Enlarge image

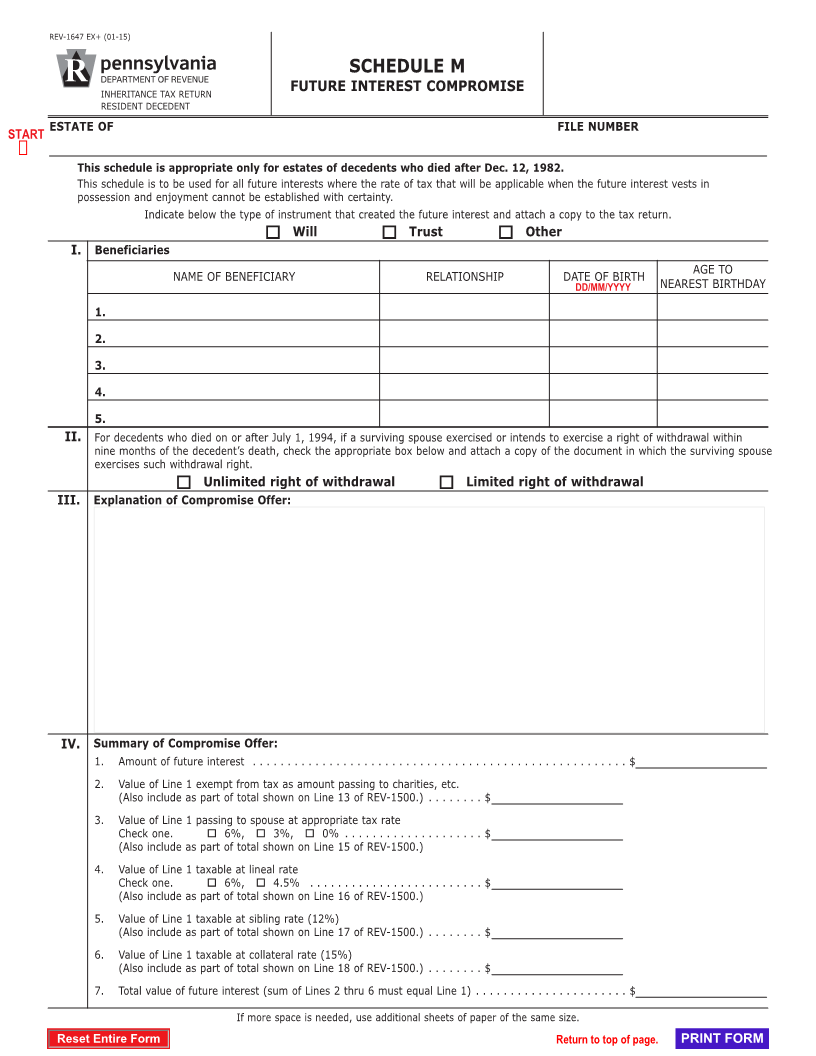

REV-1647 EX+ (01-15)

SCHEDULE M

INHERITANCE TAX RETURN FUTURE INTEREST COMPROMISE

RESIDENT DECEDENT

ESTATE OF FILE NUMBER

START

Ü

This schedule is appropriate only for estates of decedents who died after Dec. 12, 1982.

This schedule is to be used for all future interests where the rate of tax that will be applicable when the future interest vests in

possession and enjoyment cannot be established with certainty.

Indicate below the type of instrument that created the future interest and attach a copy to the tax return.

o Will o Trust o Other

I. Beneficiaries

AGE TO

NAME OF BENEFICIARY RELATIONSHIP DATE OF BIRTH

DD/MM/YYYY NEAREST BIRTHDAY

1.

2.

3.

4.

5.

II. For decedents who died on or after July 1, 1994, if a surviving spouse exercised or intends to exercise a right of withdrawal within

nine months of the decedent’s death, check the appropriate box below and attach a copy of the document in which the surviving spouse

exercises such withdrawal right.

o Unlimited right of withdrawal o Limited right of withdrawal

III. Explanation of Compromise Offer:

IV. Summary of Compromise Offer:

1. Amount of future interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

2. Value of Line 1 exempt from tax as amount passing to charities, etc.

(Also include as part of total shown on Line 13 of REV-1500.) . . . . . . . . $

3. Value of Line 1 passing to spouse at appropriate tax rate

Check one. o 6%, o 3%, o 0% . . . . . . . . . . . . . . . . . . . . $

(Also include as part of total shown on Line 15 of REV-1500.)

4. Value of Line 1 taxable at lineal rate

Check one. o 6%, o 4.5% . . . . . . . . . . . . . . . . . . . . . . . . . $

(Also include as part of total shown on Line 16 of REV-1500.)

5. Value of Line 1 taxable at sibling rate (12%)

(Also include as part of total shown on Line 17 of REV-1500.) . . . . . . . . $

6. Value of Line 1 taxable at collateral rate (15%)

(Also include as part of total shown on Line 18 of REV-1500.) . . . . . . . . $

7. Total value of future interest (sum of Lines 2 thru 6 must equal Line 1) . . . . . . . . . . . . . . . . . . . . . . $

If more space is needed, use additional sheets of paper of the same size.

Reset Entire Form Return to top of page. PRINT FORM