Enlarge image

1111111111222222222233333333334444444444555555555566666666667777777777888

34567890123456789012345678901234567890123456789012345678901234567890123456789012

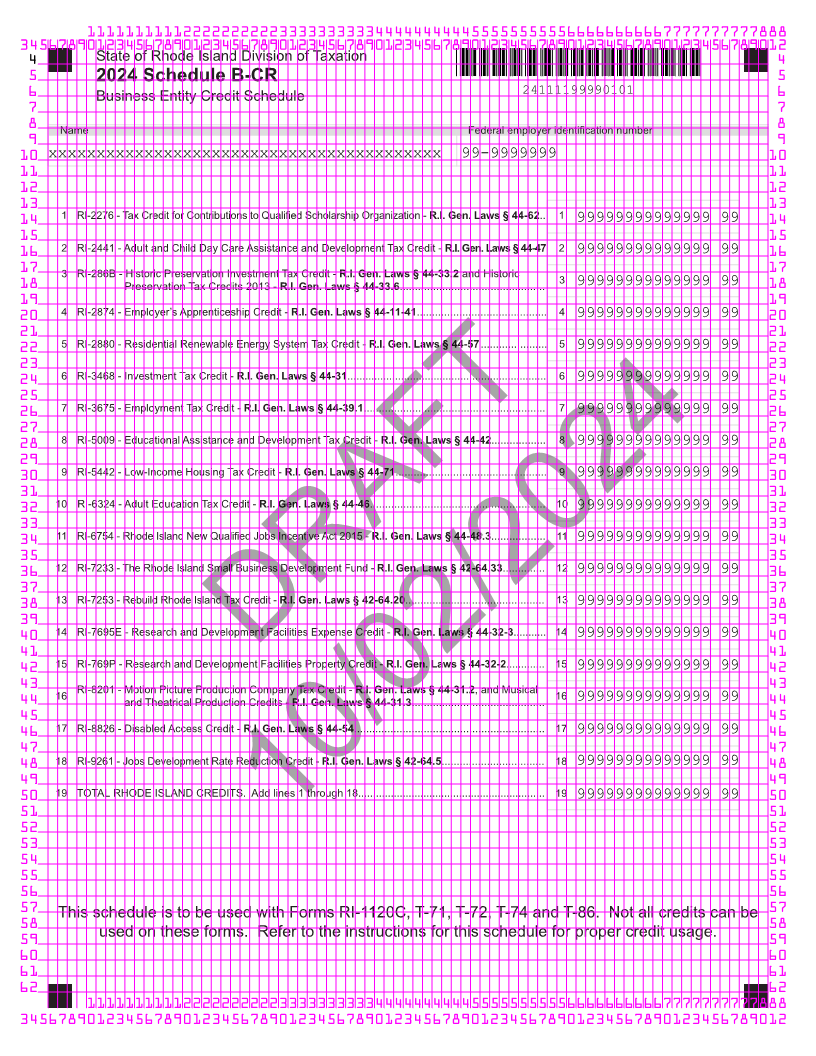

4 State of Rhode Island Division of Taxation 4

5 2024 Schedule B-CR 5

6 Business Entity Credit Schedule 24111199990101 6

7 7

8 Name Federal employer identification number 8

9 9

10 xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx 99-9999999 10

11 11

12 12

13 13

14 1 RI-2276 - Tax Credit for Contributions to Qualified Scholarship Organization - R.I. Gen. Laws § 44-62.. 1 99999999999999 99 14

15 15

16 2 RI-2441 - Adult and Child Day Care Assistance and Development Tax Credit - R.I. Gen. Laws § 44-47 2 99999999999999 99 16

17 3 RI-286B - Historic Preservation Investment Tax Credit - R.I. Gen. Laws § 44-33.2 and Historic 3 17

18 Preservation Tax Credits 2013 - R.I. Gen. Laws § 44-33.6................................................ 99999999999999 99 18

19 19

20 4 RI-2874 - Employer’s Apprenticeship Credit - R.I. Gen. Laws § 44-11-41........................................... 4 99999999999999 99 20

21 21

22 5 RI-2880 - Residential Renewable Energy System Tax Credit - R.I. Gen. Laws § 44-57 ...................... 5 99999999999999 99 22

23 23

24 6 RI-3468 - InvestmentR.I. Gen.Tax CreditLaws - § 44-31 ................................................................... 6 99999999999999 99 24

25 25

26 7 RI-3675 - Employment Tax Credit - R.I. Gen. Laws § 44-39.1............................................................ 7 99999999999999 99 26

27 27

28 8 RI-5009 - Educational Assistance and Development Tax Credit - R.I. Gen. Laws § 44-42.................. 8 99999999999999 99 28

29 29

30 9 RI-5442 - Low-Income Housing Tax Credit - R.I. Gen. Laws § 44-71.................................................. 9 99999999999999 99 30

31 31

32 10 RI-6324 - Adult Education Tax Credit - R.I. Gen. Laws § 44-46.......................................................... 10 99999999999999 99 32

33 33

34 11 RI-6754 - Rhode Island New Qualified Jobs Incentive Act 2015 - R.I. Gen. Laws § 44-48.3.................. 11 99999999999999 99 34

35 35

36 12 RI-7233 - The Rhode Island Small Business Development Fund - R.I. Gen. Laws § 42-64.33.............. 12 99999999999999 99 36

37 37

38 13 RI-7253 - Rebuild Rhode Island Tax Credit - R.I. Gen. Laws § 42-64.20.............................................. 13 99999999999999 99 38

39 39

40 14 RI-7695E - Research and Development Facilities Expense Credit - R.I. Gen. Laws § 44-32-3........... 14 99999999999999 99 40

41 41

42 15 RI-769P - Research and Development FacilitiesDRAFTProperty Credit -R.I. Gen. Laws§ 44-32-2............. 15 99999999999999 99 42

43 43

and Theatrical Production Credits - R.I. Gen. Laws § 44-31.3............................................

44 16 RI-8201 - Motion Picture Production Company Tax Credit - R.I. Gen. Laws § 44-31.2 , and Musical 16 99999999999999 99 44

45 45

46 17 RI-8826 - Disabled Access Credit - R.I. Gen. Laws § 44-54............................................................... 17 99999999999999 99 46

47 47

48 18 RI-9261 - Jobs Development Rate Reduction Credit - R.I. Gen. Laws § 42-64.5.................................. 18 99999999999999 99 48

49 49

50 19 TOTAL RHODE ISLAND CREDITS. Add lines 1 through 18............................................................... 19 99999999999999 99 50

51 51

52 52

10/02/2024

53 53

54 54

55 55

56 56

57 This schedule is to be used with Forms RI-1120C, T-71, T-72, T-74 and T-86. Not all credits can be 57

58 58

used on these forms. Refer to the instructions for this schedule for proper credit usage.

59 59

60 60

61 61

62 62

1111111111222222222233333333334444444444555555555566666666667777777777888

34567890123456789012345678901234567890123456789012345678901234567890123456789012