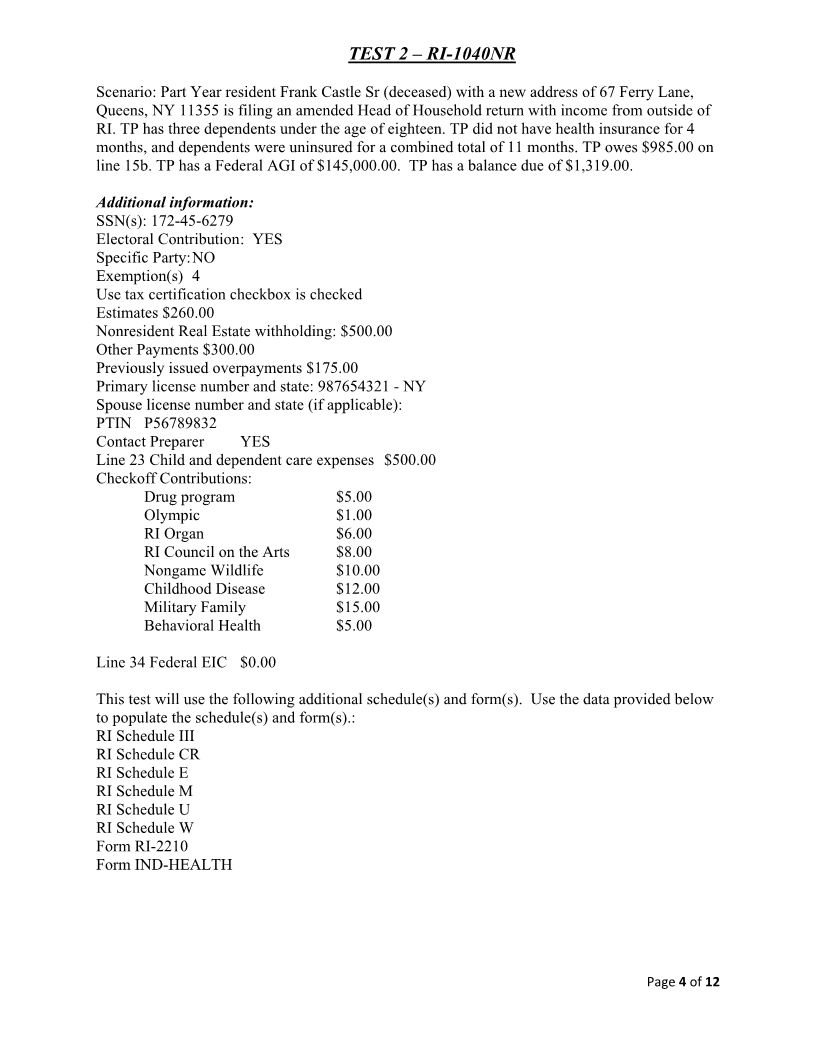

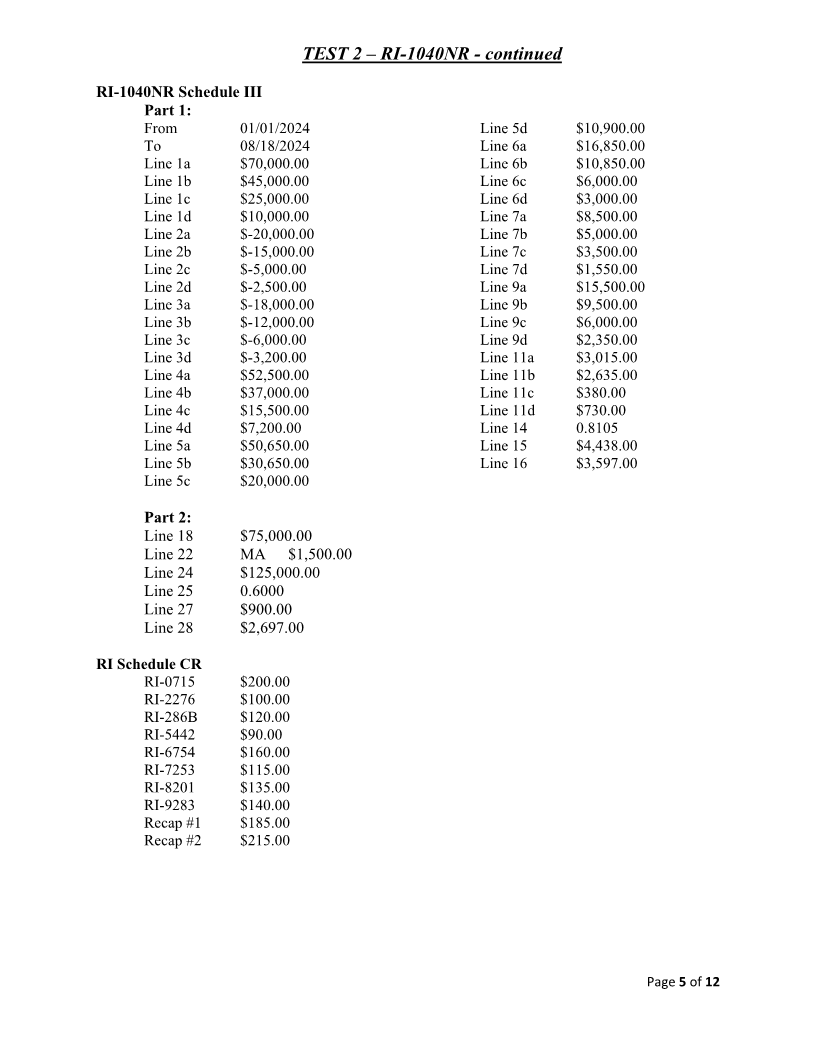

Enlarge image

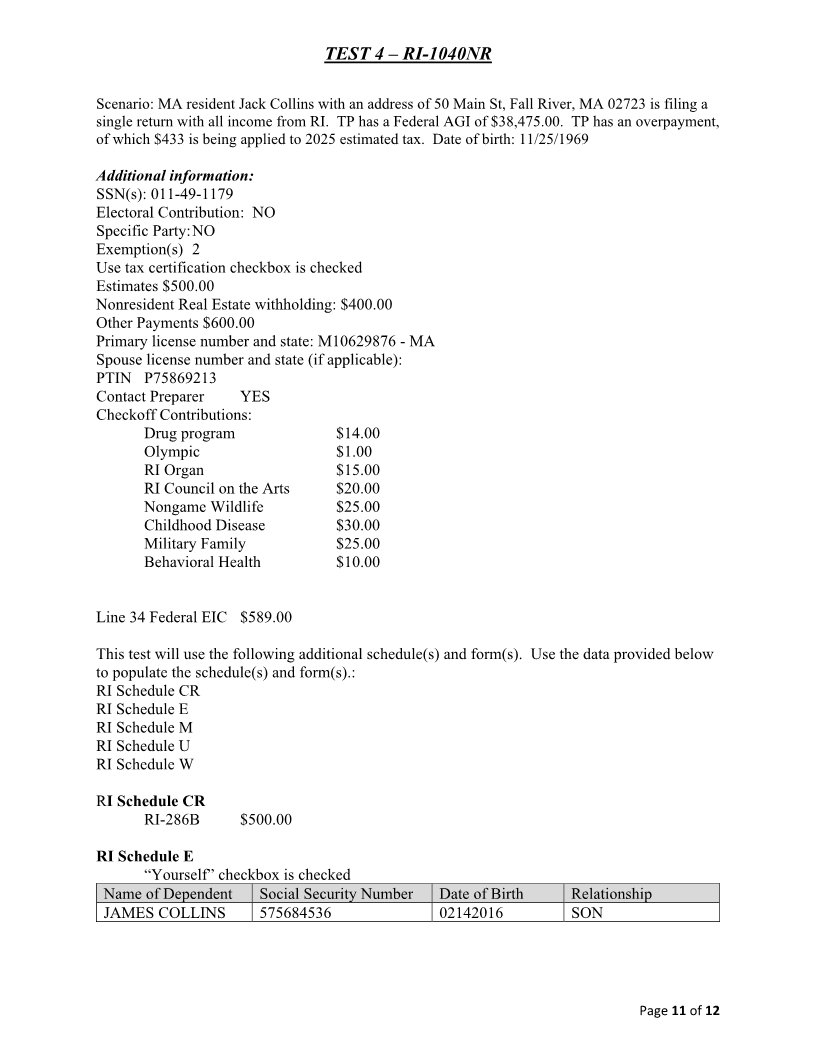

TEST 1 – RI-1040NR

Scenario: NY residents Henry (deceased) and Karen Hill with an address of 22 Broad Street,

New York, NY 10001, are filing an amended Married Filing Jointly return with income from

outside of RI. TPs have a Federal AGI of $195,000.00. TPs have a balance due of $1,882.00.

