Enlarge image

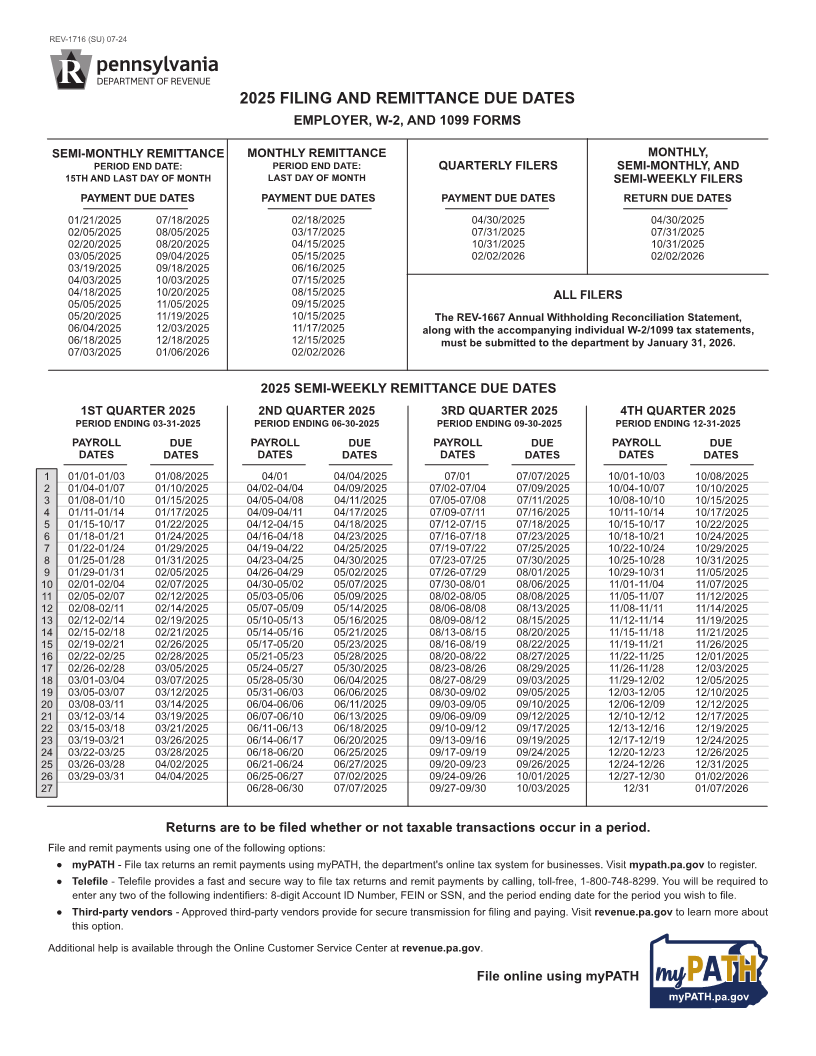

REV-1716 (SU) 07-24 2025 FILING AND REMITTANCE DUE DATES EMPLOYER, W-2, AND 1099 FORMS SEMI-MONTHLY REMITTANCE MONTHLY REMITTANCE MONTHLY, PERIOD END DATE: PERIOD END DATE: QUARTERLY FILERS SEMI-MONTHLY, AND 15TH AND LAST DAY OF MONTH LAST DAY OF MONTH SEMI-WEEKLY FILERS PAYMENT DUE DATES PAYMENT DUE DATES PAYMENT DUE DATES RETURN DUE DATES 01/21/2025 07/18/2025 02/18/2025 04/30/2025 04/30/2025 02/05/2025 08/05/2025 03/17/2025 07/31/2025 07/31/2025 02/20/2025 08/20/2025 04/15/2025 10/31/2025 10/31/2025 03/05/2025 09/04/2025 05/15/2025 02/02/2026 02/02/2026 03/19/2025 09/18/2025 06/16/2025 04/03/2025 10/03/2025 07/15/2025 04/18/2025 10/20/2025 08/15/2025 ALL FILERS 05/05/2025 11/05/2025 09/15/2025 05/20/2025 11/19/2025 10/15/2025 The REV-1667 Annual Withholding Reconciliation Statement, 06/04/2025 12/03/2025 11/17/2025 along with the accompanying individual W-2/1099 tax statements, 06/18/2025 12/18/2025 12/15/2025 must be submitted to the department by January 31, 2026. 07/03/2025 01/06/2026 02/02/2026 2025 SEMI-WEEKLY REMITTANCE DUE DATES 1ST QUARTER 2025 2ND QUARTER 2025 3RD QUARTER 2025 4TH QUARTER 2025 PERIOD ENDING 03-31-2025 PERIOD ENDING 06-30-2025 PERIOD ENDING 09-30-2025 PERIOD ENDING 12-31-2025 PAYROLL DUE PAYROLL DUE PAYROLL DUE PAYROLL DUE DATES DATES DATES DATES DATES DATES DATES DATES 1 01/01-01/03 01/08/2025 04/01 04/04/2025 07/01 07/07/2025 10/01-10/03 10/08/2025 2 01/04-01/07 01/10/2025 04/02-04/04 04/09/2025 07/02-07/04 07/09/2025 10/04-10/07 10/10/2025 3 01/08-01/10 01/15/2025 04/05-04/08 04/11/2025 07/05-07/08 07/11/2025 10/08-10/10 10/15/2025 4 01/11-01/14 01/17/2025 04/09-04/11 04/17/2025 07/09-07/11 07/16/2025 10/11-10/14 10/17/2025 5 01/15-10/17 01/22/2025 04/12-04/15 04/18/2025 07/12-07/15 07/18/2025 10/15-10/17 10/22/2025 6 01/18-01/21 01/24/2025 04/16-04/18 04/23/2025 07/16-07/18 07/23/2025 10/18-10/21 10/24/2025 7 01/22-01/24 01/29/2025 04/19-04/22 04/25/2025 07/19-07/22 07/25/2025 10/22-10/24 10/29/2025 8 01/25-01/28 01/31/2025 04/23-04/25 04/30/2025 07/23-07/25 07/30/2025 10/25-10/28 10/31/2025 9 01/29-01/31 02/05/2025 04/26-04/29 05/02/2025 07/26-07/29 08/01/2025 10/29-10/31 11/05/2025 10 02/01-02/04 02/07/2025 04/30-05/02 05/07/2025 07/30-08/01 08/06/2025 11/01-11/04 11/07/2025 11 02/05-02/07 02/12/2025 05/03-05/06 05/09/2025 08/02-08/05 08/08/2025 