Enlarge image

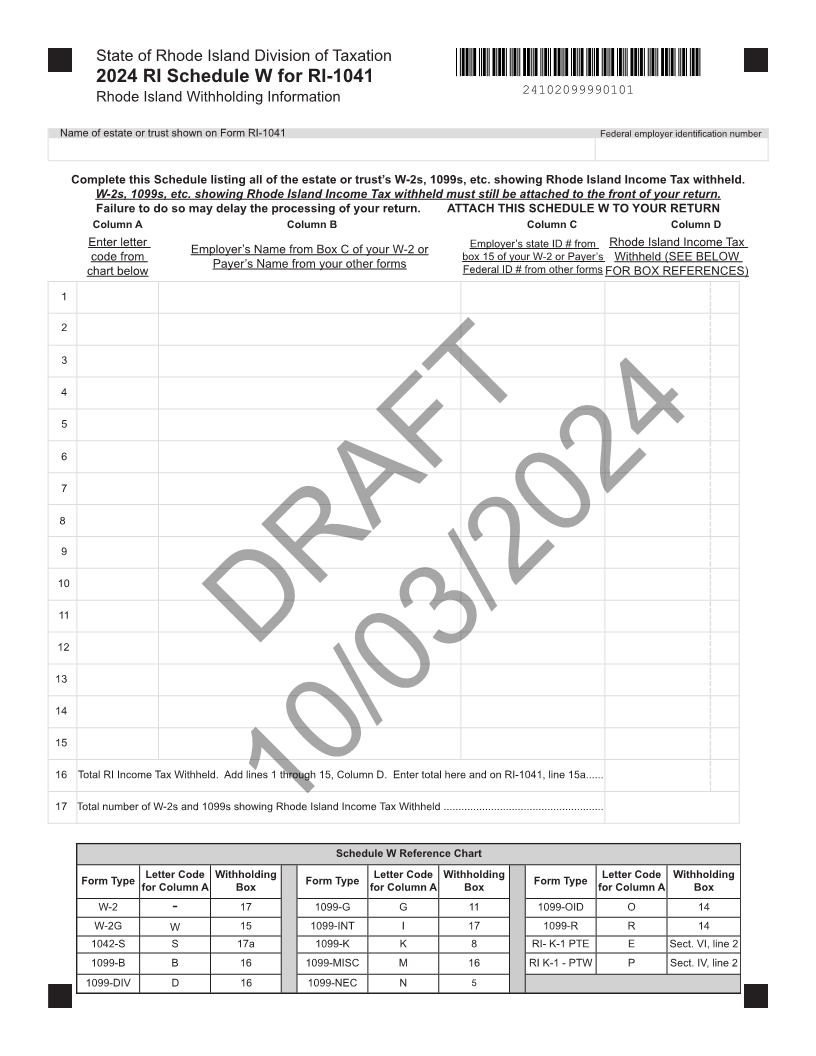

State of Rhode Island Division of Taxation

2024 RI Schedule W for RI-1041

Rhode Island Withholding Information 24102099990101

Name of estate or trust shown on Form RI-1041 Federal employer identification number

Complete this Schedule listing all of the estate or trust’s W-2s, 1099s, etc. showing Rhode Island Income Tax withheld.

W-2s, 1099s, etc. showing Rhode Island Income Tax withheld must still be attached to the front of your return.

Failure to do so may delay the processing of your return. ATTACH THIS SCHEDULE W TO YOUR RETURN

Column A Column B Column C Column D

Enter letter Employer’s state ID # from Rhode Island Income Tax

Employer’s Name from Box C of your W-2 or

code from box 15 of your W-2 or Payer’s Withheld (SEE BELOW

Payer’s Name from your other forms

chart below Federal ID # from other forms FOR BOX REFERENCES)

1

2

3

4

5

6

7

8

9

10

11

12

DRAFT

13

14

15

16 Total RI Income Tax Withheld. Add lines 1 through 15, Column D. Enter total here and on RI-1041, line 15a......

17 Total number of W-2s and 1099s showing Rhode Island Income Tax Withheld ......................................................

10/03/2024

Schedule W Reference Chart

Form Type Letter Code Withholding Form Type Letter Code Withholding Form Type Letter Code Withholding

for Column A Box for Column A Box for Column A Box

W-2 - 17 1099-G G 11 1099-OID O 14

W-2G W 15 1099-INT I 17 1099-R R 14

1042-S S 17a 1099-K K 8 RI- K-1 PTE E Sect. VI, line 2

1099-B B 16 1099-MISC M 16 RI K-1 - PTW P Sect. IV, line 2

1099-DIV D 16 1099-NEC N 5