Enlarge image

Reemployment Tax Instructions RT-89

for Excess Wage Computation R. 06/21

Rule 73B-10.037, F.A.C.

Effective 06/21

This information is provided for use in computing excess wages. It is intended to assist employers in the correct reporting

of wages on the Employer’s Quarterly Report (RT-6). An Employer’s Quarterly Report must be filed even when all wages

are excess and no tax is due.

• For calendar years 2015 and forward, Taxable Wages are the first $7,000 paid to each covered employee during the

calendar year.

• Excess Wages are wages paid over $7,000 to an employee during the calendar year. Excess wages are not taxable

wages.

• Only the first $7,000 paid to an employee by the same employer in a calendar year is taxable. Taxable wages reported

to another state by the same employer within the same calendar year should be included in determining the excess

wage base for the employer. Report year-to-date, out-of-state taxable wages on the Employers Quarterly Report for

Out-of-State Wages (RT-6NF).

• If you are a legal successor, the wages paid by your predecessor during the calendar year should be included in

determining excess wages.

• Wages must be reported on the Employer’s Quarterly Report (RT-6) in the quarter paid.

• The sum of all amounts exceeding $7,000 per employee (excess wages) is entered on Line 3 of the tax report. This

sum can never be larger than the gross wages (Line 2).

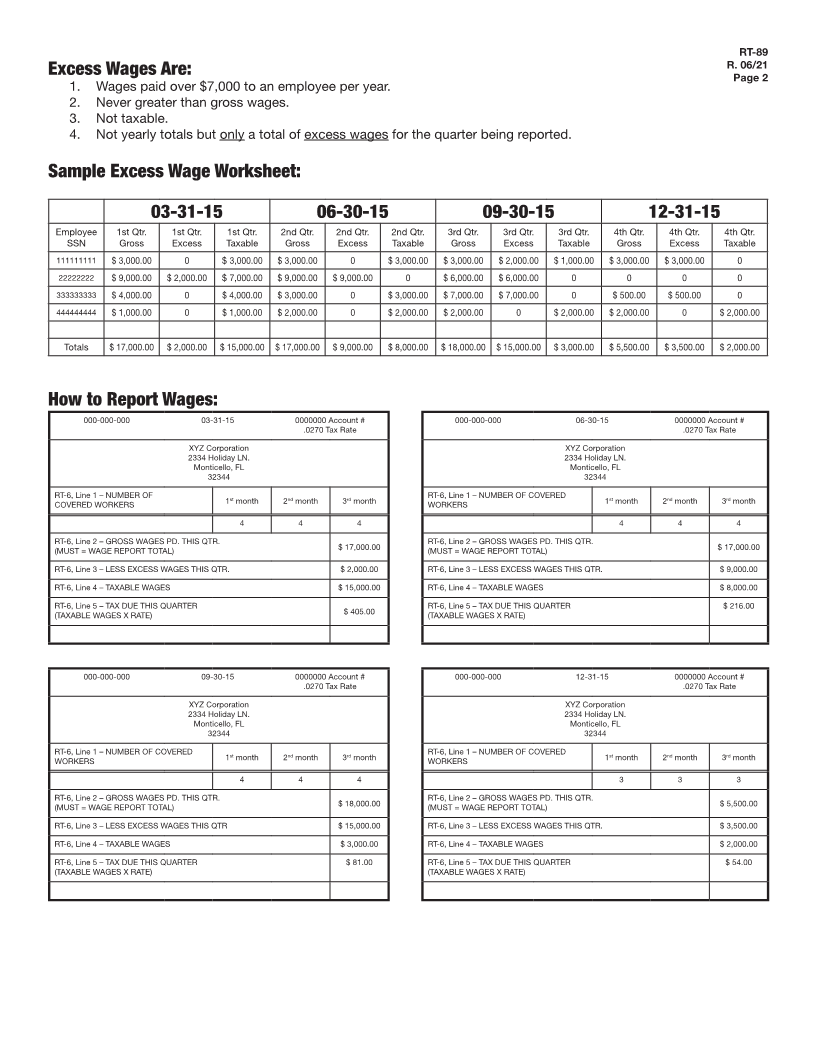

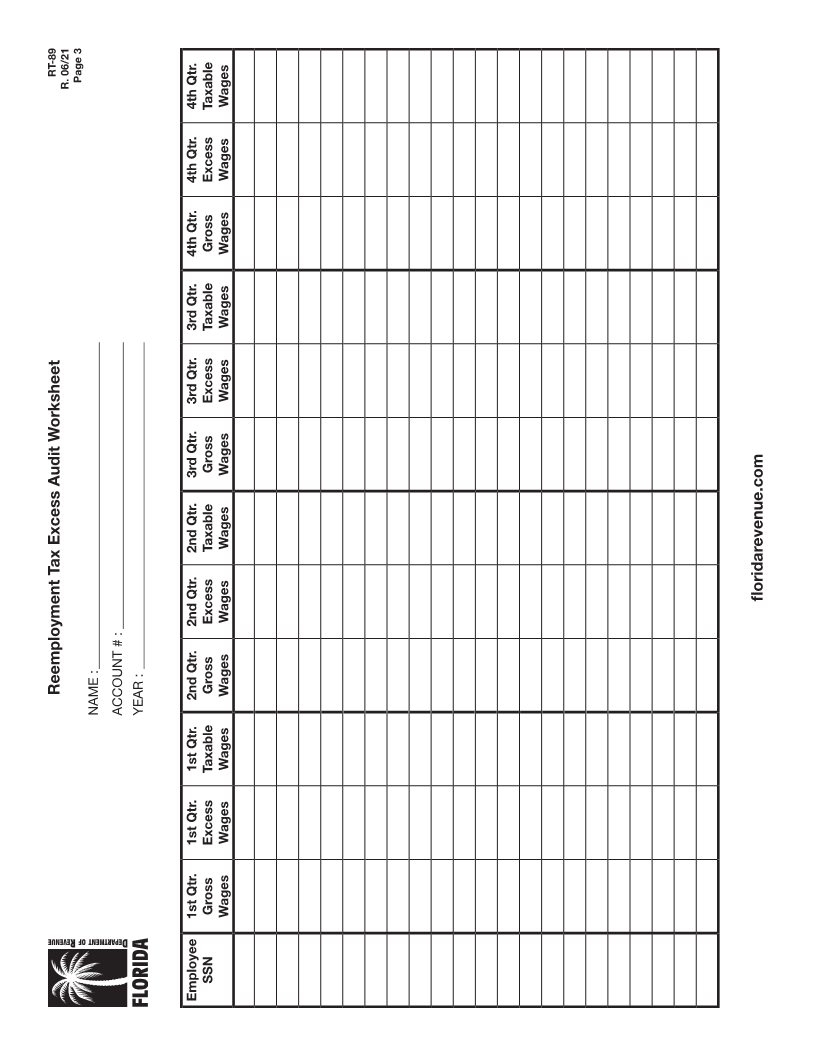

The example on the reverse side shows a sample payroll with the employees’ wages and how to report them for a calendar

year.

For Information and Forms

Information and forms are available on our website at floridarevenue.com/forms.

