Enlarge image

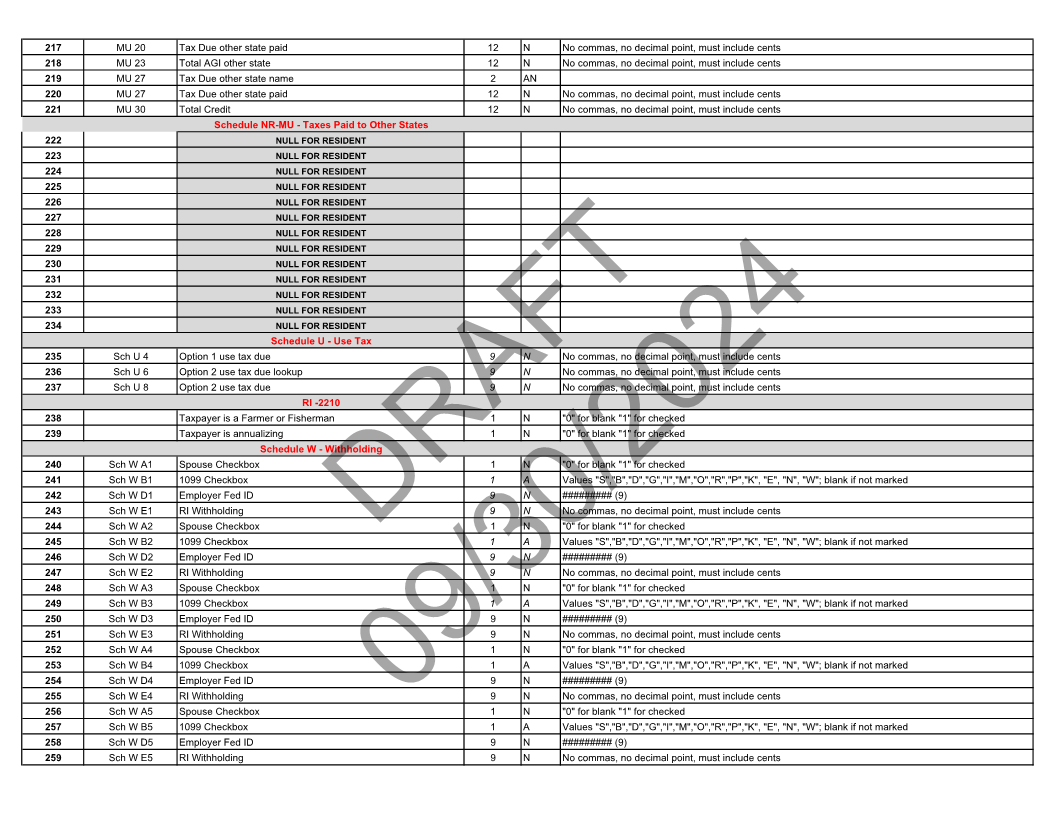

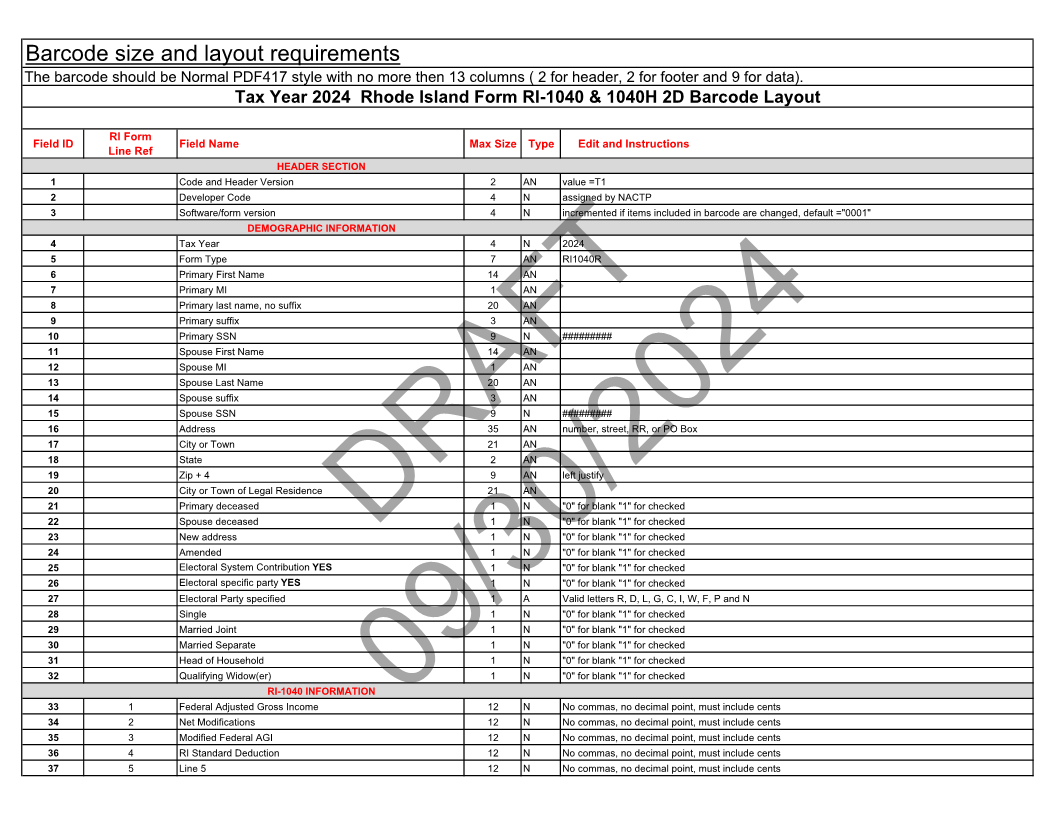

valueassigned=T1incrementedby2024 NACTPRI1040R if items included######### in barcode are changed,######### number,defaultstreet,left="0001"justifyRR,"0"orfor"0"POblankfor"0"Boxblankfor"0""1"blankfor"0"for"1"blankfor"0"checkedfor"1"blankforValidcheckedfor"1"blank"0"checkedlettersfor"1"for"0"checkedfor"1"blankfor"0"R,checkedforblankfor"0"D,checked"1"blankfor"0"L,for"1"G,blankforcheckedfor"1"C,blankNocheckedI,for"1"commas,NoW,checkedfor"1"Nocommas,F,checkedforPcommas,NoandcheckednoNocommas,decimalNnocommas,decimalno decimalnopoint,decimalnopoint,decimalmustpoint,mustpoint,includemustpoint,includemustincludecentsmustincludecentsincludecentscentscents Edit and Instructions

TypeAN N N N AN AN AN AN AN N AN AN AN AN N AN AN AN AN AN N N N N N N A N N N N N N N N N N

2 4 4 4 7 14 1 20 3 9 14 1 20 3 9 35 21 2 9 21 1 1 1 1 1 1 1 1 1 1 1 1 12 12 12 12 12

