Enlarge image

1111111111222222222233333333334444444444555555555566666666667777777777888

34567890123456789012345678901234567890123456789012345678901234567890123456789012

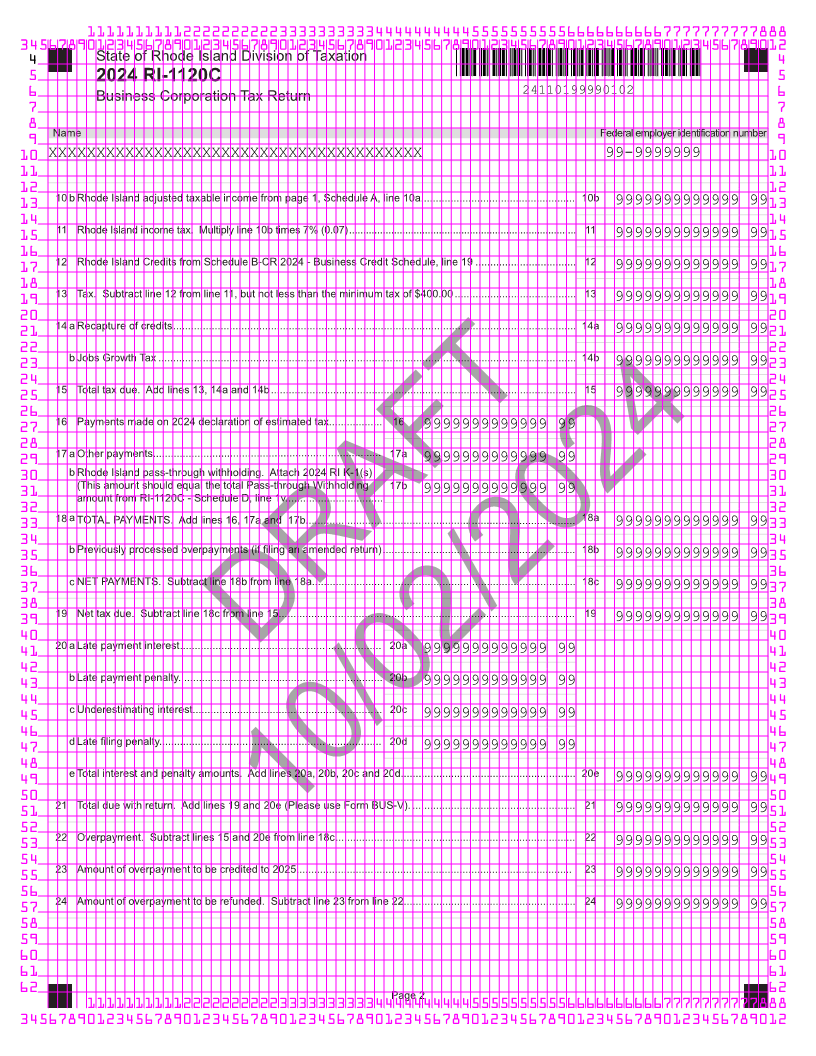

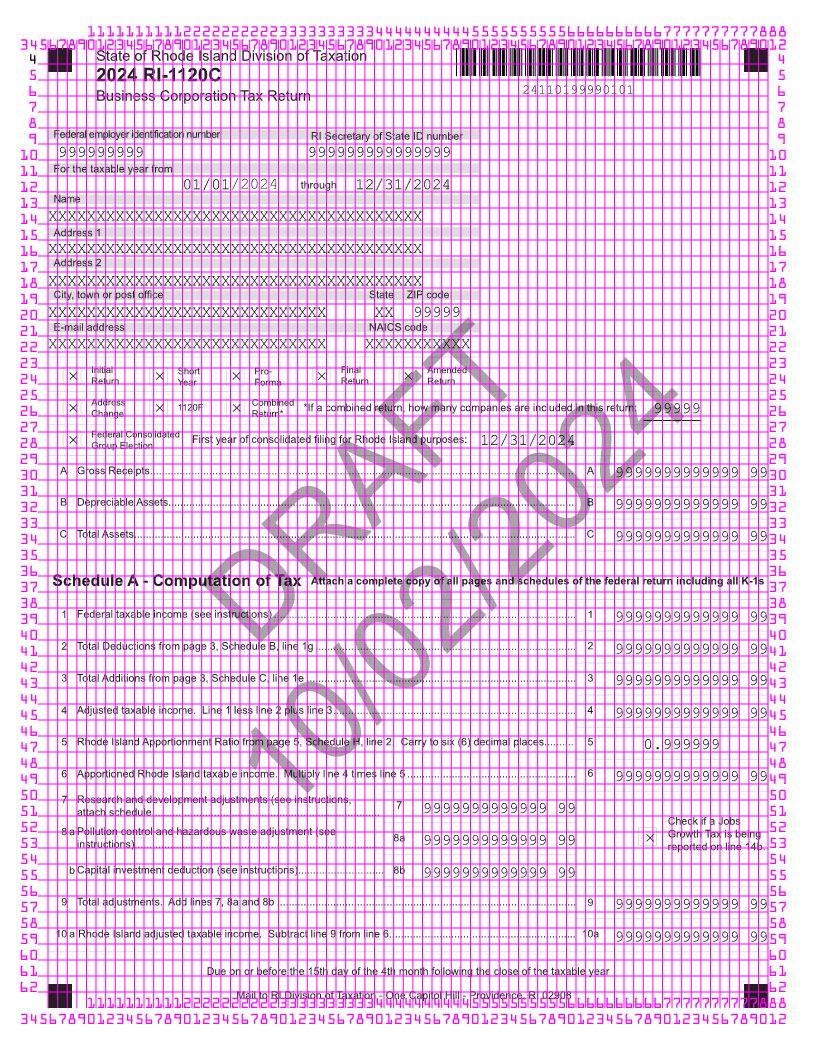

4 State of Rhode Island Division of Taxation 4

5 2024 RI-1120C 5

6 Business Corporation Tax Return 24110199990101 6

7 7

8 8

9 Federal employer identification number RI Secretary of State ID number 9

10 999999999 999999999999999 10

11 For the taxable year from 11

12 MM/DD01/01/2024 through MM/DD/YYYY12/31/2024 12

13 Name 13

14 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 14

15 Address 1 15

16 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 16

17 Address 2 17

18 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 18

19 City, town or post office State ZIP code 19

20 XXXXXXXXXXXXXXXXXXXXXXXXXXXXX XX 99999 20

21 E-mail address NAICS code 21

22 XXXXXXXXXXXXXXXXXXXXXXXXXXXXX XXXXXXXXXXX 22

23 Initial Short Pro- Final Amended 23

24 Return Year Forma Return Return 24

25 Address 1120F Combined *If a combined return, how many companies are included in this return: 25

26 Change Return* 99999 26

27 27

Group Election MM/DD/YYYY

28 Federal Consolidated First year of consolidated filing for Rhode Island purposes: 12/31/2024 28

29 29

30 A Gross Receipts............................................................................................................................................... A 9999999999999 99 30

31 31

B Depreciable Assets......................................................................................................................................... B

32 9999999999999 99 32

33 33

C Total Assets..................................................................................................................................................... C

34 9999999999999 99 34

35 35

36 36

Schedule A - Computation of Tax Attach a complete copy of all pages and schedules of the federal return including all K-1s

37 37

38 38

1 Federal taxable income (see instructions) ...................................................................................................... 1

