Enlarge image

1111111111222222222233333333334444444444555555555566666666667777777777888

34567890123456789012345678901234567890123456789012345678901234567890123456789012

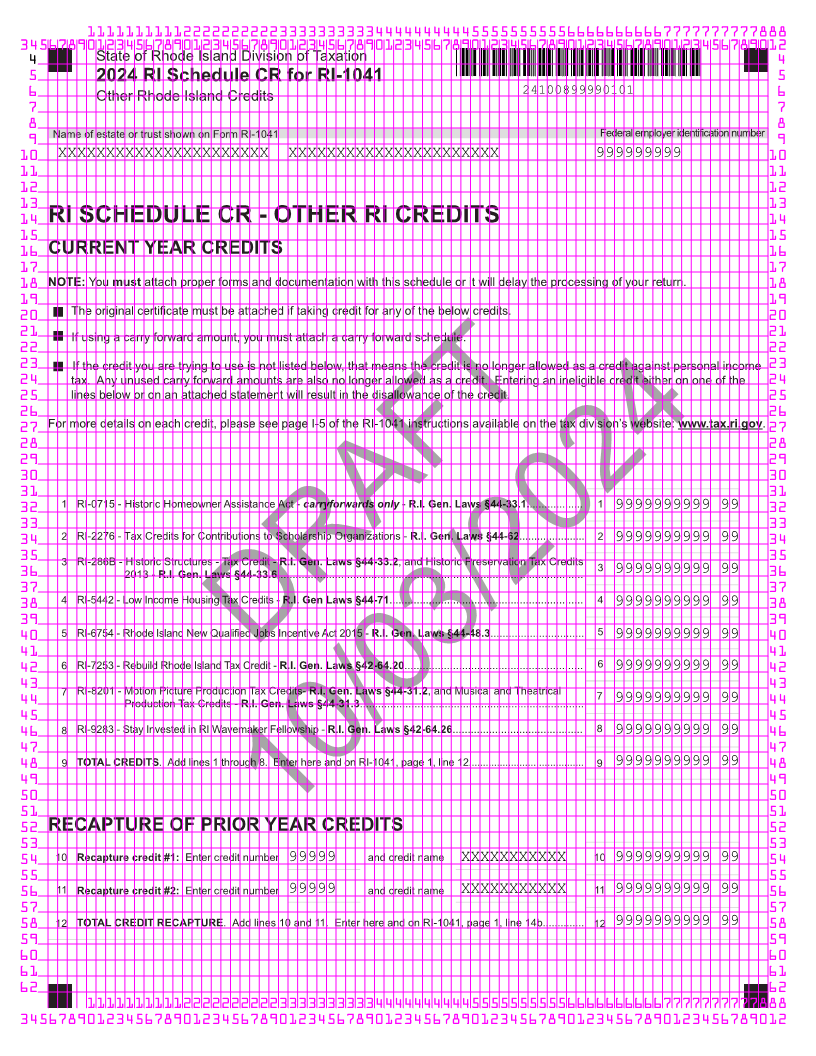

4 State of Rhode Island Division of Taxation 4

5 2024 RI Schedule CR for RI-1041 5

6 Other Rhode Island Credits 24100899990101 6

7 7

8 8

Name of estate or trust shown on Form RI-1041 Federal employer identification number

9 9

10 XXXXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXXXXXXXXX 999999999 10

11 11

12 12

13 13

14 RI SCHEDULE CR - OTHER RI CREDITS 14

15 15

16 CURRENT YEAR CREDITS 16

17 17

18 NOTE: mustYou attach proper forms and documentation with this schedule or it will delay the processing of your return. 18

19 19

20 The original certificate must be attached if taking credit for any of the below credits. 20

21 If using a carry forward amount, you must attach a carry forward schedule. 21

22 22

23 If the credit you are trying to use is not listed below, that means the credit is no longer allowed as a credit against personal income 23

24 tax. Any unused carry forward amounts are also no longer allowed as a credit. Entering an ineligible credit either on one of the 24

25 lines below or on an attached statement will result in the disallowance of the credit. 25

26 26

27 For more details on each credit, please see page I-5 of the RI-1041 instructions available on the tax division’s website: www.tax.ri.gov. 27

28 28

29 29

30 30

31 31

32 1 RI-0715 - Historic Homeowner Assistance Act - carryforwards -R.I. Gen.onlyLaws §44-33.1. .................. 1 9999999999 99 32

33 33

34 2 RI-2276 - Tax Credits for Contributions to Scholarship Organizations - R.I. Gen. Laws §44-62...................... 2 9999999999 99 34

35 3 RI-286B - Historic StructuresR.I. Gen.-LawsTax Credit - §44-33.2, and Historic Preservation Tax Credits 3 35

36 2013 - R.I. Gen. Laws §44-33.6..................................................................................................... 9999999999 99 36

37 37

38 4 RI-5442 - Low Income Housing Tax Credits - R.I. Gen Laws §44-71................................................................ 4 9999999999 99 38

39 39

40 5 RI-6754 - Rhode Island New Qualified Jobs Incentive Act 2015 - R.I. Gen. Laws §44-48.3............................... 5 9999999999 99 40

41 41

42 6 RI-7253 - Rebuild Rhode Island Tax CreditR.I.DRAFT- Gen. Laws§42-64.20........................................................... 6 999999999999 42

43 43

7 RI-8201 - Motion Picture Production Tax Credits- R.I. Gen. Laws §44-31.2 , and Musical and Theatrical 7

44 Production Tax Credits - R.I. Gen. Laws §44-31.3.......................................................................... 9999999999 99 44

45 45

46 8 RI-9283 - Stay Invested in RI Wavemaker Fellowship - R.I. Gen. Laws §42-64.26........................................... 8 9999999999 99 46

47 47

48 9 TOTAL CREDITS . Add lines 1 through 8. Enter here and on RI-1041, page 1, line 12.........................................9 999999999999 48

49 49

50 50

51 51

52 RECAPTURE OF PRIOR YEAR CREDITS 52

10/03/2024

53 53

54 10 Recapture credit #1: Enter credit number 99999 and credit name XXXXXXXXXXX 10 9999999999 99 54

55 55

56 11 Recapture credit #2: Enter credit number 99999 and credit name XXXXXXXXXXX 11 9999999999 99 56

57 57

58 12 TOTAL CREDIT RECAPTURE . Add lines 10 and 11. Enter here and on RI-1041, page 1, line 14b.............. 12 9999999999 99 58

59 59

60 60

61 61

62 62

1111111111222222222233333333334444444444555555555566666666667777777777888

34567890123456789012345678901234567890123456789012345678901234567890123456789012