Enlarge image

1111111111222222222233333333334444444444555555555566666666667777777777888

34567890123456789012345678901234567890123456789012345678901234567890123456789012

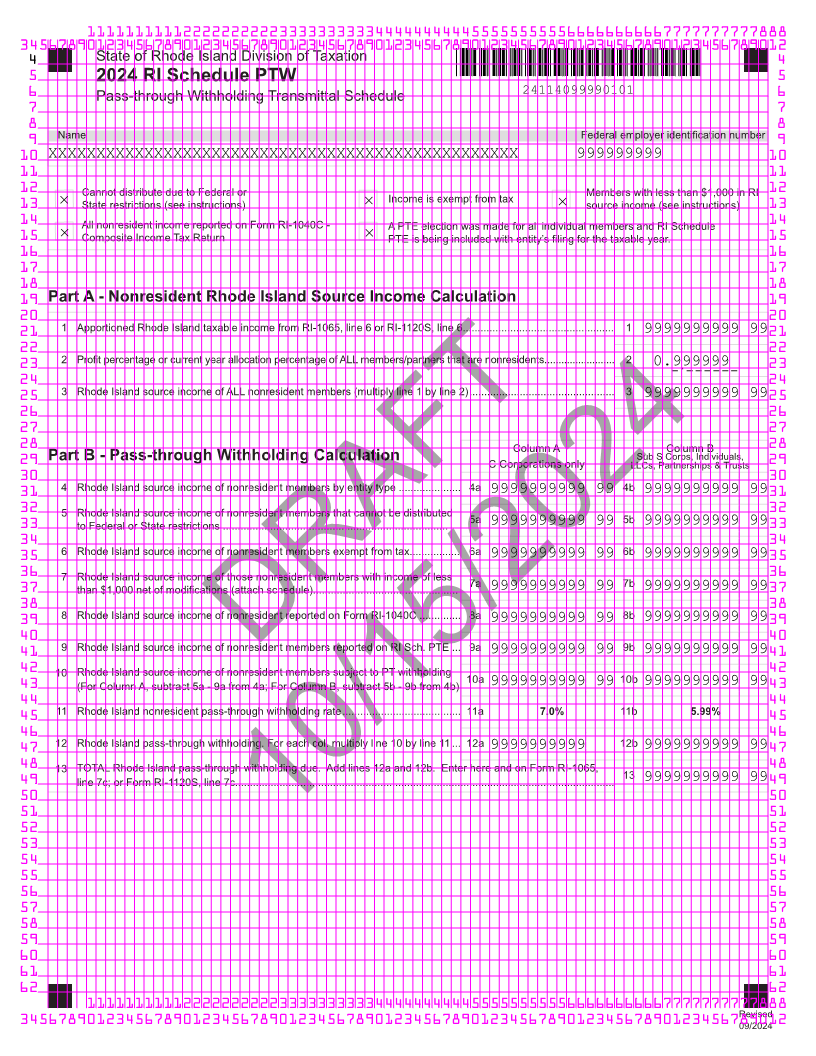

4 State of Rhode Island Division of Taxation 4

5 2024 RI Schedule PTW 5

6 Pass-through Withholding Transmittal Schedule 24114099990101 6

7 7

8 8

9 Name Federal employer identification number 9

10 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 999999999 10

11 11

12 Cannot distribute due to Federal or Income is exempt from tax Members with less than $1,000 in RI 12

13 State restrictions (see instructions) source income (see instructions) 13

14 All nonresident income reported on Form RI-1040C - A PTE election was made for all individual members and RI Schedule 14

15 Composite Income Tax Return PTE is being included with entity’s filing for the taxable year. 15

16 16

17 17

18 18

19 Part A - Nonresident Rhode Island Source Income Calculation 19

20 20

21 1 Apportioned Rhode Island taxable income from RI-1065, line 6 or RI-1120S, line 6................................................... 1 9999999999 99 21

22 22

2 Profit percentage or current year allocation percentage of ALL members/partners that are nonresidents......................... 2

23 0.999999_ . _ _ _ _ _ _ 23

24 24

25 3 Rhode Island source income of ALL nonresident members (multiply line 1 by line 2)................................................. 3 9999999999 99 25

26 26

27 27

28 Column A Column B 28

Part B - Pass-through Withholding Calculation Sub S Corps, Individuals,

29 C Corporations only LLCs, Partnerships & Trusts 29

30 30

31 4 Rhode Island source income of nonresident members by entity type ..................... 4a 9999999999 99 4b 9999999999 99 31

32 5 Rhode Island source income of nonresident members that cannot be distributed 5a 5b 32

33 to Federal or State restrictions ............................................................................ 9999999999 99 9999999999 99 33

34 34

35 6 Rhode Island source income of nonresident members exempt from tax................. 6a 9999999999 99 6b 9999999999 99 35

36 36

than $1,000 net of modifications (attach schedule).................................................

37 7 Rhode Island source income of those nonresident members with income of less 7a 9999999999 99 7b 9999999999 99 37

38 38

39 8 Rhode Island source income of nonresident reported on Form RI-1040C .............. 8a 9999999999 99 8b 9999999999 99 39

40 40

41 9 Rhode Island source income of nonresident members reported on RI Sch. PTE ... 9a 9999999999 99 9b 9999999999 99 41

42 10 DRAFT10a 10b 42

Rhode Island source income of nonresident members subject to PT withholding

43 (For Column A, subtract 5a - 9a from 4a; For Column B, subtract 5b - 9b from 4b) 9999999999 99 9999999999 99 43

44 44

45 11 Rhode Island nonresident pass-through withholding rate........................................ 11a 7.0% 11b 5.99% 45

46 46

47 12 Rhode Island pass-through withholding. For each col. multiply line 10 by line 11 ... 12a 9999999999 12b 9999999999 9947

48 48

line 7c; or Form RI-1120S, line 7c................................................................................................................................

49 13 TOTAL Rhode Island pass-through withholding due. Add lines 12a and 12b. Enter here and on Form RI-1065, 13 9999999999 99 49

50 50

51 51

52 52

10/15/2024

53 53

54 54

55 55

56 56

57 57

58 58

59 59

60 60

61 61

62 62

1111111111222222222233333333334444444444555555555566666666667777777777888

Revised

3456789012345678901234567890123456789012345678901234567890123456789012345678901209/2024