Enlarge image

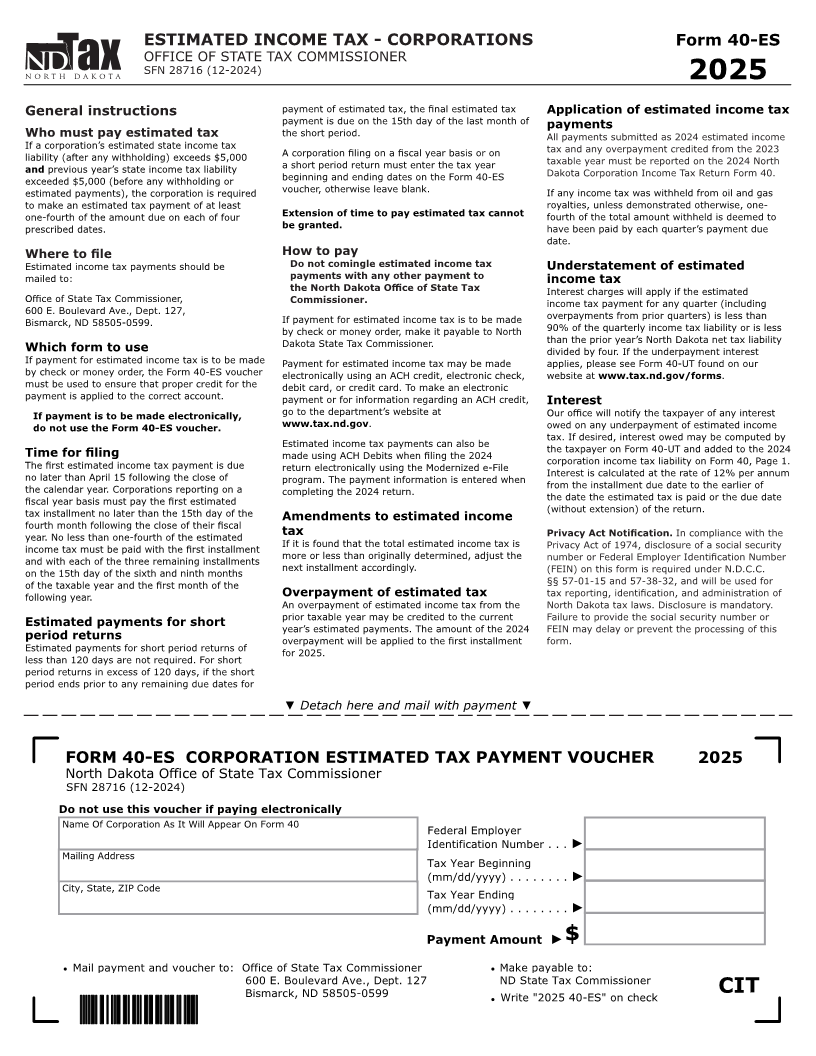

ESTIMATED INCOME TAX - CORPORATIONS Form 40-ES

OFFICE OF STATE TAX COMMISSIONER

SFN 28716 (12-2024)

2025

General instructions payment of estimated tax, the final estimated tax Application of estimated income tax

payment is due on the 15th day of the last month of payments

Who must pay estimated tax the short period. All payments submitted as 2024 estimated income

If a corporation’s estimated state income tax

liability (after any withholding) exceeds $5,000 A corporation filing on a fiscal year basis or on tax and any overpayment credited from the 2023

and previous year’s state income tax liability a short period return must enter the tax year taxable year must be reported on the 2024 North

exceeded $5,000 (before any withholding or beginning and ending dates on the Form 40-ES Dakota Corporation Income Tax Return Form 40.

estimated payments), the corporation is required voucher, otherwise leave blank. If any income tax was withheld from oil and gas

to make an estimated tax payment of at least royalties, unless demonstrated otherwise, one-

one-fourth of the amount due on each of four Extension of time to pay estimated tax cannot fourth of the total amount withheld is deemed to

prescribed dates. be granted. have been paid by each quarter’s payment due

date.

