Enlarge image

DR-1N

Registering Your Business R. 01/23

TC 07/23

Rule 12A-1.097, F.A.C.

Effective 01/23

Page 1 of 6

The Florida Department of Revenue administers over 30 taxes and fees. In most cases, you must register with the

Department as a dealer before you begin conducting business activities subject to Florida’s taxes and fees. This

publication provides the information you will need to register with the Department using a Florida Business Tax

Application, additional registration applications you may need to complete your registration with the Department, and

registration applications you may need instead of the Florida Business Tax Application.

The Florida Business Tax Application (online or paper Form DR-1) asks you to answer a series of questions about your

business that will assist you in identifying your tax responsibilities and to register to collect, report, and pay the following

Florida taxes and fees:

• Communications services tax • Rental car surcharge

• Documentary stamp tax • Reemployment tax

• Gross receipts tax on dry-cleaners • Prepaid wireless fee

• Gross receipts tax on electrical power • Sales and use tax

and gas • Severance taxes (solid mineral, gas, sulfur, and oil

• Lead-acid battery fee production)

• Miami-Dade County Lake Belt fees • Waste tire fee

Do I Have the Application I need? If you previously submitted a Florida Business Tax Application to the Department and you hold an active certificate of

registration or reemployment tax account number (if you have employees), you may use the Application for Registered

Businesses to Add a New Florida Location (Form DR-1A) to register:

• an additional business location or Florida rental property

• a registered location that has moved from one Florida county to another

to collect, report, and pay the following Florida taxes:

• Sales and use tax • Waste tire fee

• Prepaid wireless fee • Rental car surcharge

• Lead-acid battery fee • Documentary stamp tax

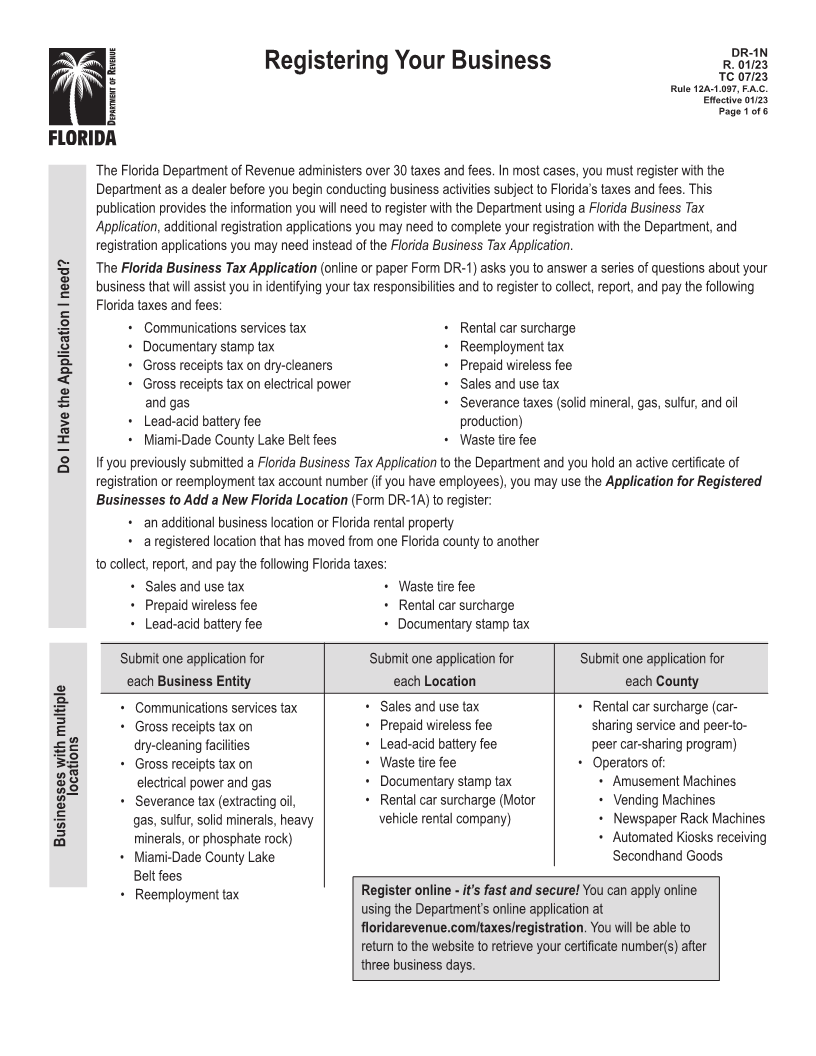

Submit one application for Submit one application for Submit one application for

each Business Entity each Location each County

• Communications services tax • Sales and use tax • Rental car surcharge (car-

• Gross receipts tax on • Prepaid wireless fee sharing service and peer-to-

dry-cleaning facilities • Lead-acid battery fee peer car-sharing program)

• Gross receipts tax on • Waste tire fee • Operators of:

locations electrical power and gas • Documentary stamp tax • Amusement Machines

• Severance tax (extracting oil, • Rental car surcharge (Motor • Vending Machines

gas, sulfur, solid minerals, heavy vehicle rental company) • Newspaper Rack Machines

Businesses minerals,with multipleor phosphate rock) • Automated Kiosks receiving

• Miami-Dade County Lake Secondhand Goods

Belt fees

• Reemployment tax Register online it’s- fast and secure! You can apply online

using the Department’s online application at

floridarevenue.com/taxes/registration. You will be able to

return to the website to retrieve your certificate number(s) after

three business days.