Enlarge image

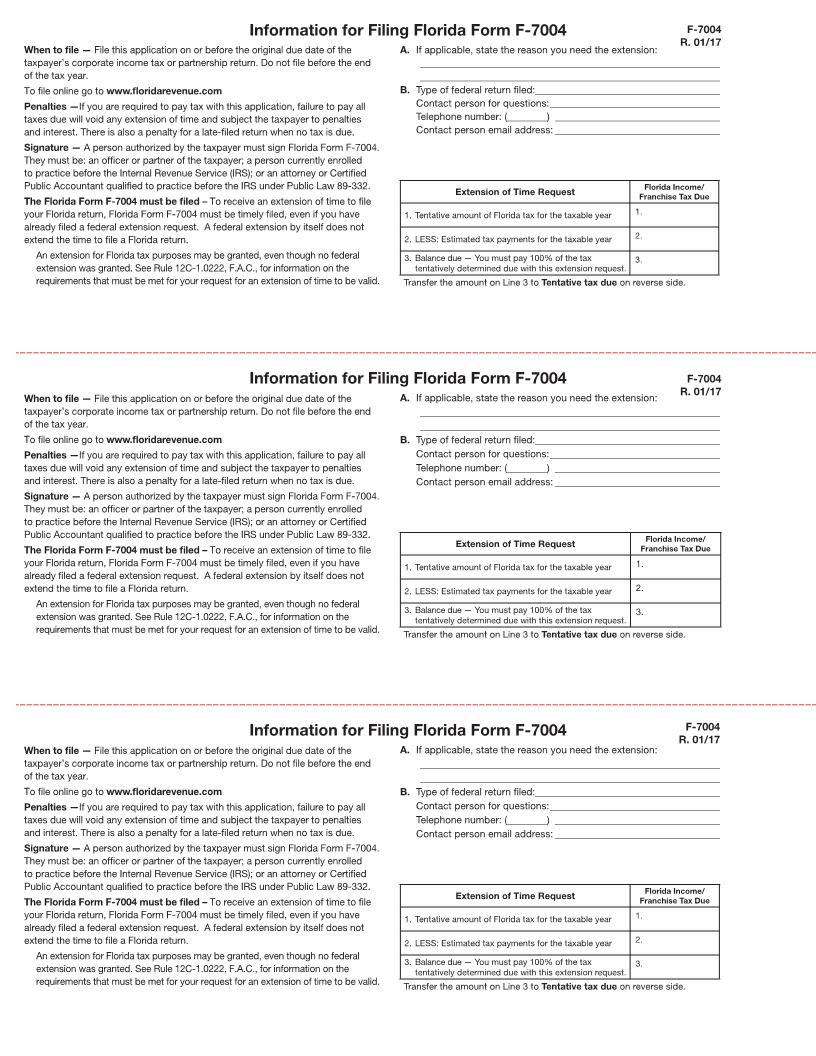

Rule 12C-1.051

Florida Administrative Code Florida Department of Revenue - Corporate Income Tax F-7004

Effective 01/17 Florida Tentative Income / Franchise Tax R. 01/17

Return and Application for Extension of Time to File Return TC

You must write within the boxes. (example) 0 1 23 4 567 8 9 If typing, type through the boxes. (example) 0123456789

Write your numbers as shown and enter one number per box.

FEIN

Name Taxable year end: Type of federal 1065 1120S

Address return to be filed

one box only)

City/St M M D D Y Y (Mark “X” in

ZIP F-7004 All other federal

returns to be filed

Under penalties of perjury, I declare that I have been authorized by the above-named taxpayer to make this US DOLLARS CENTS

application, and that to the best of my knowledge and belief the statements herein are true and correct:

Tentative tax due

Sign here: __________________________________________Date: _______________ (See reverse side)

Make checks payable to and mail to: Florida Department of Revenue, 5050 W Tennessee St, Tallahassee FL 32399-0135

9100 0 20229999 0002005030 2 3999999999 0000 2

Rule 12C-1.051

Florida Administrative Code Florida Department of Revenue - Corporate Income Tax F-7004

Effective 01/17 Florida Tentative Income / Franchise Tax R. 01/17

Return and Application for Extension of Time to File Return TC

You must write within the boxes. (example) 0 1 23 4 567 8 9 If typing, type through the boxes. (example) 0123456789

Write your numbers as shown and enter one number per box.

FEIN

Name Taxable year end: 1065 1120S

Type of federal

Address return to be filed

(Mark “X” in

City/St M M D D Y Y one box only)

ZIP F-7004 All other federal

returns to be filed

Under penalties of perjury, I declare that I have been authorized by the above-named taxpayer to make this US DOLLARS CENTS

application, and that to the best of my knowledge and belief the statements herein are true and correct:

Tentative tax due

Sign here: __________________________________________Date: _______________ (See reverse side)

Make checks payable to and mail to: Florida Department of Revenue, 5050 W Tennessee St, Tallahassee FL 32399-0135

9100 0 20229999 0002005030 2 3999999999 0000 2

Rule 12C-1.051

Florida Administrative Code Florida Department of Revenue - Corporate Income Tax F-7004

Effective 01/17 Florida Tentative Income / Franchise Tax R. 01/17

Return and Application for Extension of Time to File Return TC

You must write within the boxes. (example) 0 1 23 4 567 8 9 If typing, type through the boxes. (example) 0123456789

Write your numbers as shown and enter one number per box.

FEIN

Name Taxable year end: 1065 1120S

Address Type of federal

return to be filed

City/St M M D D Y Y (Mark “X” in

one box only)

ZIP F-7004 All other federal

returns to be filed

Under penalties of perjury, I declare that I have been authorized by the above-named taxpayer to make this US DOLLARS CENTS

application, and that to the best of my knowledge and belief the statements herein are true and correct:

Tentative tax due

Sign here: __________________________________________Date: _______________ (See reverse side)

Make checks payable to and mail to: Florida Department of Revenue, 5050 W Tennessee St, Tallahassee FL 32399-0135

9100 0 20229999 0002005030 2 3999999999 0000 2