Enlarge image

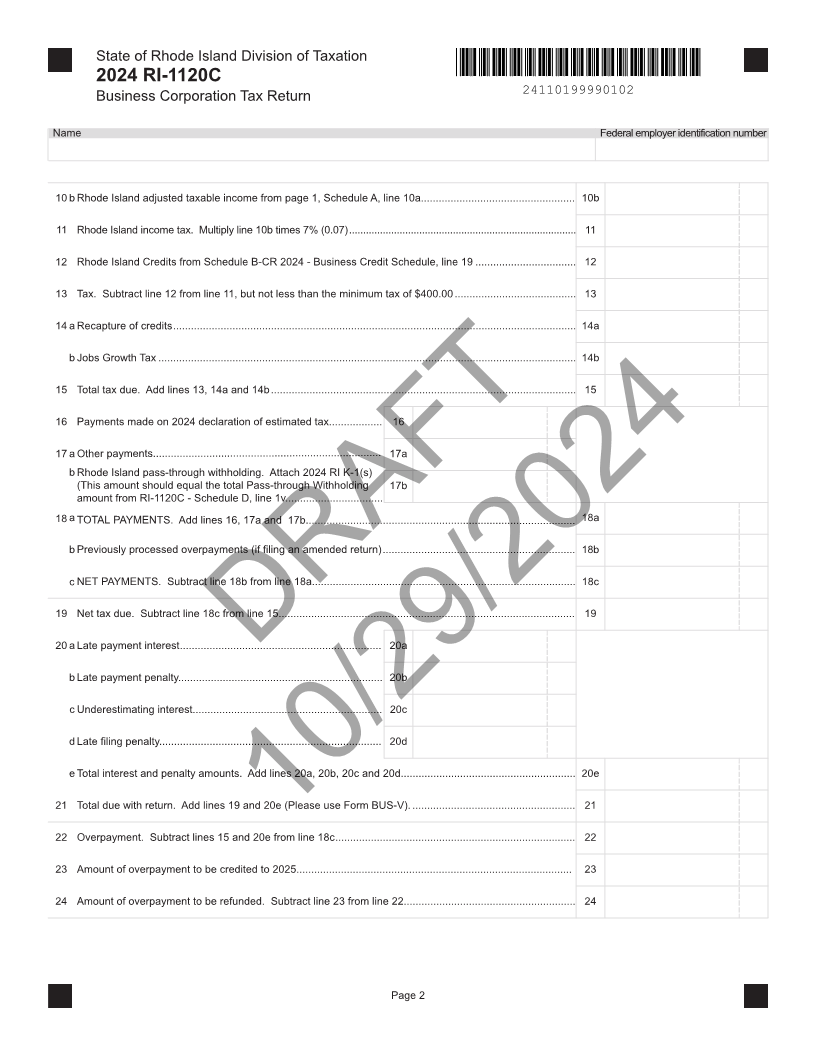

State of Rhode Island Division of Taxation

2024 RI-1120C

Business Corporation Tax Return 24110199990101

Federal employer identification number RI Secretary of State ID number Reserved for 2D barcode

For the taxable year from

MM/DD/2024 through MM/DD/YYYY x: 5.25 in

Name

y: 1.25 in

Address 1 w: 2.50 in

h: 2.75 in

Address 2

City, town or post office State ZIP code

E-mail address NAICS code

Initial Short Pro- Final Amended

Return Year Forma Return Return

Address 1120F Combined *If a combined return, how many companies are included in this return:

Change Return*

Federal Consolidated First year of consolidated filing for Rhode Island purposes:

Group Election MM/DD/YYYY

A Gross Receipts............................................................................................................................................... A

B Depreciable Assets......................................................................................................................................... B

C Total Assets..................................................................................................................................................... C

Schedule A - Computation of Tax Attach a complete copy of all pages and schedules of the federal return including all K-1s

1 Federal taxable income (see instructions) ...................................................................................................... 1

2 Total Deductions from page 3, Schedule B, line 1g ........................................................................................ 2

DRAFT

3 Total Additions from page 3, Schedule C, line 1e ........................................................................................... 3

4 Adjusted taxable income. Line 1 less line 2 plus line 3.................................................................................. 4

5 Rhode Island Apportionment Ratio from page 5, Schedule H, line 2. Carry to six (6) decimal places.......... 5

_ . __________

6 Apportioned Rhode Island taxable income. Multiply line 4 times line 5 ......................................................... 6

7 Research and development adjustments (see instructions, 7

attach schedule.............................................................................

Check if a Jobs

8 aPollution control and hazardous waste adjustment10/29/2024(see 8a Growth Tax is being

instructions).................................................................................... reported on line 14b.

b Capital investment deduction (see instructions)............................. 8b

9 Total adjustments. Add lines 7, 8a and 8b ..................................................................................................... 9

10 a Rhode Island adjusted taxable income. Subtract line 9 from line 6............................................................... 10a

Due on or before the 15th day of the 4th month following the close of the taxable year

Mail to RI Division of Taxation - One Capitol Hill - Providence, RI 02908