Enlarge image

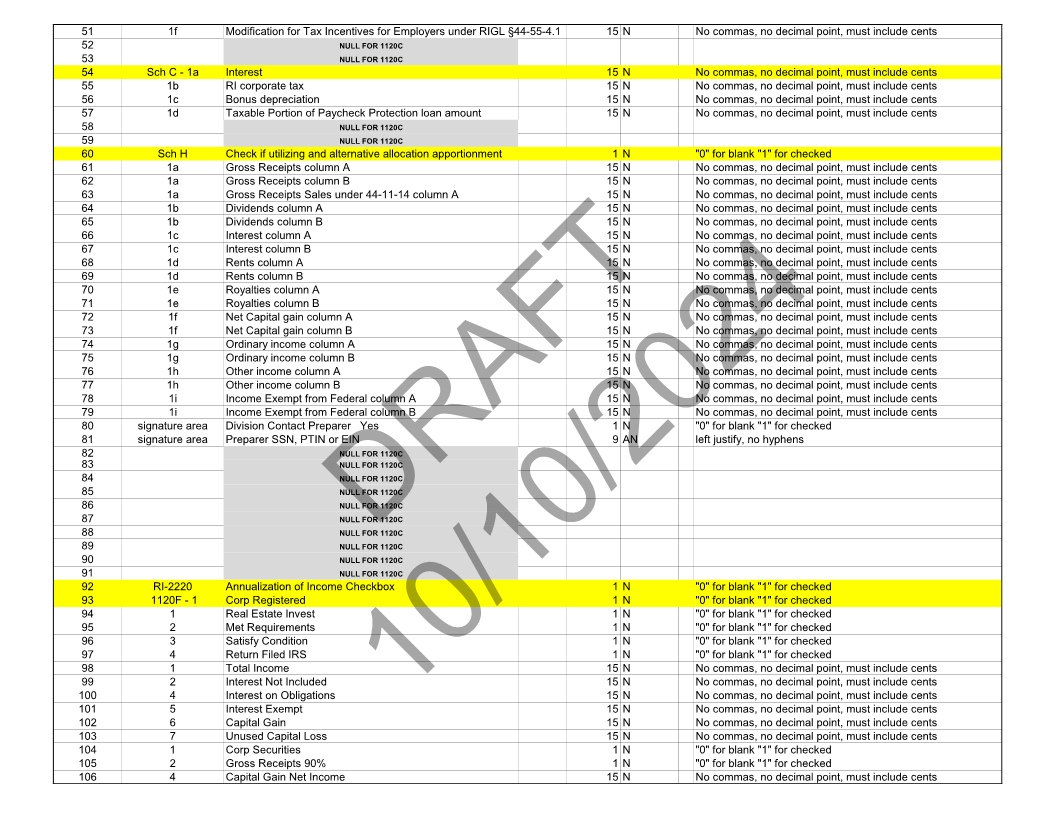

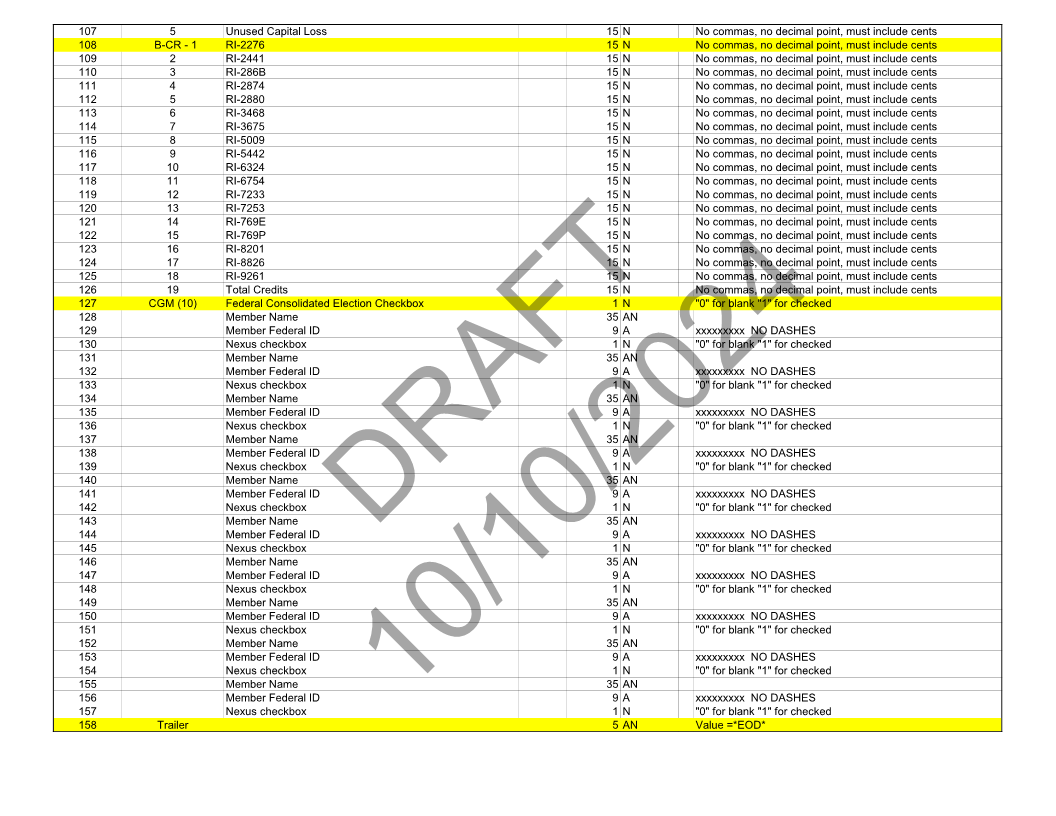

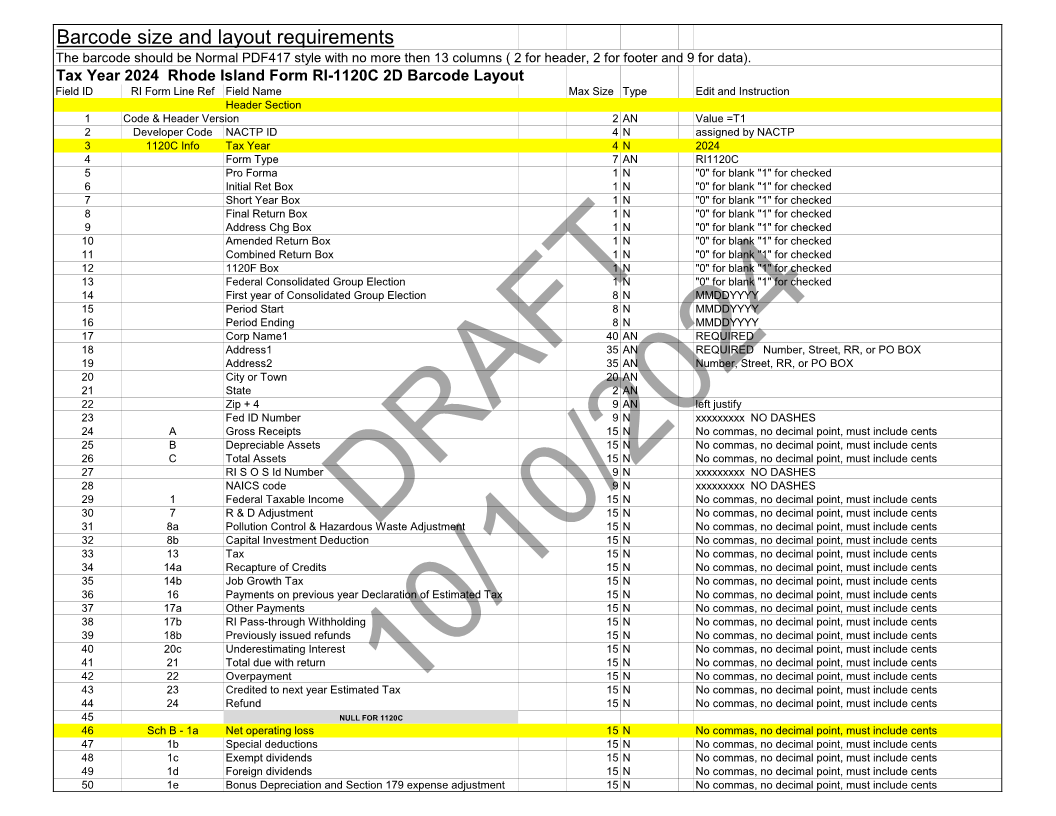

Edit and Instruction Value =T1 assigned by NACTP 2024 RI1120C "0" for blank "1" for checked "0" for blank "1" for checked "0" for blank "1" for checked "0" for blank "1" for checked "0" for blank "1" for checked "0" for blank "1" for checked "0" for blank "1" for checked "0" for blank "1" for checked "0" for blank "1" for checked MMDDYYYY MMDDYYYY MMDDYYYY REQUIRED REQUIRED Number, Street, RR, or PO BOX Number, Street, RR, or PO BOX left justify xxxxxxxxx NO DASHES No commas, no decimal point, must include cents No commas, no decimal point, must include cents No commas, no decimal point, must include cents xxxxxxxxx NO DASHES xxxxxxxxx NO DASHES No commas, no decimal point, must include cents No commas, no decimal point, must include cents No commas, no decimal point, must include cents No commas, no decimal point, must include cents No commas, no decimal point, must include cents No commas, no decimal point, must include cents No commas, no decimal point, must include cents No commas, no