Enlarge image

1111111111222222222233333333334444444444555555555566666666667777777777888

34567890123456789012345678901234567890123456789012345678901234567890123456789012

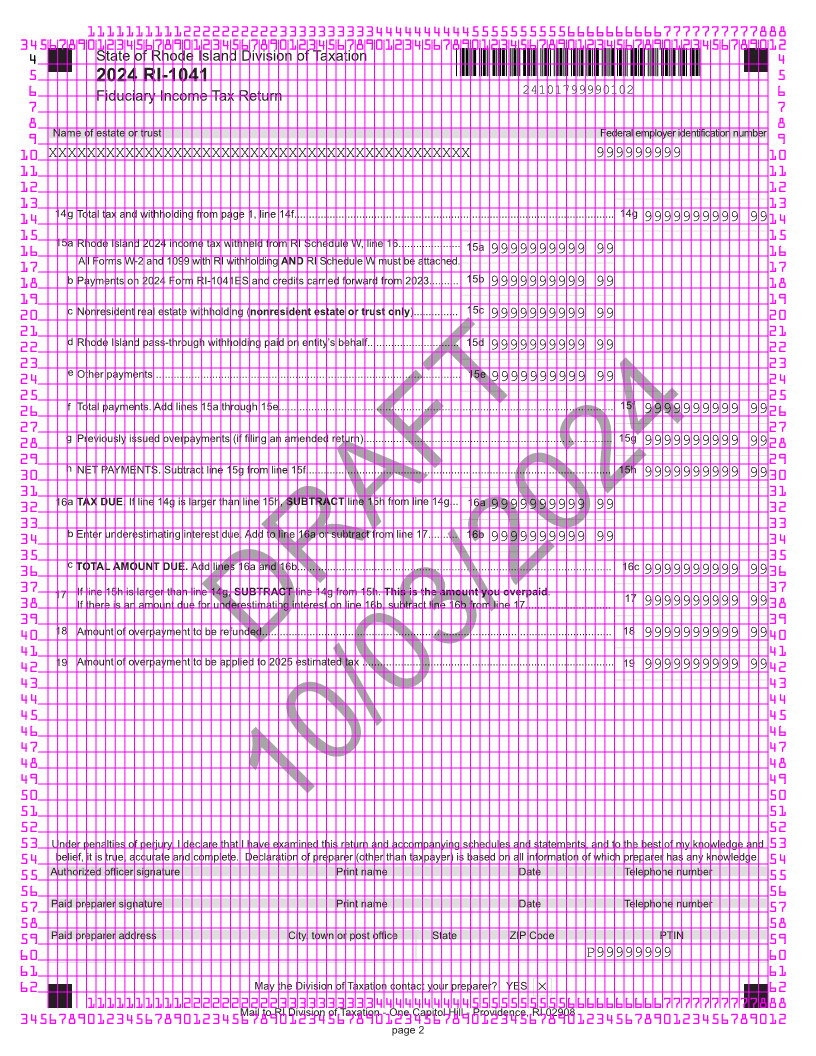

4 State of Rhode Island Division of Taxation 4

5 2024 RI-1041 5

6 Fiduciary Income Tax Return 24101799990101 6

7 7

8 8

9 You must check a Name of estate or trust Federal employer identification number 9

box:

10 Estates and XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXName and title of fiduciary 999999999 10

11 Trusts 11

12 Bankruptcy XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXAddress 1 12

13 Estate 13

14 Amended XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 14

15 Return Address 2 15

16 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 16

17 City, town or post office State ZIP code E-mail address 17

18 XXXXXXXXXXXXXXXXXXXXXXXX XX 99999 XXXXXXXXXXXXXXXXXXXXXXXX 18

19 19

20 Year End Calendar Year: 01/01/2024 through 12/31/2024 Fiscal Year: beginning 07/01MM/DD/2024 through 06/30MM/DD/2025 20

21 21

Income

22 22

23 23

1 Federal total income of fiduciary from Federal Form 1041, line 9............................................................................... 1

24 9999999999 99 24

25 25

26 2 Modifications increasing federal total income from Schedule M, line 2l................... 2 9999999999 99 26

27 27

3 Modifications decreasing federal total income from Schedule M, line 1w................ 3

28 9999999999 99 28

29 29

4 Net modifications. Combine lines 2 and 3 ................................................................................................................. 4

30 30

9999999999 99

31 31

5 Modified federal total income. Combine lines 1 and 4 (add net increases or subtract net decreases) ...................... 5

32 9999999999 99 32

33 33

34 6 Federal total deductions from Federal Form 1041, lines 16 and 22 (see instructions) ............................................ 6 9999999999 99 34

35 35

36 7 RI taxable income. Subtract line 6 from line 5 ........................................................................................................... 7 9999999999 99 36

37 37

8 Rhode Island income tax from RI-1041 Tax Computation Worksheet ........................................................................ 8

38 9999999999 99 38

39 39

40 9 Allocation. Enter amount from page 3, line 35 (resident estate or trusts enter 1.0000) ......................................... 9 _ . _ _ _ _0.999940

41 41

10 Rhode Island income tax after allocation. Multiply line 8 by line 9........................................................................... 10

42 DRAFT 9999999999 99 42

43 43

44 11 Credit for income taxes paid to other states from page 3, line(resident42 ). only............ 11 999999999999 44

45 45

12 Other Rhode Island credits from RI Schedule CR, line 9 ........................................ 12

46 9999999999 99 46

47 47

48 13 Total Rhode Island credits. Add lines 11 and 12 ......................................................................................................... 13 9999999999 99 48

49 49

50 14 a Rhode Island income tax after Rhode Island credits. Subtract line 13 from line 10 (not less than zero) ................. 14a 9999999999 99 50

51 51

52 b Recapture of Prior Year Other Rhode Island Credits from RI Schedule CR, line 12................................................... 14b 9999999999 99 52

10/03/2024

53 53

54 c Electing Small Business Trust Tax (see instructions)................................................................................................ 14c 9999999999 99 54

55 55

56 d RI Pass-Through Withholding from RI Schedule PTW - 1041, line 13........................................................................ 14d 9999999999 99 56

57 57

58 e RI Pass-through Entity Election Tax from RI Schedule PTE, line 5................................................................................ 14e 9999999999 99 58

59 59

60 f TOTAL RHODE ISLAND TAX AND WITHHOLDING. Add lines 14a through 14e...................................................... 14f 9999999999 99 60

61 61

62 62

1111111111222222222233333333334444444444555555555566666666667777777777888

34567890123456789012345678901234567890123456789012345678901234567890123456789012Revised

08/2024