Where to file How to pay

Estimated income tax payments should be Do not comingle estimated income tax Understatement of estimated

mailed to: payments with any other payment to income tax

the North Dakota Office of State Tax Interest charges will apply if the estimated

Office of State Tax Commissioner, Commissioner. income tax payment for any quarter (including

600 E. Boulevard Ave., Dept. 127,

Bismarck, ND 58505-0599. If payment for estimated income tax is to be made overpayments from prior quarters) is less than

by check or money order, make it payable to North 90% of the quarterly income tax liability or is less

Which form to use Dakota State Tax Commissioner. than the prior year’s North Dakota net tax liability

divided by four. If the underpayment interest

If payment for estimated income tax is to be made Payment for estimated income tax may be made applies, please see Form 40-UT found on our

by check or money order, the Form 40-ES voucher electronically using an ACH credit, electronic check, website at www.tax.nd.gov/forms.

must be used to ensure that proper credit for the debit card, or credit card. To make an electronic

payment is applied to the correct account. payment or for information regarding an ACH credit, Interest

If payment is to be made electronically, go to the department’s website at Our office will notify the taxpayer of any interest

do not use the Form 40-ES voucher. www.tax.nd.gov. owed on any underpayment of estimated income

Estimated income tax payments can also be tax. If desired, interest owed may be computed by

Time for filing made using ACH Debits when filing the 2024 the taxpayer on Form 40-UT and added to the 2024

The first estimated income tax payment is due return electronically using the Modernized e-File corporation income tax liability on Form 40, Page 1.

no later than April 15 following the close of program. The payment information is entered when Interest is calculated at the rate of 12% per annum

the calendar year. Corporations reporting on a completing the 2024 return. from the installment due date to the earlier of

fiscal year basis must pay the first estimated the date the estimated tax is paid or the due date

tax installment no later than the 15th day of the (without extension) of the return.

Amendments to estimated income

fourth month following the close of their fiscal

year. No less than one-fourth of the estimated tax Privacy Act Notification. In compliance with the

income tax must be paid with the first installment If it is found that the total estimated income tax is Privacy Act of 1974, disclosure of a social security

and with each of the three remaining installments more or less than originally determined, adjust the number or Federal Employer Identification Number

on the 15th day of the sixth and ninth months next installment accordingly. (FEIN) on this form is required under N.D.C.C.

of the taxable year and the first month of the §§ 57-01-15 and 57-38-32, and will be used for

following year. Overpayment of estimated tax tax reporting, identification, and administration of

An overpayment of estimated income tax from the North Dakota tax laws. Disclosure is mandatory.

Estimated payments for short prior taxable year may be credited to the current Failure to provide the social security number or

year’s estimated payments. The amount of the 2024 FEIN may delay or prevent the processing of this

period returns overpayment will be applied to the first installment form.

Estimated payments for short period returns of for 2025.

