Enlarge image

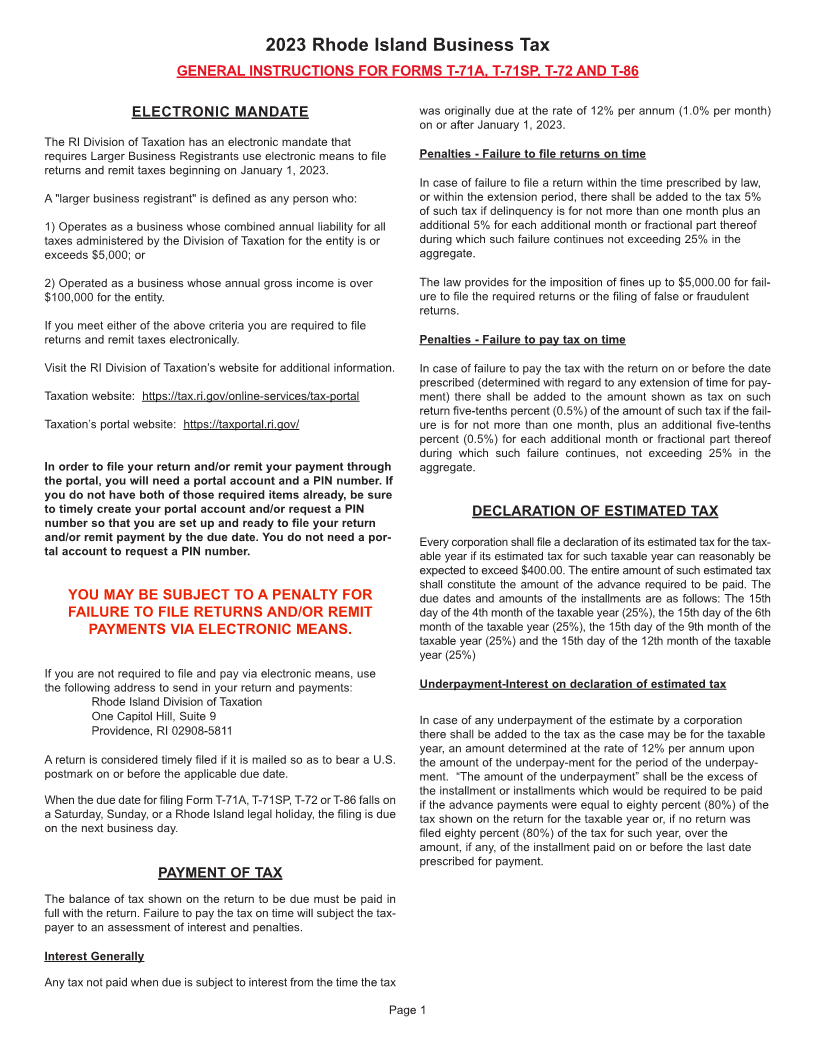

2023 Rhode Island Business Tax

GENERAL INSTRUCTIONS FOR FORMS T-71A, T-71SP, T-72 AND T-86

ELECTRONIC MANDATE was originally due at the rate of 12% per annum (1.0% per month)

on or after January 1, 2023.

The RI Division of Taxation has an electronic mandate that

requires Larger Business Registrants use electronic means to file Penalties - Failure to file returns on time

returns and remit taxes beginning on January 1, 2023.

In case of failure to file a return within the time prescribed by law,

A "larger business registrant" is defined as any person who: or within the extension period, there shall be added to the tax 5%

of such tax if delinquency is for not more than one month plus an

1) Operates as a business whose combined annual liability for all additional 5% for each additional month or fractional part thereof

taxes administered by the Division of Taxation for the entity is or during which such failure continues not exceeding 25% in the

exceeds $5,000; or aggregate.

2) Operated as a business whose annual gross income is over The law provides for the imposition of fines up to $5,000.00 for fail-

$100,000 for the entity. ure to file the required returns or the filing of false or fraudulent

returns.

If you meet either of the above criteria you are required to file

returns and remit taxes electronically. Penalties - Failure to pay tax on time

Visit the RI Division of Taxation’s website for additional information. In case of failure to pay the tax with the return on or before the date

prescribed (determined with regard to any extension of time for pay-

Taxation website: https://tax.ri.gov/online-services/tax-portal ment) there shall be added to the amount shown as tax on such

return five-tenths percent (0.5%) of the amount of such tax if the fail-

Taxation’s portal website: https://taxportal.ri.gov/ ure is for not more than one month, plus an additional five-tenths

percent (0.5%) for each additional month or fractional part thereof

during which such failure continues, not exceeding 25% in the

In order to file your return and/or remit your payment through aggregate.

the portal, you will need a portal account and a PIN number. If

you do not have both of those required items already, be sure

to timely create your portal account and/or request a PIN DECLARATION OF ESTIMATED TAX

number so that you are set up and ready to file your return

and/or remit payment by the due date. You do not need a por- Every corporation shall file a declaration of its estimated tax for the tax-

tal account to request a PIN number. able year if its estimated tax for such taxable year can reasonably be

expected to exceed $400.00. The entire amount of such estimated tax

shall constitute the amount of the advance required to be paid. The

YOU MAY BE SUBJECT TO A PENALTY FOR due dates and amounts of the installments are as follows: The 15th

FAILURE TO FILE RETURNS AND/OR REMIT day of the 4th month of the taxable year (25%), the 15th day of the 6th

PAYMENTS VIA ELECTRONIC MEANS. month of the taxable year (25%), the 15th day of the 9th month of the

taxable year (25%) and the 15th day of the 12th month of the taxable

year (25%)

If you are not required to file and pay via electronic means, use

the following address to send in your return and payments: Underpayment-Interest on declaration of estimated tax

Rhode Island Division of Taxation

One Capitol Hill, Suite 9 In case of any underpayment of the estimate by a corporation

Providence, RI 02908-5811 there shall be added to the tax as the case may be for the taxable

year, an amount determined at the rate of 12% per annum upon

A return is considered timely filed if it is mailed so as to bear a U.S. the amount of the underpay-ment for the period of the underpay-

postmark on or before the applicable due date. ment. “The amount of the underpayment” shall be the excess of

the installment or installments which would be required to be paid

When the due date for filing Form T-71A, T-71SP, T-72 or T-86 falls on if the advance payments were equal to eighty percent (80%) of the

a Saturday, Sunday, or a Rhode Island legal holiday, the filing is due tax shown on the return for the taxable year or, if no return was

on the next business day. filed eighty percent (80%) of the tax for such year, over the

amount, if any, of the installment paid on or before the last date

prescribed for payment.

PAYMENT OF TAX

The balance of tax shown on the return to be due must be paid in

full with the return. Failure to pay the tax on time will subject the tax-

payer to an assessment of interest and penalties.

Interest Generally

Any tax not paid when due is subject to interest from the time the tax

Page 1