Enlarge image

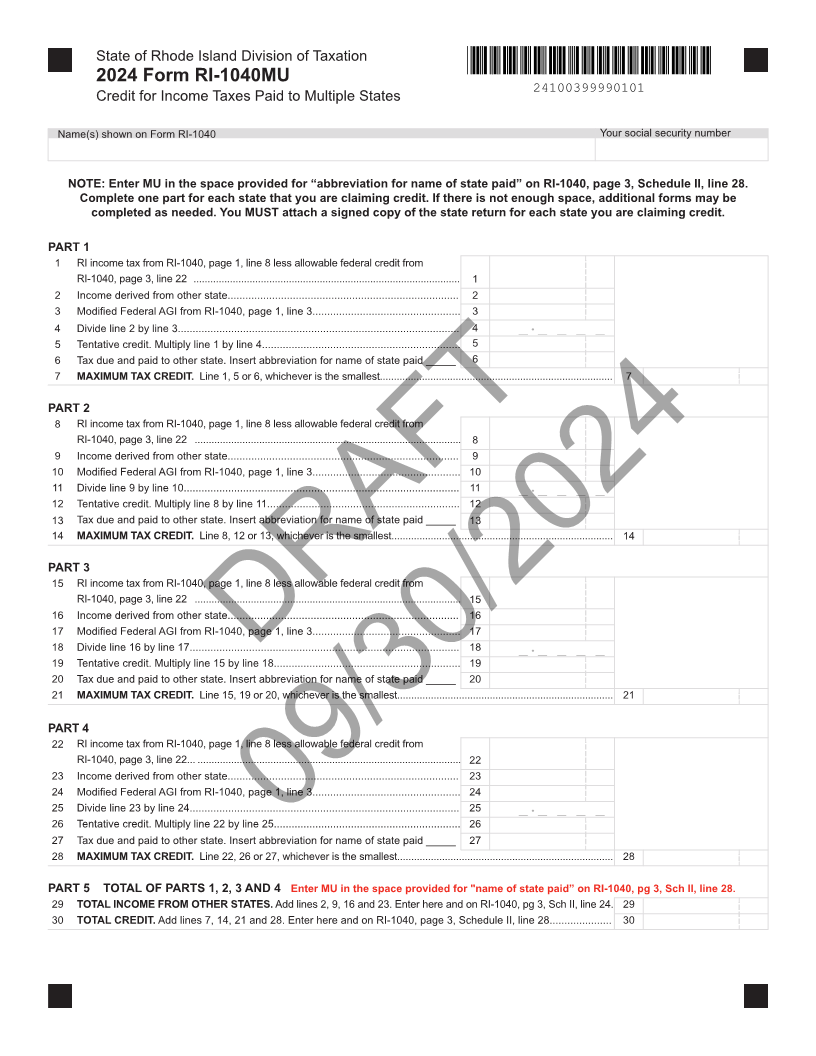

State of Rhode Island Division of Taxation

2024 Form RI-1040MU

Credit for Income Taxes Paid to Multiple States 24100399990101

Name(s) shown on Form RI-1040 Your social security number

NOTE: Enter MU in the space provided for “abbreviation for name of state paid” on RI-1040, page 3, Schedule II, line 28.

Complete one part for each state that you are claiming credit. If there is not enough space, additional forms may be

completed as needed. You MUST attach a signed copy of the state return for each state you are claiming credit.

PART 1

1 RI income tax from RI-1040, page 1, line 8 less allowable federal credit from

RI-1040, page 3, line 22 ............................................................................................... 1

2 Income derived from other state.............................................................................. 2

3 Modified Federal AGI from RI-1040, page 1, line 3.................................................. 3

4 Divide line 2 by line 3............................................................................................... 4 _._ _ _ _

5 Tentative credit. Multiply line 1 by line 4................................................................... 5

6 Tax due and paid to other state. Insert abbreviation for name of state paid _____ 6

7 MAXIMUM TAX CREDIT. Line 1, 5 or 6, whichever is the smallest................................................................................... 7

PART 2

8 RI income tax from RI-1040, page 1, line 8 less allowable federal credit from

RI-1040, page 3, line 22 ............................................................................................... 8

9 Income derived from other state.............................................................................. 9

10 Modified Federal AGI from RI-1040, page 1, line 3.................................................. 10

11 Divide line 9 by line 10............................................................................................. 11 _._ _ _ _

12 Tentative credit. Multiply line 8 by line 11................................................................. 12

13 Tax due and paid to other state. Insert abbreviation for name of state paid _____ 13

14 MAXIMUM TAX CREDIT. Line 8, 12 or 13, whichever is the smallest............................................................................... 14

PART 3

15 RI income tax from RI-1040, page 1, line 8 less allowable federal credit from

RI-1040, page 3, line 22 ............................................................................................... 15

16 Income derived from other state.............................................................................. 16

17 Modified Federal AGI from RI-1040, page 1, line 3.................................................. 17

18 Divide line 16 by line 17........................................................................................... 18

_._ _ _ _

19 Tentative credit. Multiply line 15 by line 18............................................................... 19

DRAFT

20 Tax due and paid to other state. Insert abbreviation for name of state paid _____ 20

21 MAXIMUM TAX CREDIT. Line 15, 19 or 20, whichever is the smallest............................................................................. 21

PART 4

22 RI income tax from RI-1040, page 1, line 8 less allowable federal credit from

RI-1040, page 3, line 22... .............................................................................................. 22

23 Income derived from other state.............................................................................. 23

24 Modified Federal AGI from RI-1040, page 1, line 3.................................................. 24

25 Divide line 23 by line 24........................................................................................... 25 _._ _ _ _

26 Tentative credit. Multiply line 22 by line 25............................................................... 26

27 Tax due and paid to other state. Insert abbreviation09/30/2024for name of state paid _____