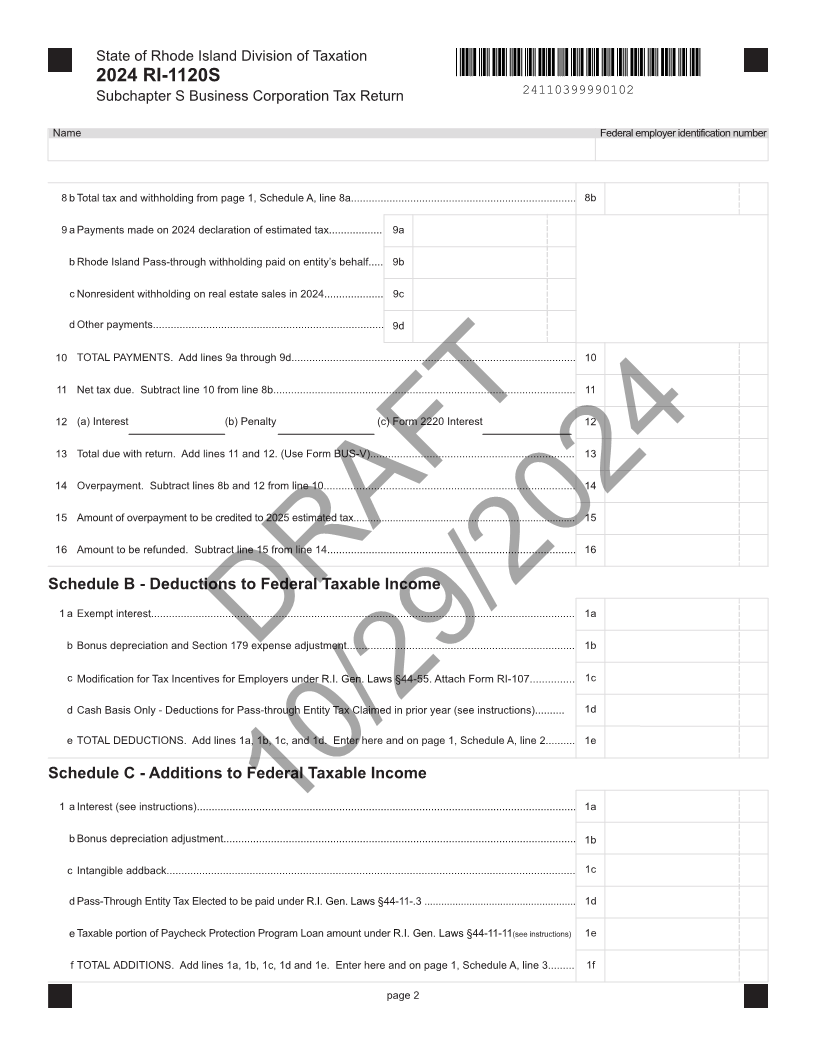

Enlarge image

State of Rhode Island Division of Taxation

2024 RI-1120S

Subchapter S Business Corporation Tax Return 24110399990101

Federal employer identification number RI Secretary of State ID number Reserved for 2D barcode

For the taxable year from

MM/DD/2024 through MM/DD/YYYY x: 5.25 in

Name

y: 1.25 in

Address 1 w: 2.50 in

h: 2.75 in

Address 2

City, town or post office State ZIP code

E-mail address NAICS code

Initial Short Pro- Final Amended

Return Year Forma Return Return

Address Q-Sub Included* *If applicable, enter the number of Q-Sub companies are included in this return:

Change

Total number of Total number of RI K-1s Total number of RI K-1s

RI K-1s issued: issued for Schedule PTE: issued for Schedule PTW:

A Gross Receipts............................................................................................................................................... A

B Depreciable Assets......................................................................................................................................... B

C Total Assets..................................................................................................................................................... C

Schedule A - Computation of Tax Attach a complete copy of all pages and schedules of the federal return including all K-1’s

1 Federal taxable income ................................................................................................................................. 1

2 Total Deductions from page 2, Schedule B, line 1e ........................................................................................ 2

DRAFT

3 Total Additions from page 2, Schedule C, line 1f ............................................................................................ 3

4 Adjusted taxable income. Line 1 less line 2 plus line 3.................................................................................. 4

5 Rhode Island Apportionment Ratio from page 4, Schedule I, line 5............................................................... 5

_ . _ _ _ _ _ _

6 Apportioned Rhode Island taxable income. Multiply line 4 times line 5 ......................................................... 6

7 a Rhode Island Minimum Tax - $400.00............................................ 7a

Check if a Jobs

bJobs Growth Tax............................................................................10/29/20247b Growth Tax is being

reported on line 7b.

c RI Pass-through withholding from RI Schedule PTW, line 13..... 7c

d RI Pass-through Entity Election Tax from RI Schedule PTE, line 5 7d

8 a TOTAL TAX AND WITHHOLDING. Add lines 7a through 7d.......................................................................... 8a

Due on or before the 15th day of the 3rd month following the close of the taxable year

Mail to RI Division of Taxation - One Capitol Hill - Providence, RI 02908