Enlarge image

2023 NORTH DAKOTA PARTNERSHIP INCOME TAX TAX.ND.GOV INCLUDES SCHEDULE FACT SCHEDULE K SCHEDULE KP SCHEDULE K-1 Email Questions to: individualtax@nd.gov

Enlarge image | 2023 NORTH DAKOTA PARTNERSHIP INCOME TAX TAX.ND.GOV INCLUDES SCHEDULE FACT SCHEDULE K SCHEDULE KP SCHEDULE K-1 Email Questions to: individualtax@nd.gov |

Enlarge image |

Contents

Need help?

Where to get help and forms ........................................................ This page You can download forms and find other

Changes for 2023 ................................................................................... 1 information on our website at:

tax.nd.gov

General instructions ................................................................................2

Email

Who must file .....................................................................................2

Individual, estate, trust, partnership,

When and where to file ........................................................................ 2 and S corporation income tax—

Extension of time to file ....................................................................... 2 individualtax@nd.gov

Penalty and interest ............................................................................ 2

Estimated tax payment (for 2024) ........................................................ 3 Call

Withholding from nonresident partners .................................................. 3 Individual income tax—

Composite filing ..................................................................................3 Questions 701-328-1247

Correcting a previously filed return ........................................................ 4 Forms 701-328-1243

Reporting federal changes .................................................................... 4 Partnership income tax—

W-2/1099 reporting requirement .......................................................... 4 Questions 701-328-1258

Forms 701-328-1243

Disclosure notification ......................................................................... 4

Use of information .............................................................................. 4 Speech/hearing impaired

TDD 800-366-6888

General instructions for completing Form 58 .............................................. 4

Specific line instructions ..........................................................................5 Write

Form 58, Page 1, Items A-J ..................................................................5 Office of State Tax Commissioner

Schedule FACT ...................................................................................5 600 E. Boulevard Ave., Dept. 127

Bismarck, ND 58505-0599

Schedule K ........................................................................................6

Schedule KP ..................................................................................... 10 Walk-in or appointment

Form 58, Page 1, Lines 1-12 ............................................................... 12 service

Schedule K-1 .................................................................................... 13 State Capitol Building, 8th Floor

Before you file Form 58 ..................................................................... 14 600 E. Boulevard Ave., Bismarck, ND

Monday through Friday

Required forms 8:00 a.m. to 5:00 p.m.

The following forms are needed to complete Form 58: (except holidays)

Form 58 Partnership return Walk-ins are welcome. To assure

Schedule FACT Calculation of North Dakota apportionment factor availability and promptness of

Schedule K Total North Dakota adjustments, credits, and other service, call in advance to make an

items distributable to partners appointment.

Schedule KP Partner information

Schedule K-1 Partner’s share of North Dakota income (loss), deductions,

adjustments, credits, and other items

The following forms may be needed:

Form 58-PV Partnership return payment voucher

Form 58-EXT Partnership extension payment voucher Privacy Act Notification

In compliance with the Privacy Act of

Form 101 Application for extension of time to file a North Dakota 1974, disclosure of a Federal Employer

income tax return Identification Number (FEIN) or social

Form PWA Passthrough entity withholding adjustment security number on this form is required under

Form PWE Nonresident passthrough entity member exemption and N.D.C.C. §§ 57-01-15 and 57-38-42, and will

be used for tax reporting, identification, and

certification administration of North Dakota tax laws.

Disclosure is mandatory. Failure to provide

Download these forms from our website at tax.nd.gov. the FEIN or social security number may

delay or prevent the processing of this form.

Taxpayer Bill of Rights

Obtain a copy of the North Dakota Taxpayer Bill of Rights on the

Office of State Tax Commissioner’s website at

tax.nd.gov

|

Enlarge image |

1

Changes affecting partnerships

Developments, updates, and items of interest relating to partnership income tax

REMINDER - Electronic Filing The apprentice must be in an The tax rate was changed from up

Partnerships with 10 or more owners apprenticeship program certified by to 20% to now be 15% of the cost

are required to file the North Dakota the U.S. Department of Labor or be an of the qualifying equipment. The

income tax return and pay any tax electrical apprentice registered under annual maximum statewide tax credits

due on it by electronic means. If a North Dakota law. authorized was increased from $1

partnership return with 10 or more million to $3 million per year. Of the

The credit is equal to 10% of the

owners is filed on paper, the return $3 million annual total tax amount,

stipend or salary paid to the qualified

will not be processed and may be $500,000 of tax credits is reserved

apprentice. The maximum credit a

subject to penalties due to the failure each year for first-time claimants for

taxpayer can claim over all tax years

to file electronically. automation equipment and $500,000

is $3,000 and limits the earning of a

of tax credits is reserved each year

NEW - North Dakota passthrough tax credit to only five apprentices at

for first-time claimants for animal

withholding the same time. Any credit earned in

agriculture equipment.

Income tax rates were lowered excess of the limit may not be carried

effective with the 2023 tax year. The forward or back to other tax years. The program was also made

highest rate was lowered to 2.50%. permanent.Other provisions were

The credit is available to corporations,

The income tax withholding rate on unchanged.

individuals, estates, trusts, and

nonresident owners of passthrough

passthrough entities. A tax credit The changes are applicable for

entities also was lowered and is

earned by a passthrough entity is purchases during calendar year 2023,

reflected on the 2023 income tax

passed through and allowed to each for which applications would be due

forms and instructions.

owner in proportion to their respective to the North Dakota Department of

NEW - Contributions to maternity interests in the passthrough entity. Commerce by January 31, 2024. The

home, child placing agency, or requirement continues to exist for

UPDATE – Renaissance Zone

pregnancy help center a claimant to subsequently file with

tax incentive changes effective

An income tax credit is allowed the Office of State Tax Commissioner

August 1, 2023

for contributions to a child placing a report of Improved Job Quality or

A variety of changes occurred to

agency licensed by the North Dakota Increased Productivity.

the Renaissance Zone program.

Department of Health and Human

One of the changes is the maximum UPDATE - Disabled employment

Services (DHS), a nonprofit maternity

length of an income tax incentive tax credit

home located in North Dakota, or a

was changed from five years to In 2023, the North Dakota Legislature

pregnancy help center recognized by

eight years for a project that meets reenacted and made permanent the

DHS.

certain rehabilitation thresholds. existing income tax credit related to

The credit is equal to 100% of the Specifically, for residential (except the employment of an individual with

contribution. The credit is limited to owner occupied) and commercial developmental disabilities or severe

50% of a taxpayer’s tax liability. Any property, a rehabilitation level mental illness. The existing provisions

credit earned in excess of the limit may exceeding 75% is required to allow of the tax credit were unchanged,

not be carried forward or back to other for an exemption up to eight years. except the statewide limitation on

tax years. Rehabilitation exceeding 50% is the number of eligible employees was

required for an exemption up to five removed and there is no limit.

The credit is available to corporations,

years. For owner occupied residential

individuals, estates, trusts, and Stay informed of developments

property, rehabilitation exceeding

passthrough entities. Individuals, businesses, or other

20% may qualify for an exemption up

interested persons may sign up to

A tax credit earned by a passthrough to eight years.

receive email notifications when

entity is passed through and allowed

For additional RZ information, please a newsletter or other important

to each owner in proportion to their

refer to our website: information is issued by the Office of

respective interests in the passthrough

www.tax.nd.gov/renaissance- State Tax Commissioner. To sign up,

entity.

zone-incentives. go to tax.nd.gov and select “News

NEW – Tax credit for compensation Center” at the top of the page. Then

paid to an apprentice UPDATE – Automation tax credit select “Email Sign-Up”.

An income tax credit was created The 2023 North Dakota Legislature

for the employment of a qualified made changes to the existing

apprentice in an apprenticeship automation tax credit program. The

program position in North Dakota. program was expanded to include

automation or robotic equipment

purchased to upgrade or advance an

animal agricultural process.

|

Enlarge image |

2

Form 58 Instructions 2023

North Dakota Partnership Income Tax Return

“N.D.C.C.” references are to the North Dakota Century Code, which contains North Dakota’s statutes.

“N.D. Admin. Code” references are to the North Dakota Administrative Code, which contains North Dakota’s rules.

North Dakota extension. If a

General federal extension is not obtained,

REMINDER: Electronic filing

instructions Partnerships with 10 or more owners but additional time is needed to

are required to file the North Dakota complete and file Form 58, a separate

Who must file income tax return and pay any tax North Dakota extension may be

A 2023 Form 58, Partnership Income due on it by electronic means. applied for by filing Form 101,

Tax Return, must be filed by a Application for Extension of Time to

partnership that meets both of the File a North Dakota Tax Return. This

When and where to file

following: The 2023 Form 58 must be filed on is not an automatic extension—there

• It is required to file a 2023 or before (1) April 15, 2024, if filing must be good cause to request a

Form 1065, U.S. Return of for the 2022 calendar year, or (2) the North Dakota extension. Form 101

Partnership Income. 15th day of the fourth month following must be postmarked on or before the

• It carries on business, or derives the end of the tax year, if filing for due date of Form 58. Notification of

gross income from sources, in a fiscal year beginning in the 2023 whether the extension is accepted or

North Dakota during the 2023 tax calendar year. If the due date falls rejected will be provided by the

year. on a Saturday, Sunday, or holiday, Office of State Tax Commissioner.

the return may be filed on or before Extension interest. If Form 58 is

Investment partnership. A the next day that is not a Saturday, filed on or before the extended due

partnership that elects out of the Sunday, or holiday. date, and the total amount of tax due

partnership rules under I.R.C. is paid with the return, no penalty will

§ 761(a)(1) and does not file a federal Note: Use the 2022 Form 58 if filing

partnership return must file a 2023 for a fiscal year beginning in the 2022 be charged. Interest on the tax due will

