Enlarge image

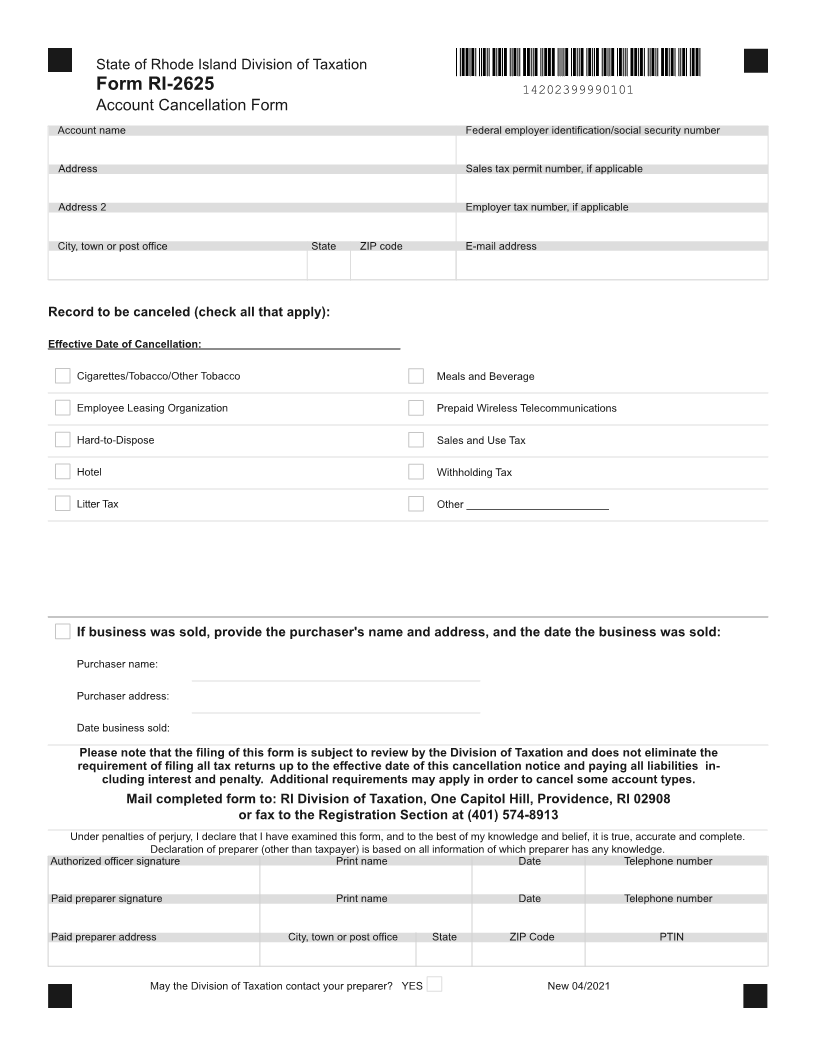

State of Rhode Island Division of Taxation

Form RI-2625

14202399990101

Account Cancellation Form

Account name Federal employer identification/social security number

Address Sales tax permit number, if applicable

Address 2 Employer tax number, if applicable

City, town or post office State ZIP code E-mail address

Record to be canceled (check all that apply):

Effective Date of Cancellation:

Cigarettes/Tobacco/Other Tobacco Meals and Beverage

Employee Leasing Organization Prepaid Wireless Telecommunications

Hard-to-Dispose Sales and Use Tax

Hotel Withholding Tax

Litter Tax Other ________________________

If business was sold, provide the purchaser's name and address, and the date the business was sold:

Purchaser name:

Purchaser address:

Date business sold:

Please note that the filing of this form is subject to review by the Division of Taxation and does not eliminate the

requirement of filing all tax returns up to the effective date of this cancellation notice and paying all liabilities in-

cluding interest and penalty. Additional requirements may apply in order to cancel some account types.

Mail completed form to: RI Division of Taxation, One Capitol Hill, Providence, RI 02908

or fax to the Registration Section at (401) 574-8913

Under penalties of perjury, I declare that I have examined this form, and to the best of my knowledge and belief, it is true, accurate and complete.

Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Authorized officer signature Print name Date Telephone number

Paid preparer signature Print name Date Telephone number

Paid preparer address City, town or post office State ZIP Code PTIN

May the Division of Taxation contact your preparer? YES New 04/2021