Enlarge image

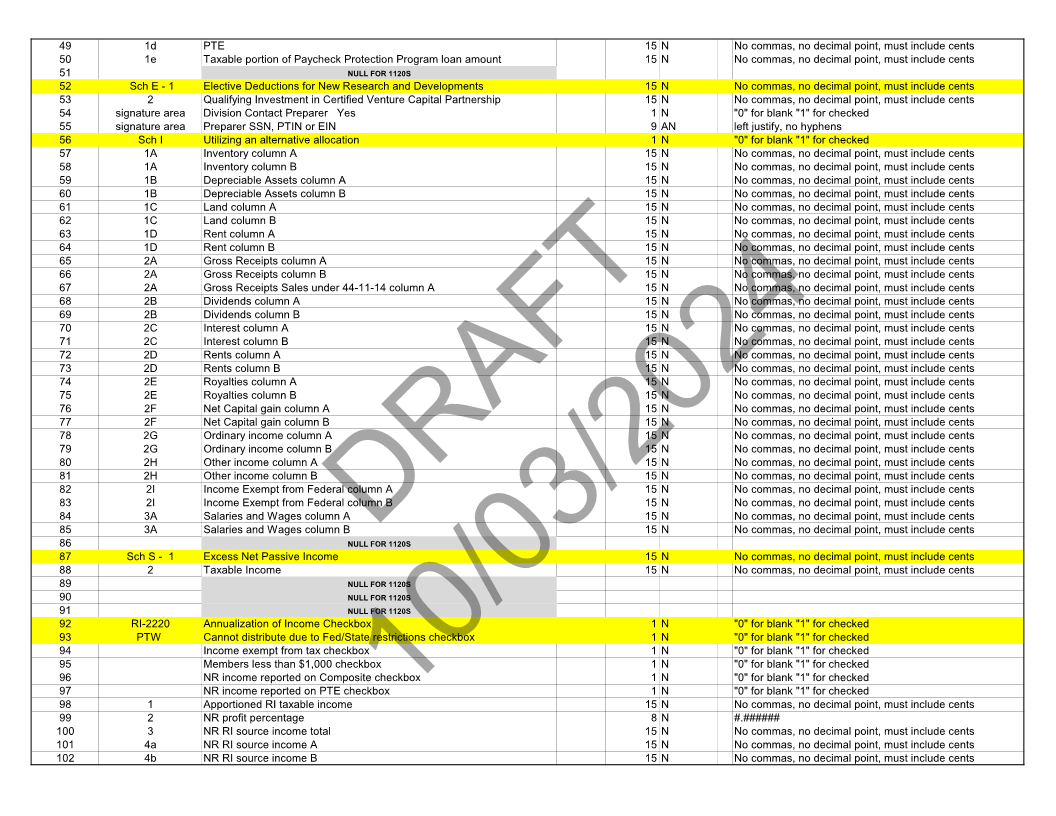

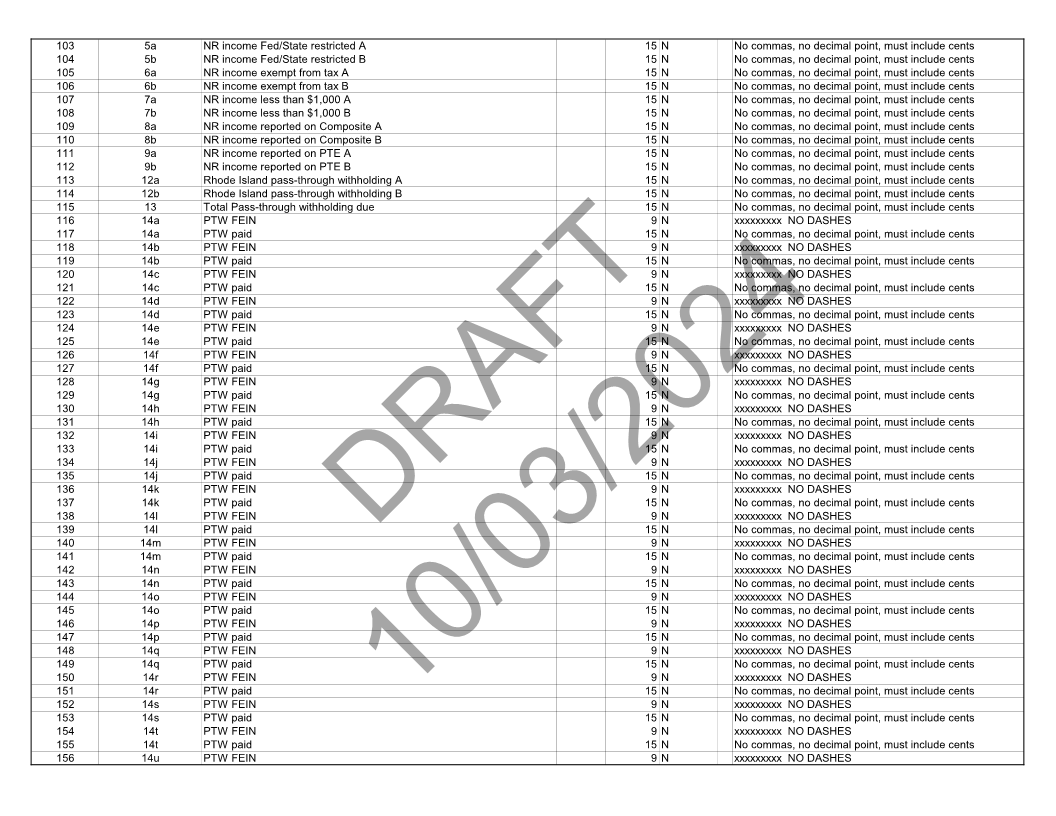

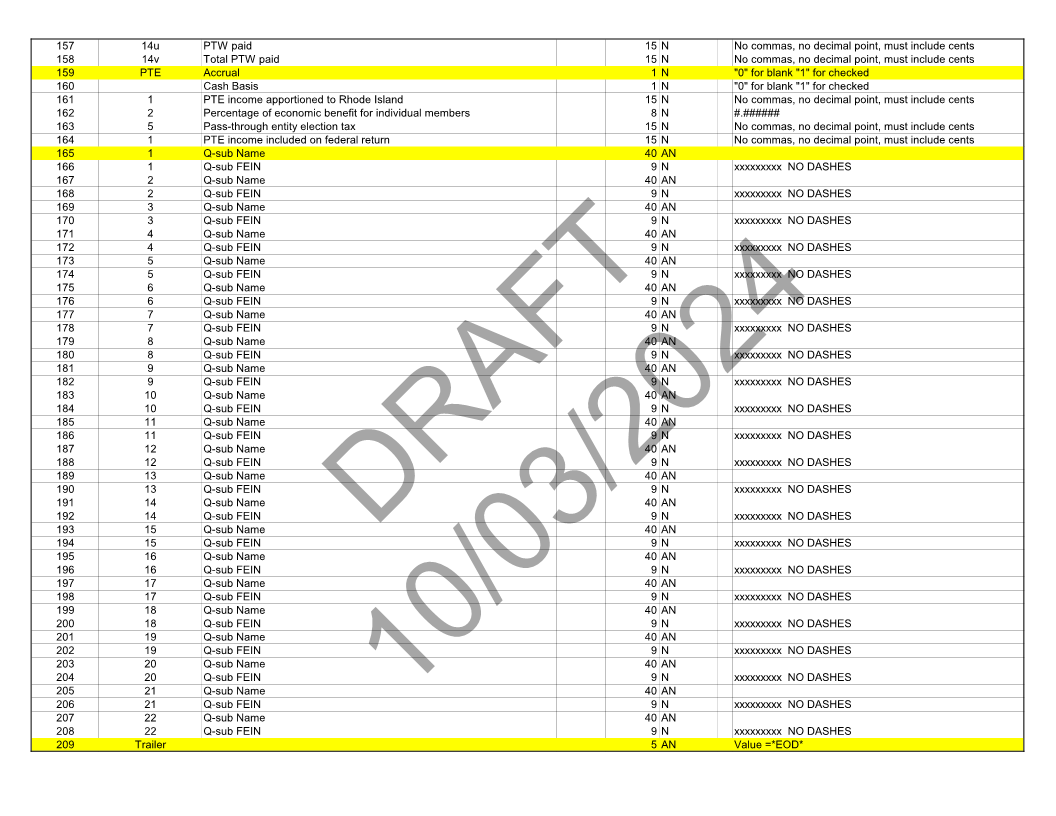

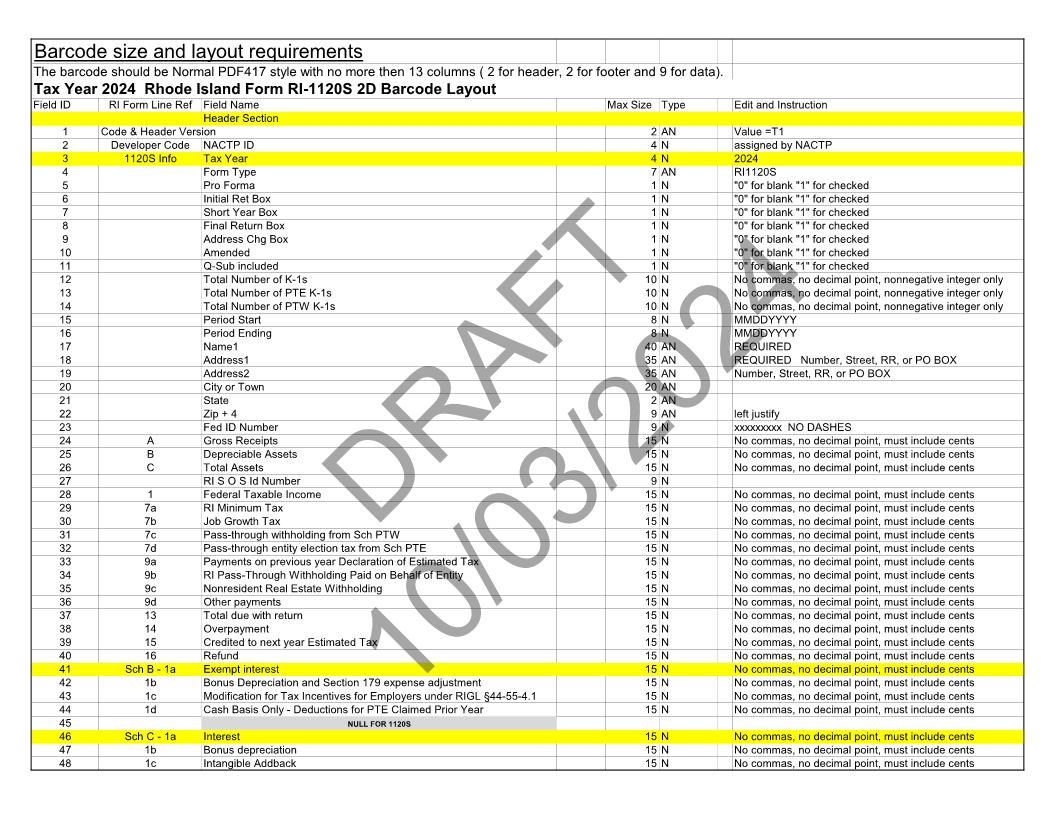

Edit and Instruction Value =T1 assigned by NACTP 2024 RI1120S "0" for blank "1" for checked "0" for blank "1" for checked "0" for blank "1" for checked "0" for blank "1" for checked "0" for blank "1" for checked "0" for blank "1" for checked "0" for blank "1" for checked No commas, no decimal point, nonnegative integer only No commas, no decimal point, nonnegative integer only No commas, no decimal point, nonnegative integer only MMDDYYYY MMDDYYYY REQUIRED REQUIRED Number, Street, RR, or PO BOX Number, Street, RR, or PO BOX left justify xxxxxxxxx NO DASHES No commas, no decimal point, must include cents No commas, no decimal point, must include cents No commas, no decimal point, must include cents No commas, no decimal point, must include cents No commas, no decimal point, must include cents No commas, no decimal point, must include cents No commas, no decimal point, must include cents No commas, no decimal point, must include cents No commas, no decimal point, must include cents No