Form 58 if it carries on investment calendar year. be charged at the rate of 12% per year

from the original due date of the return

activity, or derives any gross income If not required to file to the earlier of the date the return is

from sources, in North Dakota during electronically, mail Form 58 and all filed or the extended due date.

its 2023 tax year. A 2023 Form 1065 required attachments to:

Prepayment of tax due. If an

must be completed on a pro forma Office of State Tax Commissioner extension of time to file Form 58 is

basis and attached to Form 58. 600 East Boulevard Ave., Dept. 127 obtained, any tax expected to be due

Limited liability company (LLC). An Bismarck, ND 58505-0599 may be paid on or before the regular

LLC that is classified as a partnership due date to avoid paying extension

for federal income tax purposes is Extension of time to file interest. For more information,

treated like a partnership for An extension of time to file Form 58 including payment options, obtain the

North Dakota income tax purposes may be obtained in one of the 2023 Form 58-EXT.

and must file Form 58 if it meets the following ways:

above conditions for filing. Alternatively, a check or money

• Obtain a federal extension. order may be sent with a letter

Nonfiler penalty. If a partnership • Separately apply for a containing the following: (1) name of

does not file Form 58 as required, North Dakota extension. partnership, (2) partnership’s FEIN,

a minimum $500 penalty may be (3) partnership’s address and phone

assessed if the failure continues after Federal extension. If an extension number, and (4) statement that the

receiving a 30-day notice to file from of time to file the federal partnership payment is a 2023 Form 58-EXT

the Office of State Tax Commissioner. return is obtained, it is automatically payment.

accepted as an extension of time to

Disaster recovery tax exemptions. file Form 58. If this applies, a separate Penalty and interest

Exemptions from state and local tax North Dakota extension does not have If an extension of time to file

filing and payment obligations are to be applied for, nor does the Form 58 was obtained, the tax

available to out-of-state businesses Office of State Tax Commissioner have due may be paid by the extended

and their employees who are in to be notified that a federal extension due date of the return without

North Dakota on a temporary basis has been obtained prior to filing penalty, but extension interest will

for the sole purpose of repairing Form 58. The extended due date for apply—see “Extension interest” and

or replacing natural gas, electrical, North Dakota purposes is the same as “Prepayment of tax due” on this page.

or telecommunication transmission the federal extended due date.

property that is damaged, or under

threat of damage, from a state- or

presidentially-declared disaster or

emergency. For more information, go

to tax.nd.gov.

|

Enlarge image |

3

If Form 58 is filed by its due date (or Exemption from withholding. No distributive share of North Dakota

extended due date), but the total withholding is required if any of the income and pays the tax with

amount of tax due is not paid by the following apply: Form 58. The tax is calculated at

due date (or extended due date), a the highest individual income tax

• The distributive share of

penalty equal to 5% of the unpaid tax rate (which is 2.50% for the 2023

North Dakota income is less

or $5.00, whichever is greater, must tax year), and no adjustments,

than $1,000.

be paid. deductions, or tax credits are allowed

• The nonresident partner elects to in calculating the tax. A composite

If Form 58 is filed after its due date include the distributive share in a filing satisfies the North Dakota

(or extended due date), and there composite filing—see “Composite income tax filing and payment

is an unpaid tax due on it, a penalty filing” on this page. obligations of the eligible nonresident

equal to 5% of the unpaid tax due or

• The nonresident partner is a partners included in it, which means

$5.00, whichever is greater, for the

passthrough entity and elects they do not have to separately file

month the return was due plus 5% of

exemption from withholding on its their own North Dakota income tax

the unpaid tax due for each additional

distributive share of North Dakota returns. The composite filing method

month (or fraction of a month) during

income. For more information, is optional and does not require prior

which the return remains delinquent

obtain Form PWE. approval from the Office of State Tax

must be paid. This penalty may not

Commissioner, and a choice to use it

exceed 25% of the tax due. Withholding procedure. This may be made on a year-to-year basis.

In addition to any penalty, interest withholding requirement applies to

a nonresident partner’s year-end Eligible nonresident partner. For

must be paid at the rate of 1% per

distributive share of North Dakota purposes of this composite filing

month or fraction of a month, except

income, which is determined at the method, a nonresident partner

for the month in which the tax was

end of the partnership’s tax year and has the same meaning as that

due, on any tax due that remains

reported on Form 58, Schedule KP, used for withholding income tax

unpaid after the return’s due date (or

Column 6. The requirement does from nonresident partners—see

extended due date).

not apply to actual distributions “Withholding from nonresident

Estimated tax payment made to a nonresident partner partners” on this page. A nonresident

(for 2024) during the tax year. The withholding partner is eligible to be included in a

A partnership may, but is not required amount is calculated and reported composite filing if both of the following

to, make estimated income tax on Schedule KP, Column 7. If a apply:

payments. For more information, nonresident partner meets certain

• The nonresident partner’s

including payment options, obtain the conditions, an amount less than the

only source of income within

2024 Form 58-ES. amount calculated at the 2.50%

North Dakota is one or more

tax rate may be withheld. For the

passthrough entities. A

Withholding from qualifying conditions, see Form PWA.

passthrough entity includes a trust,

nonresident partners A partnership must submit a payment

partnership, S corporation, LLC

A partnership must withhold for the total amount of withholding

treated like a partnership or

North Dakota income tax at the rate of reported on Schedule KP, Column 7,

S corporation, and any other

2.50% from the year-end distributive with Form 58 when it is filed.

similar entity.

share of North Dakota income of a Publicly traded partnership. • The nonresident partner elects

nonresident partner. See “Publicly A publicly traded partnership, as to be included in a composite

traded partnership” on this page for defined under Internal Revenue Code filing. An election is indicated by

an exception to this requirement. § 7704(b), does not have to withhold the partnership’s calculation and

Nonresident partner. For purposes North Dakota income tax from its reporting of a tax amount for the

of this withholding requirement, a unitholders if it meets both of the nonresident partner on Form 58,

nonresident partner means: following: Schedule KP, Column 8. (If the

• an individual who is not domiciled • It is treated as a partnership for distributive share is a loss, the tax

in North Dakota; federal income tax purposes. is zero.)

• a trust, including a grantor trust, • It reports on Form 58, The distributive share of North Dakota

that is not organized under Schedule KP, every unitholder with income included in a composite return

North Dakota law. This only a North Dakota distributive share is subject to tax even if it is under

includes trusts that are subject to of income of over $500. $1,000.

income tax; or Composite filing method

• a passthrough entity that has a Composite filing procedure. The tax under the

commercial domicile outside North A composite filing method is available composite filing method is calculated

Dakota. A passthrough entity to a partnership with one or more and reported on Form 58, Schedule KP,

includes a partnership, eligible nonresident partners. Under Column 8. A partnership must submit

S corporation, LLC treated like a this method, a partnership calculates a payment for the total tax reported on

partnership or S corporation, and the North Dakota income tax on an Schedule KP, Column 8, with Form 58

any other similar entity. eligible nonresident partner’s year-end when it is filed.

|

Enlarge image |

4

Correcting a previously filed 7. Attach a statement explaining the Use of information

return reason(s) for filing the amended All of the information on Form 58 and

If a partnership needs to correct an return. If it is because of changes its attachments is confidential by law

error on Form 58 after it is filed, the the partnership or the IRS made and cannot be given to others except

partnership must file an amended to the partnership’s 2023 Federal as provided by state law. Information

return. There is no special form for Form 1065, attach a copy of the about the partners is required under

this purpose. See “How to prepare an amended federal return or IRS state law so the Office of State

amended 2023 return” below. notice. Tax Commissioner can determine

8. Complete and provide a corrected the partner’s correct North Dakota

If a partnership paid too much tax Schedule K-1 (Form 58) to the taxable income and verify if the

because of an error on its 2023 partners, as required. partner has filed a return and paid the

Form 58, the partnership generally tax.

has three years from the due date of

the return (excluding extensions) or Reporting federal changes

the date the return was actually filed, If the Internal Revenue Service General instructions

whichever is later, in which to file an (IRS) changes or audits the federal for completing

amended return to claim a refund of partnership return, or if a partnership

the overpayment. See N.D.C.C. files an amended federal partnership Form 58

§ 57-38-40 for other time periods that return, an amended North Dakota

may apply. Form 58 must be filed within 90 days Complete Federal

How to prepare an amended 2023 after the final determination of the Form 1065 as follows:

return IRS changes or the filing of the 1. Complete Federal Form 1065 (or

amended federal return. Enclose a 1065-B) in its entirety.

1. Obtain a blank 2023 Form 58. copy of the IRS audit report or the

2. Enter the partnership’s name, amended federal partnership return 2. Complete Items A through J at

current address, FEIN, etc., in the with the amended North Dakota the top of page 1 of

top portion of page 1 of Form 58. Form 58. Form 58—see page 5.

3. Complete Schedule FACT on

3. Fill in the “Amended return” circle

at the top of page 1 of Form 58. W-2/1099 reporting page 2 of Form 58—see page 5.

