Enlarge image

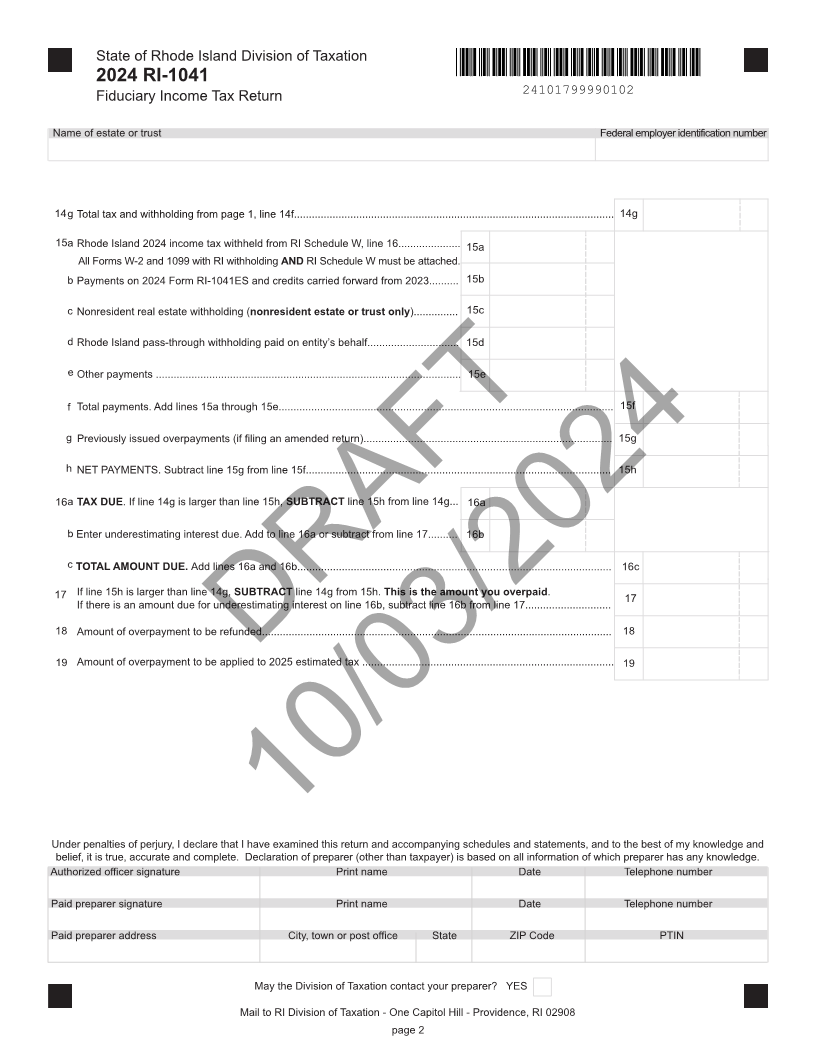

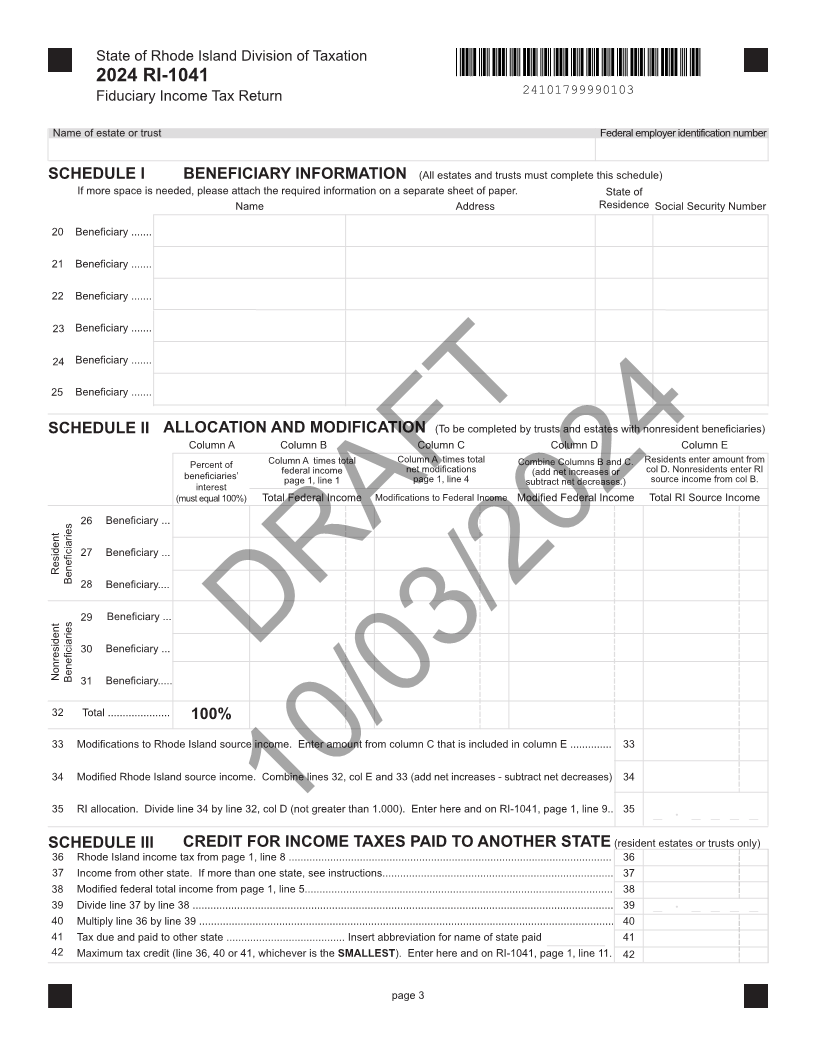

State of Rhode Island Division of Taxation

2024 RI-1041

Fiduciary Income Tax Return 24101799990101

You must check a Name of estate or trust Federal employer identification number

box:

Estates and Name and title of fiduciary

Trusts

Bankruptcy Address 1

Estate

Amended

Return Address 2

City, town or post office State ZIP code E-mail address

Year End Calendar Year: 01/01/2024 through 12/31/2024 Fiscal Year: beginning MM/DD/2024 through MM/DD/2025

Income

1 Federal total income of fiduciary from Federal Form 1041, line 9............................................................................... 1

2 Modifications increasing federal total income from Schedule M, line 2l................... 2

3 Modifications decreasing federal total income from Schedule M, line 1w................ 3

4 Net modifications. Combine lines 2 and 3 ................................................................................................................. 4

5 Modified federal total income. Combine lines 1 and 4 (add net increases or subtract net decreases) ...................... 5

6 Federal total deductions from Federal Form 1041, lines 16 and 22 (see instructions) ............................................ 6

7 RI taxable income. Subtract line 6 from line 5 ........................................................................................................... 7

8 Rhode Island income tax from RI-1041 Tax Computation Worksheet ........................................................................ 8

9 Allocation. Enter amount from page 3, line 35 (resident estate or trusts enter 1.0000) ......................................... 9 _ . _ _ _ _

10 Rhode Island income tax after allocation. Multiply line 8 by line 9........................................................................... 10

DRAFT

11 Credit for income taxes paid to other states from page 3, line(resident42 ). only............ 11

12 Other Rhode Island credits from RI Schedule CR, line 9 ........................................ 12

13 Total Rhode Island credits. Add lines 11 and 12 ......................................................................................................... 13

14 a Rhode Island income tax after Rhode Island credits. Subtract line 13 from line 10 (not less than zero) ................. 14a

b Recapture of Prior Year Other Rhode Island Credits from RI Schedule CR, line 12................................................... 14b

10/03/2024

c Electing Small Business Trust Tax (see instructions)................................................................................................ 14c

d RI Pass-Through Withholding from RI Schedule PTW - 1041, line 13........................................................................ 14d

e RI Pass-through Entity Election Tax from RI Schedule PTE, line 5................................................................................ 14e

f TOTAL RHODE ISLAND TAX AND WITHHOLDING. Add lines 14a through 14e...................................................... 14f

Revised

08/2024