commas, no decimal point, must include cents No commas, no decimal point, must include cents No commas, no decimal point, must include cents No commas, no decimal point, must include cents No commas, no decimal point, must include cents No commas, no decimal point, must include cents No commas, no decimal point, must include cents No commas, no decimal point, must include cents No commas, no decimal point, must include cents No commas, no decimal point, must include cents No commas, no decimal point, must include cents No commas, no decimal point, must include cents No commas, no decimal point, must include cents No commas, no decimal point, must include cents

Type AN N N AN N N N N N N N N N N N N AN AN AN AN AN N N N N N N N N N N N N N N N N N N N N N N N N

2 4 4 7 1 1 1 1 1 1 1 10 10 10 8 8 40 35 35 20 2AN 9 9 15 15 15 9N 15 15 15 15 15 15 15 15 15 15 15 15 15 15 15 15 15 15 15 15

Max Size

10/03/2024

DRAFT

NULL FOR 1120S

a

orm

ro F

Field Name Header Section NACTP ID Tax Year Form Type P Initial Ret Box Short Year Box Final Return Box Address Chg Box Amended Q-Sub included Total Number of K-1s Total Number of PTE K-1s Total Number of PTW K-1s Period Start Period Ending Name1 Address1 Address2 City or Town State Zip + 4 Fed ID Number Gross Receipts Depreciable Assets Total Assets RI S O S Id Number Federal Taxable Income RI Minimum Tax Job Growth Tax Pass-through withholding from Sch PTW Pass-through entity election tax from Sch PTE Payments on previous year Declaration of Estimated Tax RI Pass-Through Withholding Paid on Behalf of Entity Nonresident Real Estate Withholding Other payments Total due with return Overpayment Credited to next year Estimated Tax Refund Exempt interest Bonus Depreciation and Section 179 expense adjustment Modification for Tax Incentives for Employers under RIGL §44-55-4.1 Cash Basis Only - Deductions for PTE Claimed Prior Year Interest Bonus depreciation Intangible Addback

A B C 1 7a 7b 7c 7d 9a 9b 9c 9d 13 14 15 16 1b 1c 1d 1b 1c

1120S Info Sch B - 1a Sch C - 1a

RI Form Line Ref Developer Code

Code & Header Version

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48

Barcode size and layout requirements The barcode should be Normal PDF417 style with no more then 13 columns ( 2 for header, 2 for footer and 9 for data). Tax Year 2024 Rhode Island Form RI-1120S 2D Barcode Layout Field ID