decimal point, must include cents No commas, no decimal point, must include cents No commas, no decimal point, must include cents No commas, no decimal point, must include cents No commas, no decimal point, must include cents No commas, no decimal point, must include cents No commas, no decimal point, must include cents No commas, no decimal point, must include cents No commas, no decimal point, must include cents No commas, no decimal point, must include cents No commas, no decimal point, must include cents No commas, no decimal point, must include cents No commas, no decimal point, must include cents No commas, no decimal point, must include cents Type AN N N AN N N N N N N N N N N N N AN AN AN AN AN N N N N N N N N N N N N N N N N N N N N N N N N N N N 2 4 4 7 1 1 1 1 1 1 1 1 1 8 8 8 40 35 35 20 2AN 9 9 15 15 15 9 9 15 15 15 15 15 15 15 15 15 15 15 15 15 15 15 15 15 15 15 15 15 Max Size 10/10/2024 DRAFT NULL FOR 1120C Field Name Header Section NACTP ID Tax Year Form Type Pro Forma Initial Ret Box Short Year Box Final Return Box Address Chg Box Amended Return Box Combined Return Box 1120F Box Federal Consolidated Group Election First year of Consolidated Group Election Period Start Period Ending Corp Name1 Address1 Address2 City or Town State Zip + 4 Fed ID Number Gross Receipts Depreciable Assets Total Assets RI S O S Id Number NAICS code Federal Taxable Income R & D Adjustment Pollution Control & Hazardous Waste Adjustment Capital Investment Deduction Tax Recapture of Credits Job Growth Tax Payments on previous year Declaration of Estimated Tax Other Payments RI Pass-through Withholding Previously issued refunds Underestimating Interest Total due with return Overpayment Credited to next year Estimated Tax Refund Net operating loss Special deductions Exempt dividends Foreign dividends Bonus Depreciation and Section 179 expense adjustment A B C 1 7 8a 8b 13 14a 14b 16 17a 17b 18b 20c 21 22 23 24 1b 1c 1d 1e 1120C Info Sch B - 1a RI Form Line Ref Developer Code Code & Header Version 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 Barcode size and layout requirements The barcode should be Normal PDF417 style with no more then 13 columns ( 2 for header, 2 for footer and 9 for data). Tax Year 2024 Rhode Island Form RI-1120C 2D Barcode Layout Field ID