Enlarge image

1 1

2 2

1 2 3 3 5 6 7 8 910 12 14 16 18 20 22 24 26 28 30 32 34 36 38 40 42 44 46 48 50 52 54 56 58 60 62 64 66 68 70 72 74 76 78 80 3 84

11 13 15 17 19 21 23 25 27 29 31 33 35 37 39 41 43 45 47 49 51 53 55 57 59 61 63 65 67 69 71 73 75 77 79 81 83 85

4

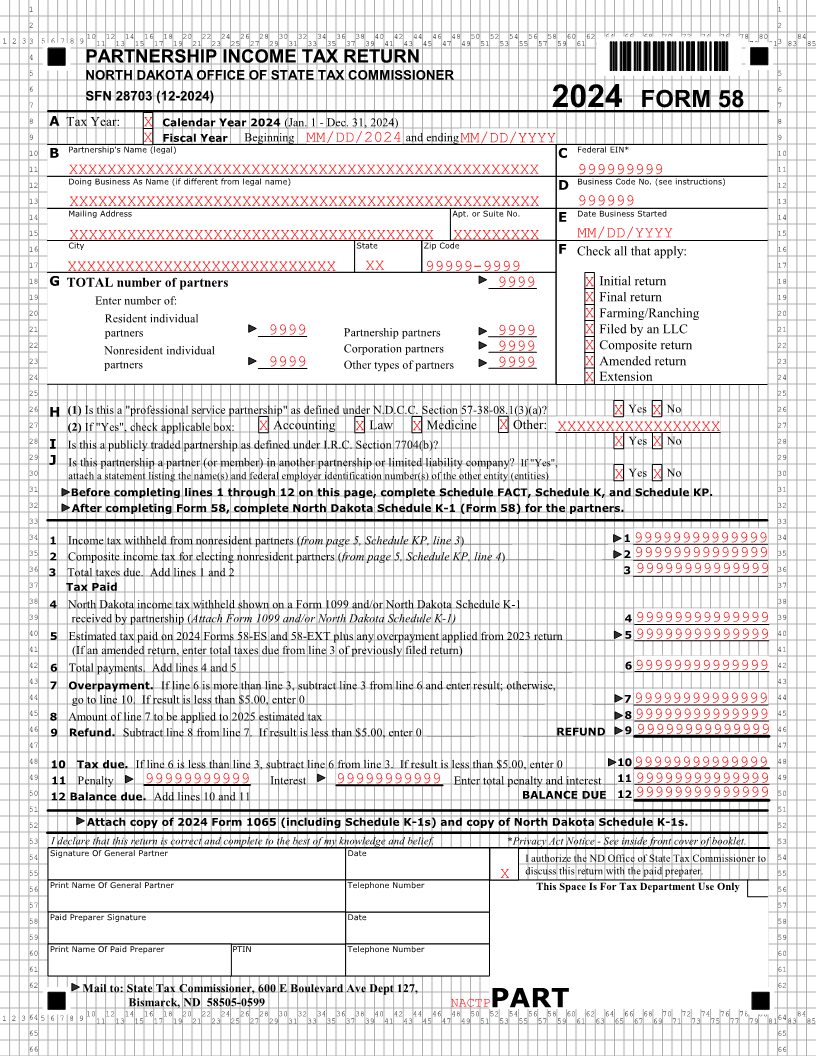

PARTNERSHIP INCOME TAX RETURN

5 5

NORTH DAKOTA OFFICE OF STATE TAX COMMISSIONER

6 6

7 SFN 28703 (12-2024) 7

2024 FORM 58

8 A Tax Year: X Calendar Year 2024 (Jan. 1 - Dec. 31, 2024) 8

9 X Fiscal Year Beginning MM/DD/2024 and ending MM/DD/YYYY 9

10 B Partnership's Name (legal) C Federal EIN* 10

11 11

XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 999999999

12 Doing Business As Name (if different from legal name) D Business Code No. (see instructions) 12

13 999999 13

XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX

14 Mailing Address Apt. or Suite No. E Date Business Started 14

15 MM/DD/YYYY 15

XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX XXXXXXXXX

16 City State Zip Code F 16

Check all that apply:

17 17

XXXXXXXXXXXXXXXXXXXXXXXXXXXX XX 99999-9999

18 G TOTAL number of partners 9999 X Initial return 18

19 X Final return 19

Enter number of:

20 X Farming/Ranching 20

Resident individual

21 9999 9999 X Filed by an LLC 21

partners Partnership partners

22 9999 X Composite return 22

Nonresident individual Corporation partners

23 9999 Other types of partners 9999 X Amended return 23

partners

24 X Extension 24

25 25

26 H (1)Is this a "professional service partnership" as defined under N.D.C.C. Section 57-38-08.1(3)(a)? X Yes X No 26

27 (2)If "Yes", check applicable box: XAccounting XXLaw Medicine XOther: XXXXXXXXXXXXXXXXX 27

28 X Yes X No 28

I Is this a publicly traded partnership as defined under I.R.C. Section 7704(b)?

29 29

J Is this partnership a partner (or member) in another partnership or limited liability company? If "Yes",

30 attach a statement listing the name(s) and federal employer identification number(s) of the other entity (entities) X Yes X No 30

31 Before completing lines 1 through 12 on this page, complete Schedule FACT, Schedule K, and Schedule KP. 31

32 After completing Form 58, complete North Dakota Schedule K-1 (Form 58) for the partners. 32

33 33

34 1 Income tax withheld from nonresident partners (from page 5, Schedule KP, line 3) 1 99999999999999 34

35 2 Composite income tax for electing nonresident partners (from page 5, Schedule KP, line 4) 2 99999999999999 35

36 3 Total taxes due. Add lines 1 and 2 3 99999999999999 36

37 Tax Paid 37

38 4 North Dakota income tax withheld shown on a Form 1099 and/or North Dakota Schedule K-1 38

39 received by partnership (Attach Form 1099 and/or North Dakota Schedule K-1) 4 99999999999999 39

40 5 Estimated tax paid on 2024 Forms 58-ES and 58-EXT plus any overpayment applied from 2023 return 5 99999999999999 40

41 (If an amended return, enter total taxes due from line 3 of previously filed return) 41

42 6 Total payments. Add lines 4 and 5 6 99999999999999 42

43 43

7 Overpayment. If line 6 is more than line 3, subtract line 3 from line 6 and enter result; otherwise,

44 go to line 10. If result is less than $5.00, enter 0 7 99999999999999 44

45 8 Amount of line 7 to be applied to 2025 estimated tax 8 99999999999999 45

46 9 Refund. Subtract line 8 from line 7. If result is less than $5.00, enter 0 REFUND 9 99999999999999 46

47 47

48 10 Tax due. If line 6 is less than line 3, subtract line 6 from line 3. If result is less than $5.00, enter 0 109999999999999948

49 11 Penalty 99999999999 Interest 99999999999 Enter total penalty and interest 11 99999999999999 49

50 12 Balance due. Add lines 10 and 11 BALANCE DUE 12 99999999999999 50

51 51

52 Attach copy of 2024 Form 1065 (including Schedule K-1s) and copy of North Dakota Schedule K-1s. 52

53 I declare that this return is correct and complete to the best of my knowledge and belief. *Privacy Act Notice - See inside front cover of booklet. 53

54 Signature Of General Partner Date I authorize the ND Office of State Tax Commissioner to 54

55 X discuss this return with the paid preparer. 55

56 Print Name Of General Partner Telephone Number This Space Is For Tax Department Use Only 56

57 57

58 Paid Preparer Signature Date 58

59 59

60 Print Name Of Paid Preparer PTIN Telephone Number 60

61 61

62 62

Mail to: State Tax Commissioner, 600 E Boulevard Ave Dept 127,

Bismarck, ND 58505-0599 NACTPPART

1 2 3 645 6 7 8 910 12 14 16 18 20 22 24 26 28 30 32 34 36 38 40 42 44 46 48 50 52 54 56 58 60 62 64 66 68 70 72 74 76 78 80 64 84

11 13 15 17 19 21 23 25 27 29 31 33 35 37 39 41 43 45 47 49 51 53 55 57 59 61 63 65 67 69 71 73 75 77 79 81 83 85

65 65

66 66