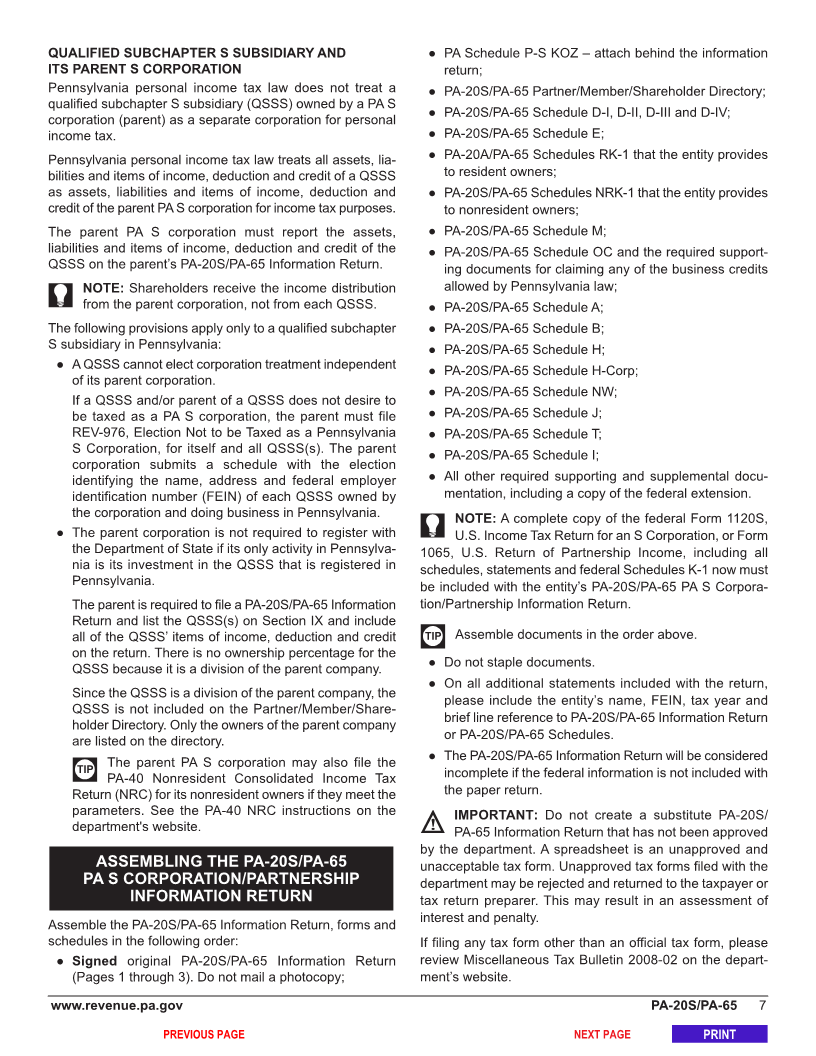

Enlarge image

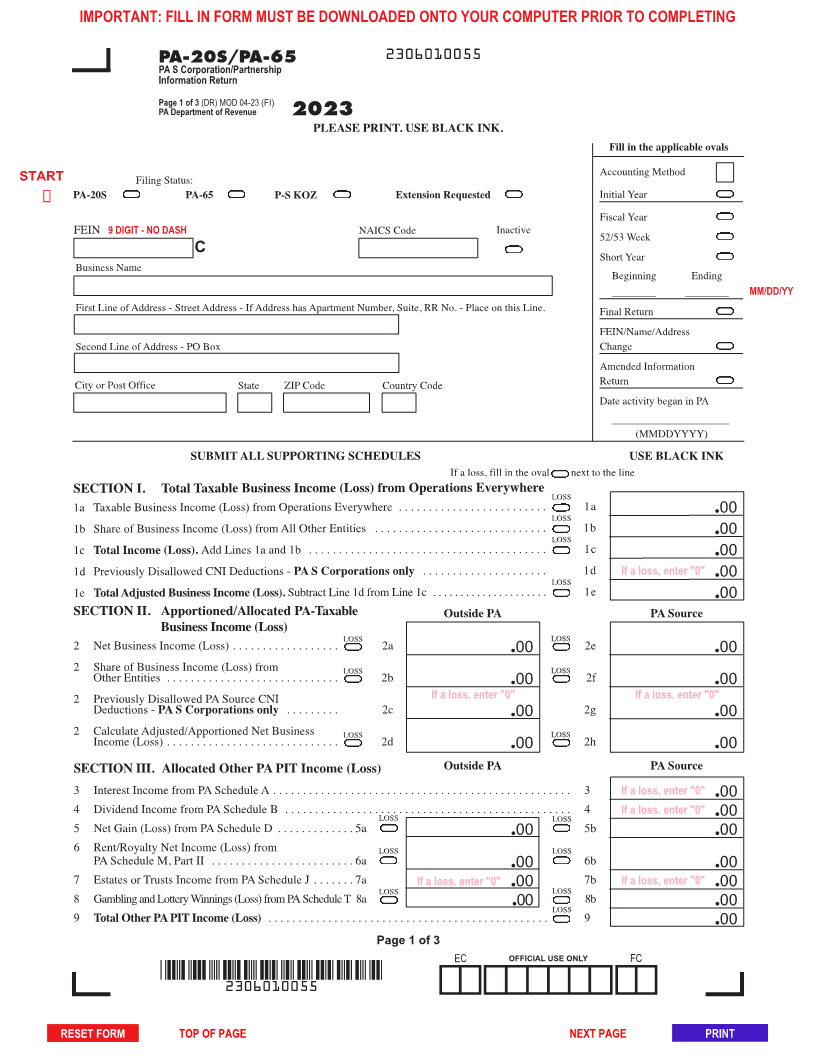

IMPORTANT: FILL IN FORM MUST BE DOWNLOADED ONTO YOUR COMPUTER PRIOR TO COMPLETING

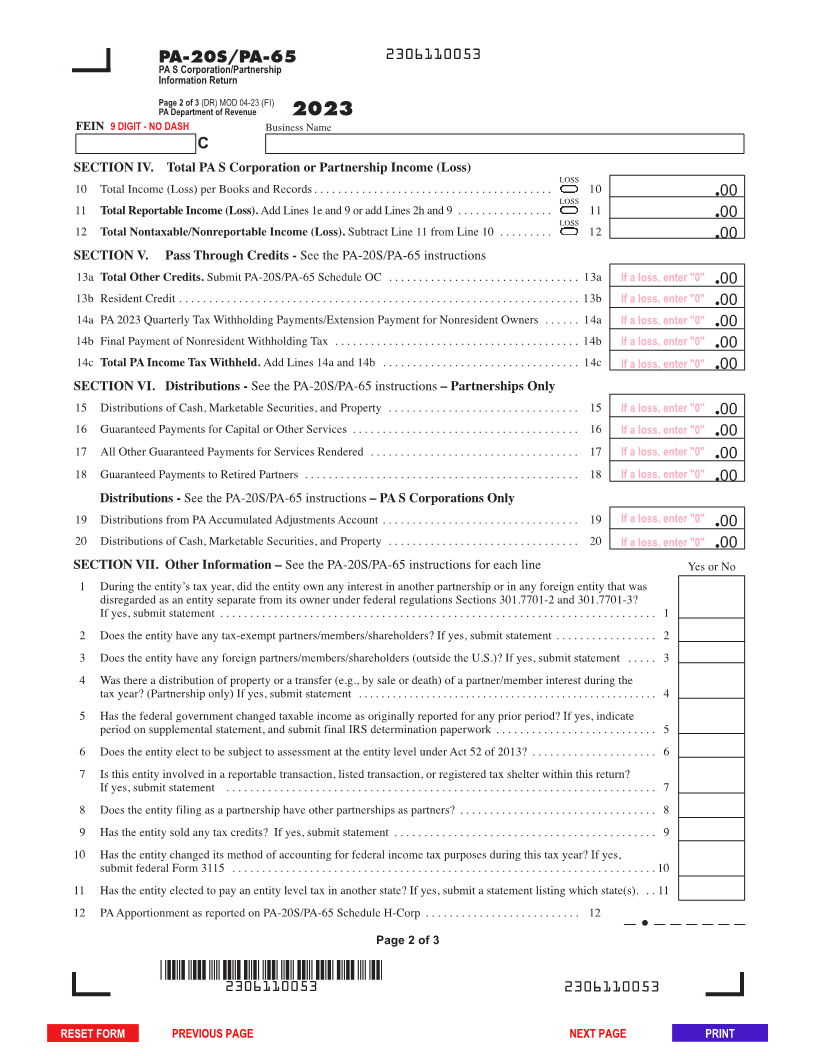

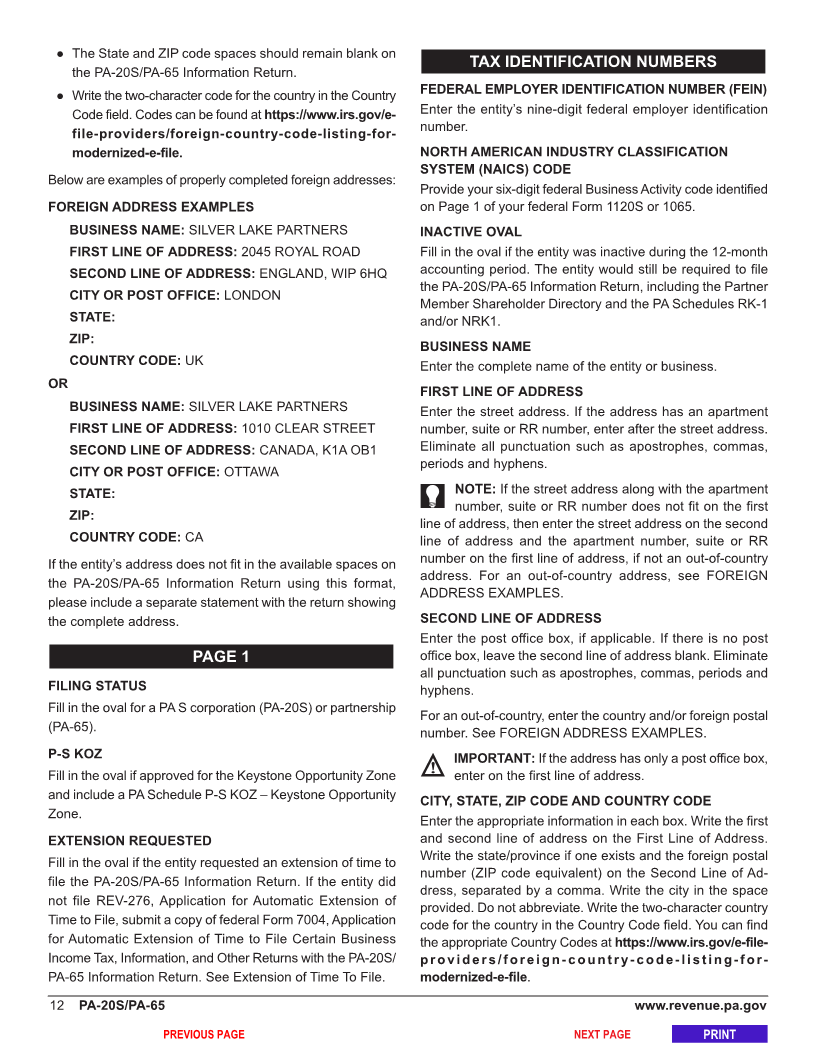

PA-20S/PA-65 2306010055

PA S Corporation/Partnership

Information Return

Page 1 of 3 (DR) MOD 04-23 (FI)

PA Department of Revenue 2023

PLEASE PRINT. USE BLACK INK.

Fill in the applicable ovals

Accounting Method

START Filing Status:

Ü PA-20S PA-65 P-S KOZ Extension Requested Initial Year

Fiscal Year

FEIN 9 DIGIT - NO DASH NAICS Code Inactive

52/53 Week

C

Short Year

Business Name

Beginning Ending

_________ _________ MM/DD/YY

First Line of Address - Street Address - If Address has Apartment Number, Suite, RR No. - Place on this Line. Final Return

FEIN/Name/Address

Second Line of Address - PO Box Change

Amended Information

City or Post Office State ZIP Code Country Code Return

Date activity began in PA

____________________________

(MMDDYYYY)

SUBMIT ALL SUPPORTING SCHEDULES USE BLACK INK

If a loss, fill in the oval next to the line

