Enlarge image

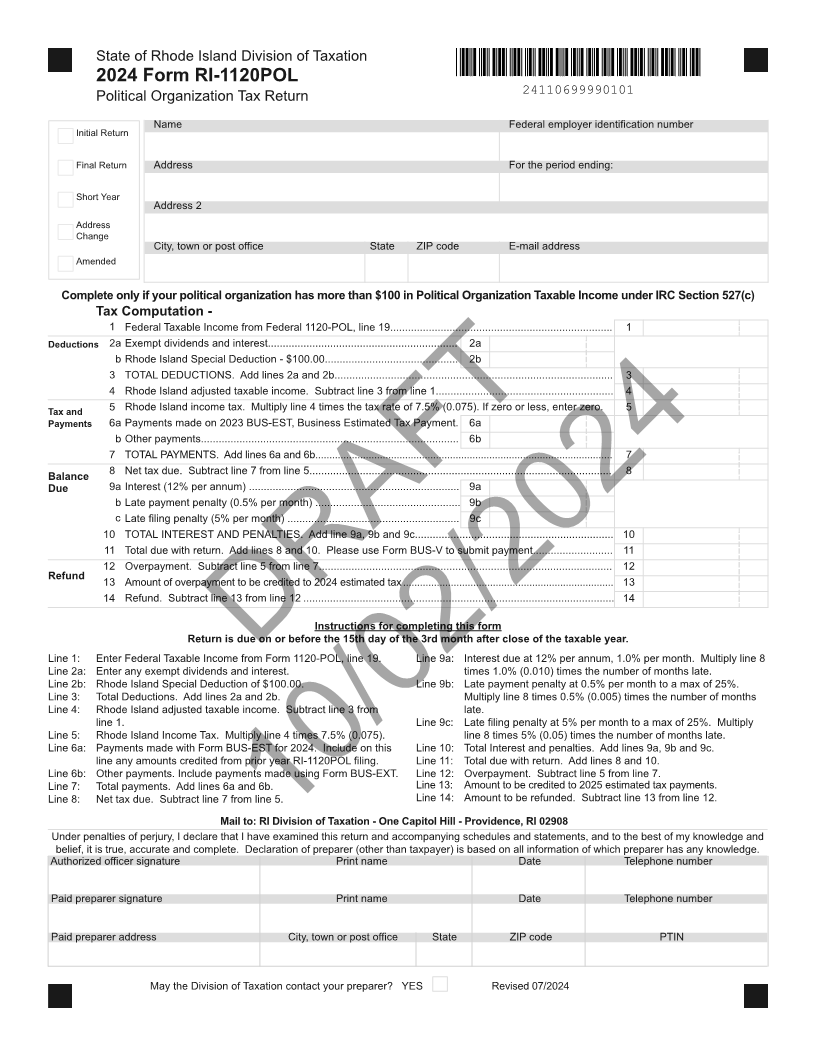

State of Rhode Island Division of Taxation

2024 Form RI-1120POL

Political Organization Tax Return 24110699990101

Name Federal employer identification number

Initial Return

Final Return Address For the period ending:

Short Year

Address 2

Address

Change

City, town or post office State ZIP code E-mail address

Amended

Complete only if your political organization has more than $100 in Political Organization Taxable Income under IRC Section 527(c)

Tax Computation -

1 Federal Taxable Income from Federal 1120-POL, line 19........................................................................... 1

Deductions 2a Exempt dividends and interest................................................................ 2a

b Rhode Island Special Deduction - $100.00............................................. 2b

3 TOTAL DEDUCTIONS. Add lines 2a and 2b.............................................................................................. 3

4 Rhode Island adjusted taxable income. Subtract line 3 from line 1............................................................ 4

Tax and 5 Rhode Island income tax. Multiply line 4 times the tax rate of 7.5% (0.075). If zero or less, enter zero. 5

Payments 6aPayments made on2023 BUS-EST, Business Estimated Tax Payment. 6a

b Other payments....................................................................................... 6b

7 TOTAL PAYMENTS. Add lines 6a and 6b.......................................................................................................... 7

Balance 8 Net tax due. Subtract line 7 from line 5...................................................................................................... 8

Due 9a Interest (12% per annum) ....................................................................... 9a

b Late payment penalty (0.5% per month) ................................................. 9b

c Late filing penalty (5% per month) .......................................................... 9c

10 TOTAL INTEREST AND PENALTIES. Add line 9a, 9b and 9c................................................................... 10

11 Total due with return. Add lines 8 and 10. Please use Form BUS-V to submit payment........................... 11

12 Overpayment. Subtract line 5 from line 7................................................................................................... 12

Refund 13 Amount of overpayment to be credited to 2024 estimated tax...........................................................................13

14 Refund. Subtract line 13 from line 12 ......................................................................................................... 14

Instructions for completing this form

Return is due on or before the 15th day of the 3rd month after close of the taxable year.

Line 1: Enter Federal Taxable Income from Form 1120-POL, line 19. Line 9a: Interest due at 12% per annum, 1.0% per month. Multiply line 8

Line 2a: Enter any exempt dividends and interest. DRAFT times 1.0% (0.010) times the number of months late.

Line 2b: Rhode Island Special Deduction of $100.00. Line 9b: Late payment penalty at 0.5% per month to a max of 25%.

Line 3: Total Deductions. Add lines 2a and 2b. Multiply line 8 times 0.5% (0.005) times the number of months

Line 4: Rhode Island adjusted taxable income. Subtract line 3 from late.

line 1. Line 9c: Late filing penalty at 5% per month to a max of 25%. Multiply

Line 5: Rhode Island Income Tax. Multiply line 4 times 7.5% (0.075). line 8 times 5% (0.05) times the number of months late.

Line 6a: Payments made with Form BUS-EST for 2024. Include on this Line 10: Total Interest and penalties. Add lines 9a, 9b and 9c.

line any amounts credited from prior year RI-1120POL filing. Line 11: Total due with return. Add lines 8 and 10.

Line 6b: Other payments. Include payments made using Form BUS-EXT. Line 12: Overpayment. Subtract line 5 from line 7.

Line 7: Total payments. Add lines 6a and 6b. Line 13: Amount to be credited to 2025 estimated tax payments.

Line 8: Net tax due. Subtract line 7 from line 5. Line 14: Amount to be refunded. Subtract line 13 from line 12.

Mail to: RI Division of Taxation - One Capitol Hill - Providence, RI 02908

Under penalties of perjury, I declare that I have examined10/02/2024this return and accompanying schedules and statements, and to the best of my knowledge and

belief, it is true, accurate and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Authorized officer signature Print name Date Telephone number

Paid preparer signature Print name Date Telephone number

Paid preparer address City, town or post office State ZIP code PTIN

May the Division of Taxation contact your preparer? YES Revised 07/2024