Enlarge image

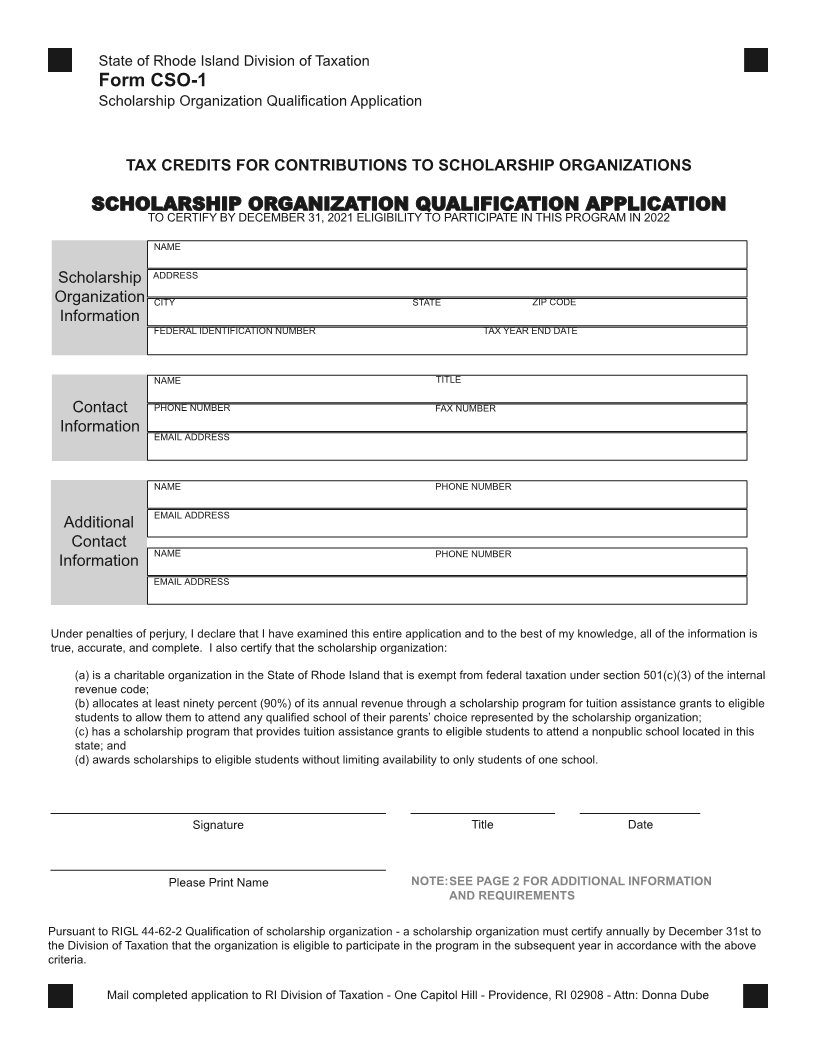

State of Rhode Island Division of Taxation

Form CSO-1

Scholarship Organization Qualification Application

TAX CREDITS FOR CONTRIBUTIONS TO SCHOLARSHIP ORGANIZATIONS

SCHOLARSHIP ORGANIZATION QUALIFICATION APPLICATION

TO CERTIFY BY DECEMBER 31, 2021 ELIGIBILITY TO PARTICIPATE IN THIS PROGRAM IN 2022

NAME

Scholarship ADDRESS

Organization CITY STATE ZIP CODE

Information

FEDERAL IDENTIFICATION NUMBER TAX YEAR END DATE

NAME TITLE

Contact PHONE NUMBER FAX NUMBER

Information

EMAIL ADDRESS

NAME PHONE NUMBER

EMAIL ADDRESS

Additional

Contact

NAME PHONE NUMBER

Information

EMAIL ADDRESS

Under penalties of perjury, I declare that I have examined this entire application and to the best of my knowledge, all of the information is

true, accurate, and complete. I also certify that the scholarship organization:

(a) is a charitable organization in the State of Rhode Island that is exempt from federal taxation under section 501(c)(3) of the internal

revenue code;

(b) allocates at least ninety percent (90%) of its annual revenue through a scholarship program for tuition assistance grants to eligible

students to allow them to attend any qualified school of their parents’ choice represented by the scholarship organization;

(c) has a scholarship program that provides tuition assistance grants to eligible students to attend a nonpublic school located in this

state; and

(d) awards scholarships to eligible students without limiting availability to only students of one school.

Signature Title Date

Please Print Name NOTE:SEE PAGE 2 FOR ADDITIONAL INFORMATION

AND REQUIREMENTS

Pursuant to RIGL 44-62-2 Qualification of scholarship organization - a scholarship organization must certify annually by December 31st to

the Division of Taxation that the organization is eligible to participate in the program in the subsequent year in accordance with the above

criteria.

Mail completed application to RI Division of Taxation - One Capitol Hill - Providence, RI 02908 - Attn: Donna Dube