Enlarge image

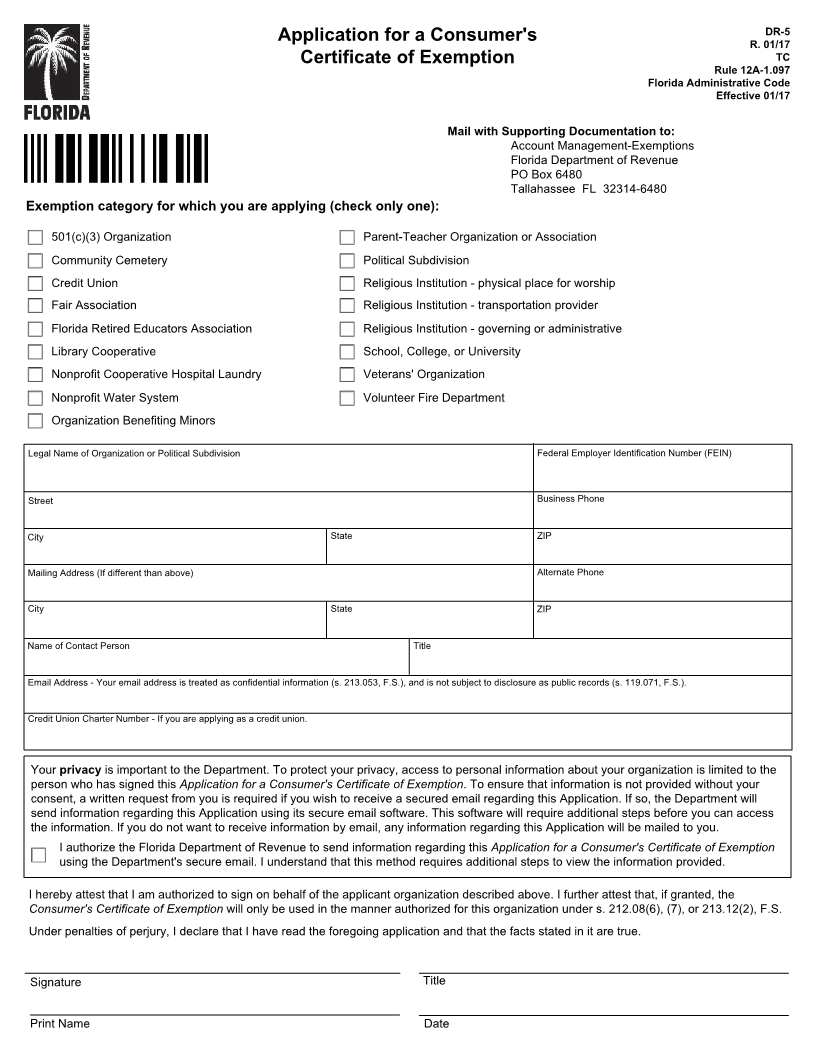

DR-5

Application for a Consumer's R. 01/17

Certificate of Exemption TC

Rule 12A-1.097

InstructionsFlorida Administrative Code

Effective 01/17

General Information Exemption Categories

Exemption from Florida sales and use tax is granted to certain 501(c)(3) Organizations

nonprofit organizations and governmental entities that meet the

Who qualifies? Organizations determined by the Internal Revenue

criteria set forth in sections (ss.) 212.08(6), 212.08(7), and

Service (IRS) to be currently exempt from federal income tax

213.12(2), Florida Statutes (F.S.). Florida law requires that these

pursuant to Internal Revenue Code (IRC) 501(c)(3) ["501(c)(3)

nonprofit organizations and governmental entities obtain an

nonprofit organization"].

exemption certificate from the Department.

What is exempt? Purchases and leases of items or services by, and

Application Process: This application provides the various rentals or leases of real property and living or sleeping

exemption categories under which a nonprofit organization or accommodations to, a nonprofit organization that are used in

governmental entity (political subdivision) may obtain a Consumer's carrying on the organization's customary nonprofit activities.

Certificate of Exemption (Form DR-14). The information in each

exemption category includes: How to Establish Qualification as a Single Organization. Verify

that the federal employer identification number (FEIN) included in

• who qualifies; the application is identical to the FEIN contained in the

• what is exempt; and determination letter for 501(c)(3) federal tax status issued by the

IRS. Your organization's federal tax exemption status will be verified

• how to establish qualification for the exemption. using the FEIN that you provide and the IRS Exempt Organizations

The Department will issue a Consumer's Certificate of Exemption to Select Check [publication of organizations exempt from federal

each nonprofit organization or governmental entity that qualifies for income tax under IRC 501(c)(3)].

an exemption. The certificate will be valid for a period of five (5) A limited liability company (LLC) whose sole member is a 501(c)(3)

years. nonprofit organization may receive the benefit of its member's

federal tax-exempt status. To establish qualification, provide:

Renewal Process: At the end of the five-year period, the

Department will use available information to determine whether • A copy of the Articles of Incorporation establishing that a 501(c)(3)

your nonprofit organization or governmental entity is actively nonprofit organization is the sole member of the LLC; and

engaged in an exempt endeavor. If you are located outside Florida, • A letter signed by a corporate officer stating that the LLC and

the Department will request information on whether you wish to the 501(c)(3) nonprofit organization perform the same business

have your Consumer's Certificate of Exemption renewed. If you fail activities and that the LLC is disregarded for federal income tax

to respond to the written requests, your certificate will expire and purposes.

will not be renewed.

Option to Establish Qualifications for a Group of Organizations:

When the Department is able to determine that your nonprofit

organization or governmental entity continues to be actively • Attach a list of the following information for each subsidiary

applying for exemption: legal name, mailing address, location

engaged in an exempt endeavor using available information, a new

address, and FEIN;

Consumer's Certificate of Exemption will be issued. When the

Department is unable to make a determination based on the • Provide a copy of the determination letter for 501(c)(3) federal

available information, a letter requesting the documentation listed in tax status issued by the IRS (including the list of qualified

"How to Establish Qualification" for the appropriate exemption subsidiary organizations); and

category will be mailed to you. If you fail to respond to the written • Provide a copy of any changes submitted to the IRS regarding

requests, your certificate will expire and will not be renewed. information for the subsidiaries applying for exemption.

Sales and Use Tax Registration: If your nonprofit organization Community Cemeteries

or governmental entity will be selling items, or will be leasing or

renting commercial or transient rental property to others in Florida, Who qualifies? Nonprofit corporations determined by the IRS to be

you will also need to register with the Department to collect, currently exempt from federal income tax pursuant to IRC 501(c)(13)

report, and pay sales and use tax. To register, go to our website that operate a cemetery donated by deed to the community.

at www.floridarevenue.com. The site will guide you through an What is exempt? Purchases and leases of items or services by the

application interview that will help you determine your tax qualified nonprofit corporation used in maintaining the donated

obligations. If you do not have Internet access, you can complete cemetery.

a paper Florida Business Tax Application (Form DR-1). How to Establish Qualification.

Questions? If you have any questions about the application Provide:

process, call Account Management at 850-488-6800, Monday

through Friday (excluding holidays). • A copy of the determination letter for 501(c)(13) federal tax

status issued by the IRS; and

• A copy of the deed transferring the cemetery property to the

community.