39 9999999999999 99 39

40 40

2 Total Deductions from page 3, Schedule B, line 1g ........................................................................................ 2

41 9999999999999 99 41

42 DRAFT 42

3 Total Additions from page 3, Schedule C, line 1e ........................................................................................... 3

43 9999999999999 99 43

44 44

4 Adjusted taxable income. Line 1 less line 2 plus line 3.................................................................................. 4

45 9999999999999 99 45

46 46

5 Rhode Island Apportionment Ratio from page 5, Schedule H, line 2. Carry to six (6) decimal places.......... 5

47 0.999999_ . __________ 47

48 48

6 Apportioned Rhode Island taxable income. Multiply line 4 times line 5 ......................................................... 6

49 9999999999999 99 49

50 7 Research and development adjustments (see instructions, 7 50

51 attach schedule............................................................................. 9999999999999 99 51

Check if a Jobs

52 52

8 aPollution control and hazardous waste adjustment10/02/2024(see 8a Growth Tax is being

53 instructions).................................................................................... 9999999999999 99 reported on line 14b. 53

54 54

b Capital investment deduction (see instructions)............................. 8b

55 9999999999999 99 55

56 56

9 Total adjustments. Add lines 7, 8a and 8b ..................................................................................................... 9

57 9999999999999 99 57

58 58

10 a Rhode Island adjusted taxable income. Subtract line 9 from line 6............................................................... 10a

59 9999999999999 99 59

60 60

61 Due on or before the 15th day of the 4th month following the close of the taxable year 61

62 Mail to RI Division of Taxation - One Capitol Hill - Providence, RI 02908 62

1111111111222222222233333333334444444444555555555566666666667777777777888

34567890123456789012345678901234567890123456789012345678901234567890123456789012