4. Complete Schedules FACT, requirement 4. Complete Schedule K on page 3

K, and KP using the corrected Every partnership doing business in of Form 58—see page 7.

information. However, unless North Dakota that is required to file 5. Complete Schedule KP on

there is an increase in the Federal Form 1099 or W-2 must also page 5 of Form 58—see page 10.

amount reported on Schedule KP, file one with the Office of State Tax 6. Complete lines 1 through 12 on

Column 6, of the amended return, Commissioner. For more information, page 1 of Form 58—see page 12.

enter on Schedule KP, Column 7, obtain the guideline Income Tax

the same amount reported on Withholding and see “Annual Filing 7. Complete Schedule K-1, if

the previously filed return. Then Requirements - W-2 and 1099.” required, for the partners—see

page 13.

complete lines 1 through 3 on

page 1 of Form 58. Disclosure notification Rounding of numbers. Numbers

5. On line 5 of one of Form 58, Upon written request from the may be entered on the return in

enter the total taxes due from the chairman of a North Dakota legislative dollars and cents, or they may be

previously filed 2023 Form 58, standing committee or Legislative rounded to the nearest whole dollar. If

page 1, line 3. Management, the law requires the rounding, drop the cents if less than

Office of State Tax Commissioner to $0.50 and round up to the next whole

6. Complete line 7 (overpayment) disclose the amount of any deduction dollar amount if $0.50 or higher. For

or line 10 (tax due), whichever or credit claimed on a tax return. example, $25.36 becomes $25.00,

applies. If there is an Any other confidential information, and $25.50 becomes $26.00.

overpayment on line 7, enter the such as a taxpayer’s name or federal

full amount on line 9 (refund). On employer identification number, may Fiscal year filers. The tax year for

an amended return, the amount not be disclosed. North Dakota income tax purposes

credited to the next year’s must be the same as the tax

estimated tax (line 8) may not be year used for federal income tax

increased or decreased. purposes. Use the 2022 Form 58 if

the partnership’s taxable year began

in the 2022 calendar year. Note: Use

the 2021 Form 58 if the taxable year

began in the 2021 calendar year.

|

Enlarge image |

5

Farming/ranching partnership. Item J

Specific line Fill in circle if this is an LLC that is Tiered partnership

instructions for registered as a farming and ranching Indicate whether the partnership

LLC with the North Dakota Secretary holds an interest in one or more

page 1 of of State. other partnerships or limited liability

companies. If it does, attach a

Form 58, Items A-J Filed by an LLC. Fill in circle if the

statement to Form 58 showing

entity filing this return is an LLC.

Complete Items A through J at the name and federal employer

the top of page 1 of Form 58. Composite return. Fill in this circle identification number of each

Then complete Schedule FACT, only if (1) the partnership has one or partnership or LLC in which it holds an

Schedule K, and Schedule KP more nonresident partners eligible to interest.

before completing lines 1 be included in a composite filing and

through 12 on page 1 of Form 58. (2) all of them elected to include their Instructions for

distributive shares of North Dakota

Item A - Tax year source income in a composite filing. Schedule FACT

The same tax year used for federal See “Composite filing” on page 3 for (Form 58, page 2)

income tax purposes (as indicated on more information.

the federal partnership return) must General instructions

be used for North Dakota income Amended return. Fill in circle if

All partnerships must complete the

tax purposes. Fill in the applicable this return is being filed to correct a

applicable portions of Schedule FACT.

circle. If the partnership uses a fiscal previously filed 2023 Form 58. See

year, enter the beginning and ending “Correcting a previously filed return” If the partnership has ONLY individual,

dates of the fiscal year. Use the 2023 on page 3 for more information. estate, and trust partners, complete

Schedule FACT as follows:

Form 58 only if the partnership’s tax Extension. Fill in circle if a federal

year began in the 2023 calendar year. or state extension of time to file the • 100% North Dakota

Item B - Name and address return was obtained. See “Extension partnership

Enter the legal name of the partnership of time to file” on page 2 for more If the partnership conducted all of

on the first line of the name and information. its business within North Dakota

during the tax year, skip lines 1

address area. If the partnership Item G - Number of partners

through 13 and enter “1.000000”

publicly operates under a fictitious or Enter the total number of partners

on line 14.

assumed name (which, in most states, and the number of each type of

must be recorded or registered with partner. • Multistate partnership

the state), enter that name on the If the partnership conducted its

second line of the name and address Item H - Professional service trade or business both within

area. If filing an amended return, enter partnership and without North Dakota during

the most current address. Indicate whether the partnership is the tax year, complete lines

a professional service partnership. 1 through 14. However, if all

Item C - Federal EIN A “professional service partnership” of the partners consist of only

North Dakota uses the federal is a partnership that engages in the North Dakota resident individuals,

employer identification number practice of law, accounting, medicine, estates, and trusts, skip lines 1

(FEIN) for identification purposes. or any other profession in which the through 13 and enter “1.000000”

Enter the FEIN from page 1 of Federal capital or the services of employees on line 14.

Form 1065. are not a material income-producing

Item D - Business code number factor. The services performed by If the partnership has a partner

Enter the business code number from the partners themselves must be the OTHER THAN an individual, estate,

the NAICS code list found on the primary income-producing factor. A or trust, complete lines 1 through 14

Office of State Tax Commissioner’s professional service partnership does of Schedule FACT.

website at tax.nd.gov. Enter the not include one that primarily engages

code that most closely describes the in wholesale or retail sales activity, Apportionment factor in

industry in which the partnership manufacturing activity, or any other general

derives most of its income. type of activity in which the capital In general, the apportionment factor

or the services of employees are a is a product of a formula consisting of

Item E - Date business started material income-producing factor. an equally-weighted average of three

Enter the date the business started factors: property, payroll, and sales.

from page 1 of Federal Form 1065. Item I - Publicly traded Each factor represents the percentage

partnership of the partnership’s North Dakota

Item F - Indicators Indicate whether the partnership is a activity compared to its total

Fill in applicable circles, as follows: publicly traded partnership. A “publicly activity everywhere. A partnership

Initial return. Fill in circle if this is traded partnership” is a partnership in multiplies its business income by the

the first return filed in North Dakota which interests in it are either traded apportionment factor to determine

by the partnership. on an established securities market the portion of its business income

or are readily tradable on a secondary attributable to North Dakota.

Final return. Fill in circle if this is the market.

last return to be filed in North Dakota

by this partnership.

|

Enlarge image |

6

If the partnership includes the Payroll factor Line 10

distributable share of income North Dakota sales

Line 8

from another partnership in its For sales of tangible property, the

Enter the amount of total

apportionable business income, include sale is assigned to North Dakota if the

compensation paid to employees

in the numerator and denominator destination of the property is in

for the tax year. This includes gross

of each factor the partnership’s North Dakota, regardless of the

wages, salaries, commissions, and

proportionate share of the other shipping terms. For sales of other

any other form of remuneration paid

partnership’s apportionment factors— than tangible property, the sale

to the employees. Use the amount

see the specific line instructions for is assigned to North Dakota if the

before deductions for deferred

more information. Do not include in income-producing activity which gave

compensation, flexible spending plans,

the factors any property, payroll, or rise to the receipt is performed in

and other payroll deductions. Do not

sales related to allocable nonbusiness North Dakota. Include on this line

include amounts paid for employee

income—see the instructions to the partnership’s share of the North

benefit plans that are not considered

Form 58, Schedule K, line 24, for what Dakota sales from a North Dakota

taxable wages to the employee. An

constitutes allocable nonbusiness Schedule K-1 (Form 58), Part 6. For

employee is an individual treated as

income. more complete information, see N.D.

an employee under the usual common

Admin. Code §§ 81-03-09-26 through

If the amount of any factor’s law rules, which generally mirror an

81-03-09-31 and 81-03-09-34.

denominator is zero, exclude that individual’s status for purposes of

factor from the calculation. unemployment compensation and the Line 11

Federal Insurance Contribution Act. Throwback sales

Special apportionment rules

Do not include on this line guaranteed Enter the amount of sales shipped

may apply in the case of certain

payments to partners. from a location in North Dakota that

industries or unique circumstances.

are delivered to the U.S. government

For additional information on the Compensation of an employee’s

or to another state or country

apportionment factor, see N.D.C.C. services performed entirely within

where the sales are not subject to

Ch. 57-38.1 and N.D. Admin. Code North Dakota is assigned to

a tax measured by income in that

Ch. 81-03-09. North Dakota. For an employee whose

jurisdiction. For more complete

services are performed in more than

information, see N.D. Admin. Code

Specific line instructions one state, compensation is generally

§§ 81-03-09-29 and 81-03-09-30.

assigned to North Dakota based on

Property factor

the amount of compensation reported Line 14

Lines 1 through 6 to North Dakota for unemployment Apportionment factor

Owned and rented property compensation purposes. Whether Divide line 13 by the number of

Enter on the applicable line the or not state income tax was factors having an amount greater than

average value of real and tangible withheld from an employee’s zero in column 1 on lines 7, 8, and 12.

personal property owned and rented compensation does not affect where Enter the result on this line.

by the partnership. For owned the compensation is assigned for

property, this generally means the apportionment factor purposes.

average of the original cost (before Include on this line in the applicable Instructions for

depreciation) used for federal income column the partnership’s share of the

tax purposes. For rented property, payroll factor from a North Dakota Schedule K

this generally means the amount of Schedule K-1 (Form 58), Part 6. For (Form 58, page 3)

rent paid multiplied by eight. Certain more complete information on All partnerships must complete

property items are subject to special the payroll factor, see N.D. Admin. Schedule K. The purpose of this

rules. Do not include amounts related Code §§ 81-03-09-22 through schedule is to show the total amount

to construction in progress. Include on 81-03-09-25. of North Dakota adjustments, credits,

line 5 the partnership’s share of the and other items distributable to

Sales Factor

property factor from a North Dakota its partners. These items may be

Schedule K-1 (Form 58), Part 6. Line 9 applicable to the preparation of the

Everywhere sales

The average value of owned and partners’ North Dakota income tax

Enter the partnership’s total

rented property is assigned to North returns.

sales or receipts, less returns or

Dakota if the property is located Schedule K-1 from another

allowances, for the tax year. Sales

in North Dakota. The amount passthrough entity.

