Enlarge image

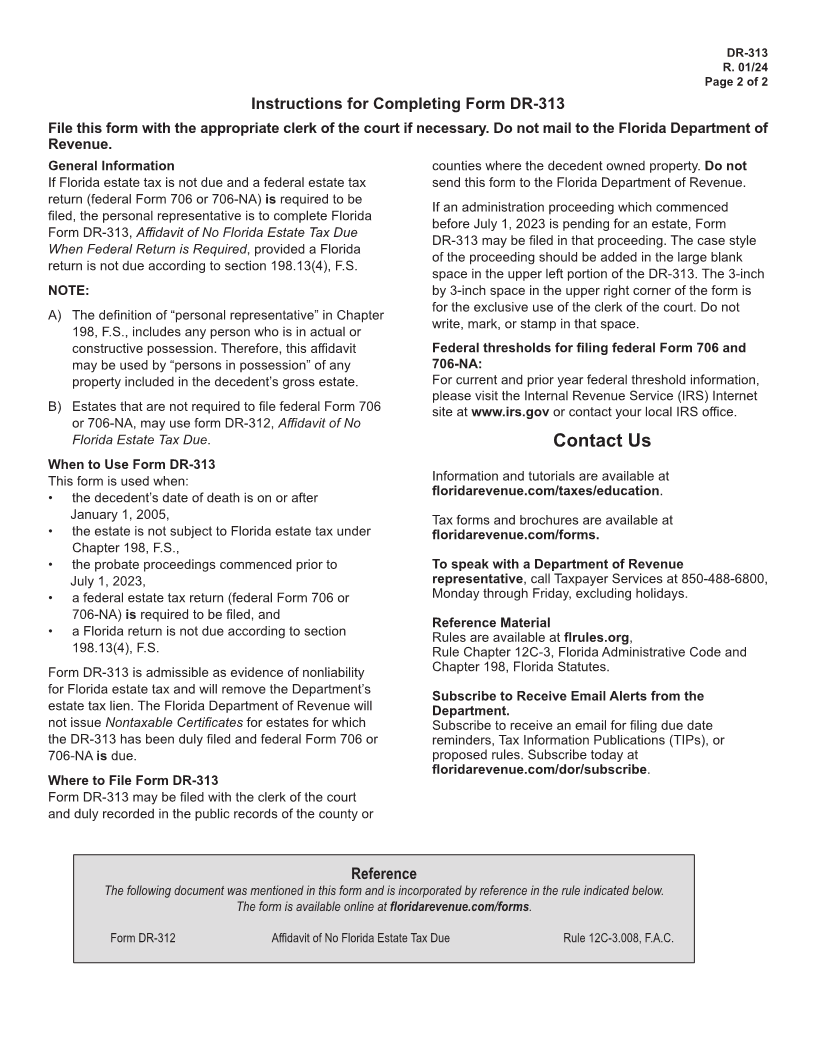

Affidavit of No Florida Estate Tax Due DR-313

R. 01/24

When Federal Return is Required Rule 12C-3.008, F.A.C.

Effective 01/24

Page 1 of 2

(This space available for case style of estate probate proceeding) (For official use only)

I, the undersigned, _________________________________________________________________, do hereby state:

(print name of personal representative)

1. I am the personal representative as defined in section 198.01 or section 731.201, Florida Statutes (F.S.), as the

case may be, of the estate of __________________________________________________________________ .

(print name of decedent)

2. The decedent referenced above died on _____/_____/_____, and was domiciled (as defined in section 198.015,

(date of death)

F.S.) at the time of death in the state of _______________________.

On date of death, the decedent was (check one): a U.S. citizeno o nota U.S. citizen

3. A federal estate tax return (federal Form 706 or 706-NA) is required to be filed for the estate.

4. The estate does not owe Florida estate tax pursuant to Chapter 198, F.S.

5. The estate is not required to file a Florida estate tax return (Form F-706) according to section 198.13(4), F.S.

6. I acknowledge personal liability for distribution in whole or in part of any of the estate by having obtained release of

such property from the lien of the Florida estate tax.

Under penalties of perjury, I declare that I have read the foregoing Affidavit and that the facts stated in it are true to the best of

my knowledge and belief. This Affidavit is based on all information of which the personal representative has any knowledge.

Signature ____________________________________________

Print name __________________________________________ Telephone number ___________________________________

Mailing address ______________________________________ City/State/ZIP _______________________________________

File this form with the appropriate clerk of the court. Do not mail to the Florida Department of Revenue.