Enlarge image

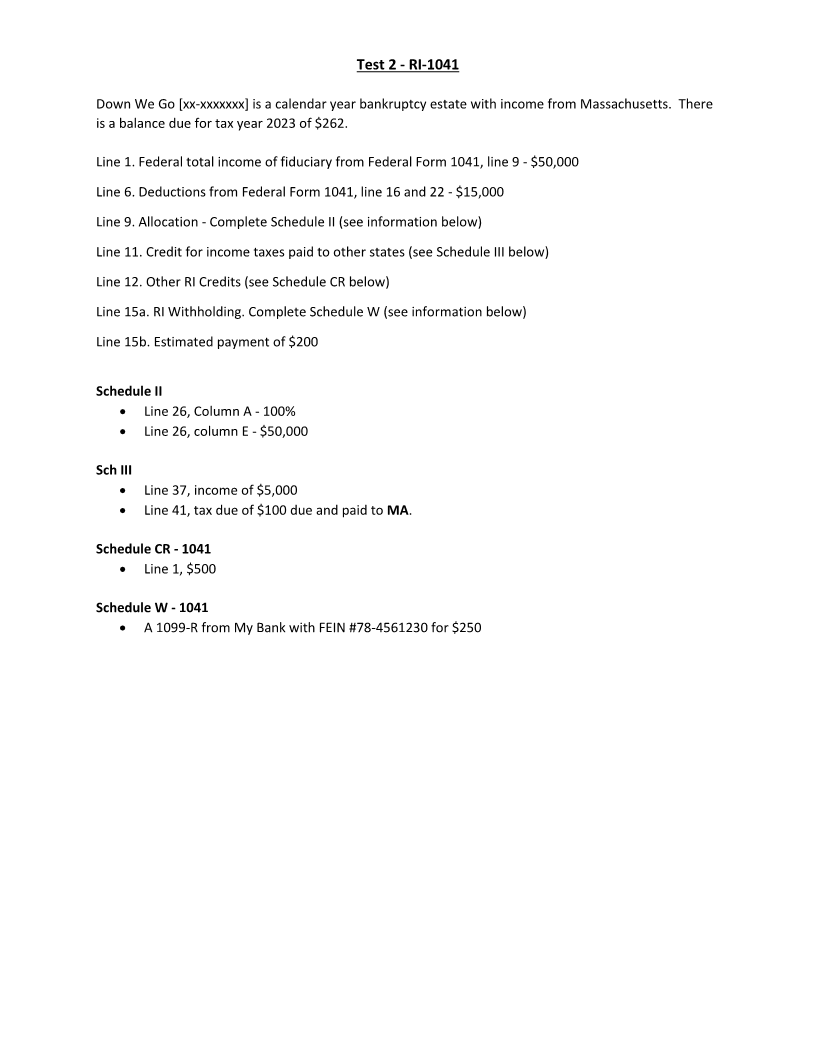

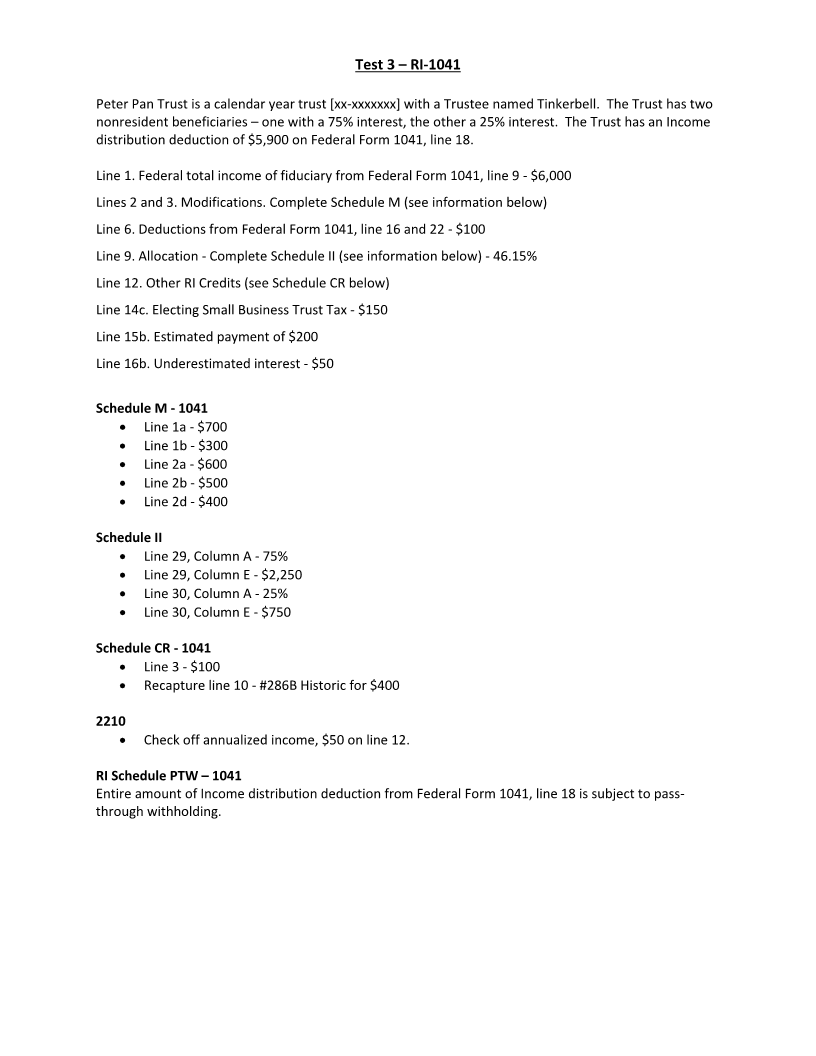

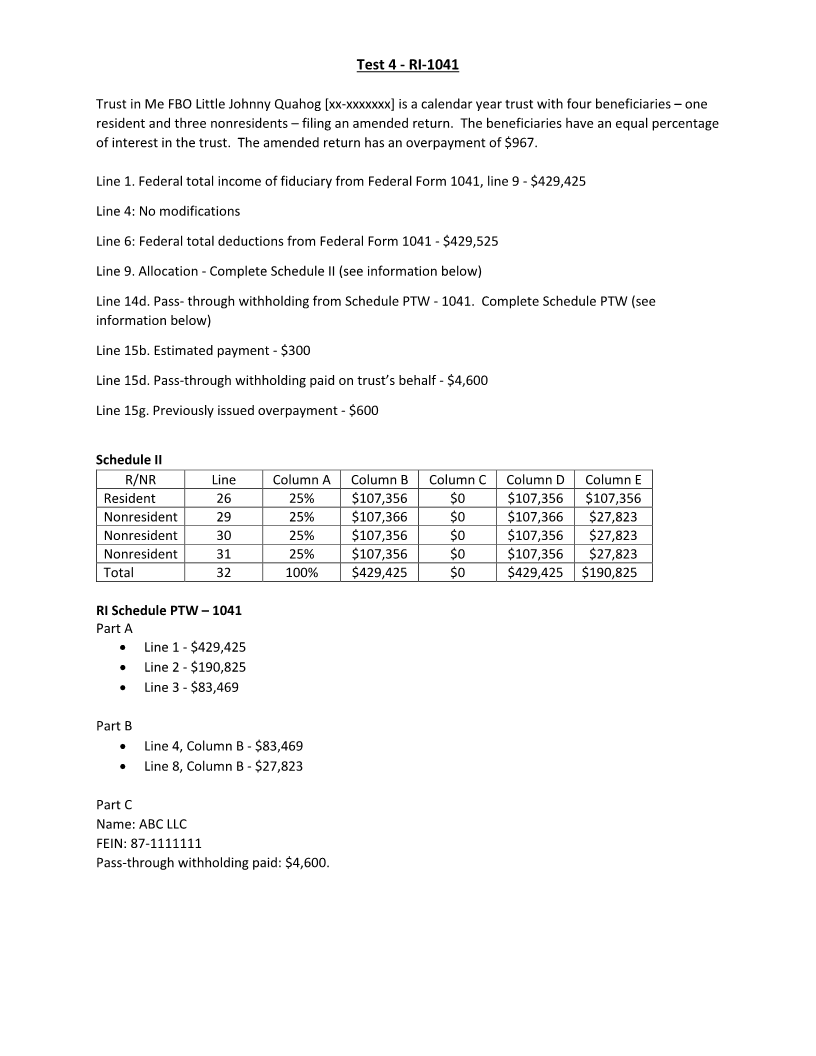

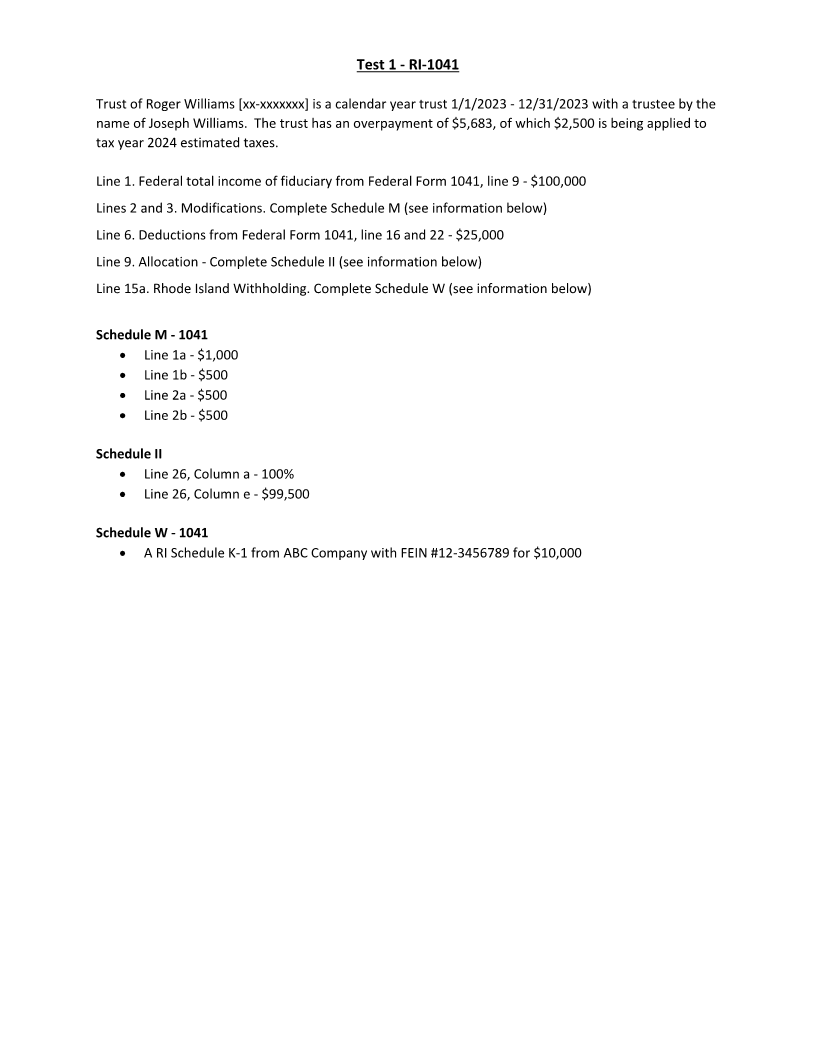

Test 1 - RI-1041

Trust of Roger Williams [xx-xxxxxxx] is a calendar year trust 1/1/2023 - 12/31/2023 with a trustee by the

name of Joseph Williams. The trust has an overpayment of $5,683, of which $2,500 is being applied to

tax year 2024 estimated taxes.

Line 1. Federal total income of fiduciary from Federal Form 1041, line 9 - $100,000

Lines 2 and 3. Modifications. Complete Schedule M (see information below)

Line 6. Deductions from Federal Form 1041, line 16 and 22 - $25,000

Line 9. Allocation - Complete Schedule II (see information below)

Line 15a. Rhode Island Withholding. Complete Schedule W (see information below)

Schedule M - 1041

• Line 1a - $1,000

• Line 1b - $500

• Line 2a - $500

• Line 2b - $500

Schedule II

• Line 26, Column a - 100%

• Line 26, Column e - $99,500

Schedule W - 1041

• A RI Schedule K-1 from ABC Company with FEIN #12-3456789 for $10,000