generally means all gross receipts

attributable to mobile property is Include on the applicable lines

of a partnership. However, the types

generally assignable to North Dakota of Schedule K any adjustments,

of sales or gross receipts included

based on a ratio of the property’s credits, etc., from a North Dakota

in the sales factor depend on the

time spent in North Dakota. For more Schedule K-1, as instructed in the

nature of the partnership’s regular

complete information on the property partner or beneficiary instructions to

business activities and may include

factor, see N.D. Admin. Code that form.

amounts other than sales reported

§§ 81-03-09-15 through 81-03-09-21

on Form 1065, line 1. Include on this

and 81-03-09-33. Reminder: Be sure to attach to

line the partnership’s share of the Form 58 any prescribed schedule or

everywhere sales from a North Dakota other supporting document specified

Schedule K-1 (Form 58), Part 6. in the instructions.

|

Enlarge image |

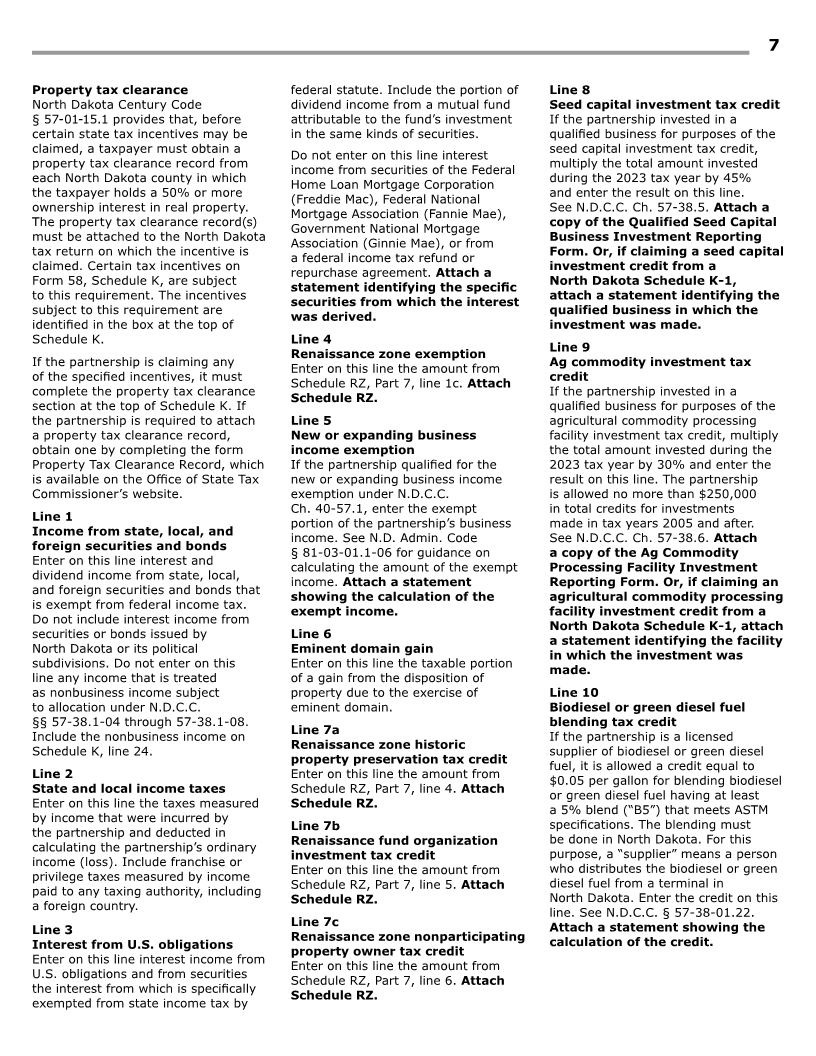

7

Property tax clearance federal statute. Include the portion of Line 8

North Dakota Century Code dividend income from a mutual fund Seed capital investment tax credit

§ 57-01-15.1 provides that, before attributable to the fund’s investment If the partnership invested in a

certain state tax incentives may be in the same kinds of securities. qualified business for purposes of the

claimed, a taxpayer must obtain a seed capital investment tax credit,

Do not enter on this line interest

property tax clearance record from multiply the total amount invested

income from securities of the Federal

each North Dakota county in which during the 2023 tax year by 45%

Home Loan Mortgage Corporation

the taxpayer holds a 50% or more and enter the result on this line.

(Freddie Mac), Federal National

ownership interest in real property. See N.D.C.C. Ch. 57-38.5. Attach a

Mortgage Association (Fannie Mae),

The property tax clearance record(s) copy of the Qualified Seed Capital

Government National Mortgage

must be attached to the North Dakota Business Investment Reporting

Association (Ginnie Mae), or from

tax return on which the incentive is Form. Or, if claiming a seed capital

a federal income tax refund or

claimed. Certain tax incentives on investment credit from a

repurchase agreement. Attach a

Form 58, Schedule K, are subject North Dakota Schedule K-1,

statement identifying the specific

to this requirement. The incentives attach a statement identifying the

securities from which the interest

subject to this requirement are qualified business in which the

was derived.

identified in the box at the top of investment was made.

Schedule K. Line 4

Line 9

Renaissance zone exemption

If the partnership is claiming any Ag commodity investment tax

Enter on this line the amount from

of the specified incentives, it must credit

Schedule RZ, Part 7, line 1c. Attach

complete the property tax clearance If the partnership invested in a

Schedule RZ.

section at the top of Schedule K. If qualified business for purposes of the

the partnership is required to attach Line 5 agricultural commodity processing

a property tax clearance record, New or expanding business facility investment tax credit, multiply

obtain one by completing the form income exemption the total amount invested during the

Property Tax Clearance Record, which If the partnership qualified for the 2023 tax year by 30% and enter the

is available on the Office of State Tax new or expanding business income result on this line. The partnership

Commissioner’s website. exemption under N.D.C.C. is allowed no more than $250,000

Ch. 40-57.1, enter the exempt in total credits for investments

Line 1

portion of the partnership’s business made in tax years 2005 and after.

Income from state, local, and

income. See N.D. Admin. Code See N.D.C.C. Ch. 57-38.6. Attach

foreign securities and bonds

§ 81-03-01.1-06 for guidance on a copy of the Ag Commodity

Enter on this line interest and

calculating the amount of the exempt Processing Facility Investment

dividend income from state, local,

income. Attach a statement Reporting Form. Or, if claiming an

and foreign securities and bonds that

showing the calculation of the agricultural commodity processing

is exempt from federal income tax.

exempt income. facility investment credit from a

Do not include interest income from

North Dakota Schedule K-1, attach

securities or bonds issued by Line 6

a statement identifying the facility

North Dakota or its political Eminent domain gain

in which the investment was

subdivisions. Do not enter on this Enter on this line the taxable portion

made.

line any income that is treated of a gain from the disposition of

as nonbusiness income subject property due to the exercise of Line 10

to allocation under N.D.C.C. eminent domain. Biodiesel or green diesel fuel

§§ 57-38.1-04 through 57-38.1-08. blending tax credit

Line 7a

Include the nonbusiness income on If the partnership is a licensed

Renaissance zone historic

Schedule K, line 24. supplier of biodiesel or green diesel

property preservation tax credit

fuel, it is allowed a credit equal to

Line 2 Enter on this line the amount from

$0.05 per gallon for blending biodiesel

State and local income taxes Schedule RZ, Part 7, line 4. Attach

or green diesel fuel having at least

Enter on this line the taxes measured Schedule RZ.

a 5% blend (“B5”) that meets ASTM

by income that were incurred by

Line 7b specifications. The blending must

the partnership and deducted in

Renaissance fund organization be done in North Dakota. For this

calculating the partnership’s ordinary

investment tax credit purpose, a “supplier” means a person

income (loss). Include franchise or

Enter on this line the amount from who distributes the biodiesel or green

privilege taxes measured by income

Schedule RZ, Part 7, line 5. Attach diesel fuel from a terminal in

paid to any taxing authority, including

Schedule RZ. North Dakota. Enter the credit on this

a foreign country.

line. See N.D.C.C. § 57-38-01.22.

Line 7c

Line 3 Attach a statement showing the

Renaissance zone nonparticipating

Interest from U.S. obligations calculation of the credit.

property owner tax credit

Enter on this line interest income from

Enter on this line the amount from

U.S. obligations and from securities

Schedule RZ, Part 7, line 6. Attach

the interest from which is specifically

Schedule RZ.

exempted from state income tax by

|

Enlarge image |

8

Line 11 Line 14 in North Dakota. A separate credit

Biodiesel or green diesel fuel sales Endowment fund tax credit is allowed for each of the three

equipment tax credit A tax credit is allowed for making a categories of school—primary school,

If the partnership is a licensed seller contribution to a qualified endowment high school, and college. For each

of biodiesel or green diesel fuel, it is fund. For more information, category of school, the credit equals

allowed a credit equal to 10% of the see Schedule QEC (for filers of 50% of the contributions made to all

costs to adapt or add equipment to Forms 38, 40, 58, and 60) Attach eligible schools within the category.

its North Dakota facility to enable it Schedule QEC. (Note: For a partner other than

to sell diesel fuel having at least a another passthrough entity, additional

Lines 14a and 14b. Enter on these

2% biodiesel or green diesel blend limitations on the allowable credit

lines the applicable amounts from

(“B2”) that meets ASTM specifications. apply at the partner level.) A list of

Schedule QEC.

