Enlarge image

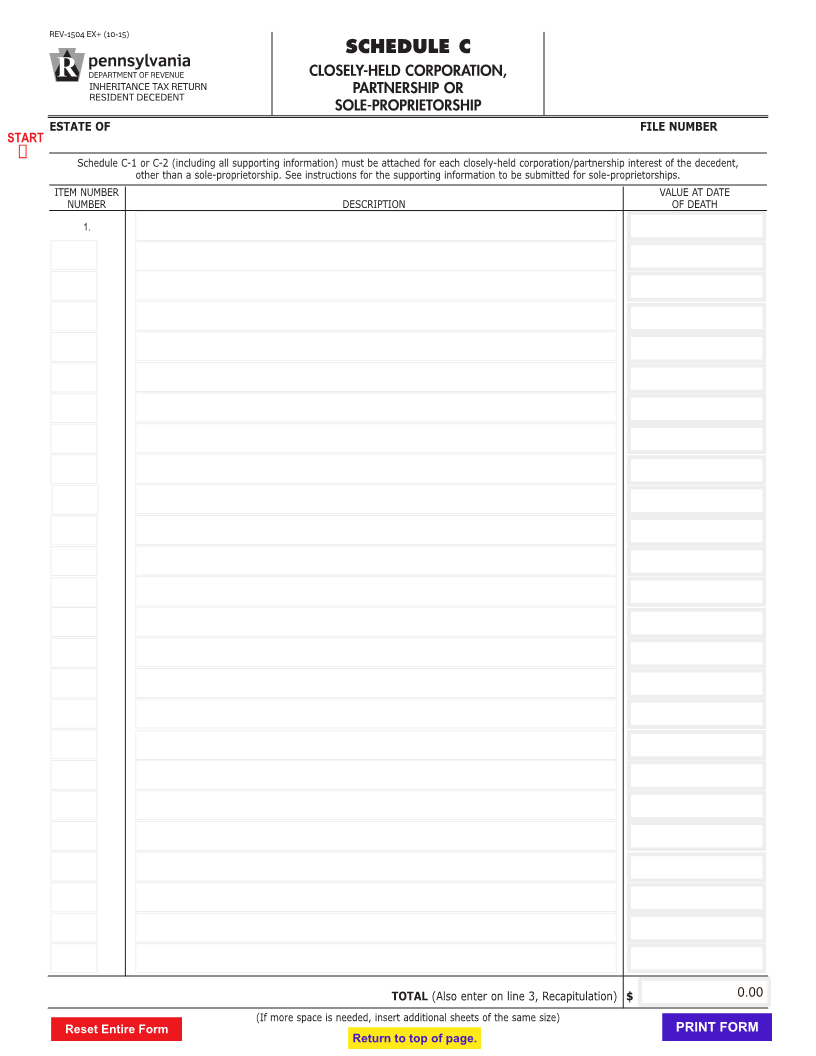

REV-1504 EX+ (10-15)

SCHEDULE C

CLOSELY-HELD CORPORATION,

INHERITANCE TAX RETURN PARTNERSHIP OR

RESIDENT DECEDENT

SOLE-PROPRIETORSHIP

ESTATE OF FILE NUMBER

START

Ü

Schedule C-1 or C-2 (including all supporting information) must be attached for each closely-held corporation/partnership interest of the decedent,

other than a sole-proprietorship. See instructions for the supporting information to be submitted for sole-proprietorships.

ITEM NUMBER VALUE AT DATE

NUMBER DESCRIPTION OF DEATH

1.

TOTAL (Also enter on line 3, Recapitulation) $ 0.00

(If more space is needed, insert additional sheets of the same size)

Reset Entire Form PRINT FORM

Return to top of page.