SECTION I. Total Taxable Business Income (Loss) from Operations Everywhere LOSS

1a Taxable Business Income (Loss) from Operations Everywhere . . . . . . . . . . . . . . . . . . . . . . . . . 1a l00

LOSS

1b Share of Business Income (Loss) from All Other Entities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1b l00

LOSS

1c Total Income (Loss). Add Lines 1a and 1b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1c l00

1d Previously Disallowed CNI Deductions -PA S Corporations only . . . . . . . . . . . . . . . . . . . . . 1d If a loss, enter "0" l00

LOSS

1e Total Adjusted Business Income (Loss). Subtract Line 1d from Line 1c . . . . . . . . . . . . . . . . . . . . . 1e l00

SECTION II. Apportioned/Allocated PA-Taxable Outside PA PA Source

Business Income (Loss)

LOSS LOSS

2 Net Business Income (Loss) . . . . . . . . . . . . . . . . . . 2a l00 2e l00

2 Share of Business Income (Loss) from LOSS LOSS

Other Entities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2b l00 2f l00

2 Previously Disallowed PA Source CNI If a loss, enter "0" If a loss, enter "0"

Deductions - PA S Corporations only . . . . . . . . . 2c l00 2g l00

2 Calculate Adjusted/Apportioned Net Business LOSS LOSS

Income (Loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2d l00 2h l00

SECTION III. Allocated Other PA PIT Income (Loss) Outside PA PA Source

3 Interest Income from PA Schedule A . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 h If a loss, enter "0" l00

If a loss, enter "0"

4 Dividend Income from PA Schedule B . . . . . . . . . . . . . . . .LOSS. . . . . . . . . . . . . . . . . . . . . . . . . . . . .LOSS. . . 4 h l00

5 Net Gain (Loss) from PA Schedule D . . . . . . . . . . . . . 5a l00 5b l00

6 Rent/Royalty Net Income (Loss) from LOSS LOSS

PA Schedule M, Part II . . . . . . . . . . . . . . . . . . . . . . . . 6a l00 6b l00

7 Estates or Trusts Income from PA Schedule J . . . . . . . 7a If a loss, enter "0" l00 7b If a loss, enter "0" l00

LOSS LOSS

8 Gambling and Lottery Winnings (Loss) from PA Schedule T 8a l00 8b l00

LOSS

9 Total Other PA PIT Income (Loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9 b l00

Page 1 of 3

EC OFFICIAL USE ONLY FC

2306010055

RESET FORM TOP OF PAGE NEXT PAGE PRINT