For this purpose, a “seller” means a the eligible schools within each of

person who acquires the fuel from Lines 14c and 14d. Enter on the three categories of schools is

a wholesale supplier or distributor these lines an endowment fund provided on page 14.

for resale to a consumer at a retail credit and the related contribution

Election. A partnership may elect, on

location. Except for costs incurred amount shown on a North Dakota

a contribution by contribution basis,

before January 1, 2005, include Schedule K-1 received from an estate,

to treat a contribution as having been

eligible costs incurred before the tax trust, partnership, or S corporation.

made during the 2023 tax year if it

year in which sales of the eligible

is made on or before the due date,

biodiesel or green diesel fuel begin. Line 15

including extensions, for filing the

The credit is allowed in each of five Workforce recruitment tax credit

2023 Form 58. Make the election by

tax years, starting with the tax year If the partnership employs

attaching to the return a document

in which sales of the eligible biodiesel extraordinary recruitment methods

containing the following:

or green diesel fuel begin. Enter to hire an employee to fill a hard-

the credit on this line. See N.D.C.C. to-fill position in North Dakota, it is 1. A statement that the election is

§ 57-38-01.23. Attach a statement allowed a tax credit equal to 5% of being made.

showing the calculation of the the compensation paid during the 2. Name of qualifying school.

credit. first 12 months to the employee

3. Date of contribution.

hired to fill that position. The credit

Line 12 4. Amount of contribution.

may be claimed in the first taxable

Employer internship program tax

year beginning after the employee

credit To qualify, a contribution must be

completes the first 12 consecutive

If the partnership hired an eligible made directly to, or specifically

months of employment. For details,

college student under a qualifying designated for the exclusive use of, a

see N.D.C.C. § 57-38-01.25.

internship program set up in qualifying school.

North Dakota, it is allowed a credit Line 15a. Enter the allowable credit School network or organization.

equal to 10% of the compensation on this line. If a contribution is made payable

paid to the intern. For details,

see N.D.C.C. § 57-38-01.24. The Line 15b. Enter the number of to the account or fund of a school

partnership is allowed no more than eligible employees whose first 12 network or organization that governs

$3,000 of credits for all tax years. months of employment ended during or benefits multiple schools, the

the partnership’s 2022 tax year. contribution will qualify only if the

Line 12a. Enter the allowable credit partnership specifically designates it

on this line. Line 15c. Enter the total for the use of a qualifying school, and

compensation paid to the eligible the network or organization separately

Line 12b. Enter the number of employees’ during their first 12 accounts for the funds on behalf of

eligible interns employed during the consecutive months of employment that school. The partnership must

2023 tax year. Disregard this line ending in the partnership’s 2022 tax obtain a statement from the network

if the credit is from a passthrough year. or organization that identifies the

entity. qualifying school and the amount

Line 16

Line 12c. Enter on this line the contributed to it. If the qualifying

Credit for wages paid to a

total compensation paid to eligible school falls into both the primary and

mobilized employee

interns during the 2023 tax year (as high school categories, also see the

Enter on this line the amount from

shown on their 2023 Form W-2s). next paragraph.

Schedule ME, line 13. N.D.C.C.

Disregard this line if the credit is from Schools in both primary and high

§ 57-38-31. Attach Schedule ME.

a passthrough entity. school categories. If a contribution

Line 13 Lines 17 through 19 is made to a qualifying school that

Research expense tax credit Nonprofit private school tax provides education in one or more

A credit is allowed for conducting credits grades in both the primary school

qualified research in North Dakota. For Tax credits are allowed under category (kindergarten through 8th

details, see N.D.C.C. § 57-38-30.5. N.D.C.C. § 57-38-01.7 for making grades) and the high school category

Enter the allowable credit on this line. charitable contributions to qualifying (9th through 12th grades), a separate

Attach a statement showing the nonprofit private primary schools, credit is allowed for the portion of the

computation of the base amount high schools, and colleges located contribution designated for use within

and the credit.

|

Enlarge image |

9

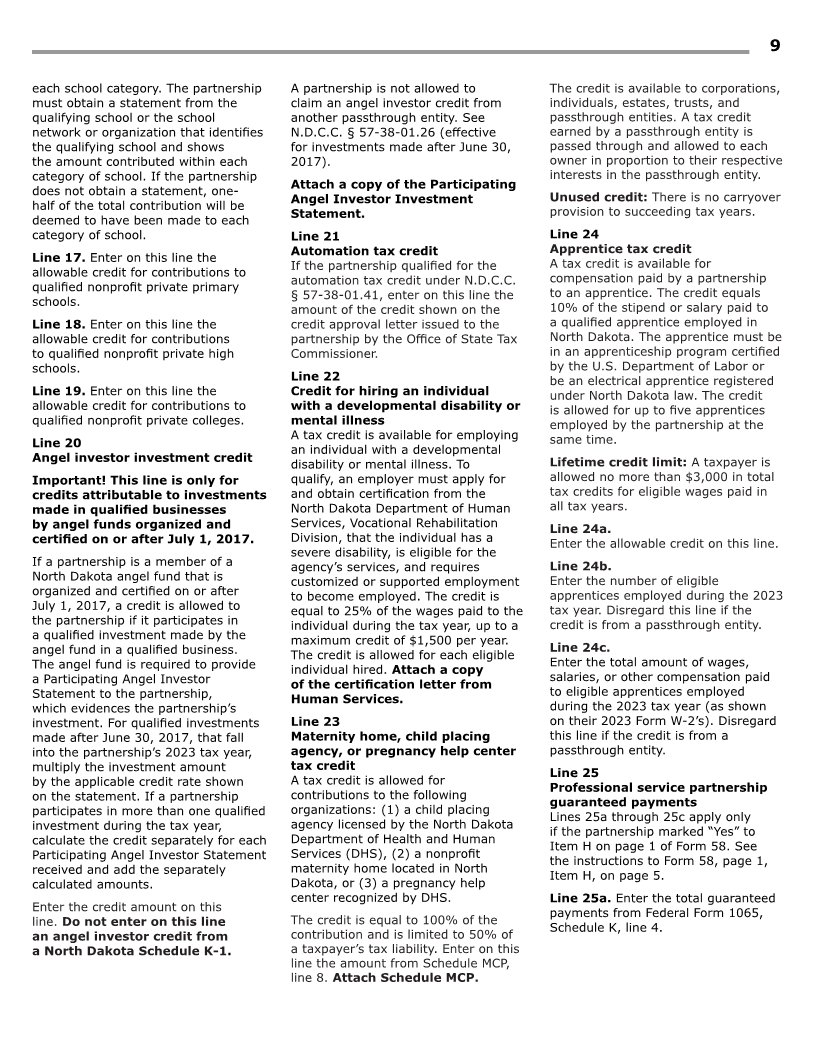

each school category. The partnership A partnership is not allowed to The credit is available to corporations,

must obtain a statement from the claim an angel investor credit from individuals, estates, trusts, and

qualifying school or the school another passthrough entity. See passthrough entities. A tax credit

network or organization that identifies N.D.C.C. § 57-38-01.26 (effective earned by a passthrough entity is

the qualifying school and shows for investments made after June 30, passed through and allowed to each

the amount contributed within each 2017). owner in proportion to their respective

category of school. If the partnership interests in the passthrough entity.

Attach a copy of the Participating

does not obtain a statement, one- Unused credit: There is no carryover

Angel Investor Investment

half of the total contribution will be provision to succeeding tax years.

Statement.

deemed to have been made to each

category of school. Line 21 Line 24

Automation tax credit Apprentice tax credit

Line 17. Enter on this line the A tax credit is available for

If the partnership qualified for the

allowable credit for contributions to compensation paid by a partnership

automation tax credit under N.D.C.C.

qualified nonprofit private primary to an apprentice. The credit equals

§ 57-38-01.41, enter on this line the

schools. 10% of the stipend or salary paid to

amount of the credit shown on the

Line 18. Enter on this line the credit approval letter issued to the a qualified apprentice employed in

allowable credit for contributions partnership by the Office of State Tax North Dakota. The apprentice must be

to qualified nonprofit private high Commissioner. in an apprenticeship program certified

schools. by the U.S. Department of Labor or

Line 22 be an electrical apprentice registered

Line 19. Enter on this line the Credit for hiring an individual under North Dakota law. The credit

allowable credit for contributions to with a developmental disability or is allowed for up to five apprentices

qualified nonprofit private colleges. mental illness employed by the partnership at the

A tax credit is available for employing

Line 20 same time.

an individual with a developmental

Angel investor investment credit Lifetime credit limit: A taxpayer is

disability or mental illness. To

Important! This line is only for qualify, an employer must apply for allowed no more than $3,000 in total

credits attributable to investments and obtain certification from the tax credits for eligible wages paid in

made in qualified businesses North Dakota Department of Human all tax years.

by angel funds organized and Services, Vocational Rehabilitation Line 24a.

certified on or after July 1, 2017. Division, that the individual has a Enter the allowable credit on this line.

severe disability, is eligible for the

If a partnership is a member of a agency’s services, and requires Line 24b.

North Dakota angel fund that is customized or supported employment Enter the number of eligible

organized and certified on or after to become employed. The credit is apprentices employed during the 2023

July 1, 2017, a credit is allowed to equal to 25% of the wages paid to the tax year. Disregard this line if the

the partnership if it participates in individual during the tax year, up to a credit is from a passthrough entity.

a qualified investment made by the maximum credit of $1,500 per year.