Additional information:

SSN(s): 311-62-3644 & 272-15-3545

Electoral Contribution : YES

Specific Party: YES R

Exemption(s) 3

Use tax certification checkbox is checked

Estimates $300.00

Nonresident Real Estate withholding: $400.00

Other Payments $380.00

Previously issued overpayments $250.00

Primary license number and state: 098123456 - NY

Spouse license number and state (if applicable): 078901234 - NY

PTIN P44335567

Contact Preparer YES

Line 23 Child and dependent care expenses $400.00

Checkoff Contributions:

Drug program $1.00

Olympic $2.00

RI Organ $3.00

RI Council on the Arts $4.00

Nongame Wildlife $5.00

Childhood Disease $6.00

Military Family $3.00

Behavior Health $4.00

This test will use the following additional schedule(s) and form(s). Use the data provided below

to populate the schedule(s) and form(s).:

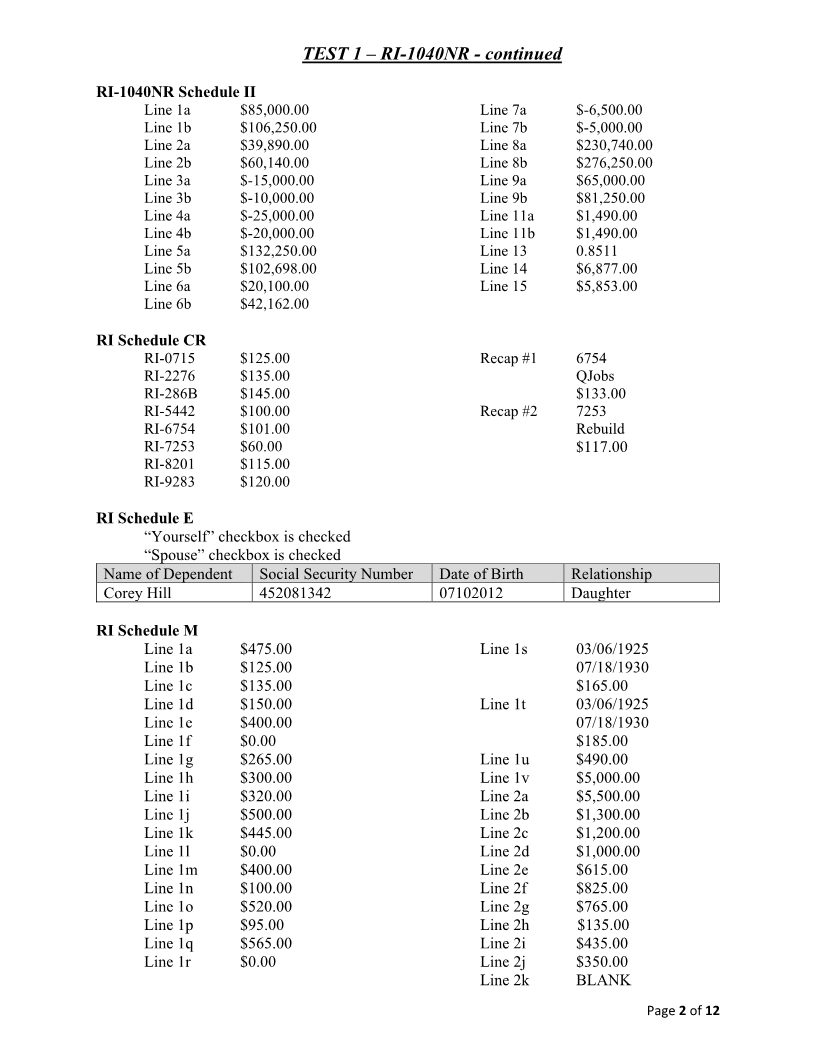

RI Schedule II

RI Schedule CR

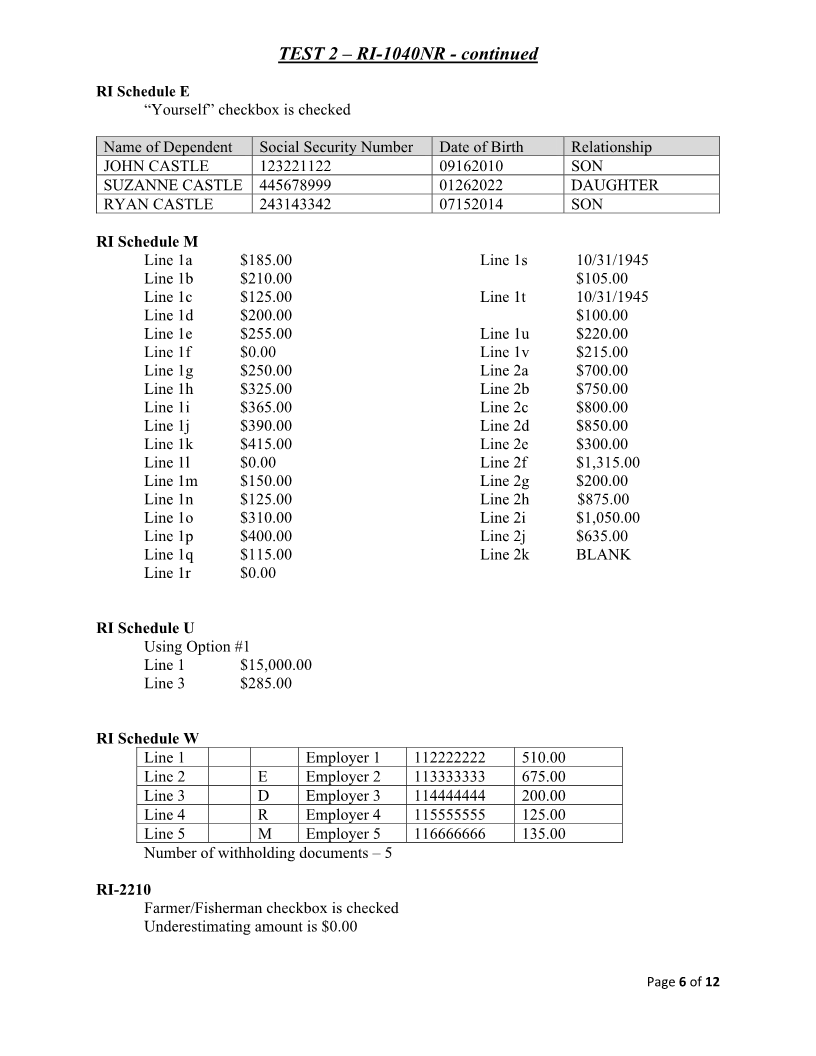

RI Schedule E

RI Schedule M

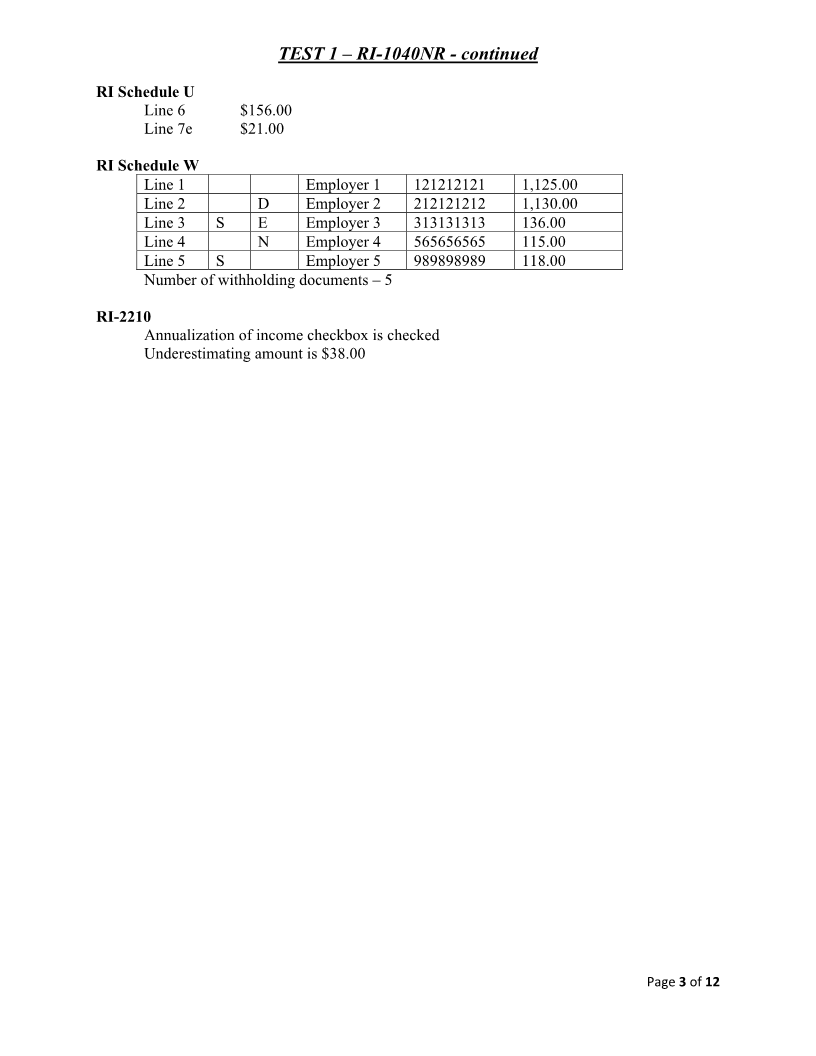

RI Schedule U

RI Schedule W

Form RI-2210

Page of 1 12