Enlarge image

1111111111222222222233333333334444444444555555555566666666667777777777888

34567890123456789012345678901234567890123456789012345678901234567890123456789012

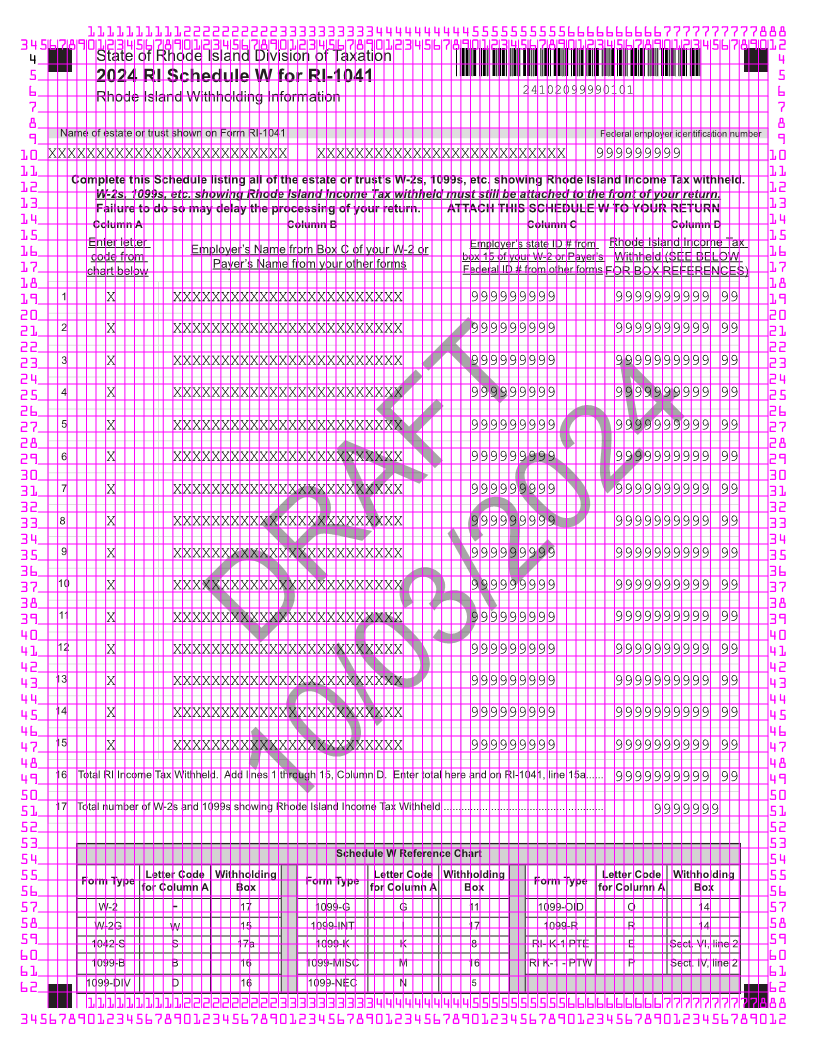

4 State of Rhode Island Division of Taxation 4

5 2024 RI Schedule W for RI-1041 5

6 Rhode Island Withholding Information 24102099990101 6

7 7

8 8

Name of estate or trust shown on Form RI-1041 Federal employer identification number

9 9

10 XXXXXXXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXXXXXXXXXXXXX 999999999 10

11 11

Complete this Schedule listing all of the estate or trust’s W-2s, 1099s, etc. showing Rhode Island Income Tax withheld.

12 W-2s, 1099s, etc. showing Rhode Island Income Tax withheld must still be attached to the front of your return. 12

13 Failure to do so may delay the processing of your return. ATTACH THIS SCHEDULE W TO YOUR RETURN 13

14 Column A Column B Column C Column D 14

15 Enter letter Employer’s state ID # from Rhode Island Income Tax 15

Employer’s Name from Box C of your W-2 or

16 code from box 15 of your W-2 or Payer’s Withheld (SEE BELOW 16

Payer’s Name from your other forms

17 chart below Federal ID # from other forms FOR BOX REFERENCES) 17

18 18

19 1 X XXXXXXXXXXXXXXXXXXXXXXXX 999999999 9999999999 99 19

20 20

21 2 X XXXXXXXXXXXXXXXXXXXXXXXX 999999999 9999999999 99 21

22 22

23 3 X XXXXXXXXXXXXXXXXXXXXXXXX 999999999 9999999999 99 23

24 24

25 4 X XXXXXXXXXXXXXXXXXXXXXXXX 999999999 9999999999 99 25

26 26

27 5 X XXXXXXXXXXXXXXXXXXXXXXXX 999999999 9999999999 99 27

28 28

29 6 X XXXXXXXXXXXXXXXXXXXXXXXX 999999999 9999999999 99 29

30 30

31 7 X XXXXXXXXXXXXXXXXXXXXXXXX 999999999 9999999999 99 31

32 32

33 8 X XXXXXXXXXXXXXXXXXXXXXXXX 999999999 9999999999 99 33

34 34

35 9 X XXXXXXXXXXXXXXXXXXXXXXXX 999999999 9999999999 99 35

36 36

37 10 X XXXXXXXXXXXXXXXXXXXXXXXX 999999999 9999999999 99 37

38 38

39 11 X XXXXXXXXXXXXXXXXXXXXXXXX 999999999 9999999999 99 39

40 40

41 12 X XXXXXXXXXXXXXXXXXXXXXXXX 999999999 9999999999 99 41

42 DRAFT 42

43 13 X XXXXXXXXXXXXXXXXXXXXXXXX 999999999 9999999999 99 43

44 44

45 14 X XXXXXXXXXXXXXXXXXXXXXXXX 999999999 9999999999 99 45

46 46

47 15 X XXXXXXXXXXXXXXXXXXXXXXXX 999999999 9999999999 99 47

48 48

49 16 Total RI Income Tax Withheld. Add lines 1 through 15, Column D. Enter total here and on RI-1041, line 15a...... 9999999999 99 49

50 50

51 17 Total number of W-2s and 1099s showing Rhode Island Income Tax Withheld ...................................................... 9999999 51

52 52

10/03/2024

53 53

Schedule W Reference Chart

54 54

55 Form Type Letter Code Withholding Form Type Letter Code Withholding Form Type Letter Code Withholding 55

56 for Column A Box for Column A Box for Column A Box 56

57 W-2 - 17 1099-G G 11 1099-OID O 14 57

58 W-2G W 15 1099-INT I 17 1099-R R 14 58

59 1042-S S 17a 1099-K K 8 RI- K-1 PTE E Sect. VI, line 2 59

60 1099-B B 16 1099-MISC M 16 RI K-1 - PTW P Sect. IV, line 2 60

61 61

1099-DIV D 16 1099-NEC N 5

62 62

1111111111222222222233333333334444444444555555555566666666667777777777888

34567890123456789012345678901234567890123456789012345678901234567890123456789012