less than 120 days are not required. For short

period returns in excess of 120 days, if the short

period ends prior to any remaining due dates for

▼ Detach here and mail with payment ▼

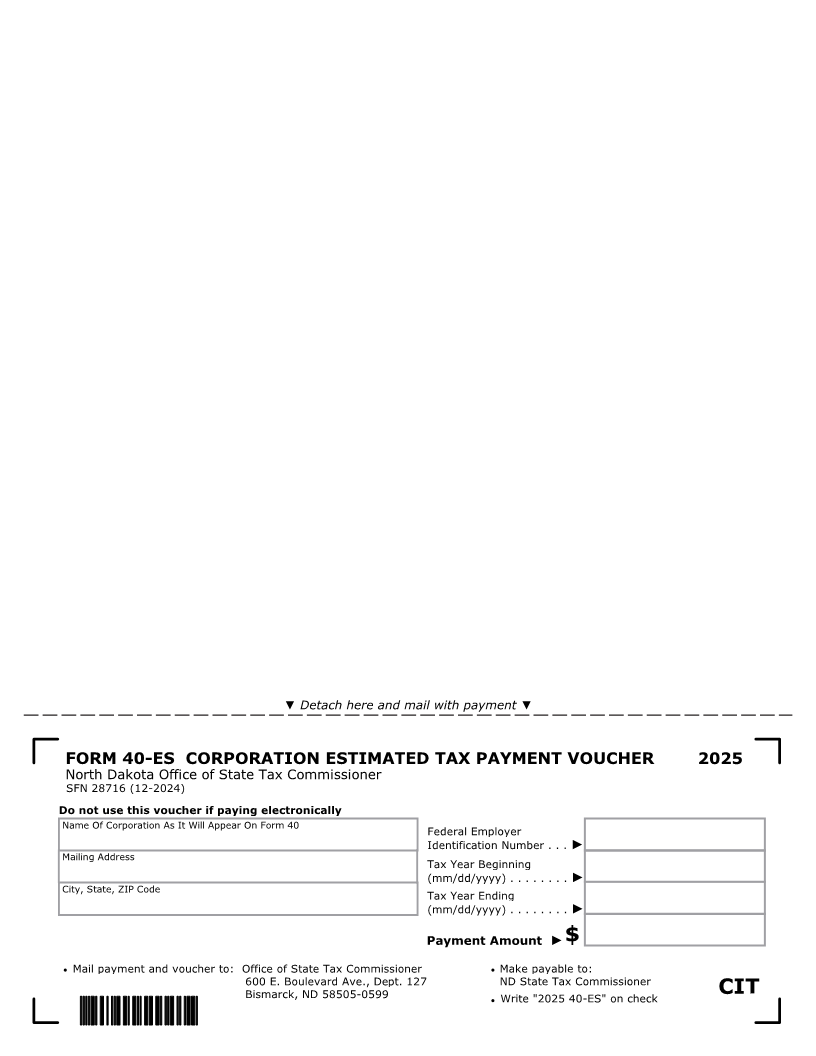

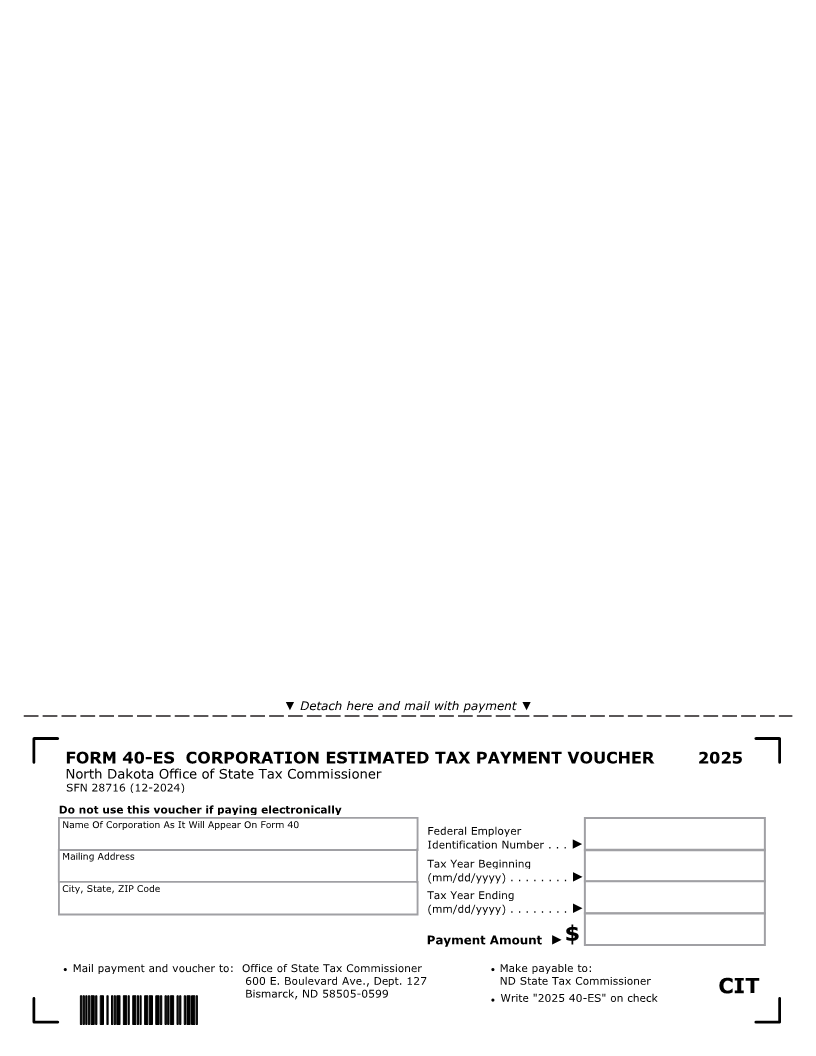

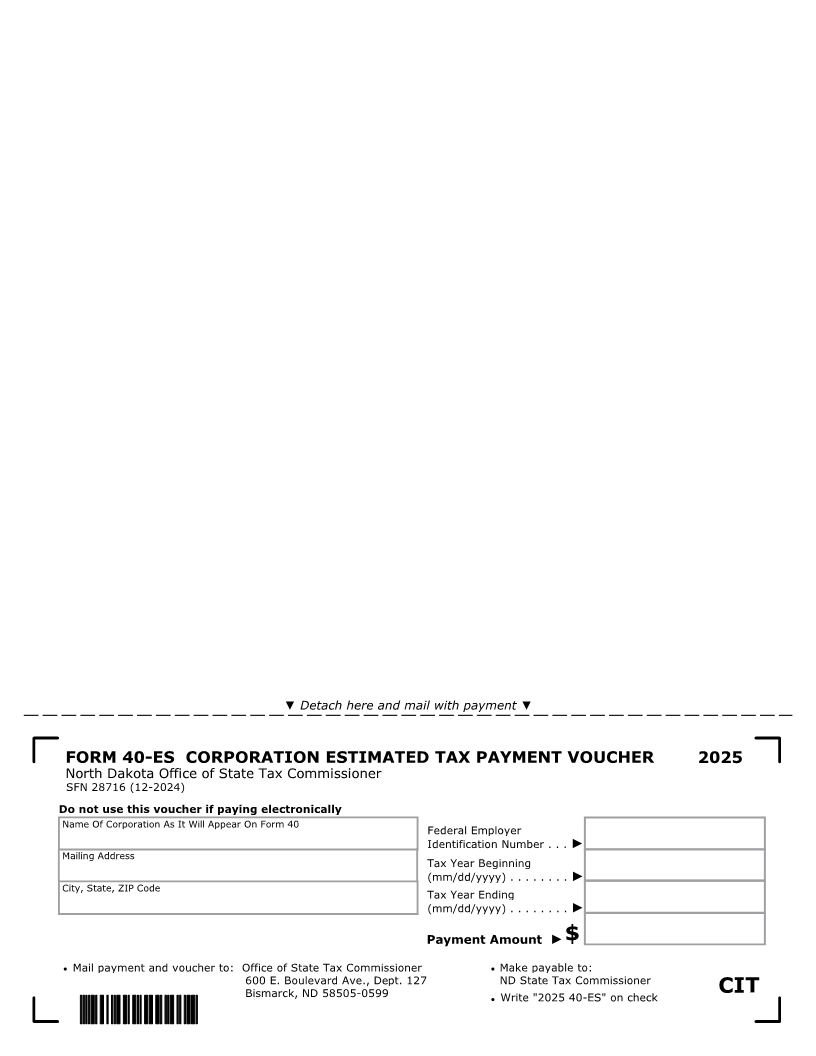

FORM 40-ES CORPORATION ESTIMATED TAX PAYMENT VOUCHER 2025

North Dakota Office of State Tax Commissioner

SFN 28716 (12-2024)

Do not use this voucher if paying electronically

Name Of Corporation As It Will Appear On Form 40

Federal Employer

Identification Number . . . ►

Mailing Address

Tax Year Beginning

(mm/dd/yyyy) . . . . . . . . ►

City, State, ZIP Code

Tax Year Ending

(mm/dd/yyyy) . . . . . . . . ►

Payment Amount ► $

• Mail payment and voucher to: Office of State Tax Commissioner • Make payable to:

600 E. Boulevard Ave., Dept. 127 ND State Tax Commissioner

Bismarck, ND 58505-0599 • Write "2025 40-ES" on check CIT