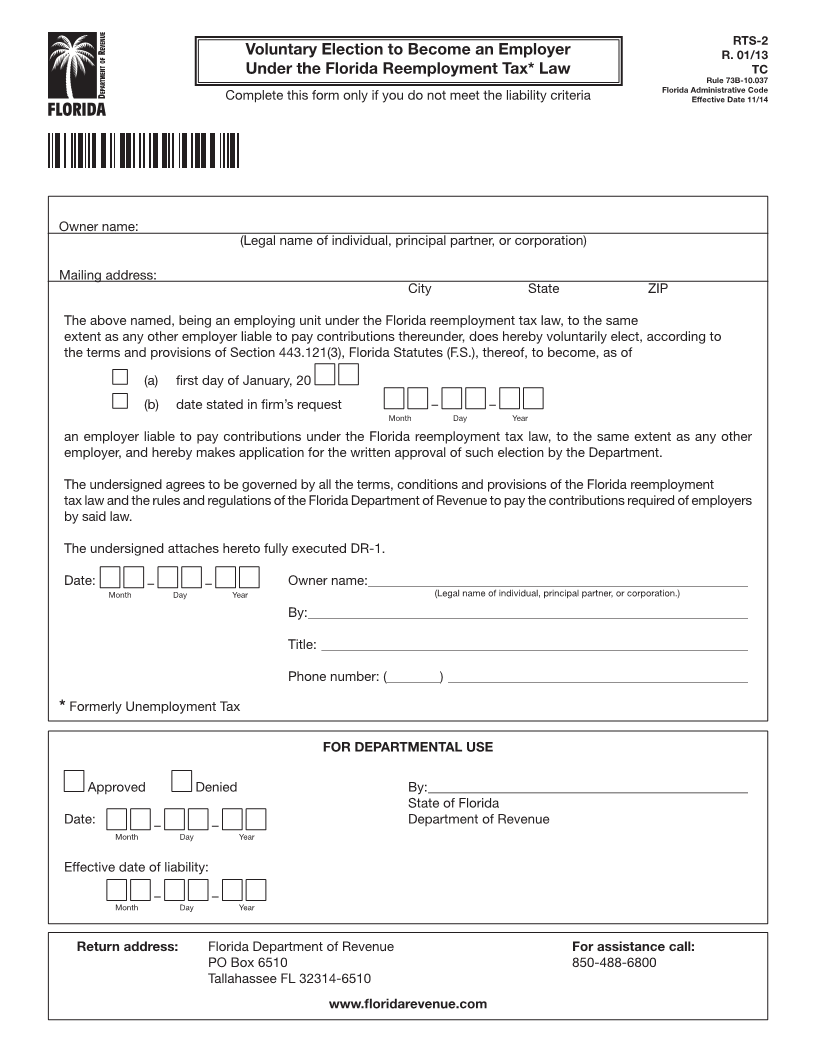

RTS-2

Voluntary Election to Become an Employer R. 01/13

Under the Florida Reemployment Tax* Law TC

Rule 73B-10.037

Florida Administrative Code

Complete this form only if you do not meet the liability criteria Effective Date 11/14

Owner name:

(Legal name of individual, principal partner, or corporation)

Mailing address:

City State ZIP

The above named, being an employing unit under the Florida reemployment tax law, to the same

extent as any other employer liable to pay contributions thereunder, does hereby voluntarily elect, according to

the terms and provisions of Section 443.121(3), Florida Statutes (F.S.), thereof, to become, as of

(a) first day of January, 20

(b) date stated in firm’s request – –

Month Day Year

an employer liable to pay contributions under the Florida reemployment tax law, to the same extent as any other

employer, and hereby makes application for the written approval of such election by the Department.

The undersigned agrees to be governed by all the terms, conditions and provisions of the Florida reemployment

tax law and the rules and regulations of the Florida Department of Revenue to pay the contributions required of employers

by said law.

The undersigned attaches hereto fully executed DR-1.

Date: Month – Day – Year Owner name: _________________________________________________________(Legal name of individual, principal partner, or corporation.)

By: __________________________________________________________________

Title: ________________________________________________________________

Phone number: (________) _____________________________________________

* Formerly Unemployment Tax

FOR DEPARTMENTAL USE

Approved Denied By: ________________________________________________

State of Florida

Date: Department of Revenue

Month – Day – Year

Effective date of liability:

Month – Day – Year

Return address: Florida Department of Revenue For assistance call:

PO Box 6510 850-488-6800

Tallahassee FL 32314-6510

www.floridarevenue.com