Enlarge image

1111111111222222222233333333334444444444555555555566666666667777777777888

34567890123456789012345678901234567890123456789012345678901234567890123456789012

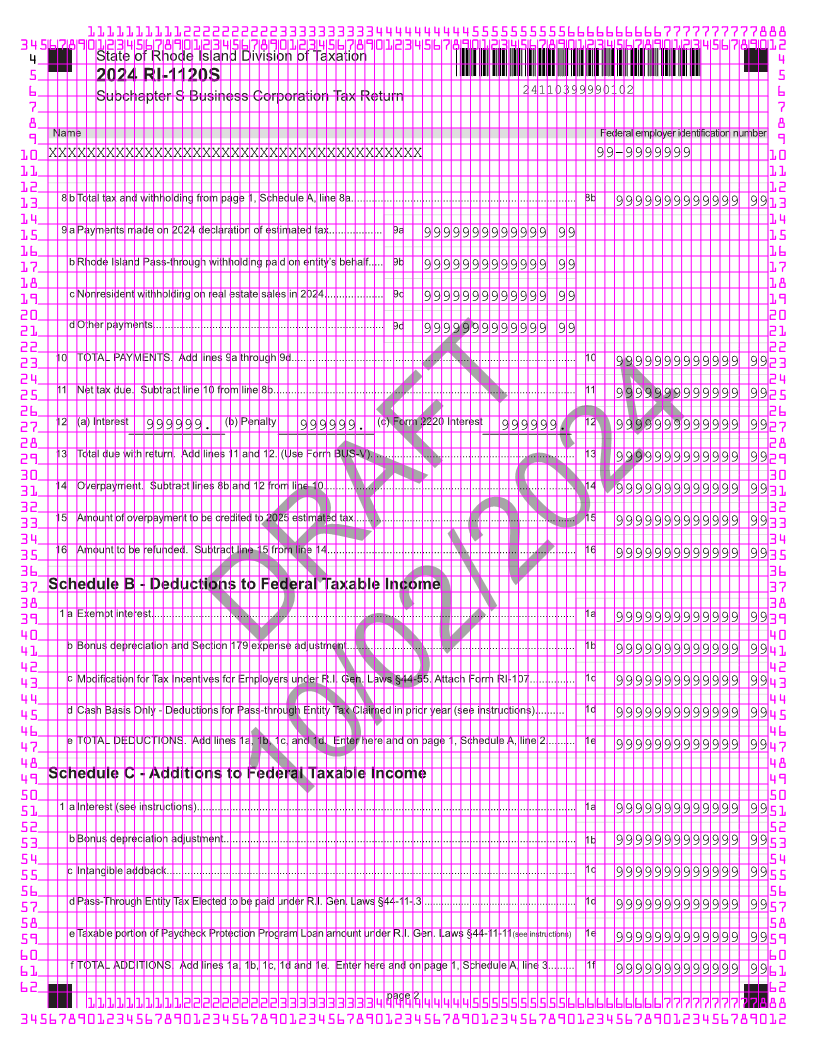

4 State of Rhode Island Division of Taxation 4

5 2024 RI-1120S 5

6 Subchapter S Business Corporation Tax Return 24110399990101 6

7 7

8 8

9 Federal employer identification number RI Secretary of State ID number 9

10 999999999 999999999999999 10

11 For the taxable year from 11

12 MM/DD01/01/2024 through MM/DD/YYYY12/31/2024 12

13 Name 13

14 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 14

15 Address 1 15

16 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 16

17 Address 2 17

18 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 18

19 City, town or post office State ZIP code 19

20 XXXXXXXXXXXXXXXXXXXXXXXXXXXXX XX 99999 20

21 E-mail address NAICS code 21

22 XXXXXXXXXXXXXXXXXXXXXXXXXXXXX XXXXXXXXXXX 22

23 Initial Short Pro- Final Amended 23

24 Return Year Forma Return Return 24

25 25

Change

26 Address Q-Sub Included* *If applicable, enter the number of Q-Sub companies are included in this return: 99999 26

27 Total number of Total number of RI K-1s Total number of RI K-1s 27

28 RI K-1s issued: 999999999 issued for Schedule PTE: 999999999 issued for Schedule PTW: 999999999 28

29 29

30 A Gross Receipts............................................................................................................................................... A 9999999999999 99 30

31 31

32 B Depreciable Assets......................................................................................................................................... B 9999999999999 99 32

33 33

34 C Total Assets..................................................................................................................................................... C 9999999999999 99 34

35 35

36 36

37 Schedule A - Computation of Tax Attach a complete copy of all pages and schedules of the federal return including all K-1’s 37

38 38

39 1 Federal taxable income ................................................................................................................................. 1 9999999999999 99 39

40 40

41 2 Total Deductions from page 2, Schedule B, line 1e ........................................................................................ 2 9999999999999 99 41

42 DRAFT 42

43 3 Total Additions from page 2, Schedule C, line 1f ............................................................................................ 3 9999999999999 99 43

44 44

45 4 Adjusted taxable income. Line 1 less line 2 plus line 3.................................................................................. 4 9999999999999 99 45

46 46

47 5 Rhode Island Apportionment Ratio from page 4, Schedule I, line 5............................................................... 5 0.999999 47

_ . _ _ _ _ _ _

48 48

49 6 Apportioned Rhode Island taxable income. Multiply line 4 times line 5 ......................................................... 6 9999999999 99 49

50 50

51 7 a Rhode Island Minimum Tax - $400.00............................................ 7a 9999999999999 99 51

52 Check if a Jobs 52

bJobs Growth Tax............................................................................10/02/20247b Growth Tax is being

53 9999999999999 99 reported on line 7b. 53

54 54

55 c RI Pass-through withholding from RI Schedule PTW, line 13..... 7c 9999999999999 99 55

56 56

57 d RI Pass-through Entity Election Tax from RI Schedule PTE, line 5 7d 9999999999999 99 57

58 58

59 8 a TOTAL TAX AND WITHHOLDING. Add lines 7a through 7d.......................................................................... 8a 9999999999999 99 59

60 60

61 Due on or before the 15th day of the 3rd month following the close of the taxable year 61

62 Mail to RI Division of Taxation - One Capitol Hill - Providence, RI 02908 62

1111111111222222222233333333334444444444555555555566666666667777777777888

34567890123456789012345678901234567890123456789012345678901234567890123456789012