Enlarge image

2024 RI-1120C - Rhode Island Business Corporation Tax Return

SPECIFIC INSTRUCTIONS

INFORMATION SECTION: numerator the total sales (receipts) associated with the combined group’s

Enter the requested entity information on the top of the form, including name, business in Rhode Island, and including in the denominator the total sales

address, federal identification number, type of return being filed, and if the (receipts) of all members of the combined group, which total sales (receipts)

entity is not a calendar year filer, enter the beginning and end dates of the are associated with the combined group’s business wherever located.

entity’s fiscal year.

(2) The combined return uses the income, losses, and factors of all members

Enter the following information in the corresponding boxes: included on the combined return to more accurately determine the taxable

A. The gross receipts from U.S. Form 1120. income of those entities that have corporate income tax nexus with Rhode

B. The depreciable assets from U.S. Form 1120, page 6, Schedule L, line Island.

10a, Column (c).

C. Enter the total assets from U.S. Form 1120, page 6, Schedule L, line 15, See the most recent version of the Rhode Island Combined Reporting

Column (d). Regulation for more information.

All amounts should be listed in whole dollar amounts.

RETURN DUE DATES:

For calendar year and non-June 30 fiscal year end filers, Form RI-1120C is

due on or before the fifteenth day of the fourth month following the close of ELECTION TO USE FEDERAL CONSOLIDATED GROUP:

the taxable year. An affiliated group of C corporations, as defined in IRC, 26 U.S.C. § 1504,

may elect to be treated as a combined group with respect to the combined

For June 30 fiscal year end filers, Form RI-1120C is due on or before the fif- reporting requirement imposed by Rhode Island General Laws.

teenth day of the third month following the close of the taxable year.

When such an election is made, the entities that appear on the federal con-

solidated return shall be considered a combined group for Rhode Island cor-

porate income tax purposes.

NOTE:

If filing a final return, a separate request for a letter of good standing for the To make the election, the affiliated group shall check the appropriate box on

purpose of dissolution or withdrawal should also be filed. Attach the final Form RI-1120C. The consolidated return can include entities that would not

return to the request form and follow the instructions for section V or VI. The otherwise be subject to combination. The election shall be upon the condition

final return and request form must be completed through the date of with- that all entities which are included on the federal consolidated return for the

drawal. When filing for dissolution or withdrawal, an extension is not valid. taxable year consent to be included in the group for Rhode Island purposes.

Within thirty (30) days of date of letter of good standing, it must be recorded

with the Secretary of State. Checking the appropriate box on Form RI-1120C and filing the completed

return shall be considered as such consent.

COMBINED REPORTING: Should the affiliated group make this election, the election shall be binding

For tax years beginning on or after January 1, 2015, a business which is for purposes of Rhode Island combined reporting for five consecutive tax

treated as a C corporation for federal income tax purposes, and which is part years beginning with the first tax year to which the election applies.

of a combined group engaged in a single or common business enterprise –

a “unitary” business – must file a combined return with Rhode Island. Under To make the election, the affiliated group shall check the Federal

mandatory unitary combined reporting, R.I. Gen. Laws § 44-11-4.1, an entity Consolidated Group Election box on page 1 of Form RI-1120C and enter the

treated as a C corporation for federal income tax purposes must report on its first tax year to which the election applies.