Line 24c.

angel fund in a qualified business. The credit is allowed for each eligible

Enter the total amount of wages,

The angel fund is required to provide individual hired. Attach a copy

salaries, or other compensation paid

a Participating Angel Investor of the certification letter from

to eligible apprentices employed

Statement to the partnership, Human Services.

which evidences the partnership’s during the 2023 tax year (as shown

investment. For qualified investments Line 23 on their 2023 Form W-2’s). Disregard

made after June 30, 2017, that fall Maternity home, child placing this line if the credit is from a

into the partnership’s 2023 tax year, agency, or pregnancy help center passthrough entity.

multiply the investment amount tax credit

Line 25

by the applicable credit rate shown A tax credit is allowed for

Professional service partnership

on the statement. If a partnership contributions to the following

guaranteed payments

participates in more than one qualified organizations: (1) a child placing

Lines 25a through 25c apply only

investment during the tax year, agency licensed by the North Dakota

if the partnership marked “Yes” to

calculate the credit separately for each Department of Health and Human

Item H on page 1 of Form 58. See

Participating Angel Investor Statement Services (DHS), (2) a nonprofit

the instructions to Form 58, page 1,

received and add the separately maternity home located in North

Item H, on page 5.

calculated amounts. Dakota, or (3) a pregnancy help

center recognized by DHS. Line 25a. Enter the total guaranteed

Enter the credit amount on this payments from Federal Form 1065,

line. Do not enter on this line The credit is equal to 100% of the

Schedule K, line 4.

an angel investor credit from contribution and is limited to 50% of

a North Dakota Schedule K-1. a taxpayer’s tax liability. Enter on this

line the amount from Schedule MCP,

line 8. Attach Schedule MCP.

|

Enlarge image |

10

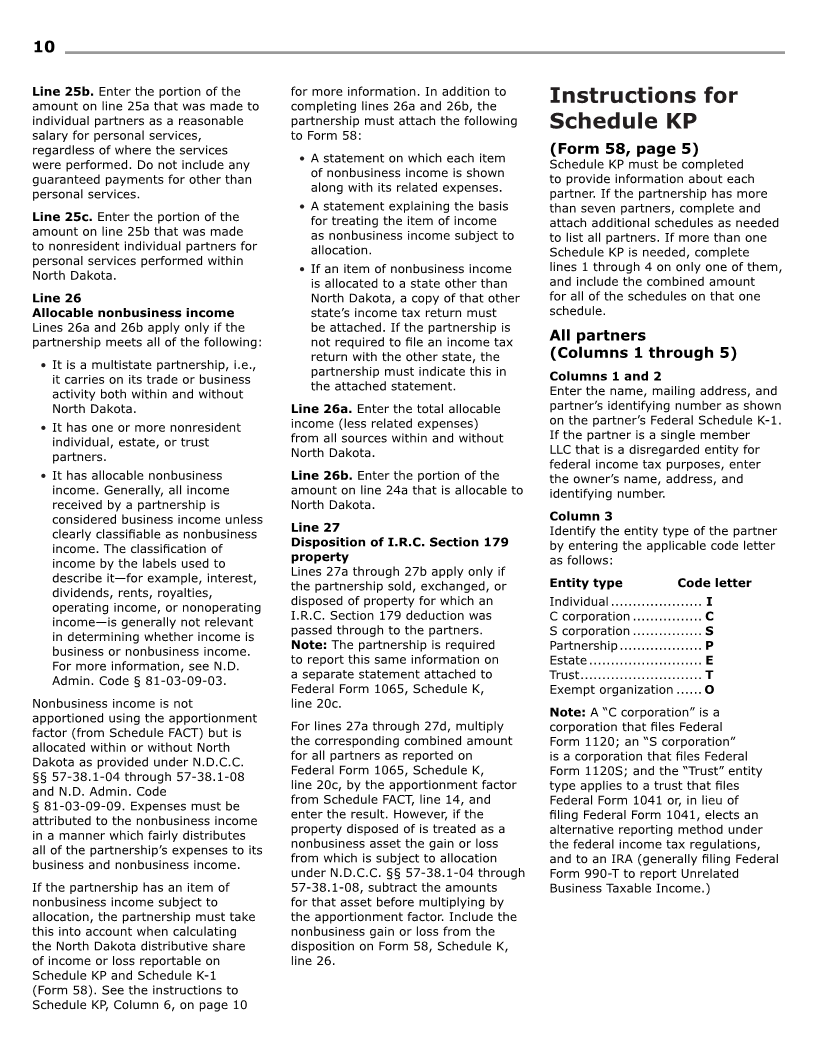

Line 25b. Enter the portion of the for more information. In addition to

amount on line 25a that was made to completing lines 26a and 26b, the Instructions for

individual partners as a reasonable partnership must attach the following Schedule KP

salary for personal services, to Form 58:

regardless of where the services (Form 58, page 5)

• A statement on which each item

were performed. Do not include any Schedule KP must be completed

of nonbusiness income is shown

guaranteed payments for other than to provide information about each

along with its related expenses.

personal services. partner. If the partnership has more

• A statement explaining the basis than seven partners, complete and

Line 25c. Enter the portion of the for treating the item of income attach additional schedules as needed

amount on line 25b that was made as nonbusiness income subject to to list all partners. If more than one

to nonresident individual partners for allocation. Schedule KP is needed, complete

personal services performed within lines 1 through 4 on only one of them,

• If an item of nonbusiness income

North Dakota. and include the combined amount

is allocated to a state other than

Line 26 North Dakota, a copy of that other for all of the schedules on that one

Allocable nonbusiness income state’s income tax return must schedule.

Lines 26a and 26b apply only if the be attached. If the partnership is

partnership meets all of the following: not required to file an income tax All partners

return with the other state, the (Columns 1 through 5)

• It is a multistate partnership, i.e., partnership must indicate this in Columns 1 and 2

it carries on its trade or business

the attached statement.

activity both within and without Enter the name, mailing address, and

North Dakota. Line 26a. Enter the total allocable partner’s identifying number as shown

• It has one or more nonresident income (less related expenses) on the partner’s Federal Schedule K-1.

individual, estate, or trust from all sources within and without If the partner is a single member

partners. North Dakota. LLC that is a disregarded entity for

federal income tax purposes, enter

• It has allocable nonbusiness Line 26b. Enter the portion of the the owner’s name, address, and

income. Generally, all income amount on line 24a that is allocable to identifying number.

received by a partnership is North Dakota.

considered business income unless Column 3

Line 27

clearly classifiable as nonbusiness Identify the entity type of the partner

Disposition of I.R.C. Section 179

income. The classification of by entering the applicable code letter

property

income by the labels used to as follows:

Lines 27a through 27b apply only if

describe it—for example, interest, Entity type Code letter

the partnership sold, exchanged, or

dividends, rents, royalties,

disposed of property for which an

operating income, or nonoperating Individual ..................... I

I.R.C. Section 179 deduction was

income—is generally not relevant C corporation ................ C

passed through to the partners.

in determining whether income is S corporation ................ S

Note: The partnership is required

business or nonbusiness income. Partnership ................... P

to report this same information on

For more information, see N.D. Estate .......................... E

a separate statement attached to

Admin. Code § 81-03-09-03. Trust ............................ T

Federal Form 1065, Schedule K, Exempt organization ...... O

Nonbusiness income is not line 20c.

apportioned using the apportionment Note: A “C corporation” is a

For lines 27a through 27d, multiply

factor (from Schedule FACT) but is corporation that files Federal

the corresponding combined amount

allocated within or without North Form 1120; an “S corporation”

for all partners as reported on

Dakota as provided under N.D.C.C. is a corporation that files Federal

Federal Form 1065, Schedule K,

§§ 57-38.1-04 through 57-38.1-08 Form 1120S; and the “Trust” entity

line 20c, by the apportionment factor

and N.D. Admin. Code type applies to a trust that files

from Schedule FACT, line 14, and

§ 81-03-09-09. Expenses must be Federal Form 1041 or, in lieu of

enter the result. However, if the

attributed to the nonbusiness income filing Federal Form 1041, elects an

property disposed of is treated as a

in a manner which fairly distributes alternative reporting method under

nonbusiness asset the gain or loss

all of the partnership’s expenses to its the federal income tax regulations,

from which is subject to allocation

business and nonbusiness income. and to an IRA (generally filing Federal

under N.D.C.C. §§ 57-38.1-04 through Form 990-T to report Unrelated

If the partnership has an item of 57-38.1-08, subtract the amounts Business Taxable Income.)

nonbusiness income subject to for that asset before multiplying by

allocation, the partnership must take the apportionment factor. Include the

this into account when calculating nonbusiness gain or loss from the

the North Dakota distributive share disposition on Form 58, Schedule K,

of income or loss reportable on line 26.