Max Size

09/30/2024

DRAFT

YES

HEADERYES SECTION

RI-1040 INFORMATION

DEMOGRAPHIC INFORMATION

Tax Year 2024 Rhode Island Form RI-1040 & 1040H 2D Barcode Layout

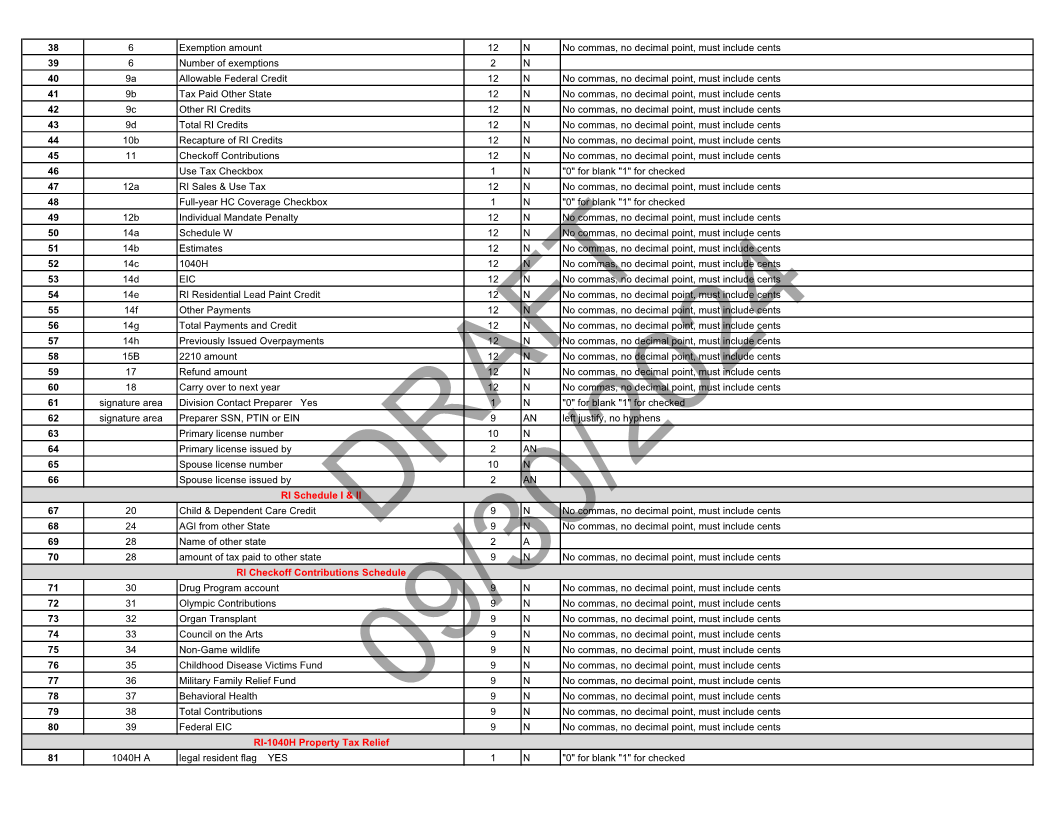

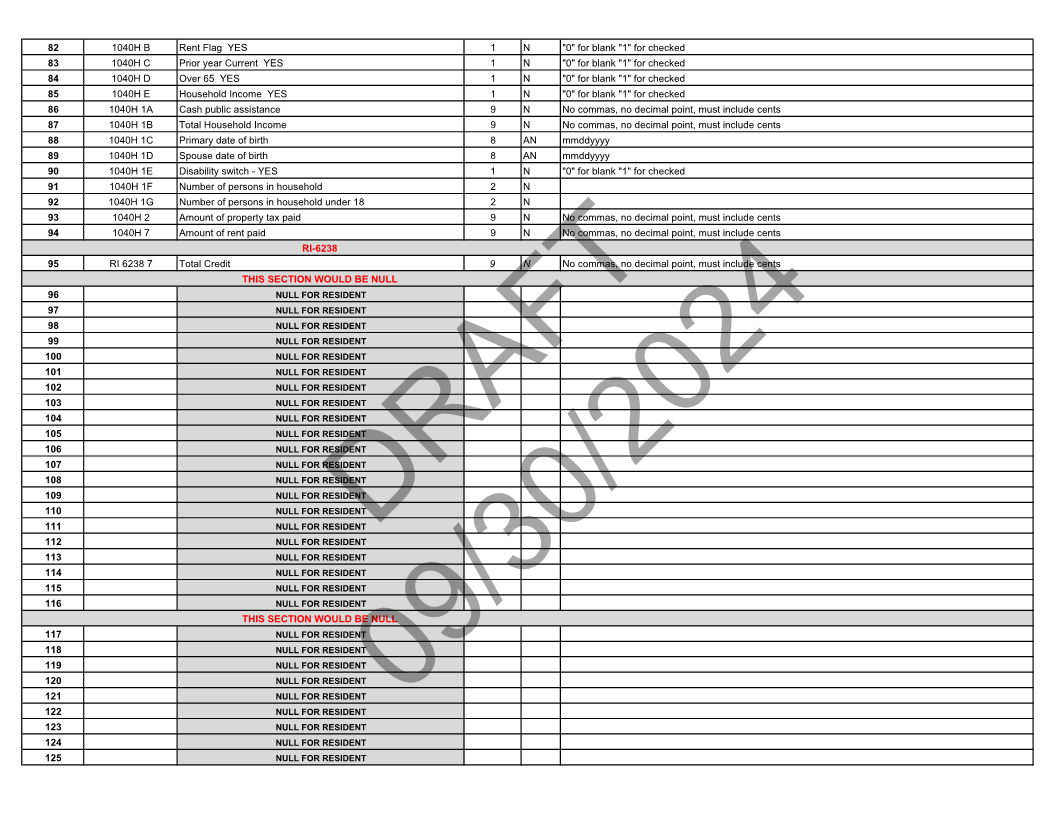

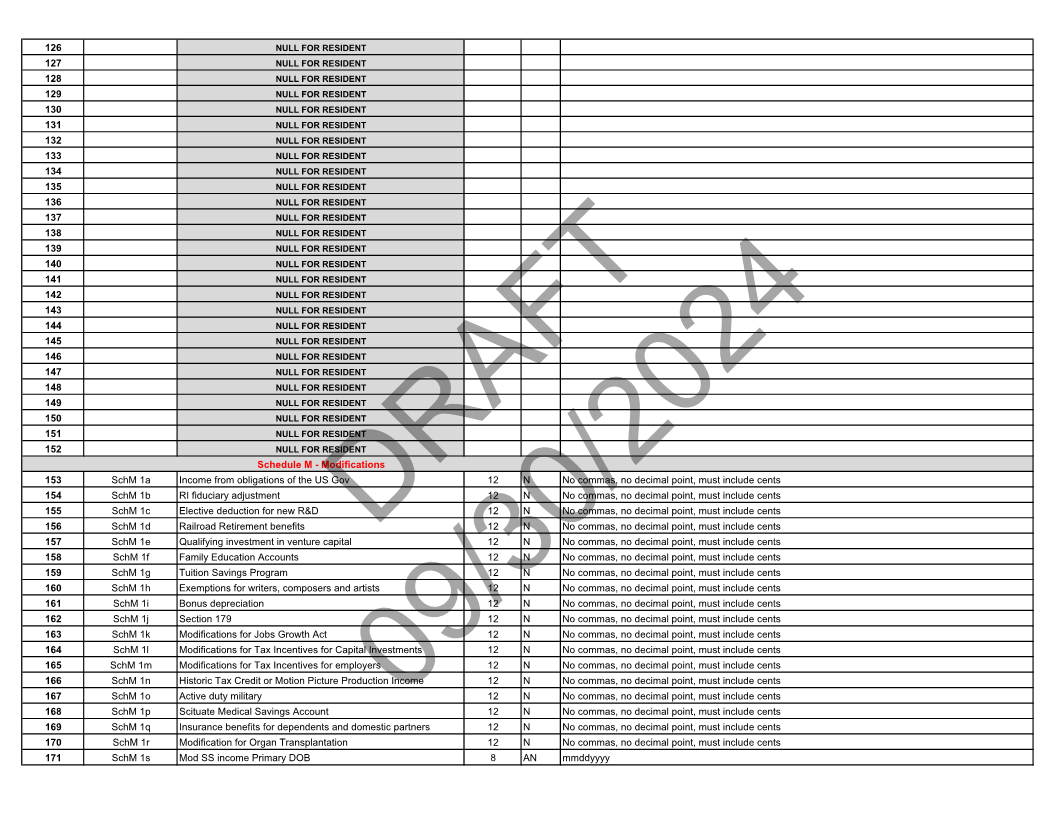

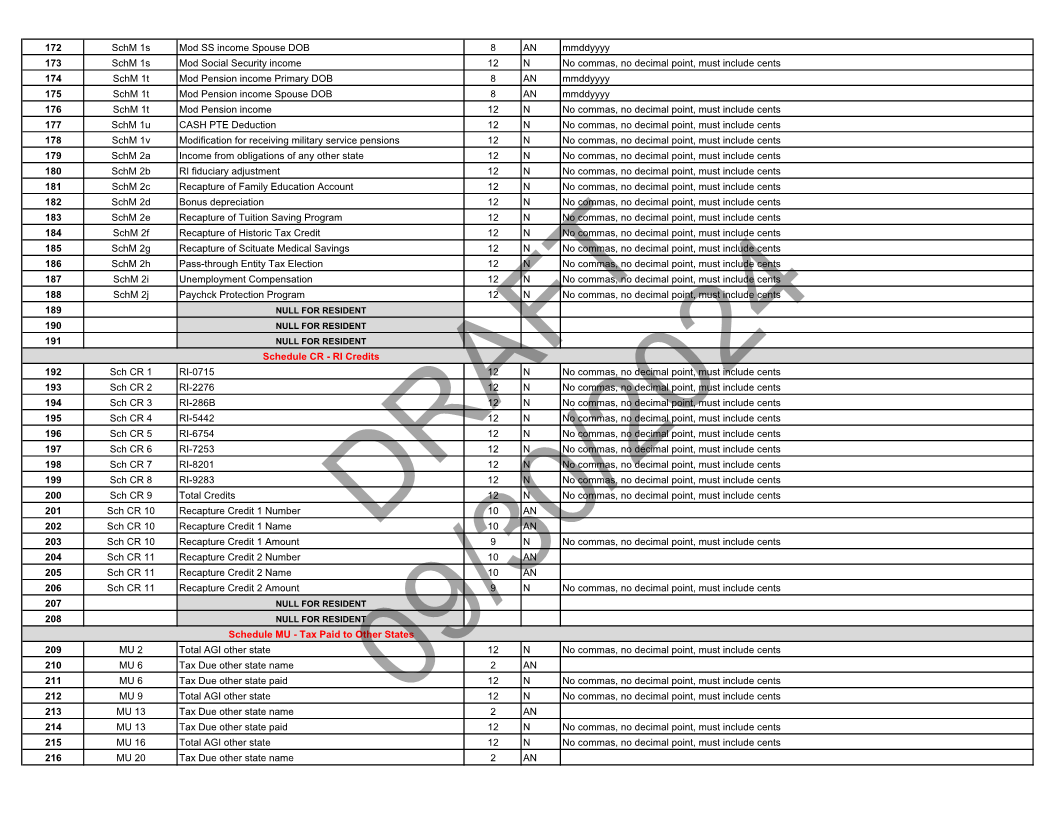

FieldCodeDeveloperandSoftware/formHeaderTaxCodeFormYearVersionPrimaryversionTypePrimaryPrimaryFirstPrimaryMINamePrimarylastSpousesuffixname,SpouseSSNSpouseFirstnoSpouseMIsuffixNameSpouseLastAddress suffixNameCitySSNState orZipTownCity+ 4PrimaryorSpouseTownNewdeceasedofAmended deceasedaddressLegalElectoralElectoralResidenceElectoralSystemSingle specificMarriedPartyContributionMarriedpartyHeadJointspecifiedQualifyingSeparateof HouseholdFederalNetWidow(er)ModifiedModificationsAdjustedRI StandardLineFederalGross5 DeductionIncomeAGI Name

1 2 3 4 5

RI Form Line Ref

12345678910111213141516171819202122232425262728293031323334353637

Field ID

Barcode size and layout requirements The barcode should be Normal PDF417 style with no more then 13 columns ( 2 for header, 2 for footer and 9 for data).