Enlarge image

1 1

2 2

1 2 3 3 5 6 7 8 910 12 14 16 18 20 22 24 26 28 30 32 34 36 38 40 42 44 46 48 50 52 54 56 58 60 62 64 66 68 70 72 74 76 78 80 3 84

11 13 15 17 19 21 23 25 27 29 31 33 35 37 39 41 43 45 47 49 51 53 55 57 59 61 63 65 67 69 71 73 75 77 79 81 83 85

4

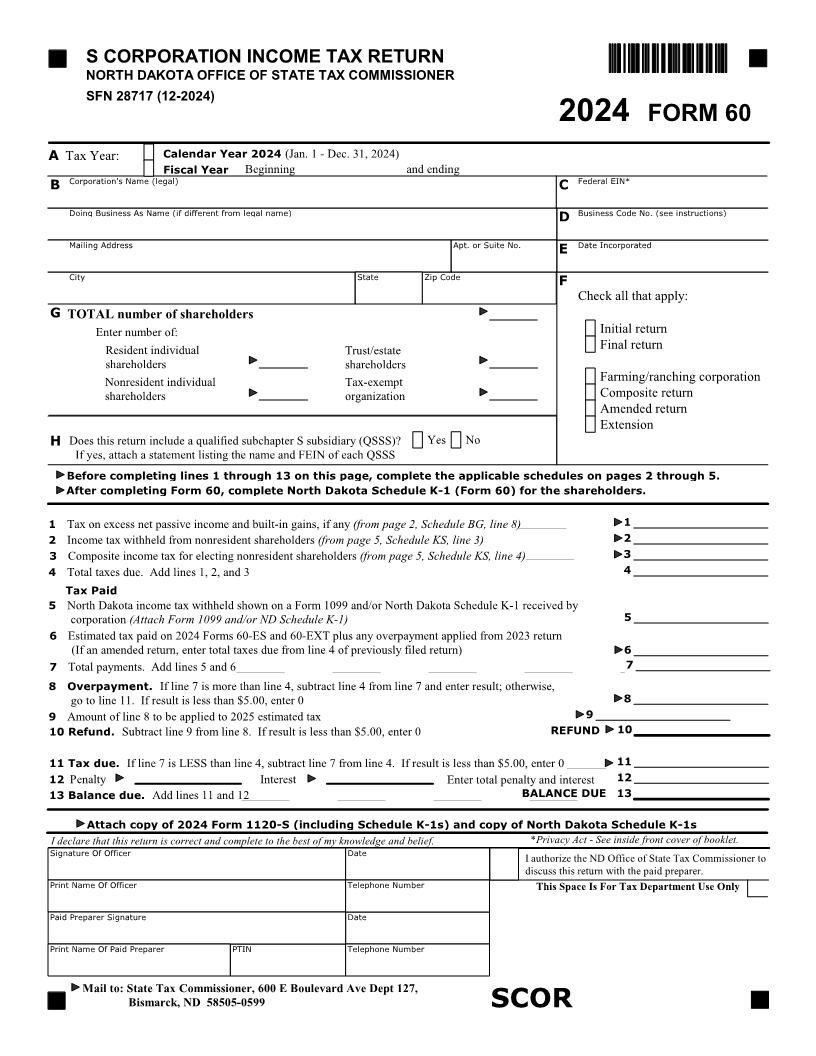

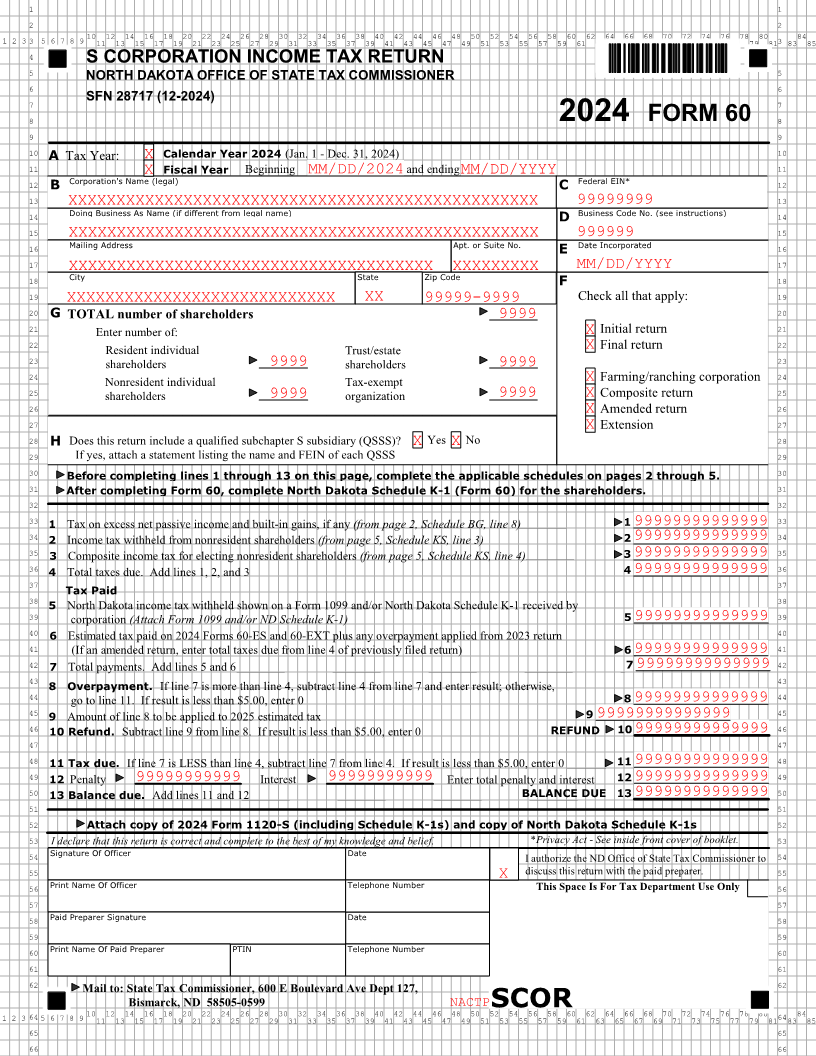

S CORPORATION INCOME TAX RETURN

5 5

NORTH DAKOTA OFFICE OF STATE TAX COMMISSIONER

6 6

7 SFN 28717 (12-2024) 7

8 2024 FORM 60 8

9 9

A Tax Year:

10 X Calendar Year 2024 (Jan. 1 - Dec. 31, 2024) 10

11 X Fiscal Year Beginning MM/DD/2024 and ending MM/DD/YYYY 11

12 B Corporation's Name (legal) C Federal EIN* 12

13 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 99999999 13

14 Doing Business As Name (if different from legal name) D Business Code No. (see instructions) 14

15 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 999999 15

16 Mailing Address Apt. or Suite No. E Date Incorporated 16

17 MM/DD/YYYY 17

XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX XXXXXXXXX

18 City State Zip Code F 18

19 XXXXXXXXXXXXXXXXXXXXXXXXXXXX XX 99999-9999 Check all that apply: 19

20 G TOTAL number of shareholders 9999 20

21 X Initial return 21

Enter number of:

22 X Final return 22

Resident individual Trust/estate

shareholders shareholders

23 9999 9999 23

24 X Farming/ranching corporation 24

Nonresident individual Tax-exempt

25 9999 9999 X Composite return 25

shareholders organization

26 X Amended return 26

27 X Extension 27

28 H Does this return include a qualified subchapter S subsidiary (QSSS)? X Yes XNo 28

29 If yes, attach a statement listing the name and FEIN of each QSSS 29

30 Before completing lines 1 through 13 on this page, complete the applicable schedules on pages 2 through 5. 30

31 After completing Form 60, complete North Dakota Schedule K-1 (Form 60) for the shareholders. 31

32 32

33 1 Tax on excess net passive income and built-in gains, if any (from page 2, Schedule BG, line 8) 1 99999999999999 33

34 2 Income tax withheld from nonresident shareholders (from page 5, Schedule KS, line 3) 2 99999999999999 34

35 3 Composite income tax for electing nonresident shareholders (from page 5, Schedule KS, line 4) 3 99999999999999 35