Closing/Sale of Business or Change of Address or Business Name: If you change your business name, business location, mailing

address, or close/sell your business, you must notify us immediately. The quickest way to make changes to your business location,

mailing address, phone numbers, or tax status (active/inactive), or cancel your Certificate of Registration, is to notify us online. You

may do so by going to floridarevenue.com/taxes/updateaccount.

To speak with a Department of Revenue representative: You must submit a new registration if you:

Call Taxpayer Services at 850-488-6800, Monday through • Move your business location from one county to

Friday, excluding holidays. another.

• Change your legal entity.

Subscribe to Receive Updates by Email from the • Change the ownership of your business.

Department. Subscribe to receive due date reminders, Tax Register online at floridarevenue.com/taxes/registration.

Information Publications (TIPs), or proposed rules. Subscribe

today at floridarevenue.com/dor/subscribe. For a written reply to tax questions, write:

Taxpayer Services MS 3-2000

Florida Department of Revenue

5050 W Tennessee St

Tallahassee FL 32399-0112

Social security numbers (SSNs) are used by the Florida Department of Revenue as unique identifiers for the administration of Florida’s taxes. SSNs

obtained for tax administration purposes are confidential under sections 213.053 and 119.071, Florida Statutes, and not subject to disclosure as public

records. Collection of your SSN is authorized under state and federal law. Visit our Internet site at floridarevenue.com/privacy for more information

regarding the state and federal law governing the collection, use, or release of SSNs, including authorized exceptions.