Enlarge image

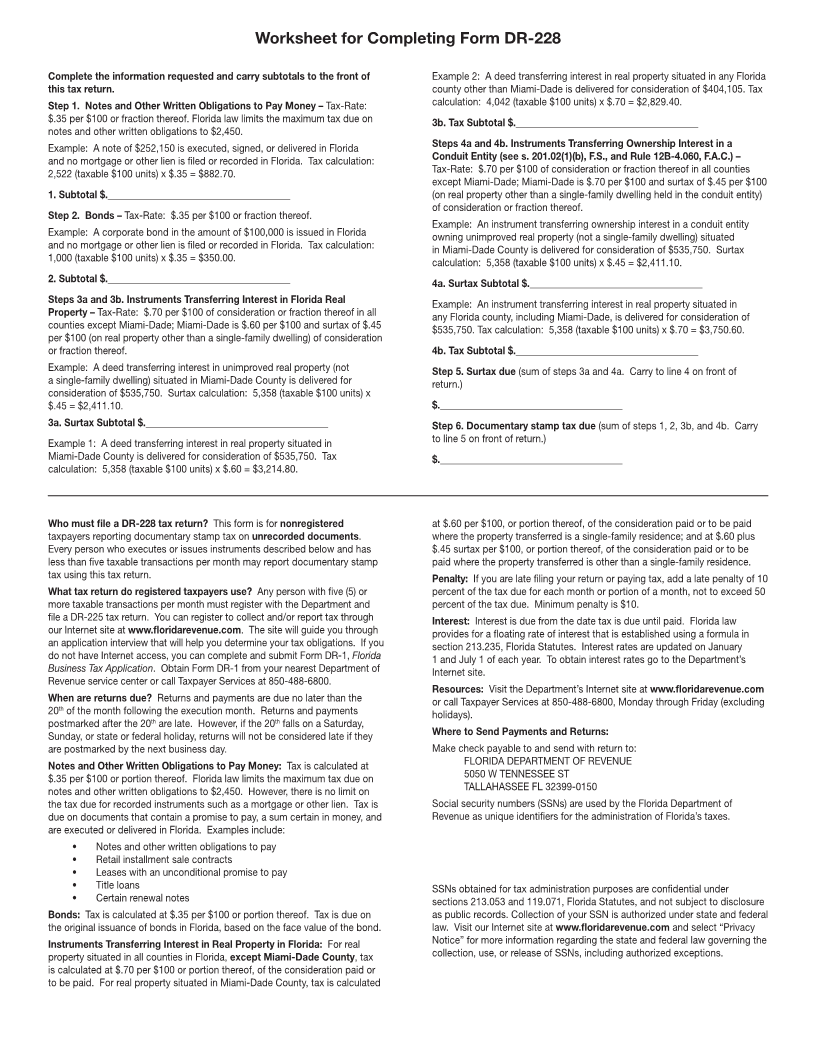

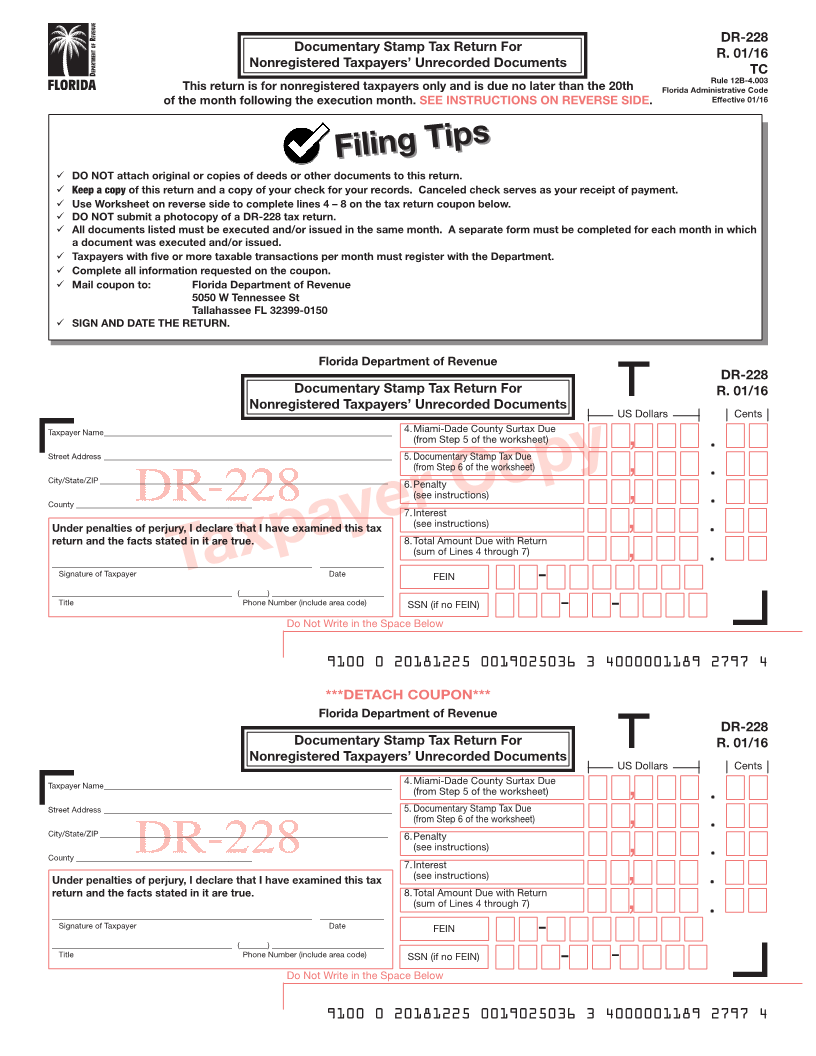

DR-228

Documentary Stamp Tax Return For

R. 01/16

Nonregistered Taxpayers’ Unrecorded Documents

TC

Rule 12B-4.003

This return is for nonregistered taxpayers only and is due no later than the 20th Florida Administrative Code

of the month following the execution month. SEE INSTRUCTIONS ON REVERSE SIDE. Effective 01/16

Filing TipsFiling Tips

ü DO NOT attach original or copies of deeds or other documents to this return.

ü Keep a copy of this return and a copy of your check for your records. Canceled check serves as your receipt of payment.

ü Use Worksheet on reverse side to complete lines 4 – 8 on the tax return coupon below.

ü DO NOT submit a photocopy of a DR-228 tax return.

ü All documents listed must be executed and/or issued in the same month. A separate form must be completed for each month in which

a document was executed and/or issued.

ü Taxpayers with five or more taxable transactions per month must register with the Department.

ü Complete all information requested on the coupon.

ü Mail coupon to: Florida Department of Revenue

5050 W Tennessee St

Tallahassee FL 32399-0150

ü SIGN AND DATE THE RETURN.

Florida Department of Revenue

DR-228

Documentary Stamp Tax Return For R. 01/16

Nonregistered Taxpayers’ Unrecorded Documents

US Dollars Cents

Taxpayer Name ________________________________________________________________________ 4. Miami-Dade County Surtax Due

(from Step 5 of the worksheet)

,

Street Address ________________________________________________________________________ 5. Documentary Stamp Tax Due

(from Step 6 of the worksheet) ,

City/State/ZIP ________________________________________________________________________ 6. Penalty

(see instructions) ,