Rhode Island return not only its own income, but also the combined income

of the other corporations, or affiliates, that are part of a combined group

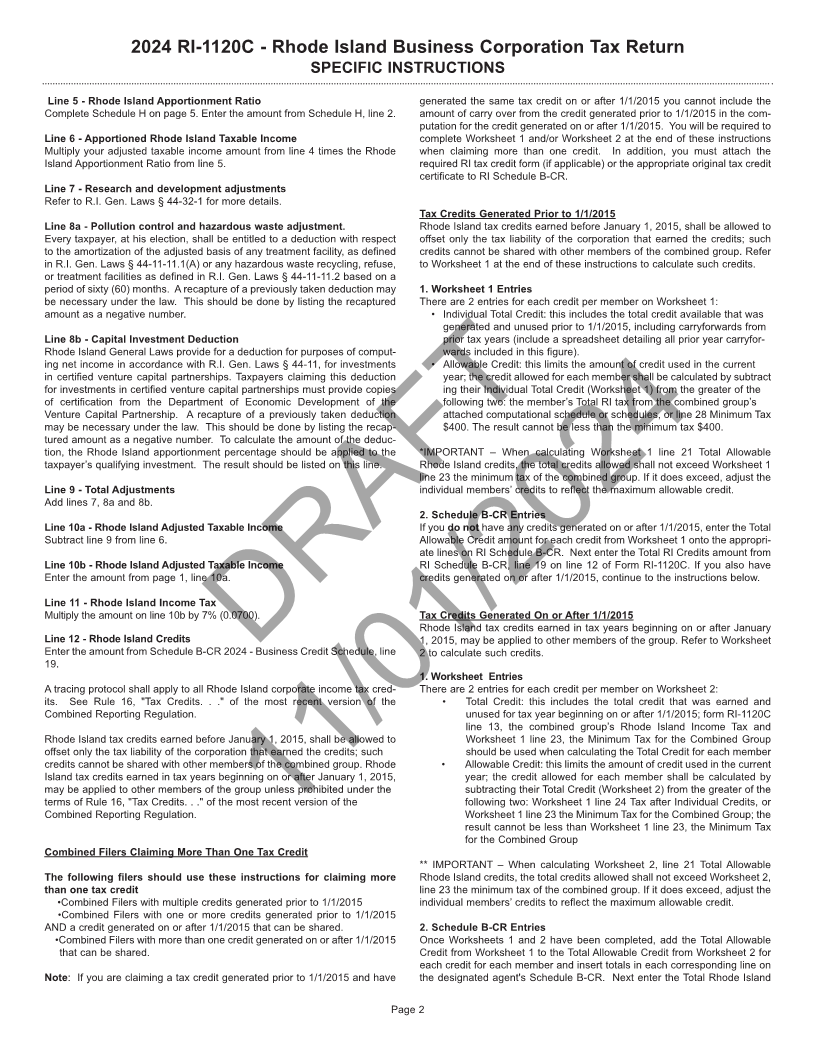

under common ownership and part of a unitary business. SCHEDULE A - COMPUTATION OF TAX

An affiliated group of C corporations, as defined in IRC § 1504, may also DRAFT

elect to be treated as a combined group with respect to the combined report- TAXABLE INCOME

ing requirement imposed by Rhode Island General Laws. When such an

election is made, the entities that appear on the federal consolidated return Line 1 -

shall be considered a combined group for Rhode Island corporate income Enter the taxable income as it appears on line 28, Federal Form 1120.

tax purposes.

The combined group shall file by checking the box for Combined Return on CAPTIVE REAL ESTATE INVESTMENT TRUST (CAPTIVE REIT):

the 2024 RI-1120C form, and including a RI-1120C - CGM Schedule listing A Captive REIT shall file form RI-1120C and calculate tax at the corpora-

the name, federal employer identification number, and address for each tion tax rate, adding back the “total deduction for dividends paid” to their

member of the combined group. If a federal consolidated group has made federal taxable income under R.I. Gen. Laws § 44-11-11. Non-Captive

the election to be treated as a combined group with respect to the Rhode REIT’s shall check the box for 1120F and use Schedule RI-1120F to calcu-

Island combined reporting requirement, they may do so by checking of the late the tax.

box for Federal Consolidated Election on the RI-1120C - CGM11/01/2024Schedule. Line 2 - Total Deductions

Enter Total Deductions from page 3, Schedule B, line 1g.

The combined group shall be required to attach a computational schedule or

schedules which report the income and apportionment information of all enti- Line 3 - Total Additions

ties of the taxpayer member’s combined group, as well as any supporting Enter Total Additions from page 3, Schedule C, line 1e.

information required to substantiate the amounts in the computational sched-

ule or schedules.

Taxable income of a combined group apportionable to this state: APPORTIONED TAXABLE INCOME

(1) The taxable income apportionable to Rhode Island of each combined

group shall be the product of: (i) the adjusted taxable income of the com- Line 4 - Adjusted Taxable Income

bined group, determined under the most recent version of the Combined Subtract the total deductions amount on line 1 from the Federal Taxable

Reporting Regulation, and (ii) the apportionment percentage, including in the Income amount on line 2. Add to that the total additions amount on line 3.

Page 1