Enlarge image

1111111111222222222233333333334444444444555555555566666666667777777777888

34567890123456789012345678901234567890123456789012345678901234567890123456789012

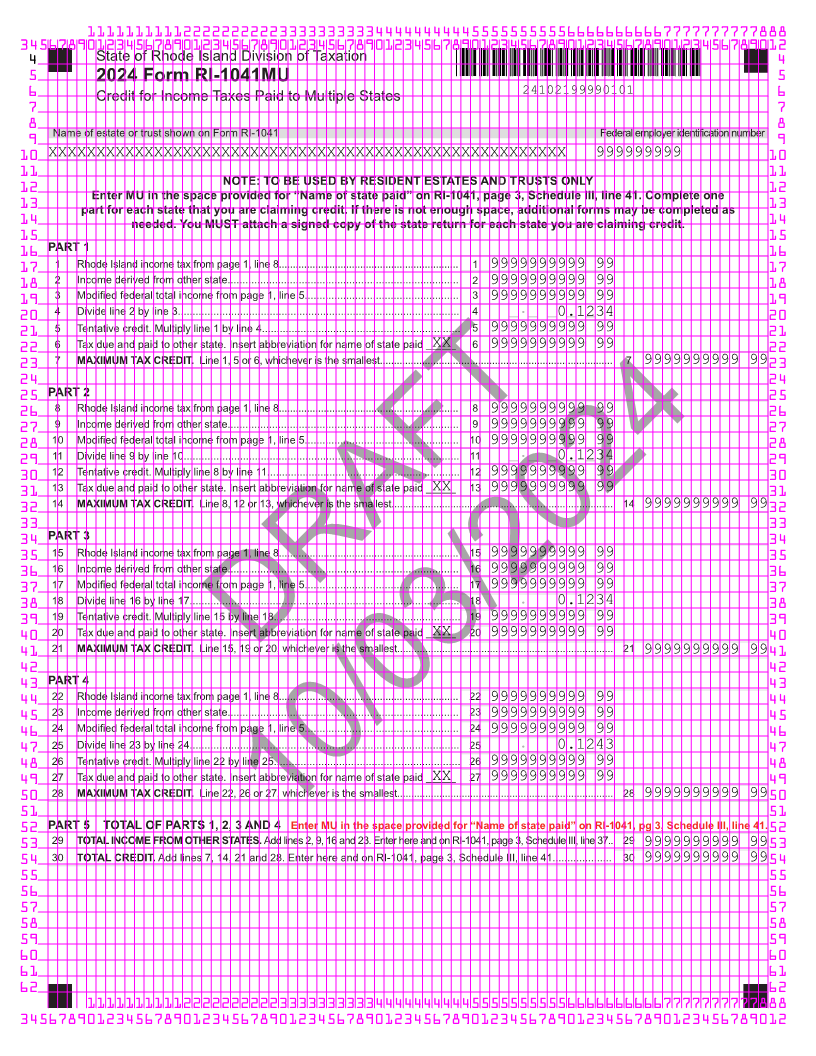

4 State of Rhode Island Division of Taxation 4

5 2024 Form RI-1041MU 5

6 Credit for Income Taxes Paid to Multiple States 24102199990101 6

7 7

8 8

Name of estate or trust shown on Form RI-1041 Federal employer identification number

9 9

10 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 999999999 10

11 11

NOTE: TO BE USED BY RESIDENT ESTATES AND TRUSTS ONLY

12 12

Enter MU in the space provided for “Name of state paid” on RI-1041, page 3, Schedule III, line 41. Complete one

13 part for each state that you are claiming credit. If there is not enough space, additional forms may be completed as 13

14 needed. You MUST attach a signed copy of the state return for each state you are claiming credit. 14

15 15

16 PART 1 16

17 1 Rhode Island income tax from page 1, line 8................................................................ 1 9999999999 99 17

18 2 Income derived from other state.............................................................................. 2 9999999999 99 18

19 3 Modified federal total income from page 1, line 5.................................................... 3 9999999999 99 19

20 4 Divide line 2 by line 3............................................................................................... 4 _._ _ _ _0.1234 20

21 5 Tentative credit. Multiply line 1 by line 4................................................................... 5 9999999999 99 21

22 6 Tax due and paid to other state. Insert abbreviation for name of state paid _____XX 6 9999999999 99 22

23 7 MAXIMUM TAX CREDIT. Line 1, 5 or 6, whichever is the smallest................................................................................... 7 9999999999 99 23

24 24

25 PART 2 25

26 8 Rhode Island income tax from page 1, line 8................................................................ 8 9999999999 99 26

27 9 Income derived from other state.............................................................................. 9 9999999999 99 27

28 10 Modified federal total income from page 1, line 5.................................................... 10 9999999999 99 28

29 11 Divide line 9 by line 10............................................................................................. 11 _._ _ _ _0.1234 29

30 12 Tentative credit. Multiply line 8 by line 11................................................................. 12 9999999999 99 30

31 13 Tax due and paid to other state. Insert abbreviation for name of state paid _____XX 13 9999999999 99 31

32 14 MAXIMUM TAX CREDIT. Line 8, 12 or 13, whichever is the smallest............................................................................... 14 9999999999 99 32

33 33

34 PART 3 34

35 15 Rhode Island income tax from page 1, line 8................................................................ 15 9999999999 99 35

36 16 Income derived from other state.............................................................................. 16 9999999999 99 36

37 17 Modified federal total income from page 1, line 5.................................................... 17 9999999999 99 37

38 18 Divide line 16 by line 17........................................................................................... 18 _._ _ _ _0.1234 38

39 19 Tentative credit. Multiply line 15 by line 18............................................................... 19 9999999999 99 39

40 20 Tax due and paid to other state. Insert abbreviation for name of state paid _____XX 20 9999999999 99 40

41 21 MAXIMUM TAX CREDIT. Line 15, 19 or 20, whichever is the smallest............................................................................. 21 9999999999 99 41

42 DRAFT 42

43 PART 4 43

44 22 Rhode Island income tax from page 1, line 8................................................................ 22 9999999999 99 44

45 23 Income derived from other state.............................................................................. 23 9999999999 99 45

46 24 Modified federal total income from page 1, line 5.................................................... 24 9999999999 99 46

47 25 Divide line 23 by line 24........................................................................................... 25 _._ _ _ _0.1243 47

48 26 Tentative credit. Multiply line 22 by line 25............................................................... 26 9999999999 99 48

49 27 Tax due and paid to other state. Insert abbreviation for name of state paid _____XX 27 9999999999 99 49

50 28 MAXIMUM TAX CREDIT. Line 22, 26 or 27, whichever is the smallest............................................................................. 28 9999999999 99 50

51 51

52 PART 5 TOTAL OF PARTS 1, 2, 3 AND 4 Enter MU in the space provided for “Name of state paid” on RI-1041, pg 3, Schedule III, line 41. 52

29 TOTAL INCOME FROM OTHER STATES.Add lines 2,10/03/20249, 16 and 23. Enter here and on RI-1041, page 3, Schedule III, line29 37..

53 9999999999 99 53

54 30 TOTAL CREDIT. Add lines 7, 14, 21 and 28. Enter here and on RI-1041, page 3, Schedule III, line 41.................... 30 9999999999 99 54

55 55

56 56

57 57

58 58

59 59

60 60

61 61

62 62

1111111111222222222233333333334444444444555555555566666666667777777777888

34567890123456789012345678901234567890123456789012345678901234567890123456789012