County ____________________________________________

7. Interest

Under penalties of perjury, I declare that I have examined this tax (see instructions) ,

return and the facts stated in it are true. 8. Total Amount Due with Return

(sum of Lines 4 through 7)

_________________________________________________________________ ________________ ,

Signature of Taxpayer Taxpayer Date FEIN Copy

-

_____________________________________________ (_______) ____________________________

Title Phone Number (include area code) SSN (if no FEIN) - -

Do Not Write in the Space Below

9100 0 20181225 0019025036 3 4000001189 2797 4

***DETACH COUPON***

Florida Department of Revenue

DR-228

Documentary Stamp Tax Return For R. 01/16

Nonregistered Taxpayers’ Unrecorded Documents

US Dollars Cents

4. Miami-Dade County Surtax Due

Taxpayer Name ________________________________________________________________________ (from Step 5 of the worksheet) ,

Street Address ________________________________________________________________________ 5. Documentary Stamp Tax Due

(from Step 6 of the worksheet) ,

City/State/ZIP ________________________________________________________________________ 6. Penalty

(see instructions)

County ____________________________________________ ,

7. Interest

Under penalties of perjury, I declare that I have examined this tax (see instructions) ,

return and the facts stated in it are true. 8. Total Amount Due with Return

(sum of Lines 4 through 7)

_________________________________________________________________ ________________ ,

Signature of Taxpayer Date FEIN

-

_____________________________________________ (_______) ____________________________

Title Phone Number (include area code) SSN (if no FEIN) - -

Do Not Write in the Space Below

9100 0 20181225 0019025036 3 4000001189 2797 4