Enlarge image

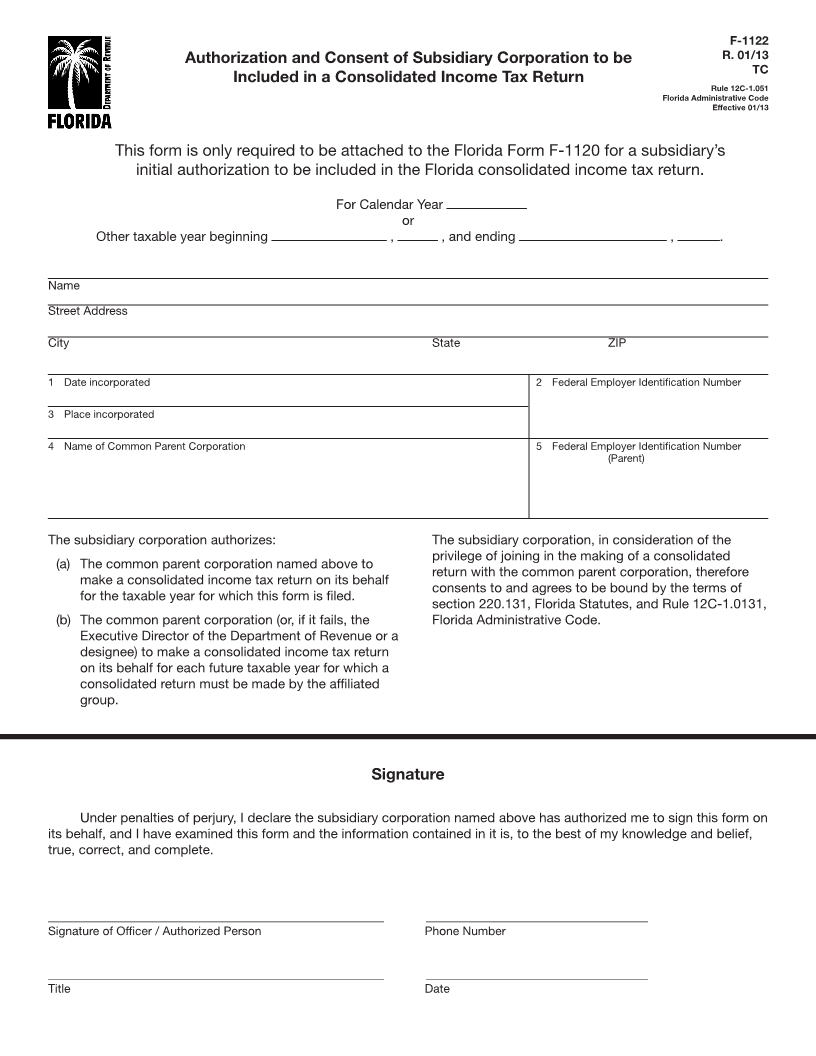

F-1122

Authorization and Consent of Subsidiary Corporation to be R. 01/13

TC

Included in a Consolidated Income Tax Return

Rule 12C-1.051

Florida Administrative Code

Effective 01/13

This form is only required to be attached to the Florida Form F-1120 for a subsidiary’s

initial authorization to be included in the Florida consolidated income tax return.

For Calendar Year

or

Other taxable year beginning , , and ending , .

Name

Street Address

City State ZIP

1 Date incorporated 2 Federal Employer Identification Number

3 Place incorporated

4 Name of Common Parent Corporation 5 Federal Employer Identification Number

(Parent)

The subsidiary corporation authorizes: The subsidiary corporation, in consideration of the

privilege of joining in the making of a consolidated

(a) The common parent corporation named above to

return with the common parent corporation, therefore

make a consolidated income tax return on its behalf

consents to and agrees to be bound by the terms of

for the taxable year for which this form is filed.

section 220.131, Florida Statutes, and Rule 12C-1.0131,

(b) The common parent corporation (or, if it fails, the Florida Administrative Code.

Executive Director of the Department of Revenue or a

designee) to make a consolidated income tax return

on its behalf for each future taxable year for which a

consolidated return must be made by the affiliated

group.

Signature

Under penalties of perjury, I declare the subsidiary corporation named above has authorized me to sign this form on

its behalf, and I have examined this form and the information contained in it is, to the best of my knowledge and belief,

true, correct, and complete.

________________________________________________________ _____________________________________

Signature of Officer / Authorized Person Phone Number

________________________________________________________ _____________________________________

Title Date