11/05-11/07 11/12/2025 12 02/08-02/11 02/14/2025 05/07-05/09 05/14/2025 08/06-08/08 08/13/2025 11/08-11/11 11/14/2025 13 02/12-02/14 02/19/2025 05/10-05/13 05/16/2025 08/09-08/12 08/15/2025 11/12-11/14 11/19/2025 14 02/15-02/18 02/21/2025 05/14-05/16 05/21/2025 08/13-08/15 08/20/2025 11/15-11/18 11/21/2025 15 02/19-02/21 02/26/2025 05/17-05/20 05/23/2025 08/16-08/19 08/22/2025 11/19-11/21 11/26/2025 16 02/22-02/25 02/28/2025 05/21-05/23 05/28/2025 08/20-08/22 08/27/2025 11/22-11/25 12/01/2025 17 02/26-02/28 03/05/2025 05/24-05/27 05/30/2025 08/23-08/26 08/29/2025 11/26-11/28 12/03/2025 18 03/01-03/04 03/07/2025 05/28-05/30 06/04/2025 08/27-08/29 09/03/2025 11/29-12/02 12/05/2025 19 03/05-03/07 03/12/2025 05/31-06/03 06/06/2025 08/30-09/02 09/05/2025 12/03-12/05 12/10/2025 20 03/08-03/11 03/14/2025 06/04-06/06 06/11/2025 09/03-09/05 09/10/2025 12/06-12/09 12/12/2025 21 03/12-03/14 03/19/2025 06/07-06/10 06/13/2025 09/06-09/09 09/12/2025 12/10-12/12 12/17/2025 22 03/15-03/18 03/21/2025 06/11-06/13 06/18/2025 09/10-09/12 09/17/2025 12/13-12/16 12/19/2025 23 03/19-03/21 03/26/2025 06/14-06/17 06/20/2025 09/13-09/16 09/19/2025 12/17-12/19 12/24/2025 24 03/22-03/25 03/28/2025 06/18-06/20 06/25/2025 09/17-09/19 09/24/2025 12/20-12/23 12/26/2025 25 03/26-03/28 04/02/2025 06/21-06/24 06/27/2025 09/20-09/23 09/26/2025 12/24-12/26 12/31/2025 26 03/29-03/31 04/04/2025 06/25-06/27 07/02/2025 09/24-09/26 10/01/2025 12/27-12/30 01/02/2026 27 06/28-06/30 07/07/2025 09/27-09/30 10/03/2025 12/31 01/07/2026 Returns are to be filed whether or not taxable transactions occur in a period. File and remit payments using one of the following options: ● myPATH - File tax returns an remit payments using myPATH, the department's online tax system for businesses. Visitmypath.pa.gov to register. ● Telefile - Telefile provides a fast and secure way to file tax returns and remit payments by calling, toll-free, 1-800-748-8299. You will be required to enter any two of the following indentifiers: 8-digit Account ID Number, FEIN or SSN, and the period ending date for the period you wish to file. ● Third-party vendors - Approved third-party vendors provide for secure transmission for filing and paying. Visitrevenue.pa.gov to learn more about this option. Additional help is available through the Online Customer Service Center at revenue.pa.gov. File online using myPATH myPATH.pa.gov