Enlarge image

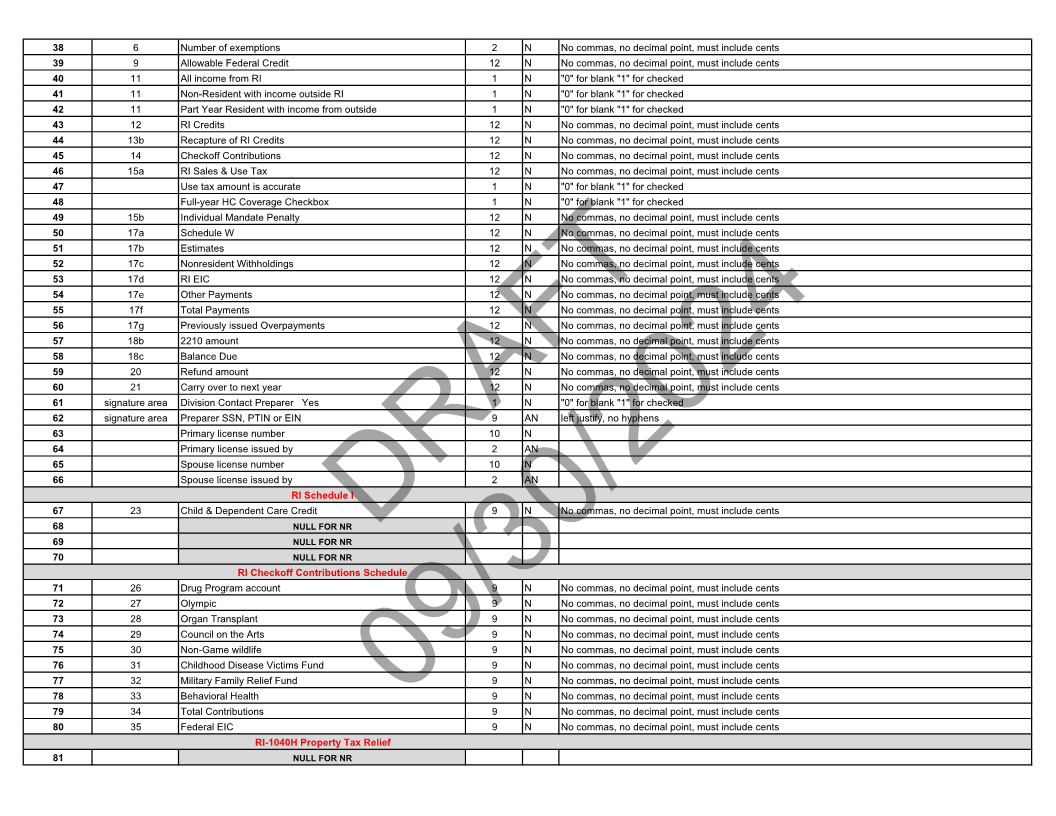

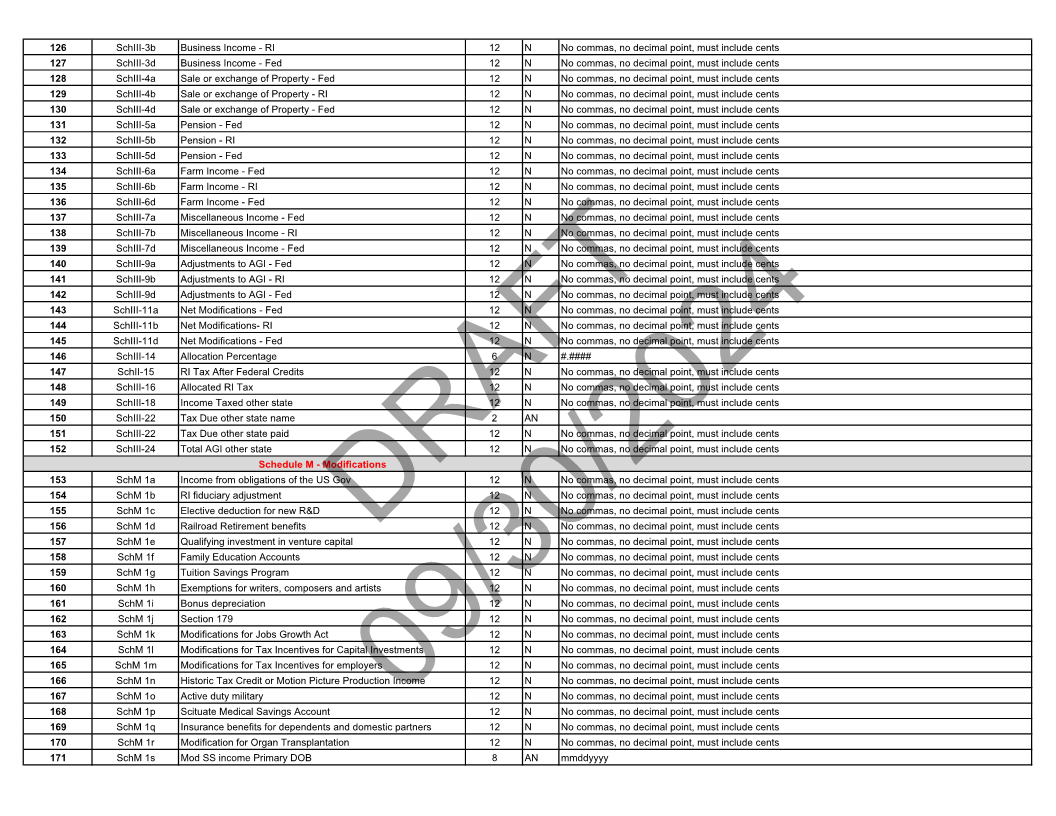

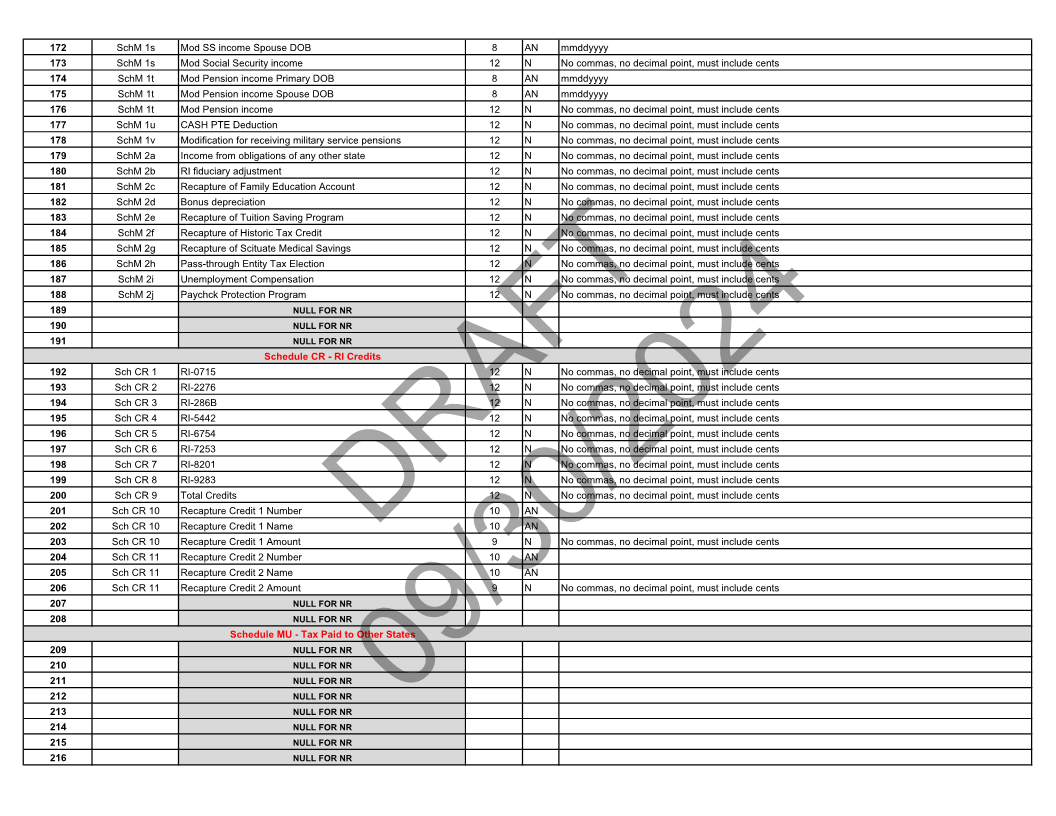

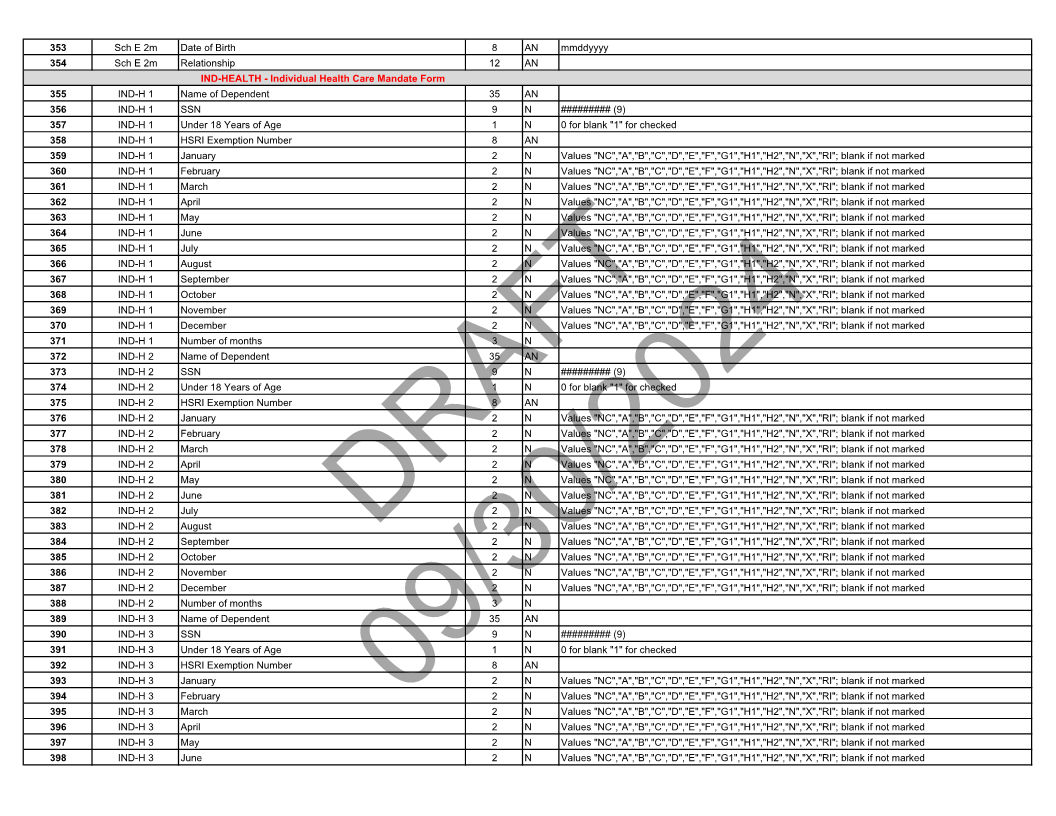

Edit and Instructions value =T1 assigned by NACTP incremented if items included in barcode are changed, default ="0001" 2024 RI1040N ######### ######### number, street, RR, or PO Box left justify "0" for blank "1" for checked "0" for blank "1" for checked "0" for blank "1" for checked "0" for blank "1" for checked "0" for blank "1" for checked "0" for blank "1" for checked Valid letters R, D, L, G, C, I, W, F, P and N "0" for blank "1" for checked "0" for blank "1" for checked "0" for blank "1" for checked "0" for blank "1" for checked "0" for blank "1" for checked No commas, no decimal point, must include cents No commas, no decimal point, must include cents No commas, no decimal point, must include cents No commas, no decimal point, must include cents No commas, no decimal point, must include cents

Type AN N N N AN AN AN AN AN N AN AN AN AN N AN AN AN AN AN N N N N N N A N N N N N N N N N N

2 4 4 4 7 14 1 20 3 9 14 1 20 3 9 35 21 2 9 21 1 1 1 1 1 1 1 1 1 1 1 1 12 12 12 12 12

Max Size

09/30/2024

DRAFT

YES

HEADER SECTION YES

Tax Year 2024 Rhode Island Form RI-1040NR 2D Barcode Layout RI-1040NR INFORMATION

DEMOGRAPHIC INFORMATION

Field Name Code and Header Version Developer Code Software/form version Tax Year Form Type Primary First Name Primary MI Primary last name, no suffix Primary suffix Primary SSN Spouse First Name Spouse MI Spouse Last Name Spouse suffix Spouse SSN Address City or Town State Zip + 4 City or Town of Legal Residence Primary deceased Spouse deceased New address Amended Electoral System Contribution Electoral specific party Electoral Party specified Single Married Joint Married Separate Head of Household Qualifying Widow(er) Federal Adjusted Gross Income Net Modifications RI Standard Deduction Modified Federal AGI Exemption amount

1 2 4 3 6

RI Form Line Ref

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37

Field ID

Barcode size and layout requirements The barcode should be Normal PDF417 style with no more then 13 columns ( 2 for header, 2 for footer and 9 for data).