Schedule KP and Schedule K-1

(Form 58). See the instructions to

Schedule KP, Column 6, on page 10

|

Enlarge image |

11

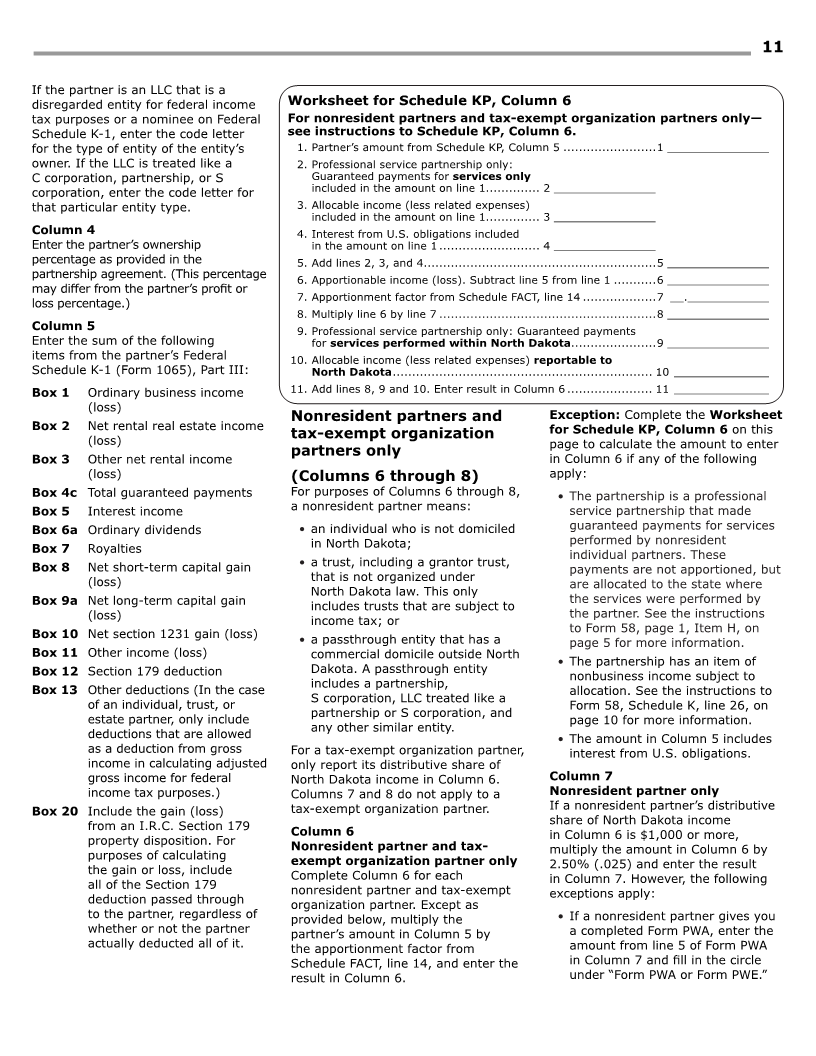

If the partner is an LLC that is a

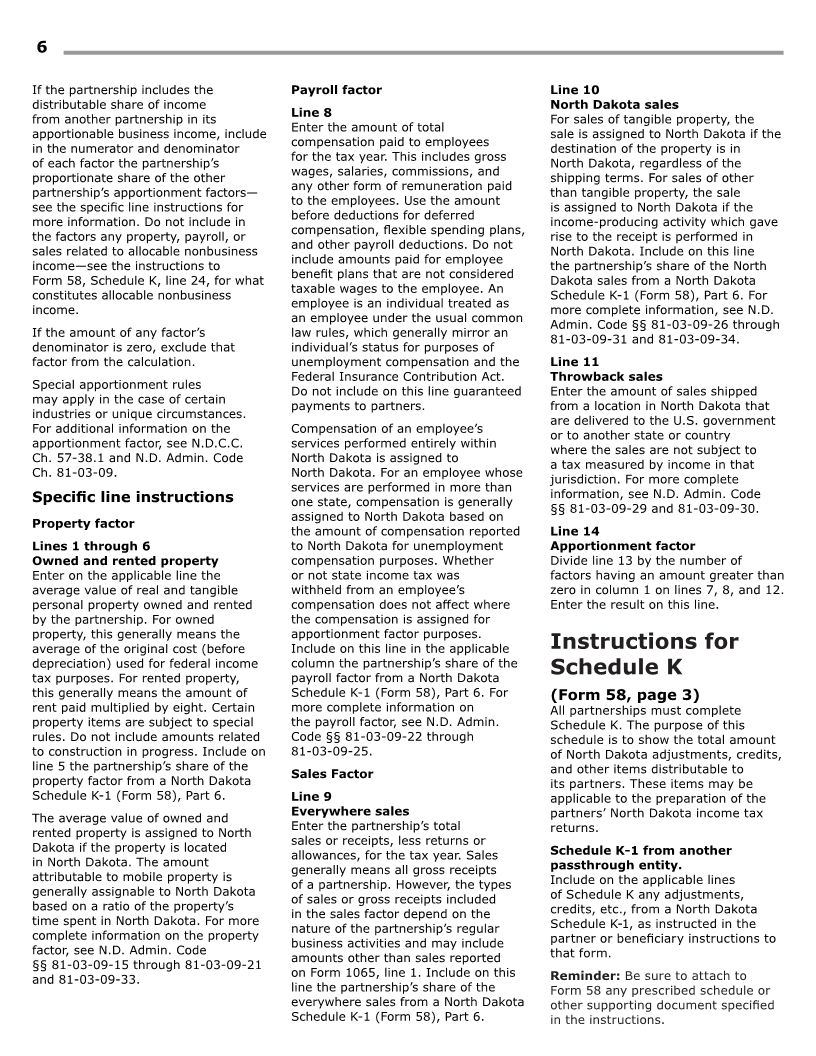

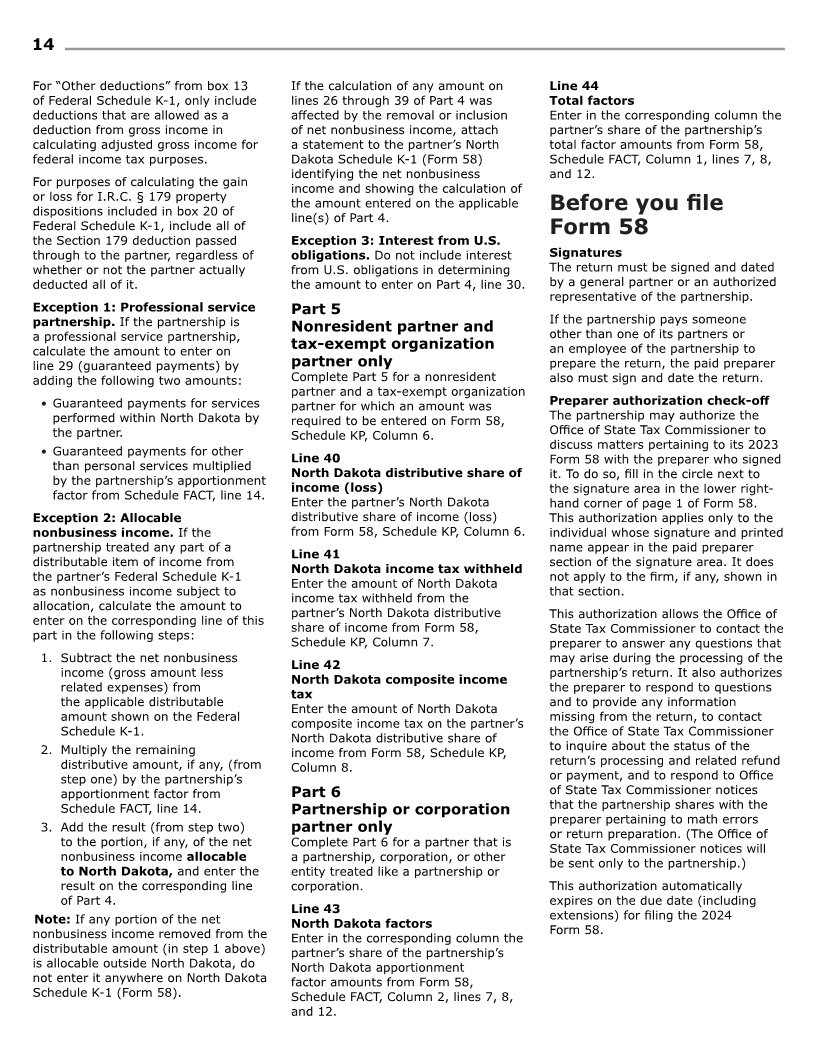

disregarded entity for federal income Worksheet for Schedule KP, Column 6

tax purposes or a nominee on Federal For nonresident partners and tax-exempt organization partners only—

Schedule K-1, enter the code letter see instructions to Schedule KP, Column 6.

for the type of entity of the entity’s 1. Partner’s amount from Schedule KP, Column 5 ........................1 _______________

owner. If the LLC is treated like a 2. Professional service partnership only:

C corporation, partnership, or S Guaranteed payments for services only

corporation, enter the code letter for included in the amount on line 1.............. 2 _______________

that particular entity type. 3. Allocable income (less related expenses)

included in the amount on line 1.............. 3 _______________

Column 4 4. Interest from U.S. obligations included

Enter the partner’s ownership in the amount on line 1 .......................... 4 _______________

percentage as provided in the 5. Add lines 2, 3, and 4 ............................................................5 _______________

partnership agreement. (This percentage 6. Apportionable income (loss). Subtract line 5 from line 1 ...........6 _______________

may differ from the partner’s profit or

7. Apportionment factor from Schedule FACT, line 14 ...................7 __.____________

loss percentage.)

8. Multiply line 6 by line 7 ........................................................8 _______________

Column 5 9. Professional service partnership only: Guaranteed payments

Enter the sum of the following for services performed within North Dakota ......................9 _______________

items from the partner’s Federal 10. Allocable income (less related expenses) reportable to

Schedule K-1 (Form 1065), Part III: North Dakota ................................................................... 10 ______________

Box 1 Ordinary business income 11. Add lines 8, 9 and 10. Enter result in Column 6 ...................... 11 ______________

(loss)

Nonresident partners and Exception: Complete the Worksheet

Box 2 Net rental real estate income for Schedule KP, Column 6 on this

(loss) tax-exempt organization

page to calculate the amount to enter

partners only

Box 3 Other net rental income in Column 6 if any of the following

(loss) (Columns 6 through 8) apply:

Box 4c Total guaranteed payments For purposes of Columns 6 through 8, • The partnership is a professional

Box 5 Interest income a nonresident partner means: service partnership that made

Box 6a Ordinary dividends • an individual who is not domiciled guaranteed payments for services

Box 7 Royalties in North Dakota; performed by nonresident

individual partners. These

Box 8 Net short-term capital gain • a trust, including a grantor trust,

payments are not apportioned, but

(loss) that is not organized under

are allocated to the state where

North Dakota law. This only

the services were performed by

Box 9a Net long-term capital gain includes trusts that are subject to

the partner. See the instructions

(loss) income tax; or

to Form 58, page 1, Item H, on

Box 10 Net section 1231 gain (loss) • a passthrough entity that has a page 5 for more information.

Box 11 Other income (loss) commercial domicile outside North

• The partnership has an item of

Box 12 Section 179 deduction Dakota. A passthrough entity

nonbusiness income subject to

Box 13 Other deductions (In the case includes a partnership,

allocation. See the instructions to

of an individual, trust, or S corporation, LLC treated like a

Form 58, Schedule K, line 26, on

estate partner, only include partnership or S corporation, and

page 10 for more information.

deductions that are allowed any other similar entity.

