Enlarge image

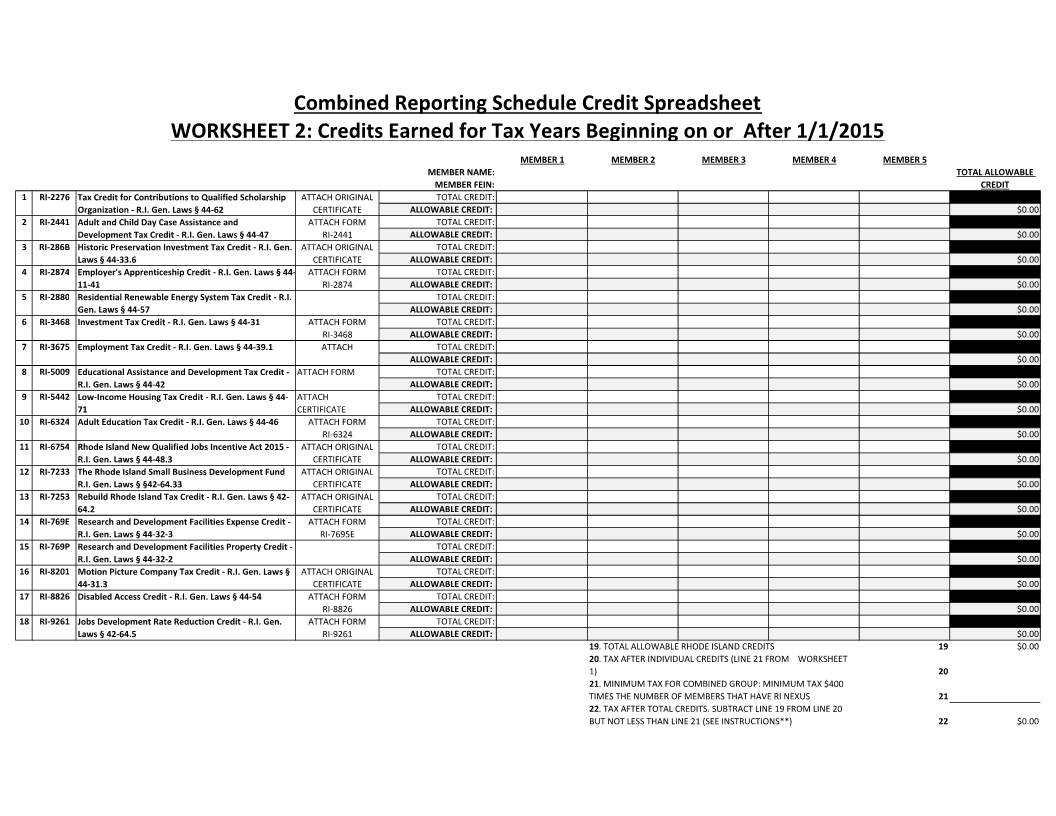

$0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00

CREDIT

TOTAL ALLOWABLE

18 19 20 21

MEMBER 5

MEMBER 4

‐1120C LINE 11

MEMBER 3

1/1/2015

Spreadsheet to

MEMBER 2

Prior . TOTAL ALLOWABLE RHODE ISLAND CREDITS . TOTAL RHODE ISLAND TAX FROM RI . MINIMUM TAX FOR COMBINED GROUP: MINIMUM TAX $400 . TAX AFTER INDIVIDUAL CREDITS. SUBTRACT LINE 18 FROM LINE

Credit 18 19 20 TIMES THE NUMBER OF MEMBERS THAT HAVE RI NEXUS 21 19 BUT NOT LESS THAN LINE 20 (SEE INSTRUCTIONS*)

Earned MEMBER 1

Schedule

Credits

MEMBER FEIN:

MEMBER NAME:

1:

ALLOWABLE CREDIT: ALLOWABLE CREDIT: ALLOWABLE CREDIT: ALLOWABLE CREDIT: ALLOWABLE CREDIT: ALLOWABLE CREDIT: ALLOWABLE CREDIT: ALLOWABLE CREDIT: ALLOWABLE CREDIT: ALLOWABLE CREDIT: ALLOWABLE CREDIT: ALLOWABLE CREDIT: ALLOWABLE CREDIT: ALLOWABLE CREDIT: ALLOWABLE CREDIT: ALLOWABLE CREDIT: ALLOWABLE CREDIT:

Reporting INDIVIDUAL TOTAL CREDIT: INDIVIDUAL TOTAL CREDIT: INDIVIDUAL TOTAL CREDIT: INDIVIDUAL TOTAL CREDIT: INDIVIDUAL TOTAL CREDIT: INDIVIDUAL TOTAL CREDIT: INDIVIDUAL TOTAL CREDIT: INDIVIDUAL TOTAL CREDIT: INDIVIDUAL TOTAL CREDIT: INDIVIDUAL TOTAL CREDIT: INDIVIDUAL TOTAL CREDIT: INDIVIDUAL TOTAL CREDIT: INDIVIDUAL TOTAL CREDIT: INDIVIDUAL TOTAL CREDIT: INDIVIDUAL TOTAL CREDIT: INDIVIDUAL TOTAL CREDIT: INDIVIDUAL TOTAL CREDIT:

‐2441 ‐2874 ‐3468 ‐5009 ‐6324 ‐7695E ‐8826 9261‐

RI RI RI RI RI RI RI RI

CERTIFICATE ATTACH FORM CERTIFICATE ATTACH FORM ATTACH FORM ATTACH FORM ATTACH FORM CERTIFICATE CERTIFICATE CERTIFICATE ATTACH FORM CERTIFICATE ATTACH FORM ATTACH FORM

Combined ATTACH ORIGINAL ATTACH ORIGINAL ‐ ‐ ‐ ATTACH ORIGINAL ATTACH ORIGINAL ‐ATTACH ORIGINAL ‐ ‐ ATTACH ORIGINAL

WORKSHEET

R.I.

‐

54‐ R.I. Gen.

‐47 R.I. Gen. ‐31 ‐39.1 ‐46

‐

‐

R.I. Gen. Laws § 44 R.I. Gen. Laws §

62 ‐ ‐

‐ R.I. Gen. Laws § 42

‐

‐

R.I. Gen. Laws § 44 R.I. Gen. Laws § 44

R.I. Gen. Laws § 44 R.I. Gen. Laws § 44 3 2‐ R.I. Gen. Laws § 44

‐ ‐ ‐ ‐

‐

‐

42‐ 48.3‐ 64.33‐ 32 32‐

R.I. Gen. Laws § 44 57‐

33.6‐

‐ 64.5‐

‐41 31.3‐

Tax Credit for Contributions to Qualified Scholarship Organization Adult and Child Day Case Assistance and Development Tax Credit Historic Preservation Investment Tax Credit Laws § 44 Employer's Apprenticeship Credit 11 Residential Renewable Energy System Tax Credit Gen. Laws § 44 Investment Tax Credit Employment Tax Credit Educational Assistance and Development Tax Credit R.I. Gen. Laws § 44 Adult Education Tax Credit Rhode Island New Qualified Jobs Incentive Act 2015 R.I. Gen. Laws § 44 The Rhode Island Small Business Development Fund R.I. Gen. Laws § §42 Rebuild Rhode Island Tax Credit 64.2 Research and Development Facilities Expense Credit R.I. Gen. Laws § 44 Research and Development Facilities Property Credit R.I. Gen. Laws § 44 Motion Picture Company Tax Credit 44 Disabled Access Credit Jobs Development Rate Reduction Credit Laws § 42

I‐2276 I‐2441 I‐286B I‐2874 I‐2880 I‐3468 I‐3675 I‐5009 I‐6324 ‐6754 ‐7233 ‐7253 ‐769E ‐769P ‐8201 ‐8826 ‐9261

RI RI RI RI RI RI RI RI

1R 2R 3R 4R 5R 6R 7R 8R 9R 10 11 12 13 14 15 16 17