36 4 Total taxes due. Add lines 1, 2, and 3 4 99999999999999 36

37 37

Tax Paid

38 38

5 North Dakota income tax withheld shown on a Form 1099 and/or North Dakota Schedule K-1 received by

39 corporation (Attach Form 1099 and/or ND Schedule K-1) 5 99999999999999 39

40 6 Estimated tax paid on 2024 Forms 60-ES and 60-EXT plus any overpayment applied from 2023 return 40

41 (If an amended return, enter total taxes due from line 4 of previously filed return) 6 99999999999999 41

42 7 Total payments. Add lines 5 and 6 7 99999999999999 42

43 43

8 Overpayment. If line 7 is more than line 4, subtract line 4 from line 7 and enter result; otherwise,

44 go to line 11. If result is less than $5.00, enter 0 8 99999999999999 44

45 9 Amount of line 8 to be applied to 2025 estimated tax 9 99999999999999 45

46 10 Refund. Subtract line 9 from line 8. If result is less than $5.00, enter 0 REFUND 10 99999999999999 46

47 47

99999999999999

48 11 Tax due. If line 7 is LESS than line 4, subtract line 7 from line 4. If result is less than $5.00, enter 0 11 48

49 12 Penalty 99999999999 Interest 99999999999 Enter total penalty and interest 12 99999999999999 49

50 13 Balance due. Add lines 11 and 12 BALANCE DUE 13 99999999999999 50

51 51

52 Attach copy of 2024 Form 1120-S (including Schedule K-1s) and copy of North Dakota Schedule K-1s 52

53 I declare that this return is correct and complete to the best of my knowledge and belief. *Privacy Act - See inside front cover of booklet. 53

54 Signature Of Officer Date I authorize the ND Office of State Tax Commissioner to 54

55 X discuss this return with the paid preparer. 55

56 Print Name Of Officer Telephone Number This Space Is For Tax Department Use Only 56

57 57

58 Paid Preparer Signature Date 58

59 59

60 Print Name Of Paid Preparer PTIN Telephone Number 60

61 61

62 62

Mail to: State Tax Commissioner, 600 E Boulevard Ave Dept 127,

Bismarck, ND 58505-0599 NACTPSCOR

1 2 3 645 6 7 8 910 12 14 16 18 20 22 24 26 28 30 32 34 36 38 40 42 44 46 48 50 52 54 56 58 60 62 64 66 68 70 72 74 76 78 80 64 84

11 13 15 17 19 21 23 25 27 29 31 33 35 37 39 41 43 45 47 49 51 53 55 57 59 61 63 65 67 69 71 73 75 77 79 81 83 85

65 65

66 66