• The amount in Column 5 includes

as a deduction from gross For a tax-exempt organization partner, interest from U.S. obligations.

income in calculating adjusted only report its distributive share of

gross income for federal North Dakota income in Column 6. Column 7

income tax purposes.) Columns 7 and 8 do not apply to a Nonresident partner only

Box 20 Include the gain (loss) tax-exempt organization partner. If a nonresident partner’s distributive

share of North Dakota income

from an I.R.C. Section 179 Column 6 in Column 6 is $1,000 or more,

property disposition. For Nonresident partner and tax- multiply the amount in Column 6 by

purposes of calculating exempt organization partner only 2.50% (.025) and enter the result

the gain or loss, include Complete Column 6 for each in Column 7. However, the following

all of the Section 179 nonresident partner and tax-exempt exceptions apply:

deduction passed through organization partner. Except as

to the partner, regardless of provided below, multiply the • If a nonresident partner gives you

whether or not the partner partner’s amount in Column 5 by a completed Form PWA, enter the

actually deducted all of it. the apportionment factor from amount from line 5 of Form PWA

Schedule FACT, line 14, and enter the in Column 7 and fill in the circle

result in Column 6. under “Form PWA or Form PWE.”

|

Enlarge image |

12

• If a nonresident partner gives Line 5 Interest. Calculate the interest

you a completed Form PWE, leave Estimated tax payments amount as follows:

Column 7 blank and fill in the circle Enter the amount paid with the 2023

• If an extension of time to file

under “Form PWA or Form PWE.” Forms 58-EXT and 58-ES plus any

Form 58 was obtained, extension

• If a nonresident partner elected to overpayment applied from the 2022

interest is calculated at the rate of

be included in a composite filing, Form 58. However, if filing an amended

12% per year on any tax due from

leave Column 7 blank and see the return, do not enter any previously

the due date of the return to the

instructions to Column 8. paid estimated tax amount; instead,

earlier of the extended due date or

enter the amount of the total taxes

the date the return was filed.

See “Withholding from nonresident due from line 3 of the previously filed

partners” on page 3 for more original or amended return. • If the total amount of tax due

information. is not paid by the due date (or

Line 8 extended due date) of the return,

Column 8 Application of overpayment to interest is calculated at the rate

Nonresident partner only 2024 of 1% per month or fraction of a

Note: Leave Column 8 blank if If there is an overpayment on line 7, month on the unpaid tax, except

Column 7 was completed for the the partnership may elect to apply for the month in which the return

nonresident partner. part or all of it as an estimated was due.

Complete Column 8 for each payment toward its 2024 tax liability.

nonresident partner electing to To make the election, enter the Line 12

be included in a composite filing. portion of line 7 to be applied on Balance due

Multiply the amount in Column 6 by line 8. If this election is made, the The balance due must be paid in full

2.50% (.025) and enter the result in election and the amount applied may with the return. The payment may

Column 8. If the amount in Column 6 not be changed after the return is be made electronically in one of the

is zero or less, enter zero in Column 8. filed. If this is an amended return, do following ways:

See “Composite filing” on page 3 for not make an entry on this line. • Online—A payment may be made

more information. Line 10 online with an electronic check or a

Tax due debit or credit card. The electronic

Specific line A tax due must be paid in full with the check option is free. North Dakota

return when the return is filed. See contracts with a national payment

instructions for the instructions to line 12 for payment service to provide the debit or

options. credit card option. There is a fee

page 1 of for the debit or credit option, none

Line 11 of which goes to the State of North

Form 58, lines 1-12 Penalty and interest Dakota. To pay online, go to

Complete Schedule FACT, The Office of State Tax Commissioner www.tax.nd.gov/payment.

Schedule K, and Schedule KP will notify the partnership of any

penalty and interest payable on a tax • Electronic funds transfer—A

before completing lines 1 due shown on Form 58. However, the payment may be made by means

through 12 on page 1 of partnership may calculate the penalty of an Automated Clearing House

Form 58. and interest amounts and include (ACH) credit transaction that

them in the balance due on Form 58. the taxpayer initiates through

Line 4 its banking institution. For more

Income tax withholding Penalty. Calculate the penalty information, go to our website at

Enter the North Dakota income amount as follows: tax.nd.gov.

tax withholding shown on a 2023

Form 1099 or North Dakota • If Form 58 is filed by the due date If paying with a paper check or money

Schedule K-1. Be sure the state (or extended due date), but the order, complete a 2023 Form 58-PV

identified on the Form 1099 is total amount of tax due is not paid payment voucher and enclose it with

North Dakota. Also enter the with the return, the penalty is the payment. Make the check or

North Dakota income tax withholding equal to 5% of the unpaid tax or money order payable to “ND State

shown on a 2022 North Dakota $5.00, whichever is greater. Tax Commissioner,” and write the last

Schedule K-1 if the entity that issued • If Form 58 is filed after its due four digits of the partnership’s FEIN

it has a fiscal tax year ending in date (or extended due date), and and “2023 Form 58” on the check or

the partnership’s 2023 tax year. Do there is an unpaid tax due on it, a money order. A check must be drawn

not enter on this line North Dakota penalty equal to 5% of the unpaid on a U.S. or Canadian bank, be in U.S.

extraction or production taxes tax due (with a $5.00 minimum) dollars, and use a standard nine-digit

withheld from mineral interest income, applies for the month the return routing number. A check drawn on a

such as an oil or gas royalty, because was due, plus 5% of the unpaid foreign bank (except one in Canada)

they are not income taxes. Attach a tax due (with a $5.00 minimum) cannot be accepted.

copy of the Form 1099 or for each month or fraction of a

North Dakota Schedule K-1. month the return remains unfiled,

not to exceed the greater of 25%

of the unpaid tax due or $25.00.

|

Enlarge image |

13

Amended schedule. If a partnership Lines 3 through 5. Enter on the

Instructions files an amended Form 58, the corresponding lines the partner’s

for completing partnership must issue amended share of each amount shown on

North Dakota Schedule K-1 forms to Form 58, Schedule K, lines 3

Schedule K-1 its partners. Fill in the “Amended” through 5.

A partnership is not subject to circle at the top of the North Dakota

Line 6. Enter on this line the amount

North Dakota income tax. Instead, Schedule K-1 (Form 58).

determined by multiplying the amount

the partners are responsible for Final schedule. Fill in the “Final” on Form 58, Schedule K, line 6, by the

reporting and paying any applicable circle at the top of the North Dakota same percentage used to determine

North Dakota income tax on their Schedule K-1 (Form 58) if it is the last the partner’s distributive share of

shares of the partnership’s income one to be issued by the partnership to income (loss) from the partnership.

reportable to North Dakota. the partner.

Lines 7 through 24 Enter on the

The North Dakota Schedule K-1 Part 2 corresponding lines the partner’s

(Form 58) must be used by a share of each amount shown on

partnership to provide its partners Partner information

Form 58, Schedule K, lines 7 through

with information they will need to Item E 24. Also, for the following lines,

complete a North Dakota income Enter the code letter for the partner additional supporting information

tax return. The information to be from Form 58, Schedule KP, Column 3. must be provided with Schedule K-1:

included in the schedule will depend

on the type of partner. In the case of Item F Lines 8 and 9. Provide a statement

certain credits reported on Schedule If the partner is an individual, estate, identifying the qualified business

K-1 (Form 58), additional supporting or trust, fill in the applicable circle to or qualified agricultural commodity

information must be provided with indicate the legal residency status of processing facility in which the

Schedule K-1 — see the instructions the partner for North Dakota income qualifying investment was made.

to Part 3. tax purposes. If an individual partner

changed his or her legal residency Line 14. Provide a statement

A North Dakota Schedule K-1 (Form to or from North Dakota during the identifying the qualified nonprofit

58) must be completed and given to: tax year, mark the part-year resident organization and the qualified

status. In the case of an estate or trust endowment fund to which the

• Each nonresident partner for qualifying contribution was made.

partner, only the full-year resident or

which the partnership is required

full-year nonresident status will apply.

to report the North Dakota Line 20. Provide a statement

distributive share of income on Item G identifying the angel fund that made

Form 58, Schedule KP, Column 6. For an eligible nonresident partner, the qualified investment in the

• Each partner to which a share of indicate whether the partner is qualified business.

a North Dakota adjustment or tax included in a composite filing by filling Part 4

credit from Form 58, Schedule K, in the applicable circle.

Nonresident individual,

lines 1 through 24, is distributable. Item I estate, or trust partner

• Each partnership or corporation Enter the partner’s ownership only — North Dakota income

partner for the purpose of percentage from Form 58,

reporting a share of the Schedule KP, Column 4. (loss)

apportionment factors from Complete Part 4 for a nonresident

Form 58, Schedule FACT. Part 3 individual, estate, or trust partner.

• Each tax-exempt organization All partners—

Line 25

partner. North Dakota adjustments Partnership’s apportionment

If there are no North Dakota and tax credits factor

If there are any North Dakota

adjustments or tax credits on Form 58, Enter the partnership’s apportionment

adjustments or tax credits on

Schedule K, lines 1 through 24, a factor from Form 58, Schedule FACT,

Form 58, Schedule K, lines 1

North Dakota Schedule K-1 does not line 14.

through 24, complete this part for all

have to be given to a North Dakota Lines 26 through 39

partners.

resident individual, estate, or trust. Income and loss items

Lines 1 and 2. Enter on the

In addition to the North Dakota Except as provided under

corresponding lines the amount

Schedule K-1 (Form 58), the Exceptions 1 through 3 below,

determined by multiplying each